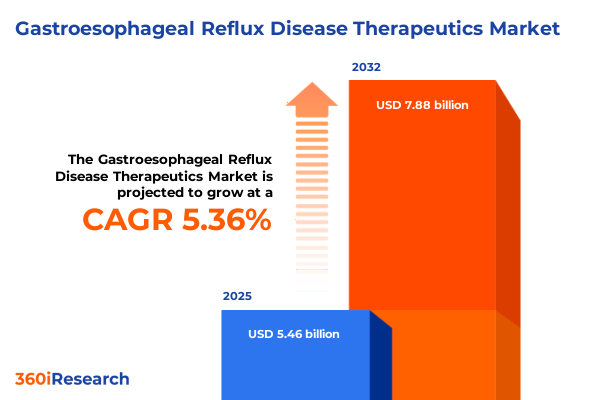

The Gastroesophageal Reflux Disease Therapeutics Market size was estimated at USD 5.46 billion in 2025 and expected to reach USD 5.74 billion in 2026, at a CAGR of 5.36% to reach USD 7.88 billion by 2032.

An Extensive Exploration of Innovations and Patient-Centric Solutions Shaping the Gastroesophageal Reflux Disease Therapeutic Paradigm in 2025

An evolving understanding of gastroesophageal reflux disease highlights the complexity of its pathophysiology and underscores the urgency for adaptable therapeutic solutions. Over the past decade, breakthroughs in acid suppression mechanisms have transformed clinical practice, while ongoing research into mucosal protection and motility modulation is expanding the treatment armamentarium. Today’s portfolio spans rapidly acting antacids, histamine-2 receptor blockers, and highly potent proton pump inhibitors, each calibrated to meet diverse patient needs from on-demand relief to sustained acid control. As real-world evidence accumulates, personalized treatment regimens that account for symptom severity, comorbidities, and risk profiles are becoming the standard of care.

Moreover, digital health innovations are reshaping patient engagement through remote monitoring tools and mobile applications that track symptom patterns and treatment adherence. Integrating these technologies into clinical workflows fosters data-driven decision making and empowers patients to play an active role in disease management. During this period of rapid transformation, the interplay between emerging scientific insights, regulatory adaptations, and stakeholder expectations is continuously redefining the GERD therapeutic landscape. This introduction sets the stage for a deeper exploration of the pivotal forces and actionable insights delineated throughout this report.

Examining the Pivotal Shifts Redefining Gastroesophageal Reflux Disease Management Through Novel Modalities Digital Advances and Regulatory Milestones

The gastroesophageal reflux disease arena is experiencing unprecedented shifts as novel treatment modalities emerge and regulatory frameworks evolve. Parallel advancements in drug delivery systems, such as delayed-release formulations and novel prodrugs, are extending dosing intervals and enhancing patient convenience. Equally significant are the strides in nonpharmacological interventions, where endoscopic techniques and magnetic sphincter augmentation devices are gaining traction for moderate to severe cases.

Simultaneously, the integration of artificial intelligence into clinical research is refining patient stratification, enabling precision enrollment and more nuanced evaluation of therapeutic outcomes. Regulatory bodies are responding by streamlining approval pathways for breakthrough therapies, while real-world evidence guidelines are maturing to support label expansions. In this evolving context, pharmaceutical developers and healthcare providers must adapt to a landscape where clinical differentiation increasingly hinges on technology-enabled value propositions and robust postmarketing data.

Taken together, these transformative shifts signal a new era in GERD management-one driven by collaboration across disciplines, accelerated by digital innovations, and guided by regulatory agility. The success of future therapies will rest on the ability to navigate these converging trends and deliver holistic solutions that address patient needs and healthcare system priorities.

Assessing the Multifaceted Impact of United States Import Tariffs on Gastroesophageal Reflux Disease Therapeutics Supply Chains and Cost Structures in 2025

In 2025, the United States’ import tariffs have introduced nuanced dynamics into the gastroesophageal reflux disease therapeutic supply chain. Tariff adjustments on key active pharmaceutical ingredients, notably those sourced from Asia-Pacific manufacturing hubs, have elevated input costs. Manufacturers have responded by optimizing sourcing strategies, negotiating long-term supplier agreements, and exploring regional production hubs to mitigate cost pressures and maintain resilience.

Moreover, healthcare payers and integrated delivery networks are intensifying scrutiny of formulary placement and reimbursement policies to offset rising acquisition expenses. In response, pharmaceutical stakeholders are strengthening value-based contracting models and demonstrating real-world outcomes to justify price points. From a strategic standpoint, this environment underscores the importance of diversifying procurement and fostering collaborative partnerships with contract development and manufacturing organizations based in tariff-exempt regions.

Consequently, industry players are recalibrating their operational footprints to balance cost efficiency with supply security. Supply chain intelligence tools and risk mitigation protocols have become indispensable for anticipating tariff fluctuations and maintaining uninterrupted patient access. Ultimately, the cumulative impact of these tariff measures accentuates the need for agile commercial strategies that safeguard both profitability and therapeutic continuity in the face of evolving trade policies.

Unraveling Deep-Dive Insights Across Treatment Modalities Distribution Pathways Dosage Forms and Patient End Users in Gastroesophageal Reflux Disease Care

Deep analysis of treatment type segmentation reveals that antacids continue to serve as frontline agents for immediate relief, while histamine-2 receptor antagonists benefit from a dual landscape of branded innovation and generic accessibility that broadens therapeutic reach. Concurrently, proton pump inhibitors are encompassed within both branded and generic portfolios, highlighting a competitive interplay between patented novel formulations and their off-patent counterparts. Prokinetic agents, though representing a smaller niche, exhibit potential through pipeline candidates aiming to enhance motility without exacerbating adverse events.

In terms of distribution pathways, hospital pharmacies anchor acute care delivery, whereas online pharmacies have emerged as pivotal channels for chronic therapy adherence and patient convenience. Traditional retail pharmacies maintain strong community presence, bridging prescriber recommendations with local accessibility. Route of administration analysis demonstrates that oral formulations dominate due to patient preference, yet intravenous options remain critical for severe in-hospital presentations.

With respect to dosage forms, capsules and tablets are well established, while liquid and suspension formats address the needs of pediatric and geriatric cohorts requiring dose flexibility. Finally, patient end user segmentation indicates that home care settings are increasingly relied upon for long-term management, hospitals remain essential for acute interventions, and specialty clinics are focal points for advanced procedural therapies. These segmentation insights illuminate strategic priorities for product developers and commercialization teams seeking targeted impact across diverse healthcare contexts.

This comprehensive research report categorizes the Gastroesophageal Reflux Disease Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- Dosage Form

- Route Of Administration

- Medicine Type

- Drug Status

- Disease Severity

- Distribution Channel

- End User

Evaluating the Regional Dynamics Influencing Gastroesophageal Reflux Disease Therapeutics Adoption Trends Across Americas EMEA and Asia Pacific Markets

Across the Americas, robust healthcare infrastructure and high per capita pharmaceutical expenditure support rapid adoption of cutting-edge GERD therapies, particularly innovative proton pump inhibitors and minimally invasive procedural solutions. Market access frameworks in North America favor value-based arrangements, empowering stakeholders to demonstrate cost-effectiveness while promoting patient-centric interventions. Latin American markets, meanwhile, present opportunities through expanding insured populations and government-led initiatives aimed at broadening chronic disease management.

Within Europe, Middle East, and Africa, heterogeneous regulatory landscapes and reimbursement paradigms shape therapeutic availability. Western European nations leverage established guidelines to fast-track breakthrough therapies, whereas emerging markets in Africa and the Middle East align with generic and biosimilar formulations to enhance affordability. Cross-border collaborations and regional trade agreements are facilitating streamlined supply routes and knowledge exchange, underpinning opportunities for manufacturers to navigate varied policy environments.

In Asia-Pacific, rapid urbanization and rising healthcare investment are driving demand for both first-line pharmaceutical and endoscopic interventions. Markets such as China and India showcase local manufacturing capabilities that bolster competitive pricing, while Japan and Australia continue to lead in adopting next-generation drug delivery technologies. Ultimately, regional dynamics underscore the necessity for tailored market entry strategies that reflect diverse payer systems and evolving patient expectations.

This comprehensive research report examines key regions that drive the evolution of the Gastroesophageal Reflux Disease Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Advancements in Gastroesophageal Reflux Disease Therapeutics Through Research and Partnerships

AstraZeneca remains at the forefront through its development of long-acting proton pump inhibitors designed for simplified dosing regimens. The company’s investments in patient-reported outcome studies further reinforce commercial differentiation by quantifying quality-of-life benefits. Merck leverages its portfolio of histamine-2 receptor antagonists alongside targeted digital health platforms, integrating mobile symptom trackers to optimize treatment pathways and adherence.

Takeda’s comprehensive approach spans branded prokinetic trials aiming to establish a new standard for gastric motility enhancement, complemented by strategic licensing partnerships to accelerate global reach. Pfizer focuses on next-generation mucosal protectants, advancing compounds that aim to fortify esophageal barrier function without systemic acid suppression. Meanwhile, Eisai is pioneering nonpharmacological solutions by collaborating with device manufacturers to refine endoscopic therapies and magnetic augmentation technologies.

Collectively, these corporate leaders harness collaborative research networks and strategic alliances to enrich their pipelines. Their targeted investments in real-world evidence generation and regulatory engagement underscore an unwavering commitment to delivering differentiated solutions that address unmet needs in GERD management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gastroesophageal Reflux Disease Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AstraZeneca plc

- Aurobindo Pharma Limited

- Bayer AG

- Cadila Pharmaceuticals Ltd.

- Camber Pharmaceuticals, Inc.

- Daewoong Pharmaceutical Co., Ltd.

- Dr. Reddy’s Laboratories Limited

- Eisai Co., Ltd.

- Elite Wealth Ltd.

- Haleon plc

- HK inno.N Co., Ltd.

- Ironwood Pharmaceuticals, Inc.

- Johnson & Johnson Services, Inc.

- Lupin Limited

- Onconic Therapeutics Inc.

- Pfizer Inc.

- Phathom Pharmaceuticals, Inc.

- RaQualia Pharma Inc.

- Reckitt Benckiser Group plc

- Sandoz Group AG

- Sanofi S.A.

- Sebela Pharmaceuticals Inc.

- Sun Pharmaceutical Industries Limited

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

- The Procter & Gamble Company

- Viatris Inc.

Formulating Strategic Pathways for Industry Leaders to Navigate Competitive Challenges and Capitalize on Emerging Opportunities in GERD Therapeutic Development

Industry leaders should prioritize integrated development models that merge pharmacologic innovation with digital therapeutics. By aligning drug development with data analytics and patient engagement platforms, organizations can create end-to-end solutions that resonate with providers and payers alike. This holistic approach not only enhances clinical outcomes but also strengthens the value proposition in increasingly outcome-driven healthcare environments.

Moreover, supply chain diversification must become a strategic imperative. Establishing regional manufacturing partnerships and leveraging trade agreements can mitigate the impact of future tariffs and geopolitical disruptions. Aligning procurement strategies with risk management frameworks will safeguard continuity of supply while optimizing cost structures.

Furthermore, deepening collaborative alliances with specialty clinics and key opinion leaders will foster early adoption of novel therapies. Engaging these stakeholders through targeted medical education and real-world evidence initiatives can expedite formulary acceptance and drive prescriber confidence. Ultimately, a balanced emphasis on rigorous scientific validation, patient-centric design, and agile commercialization roadmaps will equip industry players to navigate a dynamic GERD therapeutics landscape.

Detailing the Rigorous Multistage Research Framework Combining Primary Stakeholder Engagement and Secondary Data Synthesis to Ensure Analytical Integrity

The research framework underpinning this analysis integrates both primary and secondary information streams to ensure comprehensive coverage of the gastroesophageal reflux disease sector. Primary engagements involved in-depth interviews with gastroenterologists, pharmacologists, and healthcare payers to capture experiential insights on treatment efficacy, patient preferences, and reimbursement trends. These qualitative discussions were complemented by advisory board consultations that refined thematic priorities and validated emerging hypotheses.

Secondary research encompassed extensive review of peer-reviewed literature, clinical trial registries, and regulatory filings. Scientific databases provided access to the latest mechanistic studies and safety profiles, while policy documents and tariff schedules informed the analysis of geopolitical influences on supply chains. This dual-pronged methodology was further enhanced by cross-referencing proprietary data from regional health authorities and trade associations to corroborate regulatory interpretations.

Rigorous data triangulation ensured that findings reflect both empirical evidence and real-world practice. By synthesizing diverse intelligence sources and applying structured analytical frameworks, the research delivers a robust foundation for strategic decision-making in the GERD therapeutics arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gastroesophageal Reflux Disease Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gastroesophageal Reflux Disease Therapeutics Market, by Treatment Type

- Gastroesophageal Reflux Disease Therapeutics Market, by Dosage Form

- Gastroesophageal Reflux Disease Therapeutics Market, by Route Of Administration

- Gastroesophageal Reflux Disease Therapeutics Market, by Medicine Type

- Gastroesophageal Reflux Disease Therapeutics Market, by Drug Status

- Gastroesophageal Reflux Disease Therapeutics Market, by Disease Severity

- Gastroesophageal Reflux Disease Therapeutics Market, by Distribution Channel

- Gastroesophageal Reflux Disease Therapeutics Market, by End User

- Gastroesophageal Reflux Disease Therapeutics Market, by Region

- Gastroesophageal Reflux Disease Therapeutics Market, by Group

- Gastroesophageal Reflux Disease Therapeutics Market, by Country

- United States Gastroesophageal Reflux Disease Therapeutics Market

- China Gastroesophageal Reflux Disease Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1749 ]

Summarizing Core Insights and Strategic Imperatives Derived from In-Depth Analysis of the Gastroesophageal Reflux Disease Therapeutic Ecosystem

The comprehensive exploration of gastroesophageal reflux disease therapeutics underscores a landscape defined by continuous innovation, evolving regulatory pathways, and intricate supply chain dynamics. Insights into treatment segments reveal nuanced opportunities across antacids, histamine-2 receptor antagonists, prokinetics, and proton pump inhibitors-each demanding tailored strategies to maximize clinical and commercial impact. Regional analysis highlights the imperative of customizing market entry approaches to account for infrastructural, regulatory, and payer heterogeneity.

Key industry players demonstrate that success hinges on the ability to integrate drug development with digital tools, forge resilient supply networks, and cultivate strategic partnerships. The cumulative effect of 2025 tariff adjustments further accentuates the necessity for agile operational models and diversified procurement. Collectively, these insights inform a cohesive narrative for stakeholders to navigate the complexities of GERD management and unlock sustainable growth avenues.

This report’s synthesis of thematic areas delivers a clear set of strategic imperatives: advance patient-centric innovation, bolster supply chain resilience, and leverage evidence-based value communication. These imperatives will guide organizations toward achieving differentiated therapeutic offerings and long-term market leadership.

Seize Exclusive Insights on Gastroesophageal Reflux Disease Therapeutics by Engaging with Ketan Rohom to Unlock Your Customized Research Solutions Today

Embark on a strategic partnership with Ketan Rohom, whose expertise in sales and marketing bridges the gap between high-level insights and actionable intelligence. By engaging directly, organizations gain bespoke guidance on positioning, pricing, and partnership strategies tailored to the gastroesophageal reflux disease space. This call to action invites decision-makers to harness the full potential of a detailed research report that distills extensive secondary intelligence and firsthand stakeholder perspectives. Ketan Rohom stands ready to discuss how the rigorously derived findings can inform clinical development roadmaps and commercialization approaches. Connect today to secure the comprehensive analysis that will elevate your organization’s competitive advantage in the dynamic world of GERD therapeutics

Leveraging this opportunity ensures that pharmaceutical innovators, biotechnology firms, and healthcare providers access not only data but a strategic consultancy designed to drive growth, mitigate risks, and unlock new pathways to patient-centric value.

- How big is the Gastroesophageal Reflux Disease Therapeutics Market?

- What is the Gastroesophageal Reflux Disease Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?