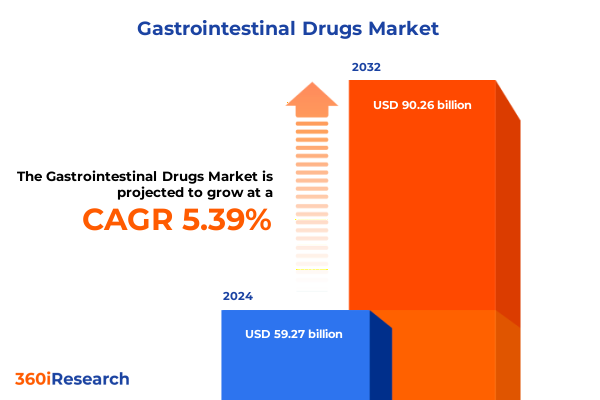

The Gastrointestinal Drugs Market size was estimated at USD 62.23 billion in 2025 and expected to reach USD 65.45 billion in 2026, at a CAGR of 5.45% to reach USD 90.26 billion by 2032.

Exploring the Evolving Terrain of Gastrointestinal Therapies Amidst Rising Prevalence and Innovative Treatment Paradigms in a Dynamic Healthcare Environment

Gastrointestinal health profoundly influences overall well-being, with digestive disorders affecting a significant portion of the population across all age groups. From functional conditions such as irritable bowel syndrome to more acute presentations like peptic ulcer disease, the spectrum of gastrointestinal challenges demands a diverse array of therapeutic interventions. In recent years, advances in molecular science and patient-centric clinical trial designs have accelerated the introduction of new drug entities while also reinvigorating the role of established therapies. As stakeholders navigate a landscape marked by both innovation and persistent unmet needs, understanding the interplay between epidemiological trends, patient behaviors, and treatment modalities becomes paramount.

Against this backdrop, the gastrointestinal drugs market is undergoing a period of dynamic transformation driven by both scientific breakthroughs and evolving care paradigms. Healthcare providers are adopting personalized treatment plans that integrate pharmacological agents with digital health tools, dietary management, and microbiome-targeted approaches. Concurrently, regulatory bodies have demonstrated increased receptivity to therapies that offer incremental improvements in efficacy or safety, provided they meet stringent evidence thresholds. Within this context, an executive summary must illuminate the critical drivers shaping therapeutic adoption, supply chain resilience, and competitive positioning, offering a strategic foundation for decision-makers seeking to navigate this vibrant yet complex sector with confidence.

Assessing the Transformational Forces in Gastrointestinal Drug Development Driven by Technological Advances Patient-Centric Care and Regulatory Evolution

The gastrointestinal drugs domain has witnessed sweeping shifts propelled by converging technological, scientific, and patient-driven forces. Precision medicine initiatives have tailored therapeutic regimens to individuals’ genetic and microbiome profiles, unlocking opportunities for more predictable outcomes and reduced adverse effects. At the same time, the integration of digital monitoring platforms-ranging from symptom-tracking apps to remote clinical assessments-has redefined how treatment efficacy and adherence are measured, enabling providers to intervene proactively and fine-tune medication plans in real time.

In parallel, regulatory frameworks have evolved to accommodate accelerated pathways for breakthrough therapies, fostering innovation without compromising safety. The heightened emphasis on real-world evidence collection has incentivized manufacturers to invest in post-approval studies, which in turn inform product differentiation strategies. Furthermore, the proliferation of biologics and biosimilars in the gastrointestinal space has broadened the therapeutic toolkit, challenging traditional small molecule dominance and compelling established players to rethink their research and development priorities. Altogether, these transformative currents have culminated in a landscape where agility, collaboration, and data-driven decision making have become essential competencies for organizations vying for market leadership.

Analyzing the Layered Consequences of United States Tariff Policies in 2025 on Procurement Logistics Manufacturing Costs and Industry Competitiveness

With the enactment of new tariff measures on imported pharmaceutical ingredients and finished dosage forms in early 2025, supply chain recalibration has emerged as a strategic imperative for gastrointestinal drug manufacturers. These escalated duties have magnified sourcing costs for critical active pharmaceutical ingredients traditionally procured from regions subject to heightened levies, compelling companies to explore alternative suppliers or to localize manufacturing operations. As a result, procurement teams are increasingly prioritizing supplier diversification, leveraging near-shore facilities to mitigate exposure to geopolitical shifts and tariff volatility.

Beyond direct cost implications, these tariffs have introduced planning complexities across logistics and inventory management functions. Extended lead times, storage capacity constraints, and the need for buffer stocks have prompted cross-functional task forces to reevaluate demand forecasting methodologies and distribution footprints. In certain instances, tariff-induced cost pressures have led to selective reprioritization of product pipelines, favoring assets with stronger margin resilience or lower raw material intensity. Ultimately, the cumulative impact of 2025 tariffs underscores the necessity of building adaptable, end-to-end supply chains capable of responding swiftly to policy changes.

Delving into Comprehensive Segmentation Insights Spanning Drug Classes Administration Routes Indications Distribution Channels and End User Dynamics

A nuanced view of the gastrointestinal drugs market emerges when one examines its segmentation across multiple dimensions, each shedding light on distinct value drivers. From a drug-class perspective, antacids remain a cornerstone for immediate symptom relief, with formulations such as aluminum hydroxide, calcium carbonate, magnesium hydroxide, and sodium bicarbonate accounting for rapid pH correction in acid-related disorders. Antidiarrheals, including bismuth subsalicylate and loperamide, continue to address acute episodes, while antispasmodics such as dicyclomine and hyoscyamine alleviate functional discomfort in conditions like irritable bowel syndrome. Laxatives support patients experiencing chronic constipation, and proton pump inhibitors have sustained their leadership position in managing gastroesophageal reflux disease by offering targeted acid suppression.

Route of administration also plays a pivotal role in patient adherence and therapeutic outcomes. Injectable forms, whether intramuscular or intravenous, cater to hospital settings and acute care episodes, whereas oral options-through capsules, powders, and tablets-dominate chronic therapies. Within oral delivery, hard shell and soft gel capsules offer distinct release profiles and patient preferences, and topical technologies such as creams, gels, and patches are increasingly explored for localized symptoms such as anal fissures or hemorrhoids.

Indication-based segmentation underscores the market’s responsiveness to disease burden, spanning treatments for constipation, diarrhea, gastroesophageal reflux disease, irritable bowel syndrome, and peptic ulcer disease. Distribution channels are evolving as online pharmacies gain traction alongside traditional hospital, retail, and specialty pharmacy networks, reshaping access and patient convenience. Finally, end users-including gastroenterology and general practice clinics, home healthcare providers, and hospitals-demand tailored solutions that align with care settings’ operational workflows and reimbursement considerations.

This comprehensive research report categorizes the Gastrointestinal Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Route Of Administration

- Molecule Type

- Formulation Type

- Indication

- End User

- Distribution Channel

Interpreting Regional Dynamics in Gastrointestinal Therapeutics with Focus on North American Trends European Regulatory Shifts and Asia-Pacific Market Drivers

Regional analysis reveals significant variation in market maturity and growth drivers across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, a combination of high patient awareness, robust insurance coverage frameworks, and a strong pipeline of novel agents has fueled both innovation and competitive generic entries. Manufacturers in this region are investing heavily in patient support programs to differentiate their portfolios and optimize adherence in chronic conditions.

In Europe, the Middle East, and Africa, regulatory harmonization efforts spearheaded by entities such as the European Medicines Agency have streamlined approval processes, while pricing and reimbursement landscapes remain complex and variable across national jurisdictions. This has given rise to targeted launch strategies, with companies customizing clinical and economic value demonstrations to meet diverse payer expectations. Meanwhile, emerging markets in the Middle East and select African nations are witnessing incremental investments in gastroenterology infrastructure, opening avenues for market penetration.

Across the Asia-Pacific region, escalating healthcare expenditures and rising prevalence of lifestyle-related gastrointestinal disorders are driving demand for both branded and off-patent therapies. Local manufacturers are scaling up production capabilities and forging partnerships with global innovators to access proprietary formulations. Simultaneously, expanding online distribution channels are enhancing access in geographically dispersed areas, underscoring the importance of channel optimization in this dynamic market.

This comprehensive research report examines key regions that drive the evolution of the Gastrointestinal Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Influential Pharmaceutical and Biotech Leaders Shaping the Gastrointestinal Drug Sector through Innovation and Strategic Partnerships

The competitive landscape in gastrointestinal medications is being shaped by a blend of established pharmaceutical giants and agile biotechnology firms. Legacy players with broad gastrointestinal portfolios have leveraged their scale to maintain market share while reinvesting in research focused on novel modalities such as microbiome-modulating therapies and targeted biologics. Concurrently, companies traditionally focused on specialty gastroenterology have broadened their scope through strategic alliances, bringing complementary assets to market more efficiently.

Emerging biotech entities have gained traction by advancing innovative drug candidates addressing unmet needs in functional disorders and inflammatory conditions. These smaller organizations often collaborate with academic institutions and contract research organizations to accelerate early-stage development and de-risk clinical pathways. In parallel, large contract manufacturing organizations are expanding capacity for small molecule and biologic production to support increased demand and facilitate on-shore API sourcing as part of broader supply chain resilience strategies.

Collectively, these players are adopting differentiated approaches to portfolio management, ranging from in-licensing and co-development agreements to bolt-on acquisitions that enhance therapeutic pipelines. The resulting competitive environment emphasizes speed to market, regulatory savvy, and a keen understanding of payer dynamics, underscoring the multifaceted strategies required to excel in the gastrointestinal drugs sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gastrointestinal Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca PLC

- Bausch Health Companies Inc.

- Bayer AG

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb

- Cipla Limited

- Cosmo Pharmaceuticals N.V.

- Dr. Reddy’s Laboratories Ltd.

- Eli Lilly and Company

- F. Hoffmann‑La Roche Ltd

- Ferring International Center S.A.

- GlaxoSmithKline plc

- Ironwood Pharmaceuticals, Inc.

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Novartis AG

- Otsuka Pharmaceutical Co., Ltd.

- Pfizer Inc.

- Reckitt Benckiser Group plc

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Proposing Actionable Strategies for Gastrointestinal Drug Industry Leaders to Enhance Operational Efficiency Strengthen Supply Chains and Foster Growth

Industry leaders seeking to solidify their position in the gastrointestinal space must prioritize strategic actions across manufacturing, commercialization, and stakeholder engagement. Building redundancy into supply networks by onboarding additional API suppliers and exploring near-shore facilities can mitigate tariff and geopolitical risks, ensuring uninterrupted production. At the same time, refining commercial models with digital patient support tools and telemedicine integration will bolster adherence rates and improve real-time monitoring of therapeutic outcomes.

Collaboration with regulatory authorities to co-develop adaptive trial designs and leverage real-world evidence can expedite product approvals while demonstrating value more effectively to payers. Furthermore, investing in advanced analytics to anticipate demand fluctuations and optimize inventory positioning can reduce working capital constraints and enhance service levels. To foster sustained growth, organizations should also explore partnerships with biotech innovators focused on emerging mechanisms of action, thereby diversifying their pipeline and tapping into novel therapeutic frontiers.

By orchestrating these initiatives in concert, industry leaders will be better equipped to navigate policy shifts, address the evolving preferences of healthcare providers and patients, and sustain competitive advantage in a rapidly changing gastrointestinal drugs market.

Elucidating Methodological Approaches in Researching the Gastrointestinal Drugs Market Incorporating Primary Insights Secondary Data with Validation

The research underpinning these insights combines rigorous primary and secondary methodologies to ensure robustness and relevance. In the primary phase, interviews with key opinion leaders-including gastroenterologists, specialized pharmacists, and regulatory experts-provided qualitative perspectives on therapeutic adoption patterns, unmet clinical needs, and supply chain vulnerabilities. These discussions informed the development of structured surveys distributed to a broader sample of clinicians, procurement professionals, and hospital administrators to quantify operational challenges and strategic priorities.

Secondary research encompassed a comprehensive review of regulatory filings, patent landscapes, clinical trial registries, and publicly available financial disclosures to map the competitive terrain and identify innovation hotspots. Supply chain data was corroborated through trade statistics, tariff schedules, and logistics provider reports, enabling precise characterization of cost drivers and lead-time variances. To validate findings, a triangulation process compared primary insights with secondary data points, ensuring consistency and identifying areas warranting deeper analysis.

This combination of expert commentary, quantitative survey results, and detailed document analysis yields a robust framework for understanding the gastrointestinal drugs market. It allows stakeholders to make informed decisions grounded in diverse evidence streams, reflecting real-world practices and forward-looking trends.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gastrointestinal Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gastrointestinal Drugs Market, by Drug Class

- Gastrointestinal Drugs Market, by Route Of Administration

- Gastrointestinal Drugs Market, by Molecule Type

- Gastrointestinal Drugs Market, by Formulation Type

- Gastrointestinal Drugs Market, by Indication

- Gastrointestinal Drugs Market, by End User

- Gastrointestinal Drugs Market, by Distribution Channel

- Gastrointestinal Drugs Market, by Region

- Gastrointestinal Drugs Market, by Group

- Gastrointestinal Drugs Market, by Country

- United States Gastrointestinal Drugs Market

- China Gastrointestinal Drugs Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3180 ]

Concluding Perspectives on Evolving Trends and Strategic Imperatives Guiding Stakeholders in the Gastrointestinal Drugs Ecosystem toward Operational Excellence

Reviewing the current state of gastrointestinal therapeutics reveals a domain marked by significant innovation alongside enduring challenges. While established drug classes continue to deliver reliable symptom management, next-generation therapies promise more tailored and effective interventions. The interplay of policy developments, including tariff adjustments and regulatory reforms, has introduced fresh complexities to supply chains and cost structures. Nonetheless, organizations that proactively adapt their procurement strategies and embrace digital and precision medicine tools are poised to capture value from emerging market segments.

Looking ahead, the sector’s success will hinge on the degree to which stakeholders can integrate diverse evidence streams-ranging from bench research to real-world patient data-into cohesive development and commercialization plans. Those that cultivate collaborative ecosystems with technology partners, regulatory bodies, and clinical experts will accelerate time to market and strengthen the case for novel therapeutics. Ultimately, by aligning strategic priorities with evolving patient needs and policy landscapes, industry participants can navigate uncertainty and support improved outcomes for individuals affected by gastrointestinal disorders.

Seize the Opportunity to Elevate Strategic Planning in Gastrointestinal Drug Development by Connecting with Ketan Rohom to Access In-Depth Market Research Insights

To drive your organization’s success in a competitive gastrointestinal drugs environment, it’s time to engage directly with an industry expert who can equip you with the granular insights and strategic context needed to outpace your peers. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to arrange a personalized consultation that highlights the report’s depth on supply chain resilience, segmentation nuances, regulatory implications, and region-specific dynamics. By establishing this direct dialogue, you will gain tailored perspectives on how the evolving tariff landscape and shifting patient preferences might affect your product portfolio and distribution strategies. Ultimately, this conversation will empower your leadership team to make timely, data-backed decisions that protect margins, anticipate market shifts, and seize growth opportunities. Reach out today to secure access to the comprehensive market research findings that will shape your roadmap for success in the gastrointestinal drugs sector.

- How big is the Gastrointestinal Drugs Market?

- What is the Gastrointestinal Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?