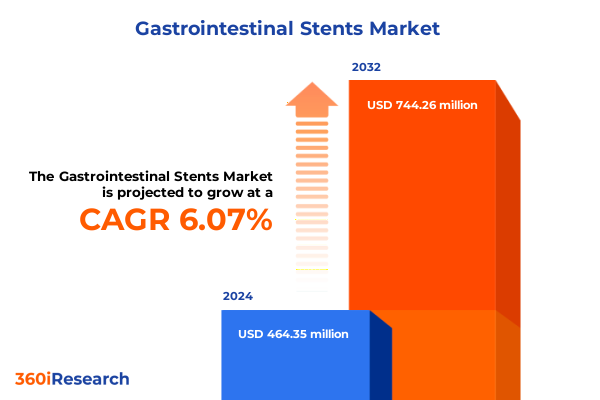

The Gastrointestinal Stents Market size was estimated at USD 489.90 million in 2025 and expected to reach USD 521.43 million in 2026, at a CAGR of 6.15% to reach USD 744.26 million by 2032.

Unveiling the Critical Foundations and Emerging Dynamics That Are Defining the Landscape of Gastrointestinal Stenting for Pathological Obstructions and Innovative Procedural Approaches

Gastrointestinal stenting has emerged as a pivotal therapeutic intervention for a wide spectrum of luminal obstructions, offering minimally invasive options in place of traditional surgery. Over the past two decades, clinical practice guidelines have increasingly endorsed stent placement to alleviate symptoms, improve patient quality of life, and reduce hospital stays. Driven by demographic shifts such as an aging population and rising incidence of gastrointestinal malignancies, the demand for advanced stent solutions continues to accelerate globally.

In parallel with evolving clinical needs, technological innovations have expanded the functional capabilities of gastrointestinal stents. Novel materials, enhanced designs, and integrated delivery platforms have been introduced to address challenges such as stent migration, tissue ingrowth, and restenosis. These advancements have fostered greater procedural confidence among endoscopists and interventional radiologists, thereby widening the adoption of stenting across both benign and malignant indications.

Furthermore, health systems are under increasing pressure to optimize care pathways and manage costs, creating fertile ground for gastrointestinal stents to demonstrate value through reduced length of stay and lower complication rates compared to open surgical alternatives. Clinicians and payers alike are scrutinizing real-world evidence to validate long-term outcomes, fueling interest in postmarket surveillance registries and multicenter studies.

Altogether, this introduction establishes the foundational context for understanding how clinical imperatives, patient demographics, and technological progress have coalesced to shape the contemporary gastrointestinal stent market environment.

Highlighting the Groundbreaking Technological, Clinical Practice, and Regulatory Transformations Reshaping Gastrointestinal Stenting Protocols Worldwide

Recent years have witnessed a paradigm shift in gastrointestinal stenting, driven by breakthroughs in material science, imaging integration, and procedural methodology. Biodegradable polymer formulations and drug-eluting coatings are now entering clinical trials, targeting common challenges such as tissue hyperplasia and microbial colonization. These emergent platforms promise to reduce the need for repeat interventions while delivering localized therapy directly to the lesion site.

Simultaneously, advances in image-guided delivery-combining high-definition endoscopy with real-time fluoroscopic visualization-have enhanced placement accuracy and procedural safety. Innovations such as three-dimensional reconstruction and augmented reality overlays are beginning to appear in select centers, providing operators with unprecedented spatial awareness and reducing fluoroscopy time. As a result, specialist teams are able to tackle complex anatomies that were previously deemed high risk.

Beyond hardware improvements, procedural protocols are evolving to incorporate integrated multidisciplinary care pathways. Collaboration among gastroenterologists, interventional radiologists, and surgical teams has streamlined patient selection and pre-procedural planning, ensuring that stenting is delivered in the most appropriate clinical context. Looking ahead, hybrid operating rooms equipped with endoscopic and radiologic capabilities are poised to become the new standard for advanced stent interventions.

Collectively, these transformative shifts underscore a move toward precision medicine in gastrointestinal endoscopy, where tailored stent designs, image-guided placement, and cross-disciplinary workflows converge to elevate patient outcomes and procedural efficiency.

Assessing the Overarching Consequences of the 2025 United States Tariff Measures on the Gastrointestinal Stent Industry’s Cost Structures and Supply Chains

In 2025, the United States implemented revised tariff measures affecting a range of imported medical devices, including gastrointestinal stents. While the stated goal of these tariffs is to safeguard domestic manufacturing, the immediate effect has been an uptick in manufacturing overhead and logistics expenses for importers. Suppliers are now grappling with the challenge of incorporating these additional costs without unduly burdening healthcare providers or patients.

Consequently, several international device manufacturers have accelerated efforts to diversify production footprints. Investment in nearshoring initiatives, partnerships with domestic contract manufacturers, and expansion of regional distribution hubs have emerged as strategic imperatives. By localizing final assembly or adopting dual-sourcing models, companies aim to mitigate tariff-related cost exposures and stabilize supply chains.

From the perspective of healthcare providers, the tariff-induced cost pressures are prompting renewed negotiations with suppliers, driving interest in alternative stent materials and lower-cost platforms. At the same time, payers are intensifying scrutiny of reimbursement policies, demanding transparent cost-benefit analyses that account for tariff impacts on procedural economics. As a result, product developers are being compelled to justify pricing through demonstrable clinical value and total cost of care reductions.

Looking forward, tariff-related dynamics are set to recalibrate competitive positioning within the gastrointestinal stent industry, favoring organizations that can optimize supply chain resilience, operational agility, and value-based propositions.

Delineating the Multi-Dimensional Market Segmentation Framework That Reveals Critical Trends Across Product Types, Materials, Methods, End Users, Applications, and Distribution Channels

A multidimensional segmentation framework reveals nuanced dynamics across product types, materials, placement methods, end users, applications, and distribution channels. Plastic stents continue to be favored for short-term interventions and benign strictures due to their cost-effectiveness and ease of placement, while self-expandable metallic stents are the platform of choice for malignant obstructions, with covered variants providing enhanced protection against tissue ingrowth and uncovered models offering superior radial force.

Material segmentation further highlights trade-offs between metal and plastic constructs. Metal frameworks deliver higher conformability and sustained patency for complex anatomies, whereas plastic polymers allow for streamlined delivery systems and reduced imaging artifacts. The advent of hybrid constructs-blending polymer coatings with metallic scaffolds-illustrates the industry’s pursuit of combining the best material attributes.

Placement method segmentation underscores the growing preference for combined endoscopic-fluoroscopic techniques, which balance the real-time visual benefits of endoscopy with the spatial resolution of fluoroscopy. Purely endoscopic approaches dominate routine cases, while fluoroscopic-only placement remains important in anatomically challenging scenarios or in facilities lacking advanced endoscopic infrastructure.

End user segmentation highlights the expanding role of ambulatory surgical centers and clinics, which are increasingly equipped to manage lower-complexity cases, thereby reducing hospital congestion. Meanwhile, hospitals continue to perform the majority of high-risk procedures. In terms of applications, biliary obstruction remains the largest indication, closely followed by management of colorectal strictures and gastric outlet obstructions, with esophageal and duodenal applications experiencing steady uptake. Lastly, distribution channel segmentation reveals a split between direct sales models, which offer controlled customer engagement, and distributor networks, which enable broader geographic coverage.

This comprehensive research report categorizes the Gastrointestinal Stents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Placement Method

- Application

- End User

- Distribution Channel

Mapping the Strategic Regional Variations and Growth Drivers Across Americas, Europe Middle East Africa, and Asia Pacific in Gastrointestinal Stenting Adoption

Regional insights into gastrointestinal stenting practices reveal distinct adoption patterns and growth drivers across the Americas, Europe Middle East & Africa (EMEA), and Asia-Pacific regions. In the Americas, robust healthcare infrastructure and favorable reimbursement frameworks have catalyzed early adoption of advanced stent platforms. Key markets such as the United States and Canada exhibit strong institutional support for minimally invasive procedures, with leading centers driving procedural guidelines and operator training programs.

In EMEA, regulatory harmonization under the Medical Device Regulation has streamlined market entry for new technologies, yet reimbursement variability across individual countries creates a complex commercial landscape. Western European nations often demonstrate high adoption rates of premium stent technologies, while emerging markets in Eastern Europe, the Middle East, and Africa are characterized by cost-conscious procurement and increasing demand for cost-effective stent solutions shaped by expanding healthcare budgets.

The Asia-Pacific region stands out for its rapid infrastructure development, growing clinical expertise, and expanding medical tourism. Countries like Japan and South Korea lead in innovation adoption, supported by strong domestic manufacturers and government-led healthcare initiatives. Meanwhile, markets such as China and India are witnessing significant growth fueled by rising incidence of gastrointestinal diseases, expanding insurance coverage, and ongoing investments in specialized care facilities.

Together, these regional dynamics underscore the importance of tailored market strategies, regulatory navigation, and localized value propositions to effectively address the evolving demands of diverse healthcare ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Gastrointestinal Stents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders to Illuminate Competitive Strategies, Portfolio Innovations, and Collaborative Initiatives Driving Gastrointestinal Stent Advancements

A review of competitive landscapes reveals several leading manufacturers and emerging challengers shaping the gastrointestinal stent arena. Major global device companies have leveraged extensive clinical trial networks and regulatory expertise to secure pivotal approvals and establish flagship product lines. These incumbents continue to invest heavily in iterative design improvements, incremental launches, and lifecycle support programs to maintain market leadership.

At the same time, specialist medtech firms and start-ups are introducing disruptive technologies such as bioresorbable stents, thermoresponsive materials, and targeted drug elution to differentiate their offerings. Strategic collaborations between regional device producers and international partners have also become increasingly common, enabling accelerated product development and broader market reach.

Moreover, the competitive focus has shifted toward ancillary services-digital health platforms, remote procedural support, and training simulators-that complement the core stent technology. Organizations that can integrate these value-added services into comprehensive solutions are gaining traction among key opinion leaders and healthcare systems seeking end-to-end procedural enhancements.

Ultimately, the evolving company landscape underscores a blend of consolidation and innovation, where established giants and agile newcomers vie for differentiation through both product excellence and holistic customer engagement models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gastrointestinal Stents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Arterial Remodeling Technologies SA

- Arterius Ltd

- B. Braun Melsungen AG

- BIOTRONIK SE & Co. KG

- Boston Scientific Corporation

- Elixir Medical Corporation

- JW Medical Systems LTD

- Kaneka Corporation

- KLS Martin Group

- Kyoto Medical Planning Co. Ltd.

- Medtronic Plc

- Meril Life Sciences Pvt. Ltd.

- Microport Scientific Corporation

- OrbusNeich Medical

- Q3 Medical Devices Limited.

- Reva Medical

- SafeGuard Surgical, Inc.

- Smith & Nephew Plc

- Stryker Corporation

- Syntellix AG

- Terumo Corporation

Presenting Evidence-Based Strategic Recommendations to Empower Manufacturers, Providers, and Stakeholders for Sustainable Growth in the Gastrointestinal Stent Segment

To navigate the complex and evolving gastrointestinal stent market, industry leaders must adopt a multifaceted strategic approach. First, investment in advanced material research-such as biodegradable polymers and localized drug delivery systems-will be critical for addressing unmet clinical needs and reducing long-term intervention rates. Coupled with robust clinical validation, these innovations can strengthen value propositions.

Next, organizations should prioritize supply chain resilience by diversifying manufacturing footprints and establishing strategic partnerships with regional contract manufacturers. This will help mitigate risks posed by external trade policies and logistic disruptions while ensuring consistent product availability across key markets.

In parallel, tailored engagement with healthcare stakeholders-including operators, payers, and procurement groups-will be essential for demonstrating total cost of care benefits. Developing comprehensive training programs, digital support tools, and outcomes registries can foster stronger clinical adoption and pave the way for favorable reimbursement terms.

Finally, pursuing targeted collaborations with technology partners in imaging, data analytics, and digital health will enable the creation of integrated procedural ecosystems. Such alliances can drive improved procedural efficiencies, enhance patient outcomes, and unlock new revenue streams beyond traditional device sales.

Detailing the Rigorous Research Methodology Underpinning the Comprehensive Analysis of the Gastrointestinal Stent Ecosystem and Data Integrity Protocols

This analysis is grounded in a rigorous research methodology designed to ensure data integrity, comprehensiveness, and industry relevance. Secondary research encompassed a review of peer-reviewed journal articles, regulatory filings, and publicly available clinical trial databases, providing a foundational understanding of technological advances and market dynamics.

Primary research involved in-depth interviews with leading clinicians, interventional radiologists, healthcare procurement managers, and device developers to capture practical insights on procedural adoption, reimbursement landscapes, and innovation priorities. Responses from these interviews were anonymized and aggregated to preserve respondent confidentiality.

Data triangulation techniques were applied throughout the research process, cross-verifying findings from diverse sources to identify consistent trends and mitigate bias. All quantitative inputs underwent validation by an expert advisory panel comprising academic researchers and industry veterans, ensuring alignment with real-world market conditions.

The result is a holistic and transparent view of the gastrointestinal stent ecosystem, underpinned by methodical data collection, robust analytical frameworks, and continuous quality control protocols.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gastrointestinal Stents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gastrointestinal Stents Market, by Product Type

- Gastrointestinal Stents Market, by Material

- Gastrointestinal Stents Market, by Placement Method

- Gastrointestinal Stents Market, by Application

- Gastrointestinal Stents Market, by End User

- Gastrointestinal Stents Market, by Distribution Channel

- Gastrointestinal Stents Market, by Region

- Gastrointestinal Stents Market, by Group

- Gastrointestinal Stents Market, by Country

- United States Gastrointestinal Stents Market

- China Gastrointestinal Stents Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Strategic Imperatives to Chart the Future Trajectory of Gastrointestinal Stenting in Evolving Clinical and Market Environments

This report has synthesized the core drivers, transformative innovations, and market forces shaping the gastrointestinal stent landscape. From material science breakthroughs and image-guided procedural enhancements to trade policy impacts and regional adoption patterns, a clear narrative emerges: the future of gastrointestinal stenting will be defined by precision, personalization, and resilience.

Key segmentation analysis highlights how product type, material selection, placement method, end user environment, clinical application, and distribution channel interact to create differentiated value propositions. Concurrently, regional insights reveal the need for nuanced market entry and commercialization strategies that reflect diverse regulatory, economic, and clinical realities.

Competitive profiling underscores a balance between established industry giants leveraging scale and emerging innovators introducing disruptive platforms. Actionable recommendations point toward investments in advanced R&D, supply chain diversification, and stakeholder engagement to navigate tariff pressures and evolving procedural demands.

Taken together, these findings chart a path forward for manufacturers, healthcare providers, and policy makers seeking to enhance patient outcomes, optimize economic value, and accelerate adoption of next-generation gastrointestinal stent solutions.

Engage With Our Associate Director of Sales and Marketing to Secure Exclusive Insights and Maximize the Value of the Gastrointestinal Stent Market Research Report

For organizations aiming to capitalize on the comprehensive insights and strategic analyses presented in this report, engaging directly with Associate Director of Sales & Marketing Ketan Rohom will provide tailored guidance on how to leverage these findings to support clinical decision-making, optimize market entry strategies, and inform product development roadmaps. With deep expertise in gastrointestinal device markets and a consultative approach to client needs, Ketan Rohom can facilitate access to the full breadth of data, including detailed appendices, expert interview transcripts, and custom segmentation models. Reach out to secure exclusive pricing and explore personalized research packages that align with your organizational priorities, ensuring you gain a decisive competitive advantage in the evolving gastrointestinal stent landscape.

- How big is the Gastrointestinal Stents Market?

- What is the Gastrointestinal Stents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?