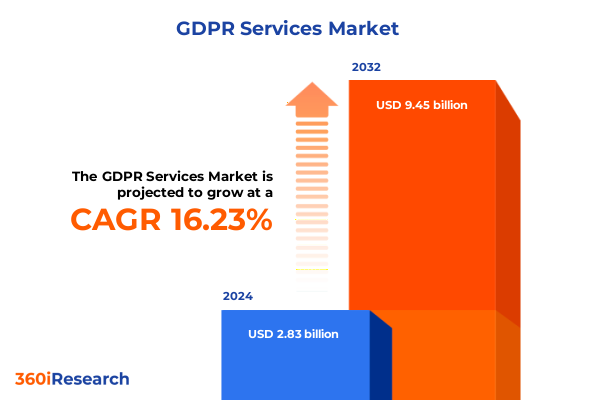

The GDPR Services Market size was estimated at USD 3.29 billion in 2025 and expected to reach USD 3.82 billion in 2026, at a CAGR of 16.24% to reach USD 9.45 billion by 2032.

Exploring the Foundations of GDPR Services with Comprehensive Insight into Regulatory Complexity and Strategic Frameworks for Data Privacy Excellence

The landscape of data privacy has undergone a profound evolution, compelling organizations to adopt more stringent protective measures. As global regulatory frameworks converge and diverge, enterprise leaders must navigate a labyrinth of compliance mandates that transcend national borders and industry verticals. This complex environment underscores the critical role of GDPR services in helping companies align with nuanced legal requirements while maintaining operational continuity. By understanding the foundational elements of GDPR compliance-data mapping, risk assessment, policy development, and ongoing monitoring-organizations can transform regulatory obligations into strategic imperatives that drive customer trust and competitive differentiation.

Transitioning from reactive compliance to proactive privacy management requires a holistic view of both external pressures and internal capabilities. Stakeholders must integrate cross‐functional teams, incorporating legal, IT, security, and business units to orchestrate a unified response. Through early engagement and continuous dialogue, executives can establish governance frameworks that not only mitigate penalties but also lay the groundwork for data‐centric innovation. In this context, GDPR services emerge as essential enablers, offering specialized expertise and structured methodologies to accelerate maturity while preserving agility. Consequently, a thorough introduction to these services sets the stage for deeper insight into transformational trends and strategic considerations that will shape the future of data privacy and protection.

Transformational Dynamics Shaping the GDPR Services Landscape Amid Evolving Data Privacy Expectations and Technological Advancements

The GDPR services sector is being redefined by a convergence of transformative shifts across technology, regulation, and stakeholder expectations. Advances in artificial intelligence and machine learning have introduced powerful tools for automated data discovery, classification, and anomaly detection, enabling privacy teams to proactively identify and remediate compliance gaps. At the same time, heightened scrutiny from regulatory bodies and the public has elevated the stakes for transparent data handling practices, driving demand for real‐time auditing and continuous monitoring capabilities. These technological and cultural forces are reshaping service portfolios, compelling providers to embed privacy-by-design principles into core offerings.

Moreover, the proliferation of cross-border data flows and the emergence of new data protection frameworks in regions outside Europe have introduced additional complexity. Privacy practitioners must now reconcile diverse legal regimes without sacrificing operational efficiency. This dynamic has spurred the development of integrated platforms that reconcile multiple regulatory requirements and provide a unified dashboard for compliance oversight. Consequently, service models are shifting toward managed-services and outcome-based engagements, reflecting a broader transformation from point solutions to comprehensive, lifecycle-driven approaches. As a result, organizations are increasingly seeking partners who can guide them through these paradigm shifts and deliver end-to-end privacy assurance.

Assessing the Aggregate Effects of 2025 United States Tariff Impositions on Data Privacy Service Cost Structures and Market Accessibility

Throughout 2025, United States tariff policies have exerted a cumulative influence on the cost structures and operational frameworks of GDPR service providers. Initial rounds of levies on cloud infrastructure components, cybersecurity appliances, and enterprise hardware have translated into increased capital expenditures for both global vendors and consulting firms. As providers navigated these elevated supply costs, many opted to pass a portion of the burden onto clients, prompting a recalibration of pricing models and contract renegotiations to maintain margin stability.

In addition, strategic sourcing decisions were reevaluated in light of tariff volatility. Service suppliers expanded nearshore and onshore partnerships to mitigate dependence on import-subject components, spurring collaborations with domestic data center operators and software integrators. This realignment not only buffered against tariff fluctuations but also strengthened data sovereignty assurances, a critical consideration for clients concerned about cross-border compliance. Consequently, organizations gained greater flexibility in deployment strategies, balancing cost, performance, and regulatory mandates. Going forward, GDPR service stakeholders will continue to manage the ripple effects of tariff adjustments through dynamic procurement strategies and innovative service delivery models.

Deriving Actionable Insights from Multidimensional Market Segmentation across Industries, Service Types, Organization Sizes, and Deployment Models in GDPR Services

Analyzing market segmentation reveals nuanced demand drivers across multiple dimensions, reflecting the varied requirements of distinct stakeholder groups. In terms of end‐user industry verticals, financial institutions leverage GDPR services to secure customer data and maintain regulatory licenses, while government agencies at both federal and state levels prioritize data residency, transparency, and interdepartmental governance. Healthcare organizations encompassing hospitals, medical device manufacturers, and pharmaceutical companies confront unique challenges around patient records, clinical trials, and device telemetry, driving specialized compliance assessments. Meanwhile, IT and telecom enterprises integrate privacy controls into software development life cycles and network services, and retail businesses-spanning brick-and-mortar outlets and online platforms-focus on consumer consent management and secure transaction processing.

Service type segmentation further diversifies the landscape, as organizations engage providers for discrete assessments, in-depth regulatory consultancy, outsourced or virtual data protection officer functions, continuous monitoring, and tailored training programs. Initial audit services and gap analyses establish compliance baselines, which feed into regulatory advisory, remediation services, and risk assessments that align with organizational risk appetites. Outsourced and virtual DPO services offer flexibility for enterprises lacking in-house expertise, while continuous monitoring and incident response capabilities enable real-time threat detection and rapid remediation. Employee awareness workshops and specialized security training reinforce a culture of privacy, ensuring that policy frameworks translate into everyday practices.

Another dimension considers organization size, where large enterprises command comprehensive portfolios that address complex, global privacy requirements, and small to medium-sized entities require scalable, cost-effective solutions that adapt to evolving growth trajectories. Deployment models also shape procurement decisions, with cloud-based platforms offering rapid provisioning and automated updates, whereas on-premise implementations appeal to entities with stringent data residency or latency constraints. By synthesizing these segmentation lenses, stakeholders can tailor service engagements that align with their unique operational contexts, risk profiles, and strategic imperatives.

This comprehensive research report categorizes the GDPR Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Organization Size

- Deployment Type

- End User Industry

Uncovering Regional Divergences and Emerging Growth Nodes across Americas, Europe Middle East Africa, and Asia Pacific in the GDPR Services Ecosystem

Regional market dynamics illuminate contrasting adoption curves and regulatory priorities. Within the Americas, organizations grapple with harmonizing GDPR compliance best practices alongside emerging local privacy statutes such as the California Consumer Privacy Act, often seeking integrated solutions that address multiple legal frameworks simultaneously. This demand fosters strategic partnerships between consultancy firms and technology vendors to deliver unified compliance platforms that streamline policy enforcement and reporting.

Across Europe, the Middle East, and Africa, the European Union remains the epicenter of GDPR enforcement, driving a robust ecosystem of specialized service providers and legal advisories. Nations outside the EU are progressively enacting GDPR-inspired regulations, spurring demand for cross-jurisdictional compliance strategies. Service architects in this region prioritize multilingual policy documentation, cross-border data transfer mechanisms, and regional data residency solutions to meet diverse legal requirements.

In the Asia-Pacific arena, governments are accelerating the development of comprehensive data protection frameworks inspired by GDPR’s foundational principles. Early adopters in Australia and Japan lead the charge, while emerging markets in Southeast Asia and India are rapidly refining their privacy legislation. Consequently, demand for GDPR services in the region is characterized by educational initiatives, capacity building, and technology transfers, as local businesses seek to align with global data privacy norms and secure international partnerships.

This comprehensive research report examines key regions that drive the evolution of the GDPR Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Players Driving Innovation, Strategic Partnerships, and Service Expansion in the Evolving GDPR Services Market

A cadre of global consultancies, technology integrators, and specialized privacy boutiques are driving service innovation and expanding market reach. Leading professional services firms have deepened their privacy advisory practices, embedding regulatory expertise within broader risk, compliance, and cybersecurity practices. At the same time, pure-play GDPR service providers have introduced modular, API-driven platforms that integrate seamlessly with enterprise IT stacks, offering automated data inventory, consent management, and breach notification workflows.

Strategic partnerships have emerged as a defining trend, with technology vendors collaborating with legal experts to co-develop compliance accelerators and customer-facing portals. Regional firms, particularly in EMEA and Asia-Pacific, are joining forces with global players to deliver localized services that meet language, cultural, and legal nuances. Additionally, innovative startups are leveraging artificial intelligence to enhance data discovery, classification, and pseudonymization processes, carving out niche positions in the market. As competition intensifies, leading companies are prioritizing client success frameworks, outcome-based SLAs, and continuous innovation pipelines to differentiate their offerings in a crowded landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the GDPR Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A-LIGN

- Absolute Software Corporation

- Amazon Web Services, Inc.

- Atos SE

- Capgemini

- Cloud4C

- Ernst & Young LLP

- Informatica Inc.

- International Business Machines Corporation

- Microsoft Corporation

- Mimecast Services Limited

- OneTrust, LLC.

- Oracle Corporation

- Protegrity Inc.

- Redscan Cyber Security Limited

- SAP SE

- SAS Institute Inc.

- Trustwave Holdings, Inc.

- Varonis Systems, Inc.

- Veritas Storage (Ireland) Limited

- Wipro Limited

- Xiarch Solutions Pvt. Ltd.

Charting Proactive Strategies and Tactical Imperatives for Industry Executives to Elevate Data Privacy Compliance and Enhance Competitive Positioning

Industry leaders can fortify their data privacy strategies by adopting a series of actionable imperatives that align technology execution with organizational objectives. Firstly, integrating privacy-by-design methodologies into digital transformation initiatives ensures that compliance considerations are embedded at project inception rather than retrofitted post‐deployment. By leveraging automated data mapping and classification tools, teams can achieve a comprehensive inventory of personal data flows, reducing manual effort and accelerating risk assessments.

Secondly, establishing cross‐functional governance bodies promotes unified decision‐making and fosters accountability across legal, IT, security, and business units. These councils should convene regularly to review privacy metrics, incident trends, and regulatory updates, enabling agile responses to emerging threats and policy changes. Thirdly, embracing outcome-based service engagements aligns provider incentives with organizational performance goals, ensuring that compliance milestones drive tangible business value.

Moreover, investing in continuous education programs builds a culture of privacy awareness, empowering employees at every level to recognize risks and adhere to best practices. Tailored training workshops and simulated incident responses prepare teams to handle real-world scenarios effectively. Lastly, cultivating strategic vendor ecosystems through technology partnerships and data localization alliances enhances service resilience and cost efficiency. By following these recommendations, executives can transform compliance obligations into sources of differentiation, innovation, and sustained competitive advantage.

Illuminating the Comprehensive Research Methodology Underpinning Rigorous Analysis of GDPR Service Market Dynamics and Stakeholder Perspectives

This analysis is underpinned by a comprehensive research framework that integrates both primary and secondary methodologies to ensure depth and rigor. Secondary research encompassed an exhaustive review of regulatory texts, industry whitepapers, peer-reviewed publications, and public filings related to GDPR enforcement and privacy frameworks. Market intelligence databases and reputable policy repositories were consulted to contextualize regional updates and tariff developments.

Primary research involved structured interviews with senior privacy officers, legal counsels, IT executives, and regulatory experts across key regions. These qualitative insights were supplemented by quantitative data gathered through targeted surveys, capturing practitioner perspectives on service adoption drivers, procurement criteria, and pain points. Additionally, advisory interviews with technology vendors and consultancy leaders validated emerging trends in automated compliance tools and managed service models.

A robust triangulation process reconciled findings across data sources, ensuring consistency and mitigating bias. The research team employed thematic analysis to distill core service capabilities and segmentation dynamics, while scenario modeling evaluated the operational impact of tariff fluctuations on service delivery. Peer reviews and validation workshops with industry stakeholders provided further assurance of accuracy and relevance. This methodological approach guarantees a multidimensional, evidence-based perspective on the GDPR services market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our GDPR Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- GDPR Services Market, by Service Type

- GDPR Services Market, by Organization Size

- GDPR Services Market, by Deployment Type

- GDPR Services Market, by End User Industry

- GDPR Services Market, by Region

- GDPR Services Market, by Group

- GDPR Services Market, by Country

- United States GDPR Services Market

- China GDPR Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Concluding Perspectives on Navigating Regulatory Complexity and Harnessing Strategic Opportunities in the Global GDPR Services Domain

In closing, the trajectory of GDPR services is shaped by multifaceted drivers-from technological innovation and regulatory divergence to supply chain considerations and evolving stakeholder expectations. Organizations that embrace holistic privacy management frameworks, leverage advanced automation, and foster cross-functional collaboration will be best positioned to navigate this complexity. Regional nuances demand tailored strategies, while segmentation insights highlight the importance of aligning service offerings with industry-specific requirements and organizational scales.

Looking ahead, dynamic procurement strategies and outcome-based service models will play an increasingly critical role in balancing cost, performance, and compliance objectives. By internalizing the actionable recommendations outlined, enterprises can transform regulatory imperatives into strategic drivers of trust, agility, and differentiation. Ultimately, a robust GDPR services partnership offers not only risk mitigation but a platform for innovation, enabling organizations to unlock the full potential of data while safeguarding individual privacy.

Engage with Ketan Rohom to Secure Exclusive Access to the Definitive GDPR Services Market Research Study and Empower Your Compliance Strategy Today

To secure your organization’s competitive edge and fortified compliance posture, connect with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) for an exclusive engagement to acquire the comprehensive GDPR services market research report. This definitive study provides the actionable insights and strategic frameworks you need to navigate regulatory complexities, optimize service investments, and drive sustainable growth in an evolving data privacy landscape. Reach out today to discuss tailored licensing options, data-driven subscription plans, or enterprise-wide deployments that align with your organizational objectives and compliance mandates. Ensure your leadership team gains immediate access to in-depth analyses, case studies, and executive-level summaries designed to empower decision-makers across functions. Partner with Ketan Rohom to transform regulatory challenges into strategic advantages and position your enterprise at the forefront of data protection excellence across global markets

- How big is the GDPR Services Market?

- What is the GDPR Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?