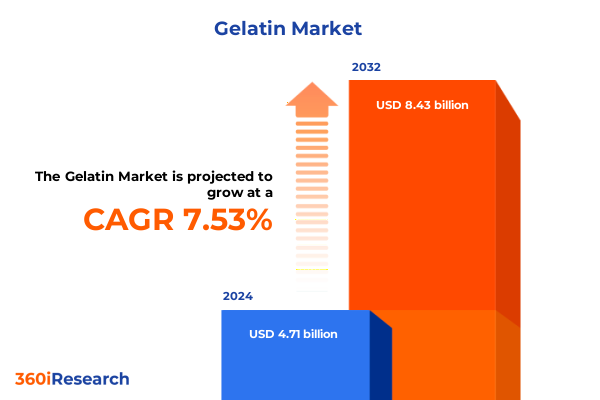

The Gelatin Market size was estimated at USD 5.05 billion in 2025 and expected to reach USD 5.42 billion in 2026, at a CAGR of 7.58% to reach USD 8.43 billion by 2032.

Unveiling the Underlying Dynamics and Emerging Forces Shaping the Gelatin Landscape in a Rapidly Evolving Global Food and Pharma Ecosystem

Gelatin serves as a versatile functional ingredient derived primarily from collagen sources, playing an essential role in food formulation, pharmaceutical encapsulation, and photographic processes. Its unique physicochemical characteristics, such as gel strength, viscosity, and melting profile, underpin the ability to drive texture modification, stabilization, and binding functionalities across multiple end-use categories. By virtue of these properties, gelatin remains a benchmark for quality in applications where sensory experience and product integrity are paramount.

Driven by growing consumer interest in clean-label solutions and natural ingredients, manufacturers continue to refine extraction and processing techniques to meet stringent regulatory standards and evolving food safety requirements. In the pharmaceutical realm, gelatin’s film-forming capacity underpins the production of hard and soft capsules, while its biodegradability and biocompatibility have positioned it as a material of choice in advanced wound care and tissue engineering research. Meanwhile, the legacy of silver gelatin photography persists within niche artistic and archival markets, sustaining demand for high-purity sheet and liquid formulations.

Moreover, gelatin’s adaptability to customization-from varying bloom strengths to tailored functional grades-enables the development of novel formulations that cater to specific sensory or performance criteria. As consumer preferences continue to shift toward products emphasizing natural provenance and sustainability, industry stakeholders are prioritizing transparent supply chains and traceability from raw material sourcing through final product delivery. In light of these developments, understanding the foundational dynamics of gelatin is critical for formulating strategies that leverage its multifunctionality across diverse market segments.

Charting the Paradigm Shifts Driven by Innovation Regulatory Reforms and Consumer Demand Transforming Gelatin Production and Adoption Worldwide

Over the past several years, the gelatin industry has experienced transformative shifts driven by technological innovation, regulatory evolution, and heightened consumer consciousness. Enzymatic hydrolysis and membrane filtration advances have enhanced extraction efficiency, allowing producers to optimize yield while reducing reliance on harsh chemical reagents. As a result, manufacturers can deliver products with consistent bloom strength and viscosity profiles, addressing long-standing quality variability concerns and elevating overall process sustainability.

Concurrently, regulatory authorities worldwide have intensified scrutiny of animal-sourced ingredients, mandating rigorous screening for transmissible spongiform encephalopathies, heavy metals, and other contaminants. This has spurred the adoption of blockchain-enabled traceability systems and third-party certification schemes to guarantee compliance and foster consumer confidence. At the same time, plant-sourced alternatives such as modified starches, pectins, and agar-agar have gained traction in segments where vegan and halal certifications are imperative, compelling gelatin producers to reevaluate sourcing strategies and product portfolios.

Furthermore, the digital transformation of procurement and supply chain management has reshaped how industry participants forecast demand, manage inventories, and coordinate logistics across borders. Cloud-based platforms and real-time analytics now inform sourcing decisions, mitigating risks associated with raw material shortages, shipping delays, and geopolitical disruptions. Taken together, these paradigm shifts underscore the necessity of agile business models that can adapt to technological breakthroughs, evolving regulatory frameworks, and the rapid emergence of alternative gelling agents.

Analyzing the Ripple Effects of 2025 United States Tariff Measures on Supply Chains Regulatory Compliance and Competitive Strategies in the Gelatin Market

In early 2025, the United States implemented revised tariff measures on select gelatin imports, reflecting broader trade policy recalibrations aimed at protecting domestic processing industries and addressing unfair trade practices. These measures impose additional duties on gelatin produced from bovine and porcine sources originating in jurisdictions subject to anti-dumping and countervailing duty investigations. The resulting cost differential has prompted manufacturers to reassess sourcing footprints and explore nearshoring opportunities.

Consequently, supply chain managers have been compelled to diversify procurement strategies, balancing the need for cost-efficient raw materials with the imperative to maintain uninterrupted production. Some producers have shifted volume commitments to marine-derived gelatin suppliers or invested in expanding in-country extraction facilities to mitigate exposure to cross-border tariffs. Meanwhile, compliance teams have intensified efforts to ensure correct tariff classification and origin declarations, reducing the risk of retroactive duties and potential customs penalties.

Moreover, the tariff landscape has influenced competitive positioning, as firms possessing vertically integrated operations-from hide procurement to downstream gelatin refinement-gain an edge through enhanced control over input costs. At the same time, smaller players are forming strategic alliances or entering toll-processing agreements to secure stable supply contracts and share the burden of compliance. Collectively, these responses underscore the profound impact of 2025 U.S. tariff adjustments on cost structures, operational agility, and long-term strategic planning within the gelatin sector.

Illuminating Critical Market Segmentation Trends Revealing Diverse Sourcing Forms Grades Applications and Channel Dynamics Defining Gelatin Demand

The gelatin market is delineated by distinct source classifications that shape product characteristics and end-use suitability. Animal-sourced gelatin, derived from bovine, marine, porcine, and poultry collagen streams, constitutes a majority of supply due to its established functional reliability and cost efficiency. In contrast, plant-sourced gelatin alternatives have carved out growing niches among formulators pursuing vegan, vegetarian, or allergen-free positioning, despite comparatively higher processing complexity.

Segmentation by type further differentiates the sector into Type A and Type B gelatin products, each characterized by unique isoelectric points that dictate gel formation and application compatibility. Type A gelatin, typically acid-processed, finds widespread use in confectionery and photographic emulsions, whereas Type B gelatin, produced via alkaline processing, often serves as the backbone of pharmaceutical capsules and specialized dairy stabilizers. This bifurcation underscores the importance of aligning functional requirements with raw material chemistry.

Physical form segmentation encompasses granules, liquids, powders, and sheets, each offering discrete advantages for formulation efficiency, storage logistics, and sensory performance. Powdered gelatin remains ubiquitous for industrial-scale integration, while sheet and liquid formats are preferred in artisanal food production and high-precision pharmaceutical processes due to their ease of handling and reduced need for rehydration controls.

Gelatin grades span from food to pharmaceutical and technical grade, reflecting the stringency of purity, microbial limits, and physicochemical tolerances required by each end market. Food-grade gelatin dominates applications in confectionery, bakery, and dairy, whereas pharmaceutical-grade variants command premium positioning in encapsulation and medical device contexts. Technical grade gelatin supports industrial adhesives, photographic substrates, and emerging bio-material innovations.

Functional segmentation reveals gelatin’s roles as a gelling agent, stabilizer, and thickener, with formulators leveraging its thermoreversible gelation, emulsion stabilization, and viscosity-modifying capabilities. In particular, its high gel strength and smooth mouthfeel render it indispensable for confections and dairy desserts, while its stabilizing effect enhances shelf stability across beverage applications.

Application segmentation spans cosmetics, food & beverages, pharmaceuticals, and silver gelatin photography, each segment presenting divergent performance criteria and regulatory overlays. Within the food & beverages arena, sub-categories such as alcoholic and non-alcoholic beverages, confectionery and bakery, dairy products, and soups and sauces each demand tailored bloom profiles and melting points. Specialized cosmetic formulations utilize gelatin for collagen-mimetic texture enhancement, while advanced pharmaceutical platforms exploit its biocompatibility for controlled-release matrices.

Distribution channels bifurcate into offline and online networks, encompassing specialty stores and supermarkets & hypermarkets for brick-and-mortar reach, alongside brand websites and e-commerce platforms for direct-to-end-user engagement. The confluence of digital ordering and traditional wholesale relationships has expanded market access while driving the need for integrated logistics and real-time inventory visibility.

This comprehensive research report categorizes the Gelatin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Type

- Form

- Grade

- Function

- Application

- Distribution Channel

Exploring Regional Market Nuances and Growth Drivers Across the Americas EMEA and AsiaPacific Reflecting Unique Regulatory Commercial and Consumer Landscapes

Across the Americas, the gelatin industry is anchored by robust production capabilities in North and South America, where proximity to collagen-rich byproducts enables efficient sourcing. The United States has emerged as a focal point for pharmaceutical-grade and high-bloom gelatin, fueled by significant R&D investments and collaborations with biotechnology firms. Brazil, meanwhile, plays a pivotal role in raw hide exports destined for downstream processing hubs, with an increasing emphasis on sustainability protocols that align with consumer demand for ethically sourced ingredients.

In Europe, Middle East, and Africa, stringent regulatory frameworks such as the European Union’s novel food regulations and halal certification requirements in parts of the Middle East have shaped product specifications and supplier approvals. European gelatin producers have embraced advanced purification technologies to meet Europharma quality benchmarks, while North African and Gulf Cooperation Council markets have prioritized halal and kosher certifications to address religious compliance. The region’s fragmented distribution networks and diverse end-use preferences underscore the value of adaptive market strategies.

Within the Asia-Pacific sphere, China and India have witnessed accelerating consumption driven by expanding food processing, confectionery, and pharmaceutical sectors. China’s marine collagen segment has experienced rapid scaling to cater to premium nutraceutical products, whereas India’s burgeoning pharmaceutical manufacturing infrastructure has heightened demand for pharmaceutical-grade gelatin. Concurrently, smaller economies in Southeast Asia are steering toward value-added applications in cosmetics and functional foods, bolstering regional export potential. This varied mosaic of regional drivers highlights the interplay between regulatory, cultural, and commercial forces in shaping gelatin demand worldwide.

This comprehensive research report examines key regions that drive the evolution of the Gelatin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Shedding Light on Leading Gelatin Manufacturers Their Strategic Positioning Innovation Investments and Collaborative Efforts Driving Industry Progress

The gelatin industry is dominated by a handful of global manufacturers that have secured their leadership through expansive production capacities, proprietary technologies, and strategic partnerships. One prominent company has leveraged decades of expertise in enzymatic extraction to deliver a diversified product suite spanning bloom strengths and functional grades. Its ongoing investments in continuous processing facilities have set new benchmarks in operational efficiency while reducing carbon intensity.

Another leading producer has differentiated itself through integrated sourcing operations, maintaining direct relationships with livestock processors to ensure raw material consistency and ethical stewardship. Through the deployment of advanced spectroscopic quality control systems, it upholds stringent compliance with food and pharmaceutical regulations, thereby reinforcing trust among high-demand customers.

A third major player has focused on marine collagen innovation, capitalizing on ocean-derived raw materials to supply premium nutraceutical and cosmetic developers seeking sustainable alternatives to terrestrial sources. Its R&D pipeline includes enzyme-modified marine peptides designed for targeted bioactivity, underscoring the strategic pivot toward value-added applications.

Additionally, a specialty gelatin provider has cultivated niche expertise in photographic emulsions and technical grades, partnering with imaging industry leaders to refine product performance and expand artisanal markets. Smaller regional firms have complemented these global giants by offering tailored contract manufacturing and rapid-response service models to local formulators, thereby fostering a more resilient and customer-centric supply ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gelatin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACG

- Advanced BioMatrix, Inc. by BICO Group AB

- Aenova Group

- Albanese Candy

- Amstel Products BV by Heineken International

- Arshine Pharmaceutical Co., Limited

- Avantor Inc.

- Banagel Co., Ltd.

- Baotou Dongbao Bio-Tech Co., Ltd.

- CAPTEK

- Catalent

- Cemoi Group

- Champion Gelatine Products LLC

- Darling Ingredients Inc.

- Elnasr4Gelatin

- EMBOCAPS by Suheung

- Erawat Pharma Limited

- EuroCaps

- Fawn Incorporation

- Ferrara Candy Company

- Ferrero Group

- Foodchem International Corporation

- Foodmate Co., Ltd. by Duravant LLC

- Fuji Capsule

- Geliko LLC

- Gelita AG

- Gelken Gelatin

- Gelnex

- Haribo

- India Gelatine & Chemicals Ltd.

- Jelly Belly Candy Company

- Lapi Gelatine S.p.a.

- Meiji Holdings Co., Ltd.

- Merck KGaA

- Mondelez International

- Narmada Gelatines Ltd.

- Nestle S.A.

- Nippi. Inc.

- Nitta Gelatin Inc.

- Perfetti Van Melle

- PIM Brands

- Procaps Group

- Roxlor Group

- RUF Lebensmittelwerk KG

- SAS Gelatines Weishardt

- Saturée Pty Ltd

- Sirio Pharma Co

- Soft Gel Technologies, Inc.

- Sterling Biotech Ltd.

- Tessenderlo Group NV

- The J.M. Smucker Company

- Trobas Gelatine

- United Labs

- Yıldız Holding

Prescribing Strategic Initiatives for Industry Leaders to Capitalize on Technological Advancements Sustainability Mandates and Evolving Consumer Preferences

Industry leaders should prioritize the development of next-generation hybrid formulations that blend animal-sourced gelatin with plant-derived hydrocolloids to cater to evolving dietary preferences while preserving functional integrity. By investing in formulation science and co-innovation with key food and pharmaceutical customers, companies can unlock new growth avenues and deepen stakeholder engagement.

Supply chain resilience must be reinforced through diversified sourcing networks that encompass marine, poultry, and alternative collagen feedstocks. Strategic partnerships or joint ventures with raw material suppliers in emerging markets can mitigate geopolitical and environmental risks, while collaborative forecasting tools and blockchain tracking enable transparent oversight from hide to finished product.

Regulatory engagement is equally critical; proactive dialogue with public health authorities and participation in industry consortia can inform the development of harmonized standards and expedite product registrations across jurisdictions. Companies that lead in sustainability reporting and third-party certification will differentiate themselves in a crowded landscape where provenance and social responsibility increasingly influence procurement decisions.

Finally, digital transformation initiatives should focus on end-to-end process integration, leveraging advanced analytics for predictive maintenance, quality anomaly detection, and agile production scheduling. By harnessing artificial intelligence and cloud-native platforms, gelatin manufacturers can optimize operational efficiency, accelerate new product introductions, and deliver superior service levels to a broadening customer base.

Detailing Rigorous Research Methodology Employed for Comprehensive Gelatin Market Analysis Including Primary Interviews Secondary Data Collection and Validation

This analysis integrates primary research comprising in-depth interviews with senior executives, procurement specialists, and R&D leaders across gelatin-end-use industries. Participants provided firsthand perspectives on supply chain dynamics, formulation challenges, and regulatory compliance hurdles, enriching the contextual understanding of market drivers.

Secondary sources include peer-reviewed scientific publications, trade association reports, and regulatory filings, which were meticulously reviewed to validate functional properties, safety standards, and emerging application trends. Publicly available technical bulletins and patent databases further informed the assessment of proprietary extraction and modification technologies.

Quantitative data points were corroborated through cross-referencing multiple datasets, ensuring consistency and reliability. Data triangulation involved reconciling production and trade statistics from government agencies with corporate disclosures and third-party analytics. All findings have been subject to rigorous validation protocols, including expert panel reviews and scenario stress-testing to account for potential policy or supply chain disruptions.

The research methodology adheres to international standards for market research, encompassing transparent documentation of data sources, analytical assumptions, and methodological limitations. This approach guarantees the integrity and reproducibility of insights, equipping stakeholders with a robust framework for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gelatin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gelatin Market, by Source

- Gelatin Market, by Type

- Gelatin Market, by Form

- Gelatin Market, by Grade

- Gelatin Market, by Function

- Gelatin Market, by Application

- Gelatin Market, by Distribution Channel

- Gelatin Market, by Region

- Gelatin Market, by Group

- Gelatin Market, by Country

- United States Gelatin Market

- China Gelatin Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Consolidating Key Findings on Gelatin Market Dynamics Highlighting Core Drivers Challenges and Opportunities Shaping the Future of Gelatin Applications

In summary, the gelatin industry is experiencing a reinvigorated phase of transformation driven by technological innovation, shifting regulatory landscapes, and evolving consumer values. The rise of plant-sourced alternatives and advanced extraction methods underscores a broader trajectory toward sustainable and traceable supply chains. Meanwhile, the introduction of elevated U.S. tariff measures in 2025 has recalibrated sourcing strategies, compelling producers to optimize their cost structures and compliance frameworks.

Segmentation analysis reveals that animal-sourced gelatin remains foundational across major end-use categories, yet emerging preferences for vegan and allergen-free options are carving out new niches. Variations in type, form, grade, and functional role highlight the necessity of tailored product development, while diverse application pathways-from confectionery and dairy to pharmaceuticals and cosmetics-present both opportunities and regulatory complexities.

Regionally, the Americas benefit from integrated production ecosystems and strong pharmaceutical demand, EMEA is shaped by rigorous compliance requirements and halal/kosher imperatives, and Asia-Pacific is propelled by rapid industrialization and premium nutraceutical growth. Competitive dynamics are anchored by global manufacturers with extensive R&D and supply chain integration, complemented by agile regional specialists.

Looking ahead, stakeholders who embrace hybrid formulation strategies, fortify supply chain resilience, and accelerate digital transformation will be best positioned to navigate market uncertainties and capture growth. The confluence of sustainability mandates, consumer empowerment, and technological progress will continue to redefine the gelatin value chain.

Engaging with Associate Director Sales and Marketing to Secure InDepth Gelatin Market Insights and Tailored Support for Informed Strategic DecisionMaking

For decision makers seeking in-depth analysis and strategic insights into the gelatin landscape, connect with Ketan Rohom, Associate Director of Sales & Marketing, to purchase a comprehensive market research report tailored to your organization’s needs. He can guide you through a customized briefing that details competitive intelligence, emerging trends, and actionable opportunities across product applications, sourcing strategies, and regulatory developments. Engage now to empower your teams with the critical data and expert perspectives required to make informed decisions and drive sustainable growth in the evolving gelatin industry.

- How big is the Gelatin Market?

- What is the Gelatin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?