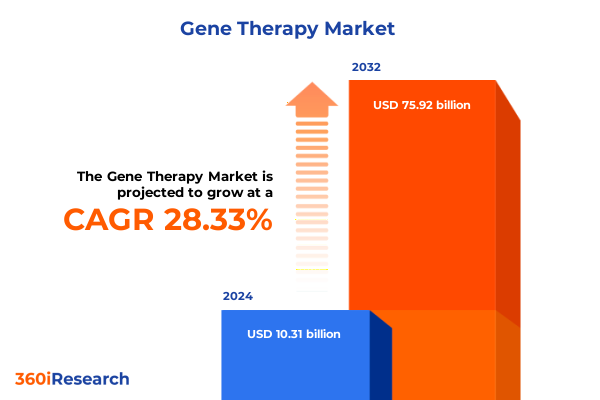

The Gene Therapy Market size was estimated at USD 12.91 billion in 2025 and expected to reach USD 16.35 billion in 2026, at a CAGR of 28.80% to reach USD 75.92 billion by 2032.

Unveiling the Transformative Promise and Boundless Potential of Gene Therapy as a Trailblazing Treatment Paradigm Reshaping Modern Medicine

Gene therapy heralds a new era in medicine, offering the possibility of curing genetic disorders at their source by modifying or replacing faulty genes. This approach extends far beyond symptomatic management and can deliver long-term, potentially one-time treatments for complex diseases ranging from monogenic disorders to oncology and cardiovascular conditions. Over the past decade, advances in gene editing technologies such as CRISPR-Cas9, prime editing, and base editing have catalyzed a surge of clinical trials, pushing both in vivo and ex vivo modalities into late-stage development.

The evolution of viral vectors-particularly adeno-associated virus (AAV) platforms-and emerging non-viral delivery systems demonstrates the sector’s commitment to enhancing safety, specificity, and manufacturing scalability. Regulatory agencies worldwide are adapting frameworks to accommodate these innovations, creating accelerated pathways for therapies addressing high unmet medical need. As stakeholders across academia, biotechnology, and big pharma converge on gene therapy’s promise, the field is positioned to transform healthcare paradigms, delivering precision cures that once seemed unimaginable.

Navigating Breakthrough Innovations and Disruptive Technologies Reshaping the Gene Therapy Landscape Toward Next Generation Modalities

The gene therapy landscape is undergoing transformative shifts driven by convergence of sophisticated vector engineering, next-generation gene editing tools, and artificial intelligence–enabled discovery. Researchers are harnessing modular AAV capsids and non-viral platforms to improve tissue targeting and minimize immunogenicity. Concurrently, programmable nucleases-ranging from CRISPR to meganucleases-are evolving to support precise base substitutions, large-gene integration, and epigenetic modulation without double-strand breaks.

These technological breakthroughs are paralleled by strategic collaborations that pool expertise in vectorology, bioinformatics, and clinical development. Digital platforms that integrate multi-omics data accelerate target identification, while machine-learning models predict vector immunogenicity and optimize manufacturing processes. As these innovations converge, they are redefining the boundaries of treatable conditions, enabling expansion from rare genetic disorders into broader indications such as solid tumors and cardiovascular diseases. Consequently, the gene therapy sector is poised for a pivotal shift toward truly personalized and curative medicine.

Assessing the Cumulative Impact of 2025 United States Trade Tariffs on Gene Therapy Supply Chains and Clinical Innovation Pipelines

In 2025, renewed U.S. tariffs on pharmaceutical ingredients and critical inputs have exerted pressure on gene therapy supply chains, affecting both raw materials and vector manufacturing. Key components, including plasmid DNA, capsid proteins, and specialized reagents sourced from China and India, now face increased duties, prompting manufacturers to reassess sourcing strategies and absorb higher production costs. Industry associations warn that these tariffs could exacerbate existing shortages of active pharmaceutical ingredients and contract research services, thereby delaying clinical trial timelines and elevating R&D expenses.

Moreover, the threat of retaliatory measures and regulatory unpredictability has encouraged companies to accelerate onshoring initiatives. Major players such as AstraZeneca are committing significant investment to expand domestic manufacturing capacity in multiple U.S. states, preempting supply disruptions and insulating their pipelines from import levies. Despite temporary relief from new trade accords that reduced broad-based tariffs, the overall climate underscores the strategic importance of diversified supply networks and proactive policy engagement to safeguard gene therapy innovation in the United States.

Uncovering Critical Insights Across Diverse Segmentation Criteria That Define the Gene Therapy Market’s Multidimensional Landscape

An in-depth examination of market segmentation reveals distinct dynamics across vector types, treatment modalities, genomic targets, and delivery strategies. Non-viral vectors, particularly lipofection and plasmid DNA methods, are gaining traction for applications requiring transient expression or large cargo delivery, while AAV, adenovirus, herpes simplex virus, and retrovirus platforms dominate in vivo and ex vivo pipelines for durable gene integration and high transduction efficiency. Germline therapy and somatic cell therapy further divide into gene augmentation and gene suppression modalities, reflecting divergent strategies for disease correction and functional silencing.

Target genome segmentation highlights a bifurcation between DNA modification approaches and emerging RNA-based interventions, each with unique safety and efficacy considerations. Ex vivo and in vivo delivery modes influence clinical feasibility, manufacturing complexity, and cost structures. Administration routes-intramuscular, intraocular, and intravenous-are chosen to optimize biodistribution and patient convenience. Patient populations delineated by adult and pediatric cohorts inform dose regimens and reimbursement pathways, while therapeutic area segmentation across cardiovascular, infectious, monogenic, and oncological indications reveals tailored development strategies. Finally, end-user channels encompass contract research organizations, hospitals and clinics, pharmaceutical and biotech companies, and research institutes, each contributing to value chain specialization and market access differentiation.

This comprehensive research report categorizes the Gene Therapy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vector Type

- Treatment Modality

- Target Genome

- Delivery Mode

- Route of Administration

- Patient Type

- Therapeutic Area

- End-User

Examining Pivotal Regional Dynamics Across Americas, Europe Middle East Africa, and Asia Pacific That Shape Gene Therapy Adoption and Growth Patterns

Regional dynamics play a pivotal role in shaping gene therapy development, with the Americas leading in clinical trial volume and investment intensity. The United States hosts the majority of global gene therapy trials, supported by robust funding mechanisms, expansive clinical infrastructure, and favorable regulatory pathways that expedite first-in-class approvals. Canada, Brazil, and Mexico are advancing early-stage research, leveraging public-private partnerships to address rare genetic disorders and emerging public health priorities.

Europe, the Middle East, and Africa demonstrate a maturing gene therapy ecosystem, characterized by increasing clinical authorizations and a supportive policy reform landscape. The European Medicines Agency’s adoption of harmonized Health Technology Assessment guidelines in 2025 is expected to streamline cross-border commercialization and reimbursement negotiations. Simultaneously, governments across GCC countries are investing in biotech hubs to attract clinical research and local manufacturing, capitalizing on talent pools and favorable economic zones.

In the Asia-Pacific region, accelerated regulatory frameworks in China, Japan, South Korea, and Australia have spurred exponential growth in cell and gene therapy trials, with China alone accounting for nearly 60% of global CAR-T studies between 2015 and 2022. Lower operational costs, large patient populations, and expedited approval processes reinforce APAC’s position as a vital partner for global gene therapy development, with patient recruitment timelines markedly shorter than in Western markets.

This comprehensive research report examines key regions that drive the evolution of the Gene Therapy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategies and Competitive Dynamics of Leading Gene Therapy Innovators Driving Research, Development, and Commercialization Across Therapeutic Areas

Leading corporations and emerging innovators are pursuing differentiated strategies to capture gene therapy opportunities. Novartis, following its high-impact acquisitions and licensing deals, is fortifying its pipeline with rare disease programs such as DFT383 for cystinosis, leveraging lentiviral ex vivo approaches and robust manufacturing partnerships. Roche’s integration of Spark Therapeutics underscores its ambition to expand CAR-T offerings and streamline operational efficiency through full integration of gene therapy units. Meanwhile, AstraZeneca’s $50 billion U.S. investment plan signals a dual focus on biologics and cell therapy, reflecting strategic hedging against tariff-related uncertainties.

Smaller specialists like PTC Therapeutics and Argenx are pursuing focused indications through splicing modulation and antibody-based gene approaches, often partnering with larger pharma to de-risk late-stage development and access global commercialization networks. Concurrently, BioMarin and other rare disease coalitions advocate for regulatory exemptions to protect orphan drug pipelines from broad-based tariffs, highlighting the critical interplay between policy and innovation incentives. Such varied corporate strategies underscore the importance of agility, collaboration, and policy engagement in navigating the evolving gene therapy landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gene Therapy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abeona Therapeutics Inc.

- Adaptimmune Therapeutics PLC

- Adverum Biotechnologies, Inc.

- AGC Biologics

- Alnylam Pharmaceuticals, Inc.

- American Gene Technologies Inc.

- Amgen Inc.

- AnGes, Inc.

- Astellas Pharma Inc.

- Biogen Inc.

- bluebird bio, Inc.

- Cellectis S.A.

- CRISPR Therapeutics AG

- Danaher Corporation

- Editas Medicine, Inc.

- F. Hoffmann-La Roche Ltd.

- Gilead Sciences, Inc.

- Intellia Therapeutics

- Ionis Pharmaceuticals, Inc.

- Johnson & Johnson

- Merck KGaA

- Mustang Bio, Inc.

- Novartis AG

- Orchard Therapeutics PLC

- Poseida Therapeutics, Inc.

- Sangamo Therapeutics, Inc.

- Sarepta Therapeutics, Inc.

- Sibiono GeneTech Co. Ltd.

- Syncona Limited

- ViGeneron GmbH

- Voyager Therapeutics Inc.

Delivering Actionable Strategic Recommendations to Guide Industry Leaders in Capitalizing on Gene Therapy Opportunities While Mitigating Emerging Risks

Industry leaders should prioritize robust supply chain resilience by diversifying sourcing of vector components and reagents across multiple geographies, thereby reducing exposure to tariff fluctuations and geopolitical disruptions. Investing in in-country manufacturing capacities, particularly within the United States and Europe, can mitigate import duties while supporting regulatory compliance and fostering local stakeholder partnerships.

To accelerate clinical progress, stakeholders must engage proactively with regulatory agencies to shape adaptive frameworks for novel gene editing modalities and delivery systems. Joint industry–government consortia can streamline evidence generation for safety and efficacy, leveraging real-world data and harmonized standards to facilitate cross-border approvals. Additionally, forging strategic alliances that integrate bioinformatics platforms and AI-driven discovery tools will optimize target identification and vector design, enhancing clinical success rates.

Finally, companies should align commercial models with emerging reimbursement paradigms-such as outcome-based agreements and annuity payment structures-to address the one-time high-cost nature of many gene therapies. By adopting patient-centric strategies and transparent value communication, industry leaders can build trust with payers, healthcare providers, and patient advocacy groups, ensuring sustainable market access and long-term growth.

Detailing a Robust Multi-Source Research Methodology Employed to Ensure Comprehensive and Credible Insights into the Gene Therapy Sector

This analysis synthesizes data from peer-reviewed journals, regulatory agency databases, and proprietary clinical trial registries to offer a comprehensive view of the gene therapy sector. Primary research included interviews with senior executives, vectorology experts, and health policy authorities across key regions to validate market narratives and identify emerging trends.

Secondary research comprised extensive review of financial filings, press releases, and patent landscapes, combined with quantitative analytics on trial initiations, approvals, and investment flows. Market intelligence was augmented by specialist consultancy perspectives and input from patient advocacy organizations to ensure balanced insights on clinical adoption and payer dynamics. Rigorous cross-validation against multiple information sources underpins the credibility of findings, enabling stakeholders to navigate the complexities of gene therapy development and commercialization with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gene Therapy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gene Therapy Market, by Vector Type

- Gene Therapy Market, by Treatment Modality

- Gene Therapy Market, by Target Genome

- Gene Therapy Market, by Delivery Mode

- Gene Therapy Market, by Route of Administration

- Gene Therapy Market, by Patient Type

- Gene Therapy Market, by Therapeutic Area

- Gene Therapy Market, by End-User

- Gene Therapy Market, by Region

- Gene Therapy Market, by Group

- Gene Therapy Market, by Country

- United States Gene Therapy Market

- China Gene Therapy Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2544 ]

Synthesizing Key Findings to Highlight the Future Trajectory of Gene Therapy and Its Implications for Stakeholders Across the Healthcare Ecosystem

Gene therapy stands at the cusp of delivering paradigm-shifting treatments that could redefine care for a spectrum of genetic, oncological, and cardiovascular disorders. The interplay of advanced vectors, precision editing tools, and innovative delivery mechanisms is driving expansion beyond rare diseases into mainstream therapeutic areas. Regional dynamics, from the U.S. onshoring trend to Europe’s harmonized regulatory reforms and APAC’s trial leadership, highlight the global interdependence of research and commercialization strategies.

As pipelines mature and approvals accelerate, industry participants must navigate tariff landscapes, reimbursement models, and evolving stakeholder expectations to realize gene therapy’s full potential. The insights presented herein underscore the importance of strategic agility, collaborative innovation, and policy engagement. For decision-makers across biotech, pharma, and healthcare systems, the roadmap ahead demands integrated approaches that balance scientific ambition with commercial and regulatory pragmatism.

Engage Ketan Rohom for Exclusive Access to the Comprehensive Gene Therapy Market Research Report and Unlock Strategic Growth Opportunities

To gain comprehensive insights and actionable intelligence tailored to your strategic priorities, contact Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan will guide you through the report’s in-depth analyses on vector technologies, clinical trends, competitive landscapes, regional dynamics, and regulatory developments.

Secure your competitive advantage and make data-driven decisions by accessing proprietary intelligence that illuminates growth opportunities, risk factors, and emerging trends shaping the gene therapy ecosystem. Reach out today to arrange a personalized briefing, request sample chapters, or obtain licensing details for enterprise-wide distribution. Ketan’s expertise and consultative approach ensure you extract maximum value from this definitive market research report, empowering your organization to lead in the evolving gene therapy industry

- How big is the Gene Therapy Market?

- What is the Gene Therapy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?