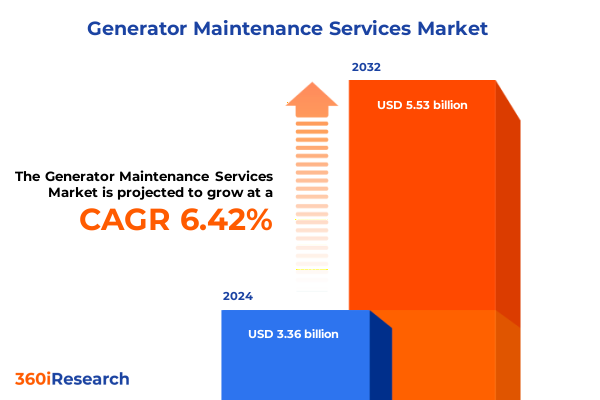

The Generator Maintenance Services Market size was estimated at USD 3.56 billion in 2025 and expected to reach USD 3.78 billion in 2026, at a CAGR of 6.48% to reach USD 5.53 billion by 2032.

Exploring the Critical Role of Generator Maintenance Services in Ensuring Uninterrupted Power Across Diverse Industries and Applications

Generator maintenance services stand at the heart of modern power reliability strategies, underpinning critical operations across industrial, commercial, and residential domains. Maintaining generator systems demands a meticulous balance of technical expertise, operational rigor, and forward-looking planning. As organizations grapple with increasingly complex energy requirements and regulatory mandates, the role of specialized service providers has expanded beyond traditional corrective tasks to encompass preventive and predictive methodologies. This expansion reflects a broader shift within the energy sector toward proactive risk management and continuous performance optimization. With 1.5 billion hours of outage events recorded in 2024 alone driving renewed interest in backup solutions, service networks must scale their capabilities to meet diverse application needs and heightened expectations for system uptime.

The generator maintenance ecosystem has evolved in response to changing customer profiles and technological innovations. Industrial users demand comprehensive diagnostic support for multi-megawatt installations, while residential consumers seek plug-and-play simplicity in home backup units. Amid this divergence, service providers must tailor their offerings to deliver reliability, cost-effectiveness, and compliance assurance. Market leaders have demonstrated that robust maintenance programs, when coupled with digital tools for remote monitoring, yield measurable improvements in asset availability and lifecycle cost management. As we delve into the market landscape, this executive summary will explore the transformative forces reshaping service strategies, the impact of 2025’s trade policy shifts, and the insights driven by nuanced segmentation, regional dynamics, and competitive intelligence.

How Digitalization and Renewable Energy Integration Are Redefining Best Practices and Service Offerings in Generator Maintenance

The generator maintenance landscape is undergoing a profound transformation driven by digitalization and data-driven insights. Advanced Internet of Things (IoT) platforms now offer real-time monitoring, predictive analytics, and automated compliance reporting, enabling service teams to detect anomalies before they escalate into costly failures. Solutions like MiraLink’s cellular-enabled connectivity illustrate how remote diagnostics and alert systems have become integral to maintenance workflows, reducing downtime and increasing operational transparency for site managers. This shift toward proactive maintenance is underpinned by artificial intelligence algorithms that parse equipment run-hour trends and vibration signatures, guiding technicians to focus on high-risk components and optimize spare parts inventory.

Simultaneously, the integration of renewable energy technologies with traditional generators has introduced new service challenges and opportunities. Solar-battery hybrid systems paired with home-standby generators require specialized calibration to balance charge cycles, energy arbitrage, and backup load sequencing. The launch of ecobee by Generac Smart Thermostat Enhanced with Home Energy Management exemplifies how converged energy solutions streamline home energy optimization by coordinating HVAC loads with generator startup sequences, thereby reducing generator sizing requirements and enhancing system efficiency. As clean energy mandates proliferate and distributed generation gains traction, service providers must expand their technical proficiency to support multi-vector energy assets, reinforcing their role as trusted lifecycle partners.

Assessing the Combined Effect of Steel, Aluminum, and China Section 301 Tariffs on Generator Maintenance Costs and Supply Chain Resilience in 2025

Trade policy developments in early 2025 have intensified cost pressures and supply chain complexities for generator maintenance providers. The reinstatement of a 25% ad valorem tariff on steel and aluminum imports under Section 232, followed by an escalation to 50% in June, directly impacts the cost of key generator components such as frames, enclosures, and mounting hardware. This tariff environment compels service providers to recalibrate their procurement strategies, seeking domestic fabrication partners or negotiating longer-term supply contracts to stabilize material costs. The removal of alternative trade agreements for Canada, Mexico, and major steel exporters as of March 12, 2025 has further narrowed sourcing options, exacerbating raw material constraints for equipment repairs and frame refurbishments.

In addition to Section 232 measures, ongoing Section 301 tariffs on Chinese-origin machinery and generator components continue to affect maintenance service economics. These duties, ranging from 25% for solar modules and non-lithium battery parts to 50% for semiconductors and gantry crane assemblies, elevate import costs for sophisticated monitoring devices and control system modules used in predictive maintenance kits. The resulting uncertainty has prompted leading engine manufacturers like Cummins to withdraw their full-year financial outlooks, citing unpredictability in tariff policy and its implications for distribution and service segments. To maintain competitive pricing and service responsiveness, maintenance firms must navigate an intricate patchwork of duty exemptions, temporary product exclusions, and regional trade incentives while balancing inventory levels with dynamic demand patterns.

Unpacking Service and Generator Type Diversification to Tailor Maintenance Solutions for Varied Customer Needs and Usage Patterns in the Market

An informed understanding of service-type demand reveals that preventive maintenance disciplines, including lubrication, operational checks, parts cleaning, and routine inspections, form the foundation of long-term asset health strategies. These activities are often bundled within OEM-backed service contracts that guarantee parts availability and minimize unscheduled downtimes. Complementing this baseline, predictive maintenance techniques such as condition monitoring, thermographic inspection, and vibration analysis deliver early warnings for wear and misalignment, enabling a shift from reactive repairs to planned interventions. Corrective maintenance services-comprising component replacements, detailed diagnostics and troubleshooting, and comprehensive repair services-remain indispensable for addressing unforeseen failures and restoring system functionality.

Generator type specialization further shapes service offerings. Diesel generators, prevalent in industrial and utility environments, demand rigorous fluid analysis and engine overhauls to mitigate soot and acid corrosion. Gas generators, prized for lower emissions, require tailored inspections of fuel delivery systems and gas regulators. Gasoline generators span portable and residential backup markets, where affordability and ease of use drive maintenance frequency and parts availability considerations. Emerging solar generator solutions, integrating photovoltaic panels with battery storage, necessitate expertise in electrical state-of-charge profiling and inverter diagnostics to deliver seamless energy transitions during outages.

Maintenance frequency segments manifest across an organization’s operational priorities. High-criticality infrastructures, such as data centers and hospitals, often deploy monthly or quarterly service cadences to ensure code compliance and guarantee 24/7 readiness. Less mission-critical applications, like commercial office buildings, opt for bi-annual or annual service engagements, balancing cost management with reliability requirements. In terms of service providers, OEM networks leverage factory-trained technicians and genuine parts packages to uphold manufacturer warranties, while third-party specialists compete by offering flexible schedules, competitive pricing, and cross-brand capabilities. Finally, end-user profiles-from agricultural operations requiring off-grid power solutions to government agencies overseeing regulated facilities-dictate service scope, documentation rigor, and emergency support benchmarks for maintenance contracts.

This comprehensive research report categorizes the Generator Maintenance Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Generator Type

- Maintenance Frequency

- Service Provider

- End-User

Evaluating Regional Dynamics and Infrastructure Demands in the Americas Europe Middle East Africa and Asia California Pacific to Drive Service Strategy Adaptation

The Americas region benefits from a mature infrastructure base and well-established service networks capable of supporting a broad spectrum of generator capacities. Aging power plants and distributed backup systems across North America drive consistent demand for both preventive and predictive maintenance services. Furthermore, severe weather events underscore the imperative for resilience-focused contracts, prompting facility managers to integrate remote monitoring and priority response clauses into service agreements. Latin America, while experiencing growth in industrial and commercial power needs, relies heavily on third-party providers to fill service gaps created by limited OEM presences.

Across Europe, Middle East, and Africa, regulatory requirements for reduced emissions and noise pollution shape service protocols. Stricter particulate and NOx standards for stationary generators compel service teams to incorporate emission control calibrations and exhaust after-treatment inspections into routine maintenance. In the Middle East, the prevalence of dual-fuel generator installations for large-scale projects has spurred demand for specialist training in fuel switchovers and combustion tuning. African markets present unique challenges, with intermittent grid reliability and remote site locations necessitating adaptive service models that blend digital remote support with localized field engineering teams.

Asia-Pacific’s rapid industrial expansion and extensive renewable energy adoption create a dynamic service environment. Emerging economies drive growth in hybrid power systems, requiring seamless integration of solar-battery arrays with genset backup. Countries such as India and China showcase robust dealer networks for major OEMs, while Southeast Asian islands rely on local service contractors to address diesel generator fleets for tourism and critical infrastructure. Regional tariff differentials and trade agreements further influence spare parts logistics, compelling service providers to optimize regional distribution hubs and coordinate cross-border compliance processes.

This comprehensive research report examines key regions that drive the evolution of the Generator Maintenance Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Market Leadership Strategies of Major Industry Players Shaping Service Innovation and Competitive Differentiation in Generator Maintenance

Generac has distinguished itself by extending its energy technology portfolio beyond traditional gensets, integrating home standby generators with advanced energy management platforms like the ecobee-enhanced thermostat and PWRcell 2 solar storage solution. This strategy underscores their shift toward holistic energy resilience offerings and reflects a growing emphasis on customer-centric innovation. Cummins, a long-standing engine specialist, has leveraged its Distribution segment expertise-where power generation sales reached $1.09 billion in Q1 2025-to deepen its service footprint, yet continues to navigate tariff-related uncertainties that recently prompted a withdrawal of full-year guidance. Caterpillar’s long-term service agreements, which extend five years or more, illustrate a lifecycle-oriented approach that bundles preventive inspections, parts kits, and rebuild options under predictable cost structures, reinforcing the value proposition of OEM-driven contracts.

Other notable industry players are advancing digital and global service models to differentiate their offerings. Wärtsilä’s Lifecycle Solutions combine AI-powered predictive diagnostics with remote support from seven Expertise Centers worldwide, solving up to 98% of support cases remotely and guaranteeing rapid issue resolution for power plant operators. Meanwhile, third-party specialists such as Weld Power Generators position their remote monitoring services as brand-agnostic solutions, appealing to critical facilities that require continuous oversight without being tied to OEM ecosystems. Collectively, these leaders emphasize technological integration, global reach, and tailored service frameworks as cornerstones of competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Generator Maintenance Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Volvo

- ABB Ltd.

- ABM Industries Inc.

- Advanced Technology Services, Inc.

- Aggreko Ltd

- Alstom SA

- APR Energy

- Atlas Copco AB

- Bilfinger SE

- Briggs & Stratton LLC

- Caterpillar Inc.

- Caverion Corporation

- Cummins Inc.

- Dron & Dickson Ltd.

- Eaton Corporation

- EMCOR Group, Inc.

- Emerson Electric Co.

- ERIKS N.V.

- Ferguson Enterprises, LLC

- Fluor Corporation

- Fuji Electric Co., Ltd.

- Generac Holdings Inc.

- General Electric Company

- GENERMEX USA

- Global Electronic Services, Inc.

- Global Power Group, Inc.

- Honeywell International Inc.

- Jacobs Solutions Inc.

- Kohler Co.

- MAN Energy Solutions Group by Volkswagen Group

- Metso Corporation

- Mitsubishi Heavy Industries, Ltd.

- Otis Worldwide Corp

- PR Industrial S.r.l

- Prime Power

- Rockwell Automation Inc.

- Rolls-Royce plc

- RS Group plc

- Siemens AG

- Southern Industrial Constructors, Inc.

- Toshiba Corporation

- Ultra power systems limited

- Vertiv Co.

- W.W. Grainger, Inc.

- Yanmar Co., Ltd.

Strategic Imperatives for Industry Leaders to Leverage Technology Partnerships and Policy Engagement for Sustainable Growth in Generator Maintenance

Industry participants must prioritize the deployment of IoT-enabled platforms across their customer bases to unlock real-time visibility into equipment health and streamline field service logistics. By investing in advanced analytics and mobile service applications, providers can shift the maintenance paradigm from time-based checks to condition-based interventions, reducing operational expenditure and minimizing unexpected downtime. Collaborative partnerships with renewable energy integrators will also be critical, enabling service organizations to address the growing portfolio of hybrid generator and energy storage systems.

Service providers should proactively engage with policy stakeholders to anticipate tariff revisions and secure exclusion requests for critical components subject to Section 301 and Section 232 duties. Negotiating multi-year procurement agreements with metal fabricators and electronics suppliers can mitigate cost volatility, while diversifying equipment sourcing through regional hubs will enhance supply chain resilience. Additionally, expanding training programs for technician certification in emissions control, hybrid system diagnostics, and advanced troubleshooting will position firms to capture emerging market segments.

Finally, companies must refine their value proposition for end-users by offering flexible maintenance frequency options aligned with operational criticality. High-value clients in sectors such as healthcare and data centers will prioritize response time guarantees and digital status dashboards, whereas cost-sensitive segments may opt for annual preventive inspections with scalable emergency support. Tailored contract structures that balance cost visibility with performance assurances will differentiate market leaders and foster long-term customer loyalty.

Methodological Framework Leveraging Primary Interviews Corporate Filings and Regulatory Analysis to Deliver Rigorous Generator Maintenance Market Intelligence

This report synthesizes insights drawn from a multi-layered research methodology encompassing both primary and secondary data sources. In the primary phase, structured interviews were conducted with senior executives from leading service providers, OEMs, and regulatory bodies to capture nuanced perspectives on operational challenges, technology adoption, and tariff impacts. These dialogues were supplemented by site visits to maintenance facilities and control rooms, where demonstrations of remote monitoring systems and preventive service protocols provided hands-on validation of emerging best practices.

Secondary research involved comprehensive analysis of corporate filings, quarterly financial disclosures, and press releases to quantify market performance metrics and segment revenue trends. Regulatory impacts were assessed through official trade proclamations and executive orders issued by the Office of the United States Trade Representative and the White House, with detailed examination of Section 232 and Section 301 tariff schedules. Industry publications, technical white papers, and peer-reviewed studies informed the evaluation of digitalization trajectories and predictive maintenance efficacy. Segmentation frameworks were constructed using service type, generator technology, maintenance frequency, service provider model, and end-user category to ensure a holistic market perspective. Regional insights incorporated economic indicators, infrastructure indices, and local policy landscapes to capture geographic nuances.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Generator Maintenance Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Generator Maintenance Services Market, by Service Type

- Generator Maintenance Services Market, by Generator Type

- Generator Maintenance Services Market, by Maintenance Frequency

- Generator Maintenance Services Market, by Service Provider

- Generator Maintenance Services Market, by End-User

- Generator Maintenance Services Market, by Region

- Generator Maintenance Services Market, by Group

- Generator Maintenance Services Market, by Country

- United States Generator Maintenance Services Market

- China Generator Maintenance Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Consolidating Insights to Highlight the Future Pathways for Innovation Operational Excellence and Resilience in Generator Maintenance Services

The generator maintenance services market is poised for continued evolution as technology integration, regulatory dynamics, and sector-specific demands converge to redefine service excellence. Providers that successfully harness digital platforms for predictive maintenance, while navigating complex tariff landscapes and strengthening supply chain agility, will secure competitive advantage. The maturation of hybrid energy solutions further underscores the imperative for adaptable service models that span diesel, gas, gasoline, and solar generator systems.

Segment nuances-spanning corrective, predictive, and preventive services-highlight opportunities to tailor offerings to diverse customer profiles, from agricultural and residential users to large-scale industrial and government deployments. Regional complexities in trade policy, environmental compliance, and infrastructure investment call for localized strategies and global coordination. Market leaders such as Generac, Cummins, Caterpillar, and Wärtsilä demonstrate that innovation, lifecycle alignment, and customer-centric value propositions are the pillars of sustained growth in this dynamic sector.

By aligning actionable recommendations with comprehensive research insights, stakeholders can anticipate market shifts, optimize service portfolios, and foster resilient partnerships across the maintenance ecosystem. The path forward requires a balance of technological ambition, operational discipline, and strategic foresight to ensure that generator maintenance services remain a cornerstone of reliable power supply in an increasingly electrified world.

Secure In-Depth Market Analysis and Expert Consultation with Associate Director Sales & Marketing Ketan Rohom to Drive Your Strategic Decisions

Ready to gain a competitive edge with comprehensive insights tailored to your strategic objectives? Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to learn how this in-depth analysis can empower your organization’s decision-making and operational planning. His expertise will guide you through the report’s key findings and recommendations, ensuring you extract maximum value from the data. Don’t miss the opportunity to secure advanced market intelligence and position your business for sustained success in the evolving generator maintenance services sector.

- How big is the Generator Maintenance Services Market?

- What is the Generator Maintenance Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?