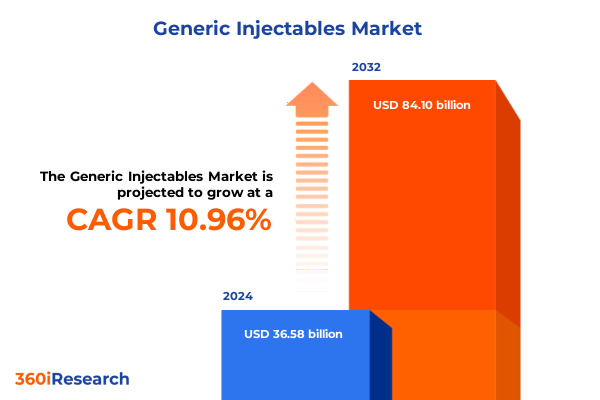

The Generic Injectables Market size was estimated at USD 40.14 billion in 2025 and expected to reach USD 44.05 billion in 2026, at a CAGR of 11.14% to reach USD 84.10 billion by 2032.

Setting the stage for generics injectable growth in the evolving healthcare ecosystem with key drivers reshaping supply and demand dynamics

The generic injectables sector stands at a pivotal juncture, driven by an unprecedented convergence of clinical demand, cost containment pressures, and regulatory evolution. Healthcare providers are increasingly under pressure to balance patient access to essential therapies with stringent budgetary constraints. As patents on high-value injectables continue to expire, a wave of generic alternatives is poised to reshape treatment protocols across acute care, ambulatory, and outpatient settings. This transition is further propelled by policy frameworks that incentivize the adoption of high-quality generics, creating fertile ground for market expansion.

Against this backdrop, supply chain resilience has emerged as a competitive differentiator. Recent disruptions have underscored the critical importance of diversified sourcing strategies and robust quality standards. Manufacturers and distributors now navigate a more complex environment where agility and compliance are paramount. Emerging manufacturing technologies, including continuous processing and advanced sterilization methods, are redefining production efficiency and cost structures. These innovations promise to reduce lead times and enhance product consistency, thereby strengthening the outlook for stakeholders across the value chain.

In this context, the executive summary that follows offers a concise yet comprehensive overview of the forces shaping the generic injectables landscape. It illuminates key shifts in market dynamics, assesses the impact of tariffs enacted in 2025, and distills actionable insights across segmentation, regional trends, and competitive positioning. This introduction sets the stage for an evidence-based exploration designed to inform strategic decision-making at the highest levels of leadership.

Unveiling game changers reshaping generic injectable development and distribution via tech breakthroughs, regulatory evolution, and supply chain optimization

Innovative manufacturing paradigms and regulatory pathways are redefining the contours of the generic injectables industry. Continuous manufacturing, once confined to pilot projects, is rapidly transitioning to commercial scales, enabling stakeholders to realize cost efficiencies while maintaining stringent sterility requirements. This shift is complemented by the advent of single-use technologies in biopharmaceutical facilities, which reduce cross-contamination risks and accelerate product changeovers. Consequently, lifecycle management strategies now incorporate modular production platforms, allowing rapid scale-up of high-demand molecules.

Regulatory bodies have introduced expedited review processes for competitive generic therapies, fostering a more collaborative environment between industry and oversight agencies. These evolutions lower barriers to market entry and incentivize investments in complex injectables, including oncology formulations and high-potency antibiotics. In parallel, digital transformation initiatives are enhancing traceability and quality assurance across the supply network. Blockchain pilots for cold-chain monitoring and advanced analytics for demand forecasting are no longer experimental but integral to operational roadmaps.

As a result, market participants are pivoting from traditional batch processing models toward integrated value chain ecosystems. Strategic partnerships and cross-sector alliances are on the rise, enabling companies to leverage complementary capabilities. This cooperative ethos is critical for addressing capacity constraints and meeting the accelerating pace of patent expirations. Ultimately, these transformative forces are coalescing to create a more agile, resilient, and innovation-driven generic injectables market.

Assessing the cumulative impact of newly imposed United States tariffs in 2025 on generic injectable procurement costs and supply resilience across sourcing

The introduction of targeted tariffs in early 2025 has recalibrated cost structures across the generic injectables supply chain. With duties imposed on key active pharmaceutical ingredients sourced from prominent manufacturing hubs, procurement teams have faced the imperative to reassess supplier portfolios. Import costs have risen appreciably, compelling many organizations to explore alternative raw-material vendors in geographically diverse regions. This re-engineering of sourcing strategies is essential to mitigate margin erosion and uphold competitive pricing for end users.

Furthermore, the tariff regime has catalyzed a shift toward vertical integration. Companies with in-house synthesis capabilities are positioned to buffer the impact of external duties, while those reliant on third-party suppliers are accelerating capacity expansions in tariff-exempt jurisdictions. These strategic adjustments are further influenced by the need to maintain uninterrupted supply of critical injectables during periods of heightened demand, including seasonal spikes and public health emergencies.

In response to the evolving trade environment, collaboration with regulatory authorities has intensified. Stakeholders are advocating for harmonized duty relief mechanisms tied to domestic manufacturing investments, seeking frameworks that reward capacity augmentation in low-risk geographies. As sourcing networks become more intricate, supply chain visibility and risk management emerge as foundational imperatives. Ultimately, the cumulative effect of the 2025 United States tariffs is reshaping the procurement calculus and prompting comprehensive realignments to safeguard supply resilience.

Uncovering market intelligence from comprehensive segmentation across channels, dosage forms, drug classes, end users, packaging and therapeutic applications

An in-depth examination of market segmentation reveals a mosaic of interdependent dimensions that collectively shape purchasing behavior and clinical adoption in the generic injectables space. Distribution channels span from direct tender agreements with large hospital systems to retail pharmacy networks, and more recently, digital platforms including consumer-facing e-pharmacies and business-to-consumer marketplaces. Parallel to this, dosage forms range from traditional aqueous solutions and suspensions to advanced lyophilized powders and emulsions designed for specialized therapeutic applications.

Within the drug class taxonomy, antibiotics continue to dominate, especially beta-lactams and glycopeptides, while analgesics and anesthetics maintain critical roles in pain management and surgical care pathways. Oncology agents, subdivided into cytotoxic compounds and monoclonal antibodies, represent a growing segment as biosimilar development accelerates. End-user contexts further diversify the landscape: hospital pharmacies account for high-volume, acute-care utilization, whereas community and specialty clinics increasingly rely on injectable formulations for outpatient procedures and chronic care regimens.

Packaging innovations, including pre-filled syringes with safety mechanisms and multi-dose vials, reflect a heightened focus on administration efficiency and dose precision. Large-volume parenterals supplied in bags or bottles facilitate continuous infusions, while cartridges and ampoules support on-demand dosing. These choices intersect with administration routes-intravenous delivery remains pervasive, though intramuscular and subcutaneous formats gain traction for emerging biologics. Drawing these segmentation layers together provides a nuanced understanding of market dynamics and highlights opportunities for targeted product development and distribution strategies.

This comprehensive research report categorizes the Generic Injectables market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Route Of Administration

- Dosage Form

- Container Type

- Distribution Channel

- Therapeutic Area

- End User

Exploring nuanced regional perspectives that drive generic injectable adoption, investment, and growth across the Americas, EMEA, and Asia-Pacific landscapes

Regional dynamics in the generic injectables market reflect distinct political, economic, and infrastructural considerations that shape growth trajectories across the Americas, EMEA, and Asia-Pacific. In the Americas, robust healthcare infrastructures, coupled with policy incentives favoring cost-effective generics, have accelerated adoption in both inpatient and outpatient settings. Consolidated purchasing agreements among hospital networks in the United States have yielded economies of scale, while Canada’s provincial tender systems continue to drive competitive pricing and ensure product availability.

Across Europe, Middle East, and Africa, diverse regulatory landscapes present both opportunities and complexities. The European Union’s centralized approval mechanisms facilitate cross-border product registrations, yet national pricing controls and reimbursement frameworks vary widely. In the Middle East, investments in healthcare modernization have expanded capacity for complex injectable therapies, while in key African markets, supply chain challenges and cold-chain vulnerabilities underscore the need for resilient distribution networks.

Asia-Pacific stands at the forefront of manufacturing expansion, with India and China serving as global hubs for active pharmaceutical ingredient production. Government-led initiatives in emerging markets, including Japan’s healthcare reform programs and Australia’s incentive schemes for local manufacturing, are fostering a more balanced ecosystem. At the same time, rising demand for high-value injectables in Southeast Asia and Latin America is encouraging producers to establish regional distribution centers, reducing lead times and enhancing responsiveness to clinical needs.

This comprehensive research report examines key regions that drive the evolution of the Generic Injectables market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the strategic strengths, collaborative ventures, and innovation pipelines of leading players shaping the generic injectable competitive landscape

Leading participants in the generic injectables space have distinguished themselves through complementary strategies encompassing capacity expansion, vertical integration, and collaborative innovation. Established chemical manufactures have augmented sterile fill-finish capabilities to integrate upstream synthesis with downstream packaging, reducing reliance on third-party providers and reinforcing quality control. Meanwhile, pure-play injectables specialists have formed joint ventures with contract manufacturing organizations to accelerate access to advanced aseptic processing technologies.

Strategic alliances with biotechnology firms are also emerging, particularly in oncology biosimilars and high-potency antibiotic segments. These collaborations leverage proprietary molecule portfolios and fill-finish expertise to streamline product development timelines. Several players have introduced digital solutions for real-time batch release monitoring and cold-chain tracking, reflecting a broader shift toward data-driven operational excellence.

In tandem, merger and acquisition activity remains robust as mid-tier companies seek scale, geographic diversity, and portfolio breadth. Selected tuck-in acquisitions in targeted regional markets have enabled faster market entry and built-out commercial footprints. Collectively, these corporate maneuvers underscore a competitive landscape defined by both consolidation and innovation, positioning companies to capture emerging opportunities in generics injectable demand.

This comprehensive research report delivers an in-depth overview of the principal market players in the Generic Injectables market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amgen Inc.

- AstraZeneca PLC

- Aurobindo Pharma Limited

- Baxter International Inc.

- Biocon Limited

- Biological E. Limited

- Bristol-Myers Squibb Company

- Cipla Limited

- Dr. Reddy's Laboratories Ltd.

- Endo, Inc.

- Fresenius Kabi AG

- Gland Pharma Limited by Shanghai Fosun Pharmaceutical Co., Ltd.

- GlaxoSmithKline PLC

- Hikma Pharmaceuticals PLC

- Johnson & Johnson Services, Inc.

- Lupin Limited

- Meitheal Pharmaceuticals, Inc.

- Merck & Co. Inc.

- Novartis AG

- Novo Nordisk A/S

- Pfizer Inc.

- Samsung Biologics Co., Ltd.

- Sanofi S.A.

- Somerset Pharma, LLC by Mylan

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Empowering industry leaders with actionable recommendations to optimize generic injectable supply chains, regulatory compliance, and market penetration tactics

Industry leaders must adopt a multi-pronged approach to capture value in the evolving generic injectables arena. First, investing in flexible manufacturing platforms and single-use technologies can markedly reduce changeover times and support rapid response to patent expirations. Concurrently, diversifying supplier footprints to include both established and emerging API producers will safeguard against trade-related cost escalations and logistical bottlenecks.

Second, firms should deepen engagement with regulatory agencies through early dialogue and participation in pilot approval pathways. Such proactive collaboration can expedite time to market for complex formulations, including biologic-generic hybrids. Third, leveraging digital supply chain solutions-ranging from predictive analytics for demand forecasting to blockchain-enabled serialization-will enhance visibility, bolster product integrity, and meet evolving traceability mandates.

Finally, forging cross-sector partnerships to co-develop pre-filled syringe platforms or novel administration devices can differentiate offerings and strengthen customer relationships. By aligning product innovation with clinician and patient needs, organizations will secure stronger market positions and unlock new areas of growth. Implementing these strategic imperatives will ensure that leaders in the generic injectables domain remain agile, compliant, and poised for sustainable success.

Detailing a rigorous mixed-method research framework integrating primary expert insights, secondary data triangulation, and validation to ensure precision

This research employs a rigorous mixed-method framework designed to deliver nuanced and actionable insights into the generic injectables market. Primary data collection involved in-depth interviews with executives across manufacturing, procurement, and clinical operations, providing firsthand perspectives on strategic priorities and operational challenges. Supplementing these insights, a comprehensive review of regulatory filings, clinical trial registries, and trade publications informed a robust secondary database.

To ensure analytical rigor, data triangulation methodologies were applied, cross-validating quantitative shipment and procurement statistics with qualitative feedback from expert panels. Geospatial mapping of manufacturing and distribution assets was overlayed with tariff impact analyses to model potential sourcing scenarios and resilience metrics. Peer review sessions with subject matter specialists further refined key findings and stress-tested assumptions, enhancing the validity of conclusions.

Collectively, this methodology ensures that the research delivers a balanced and precise representation of market dynamics, enabling decision-makers to navigate complexity with confidence and clarity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Generic Injectables market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Generic Injectables Market, by Drug Class

- Generic Injectables Market, by Route Of Administration

- Generic Injectables Market, by Dosage Form

- Generic Injectables Market, by Container Type

- Generic Injectables Market, by Distribution Channel

- Generic Injectables Market, by Therapeutic Area

- Generic Injectables Market, by End User

- Generic Injectables Market, by Region

- Generic Injectables Market, by Group

- Generic Injectables Market, by Country

- United States Generic Injectables Market

- China Generic Injectables Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 4770 ]

Synthesizing critical insights and implications to present a cohesive outlook on the evolving generic injectable landscape and emerging growth trajectories

The preceding analysis has illuminated a generics injectable market defined by transformative manufacturing trends, evolving regulatory landscapes, and strategic realignments in procurement and distribution. As cost pressures and patent expirations converge, the sector is experiencing heightened competition and accelerated adoption of advanced dosage forms and delivery systems. Regional differences underscore the importance of tailored strategies, whether optimizing centralized EU approvals, navigating North American tender mechanisms, or leveraging Asia-Pacific manufacturing capacity.

Competitive dynamics continue to favor organizations that integrate synthetic and fill-finish operations, deploy digital quality controls, and cultivate collaborative partnerships to access novel administration platforms. Meanwhile, the 2025 tariff environment has underscored the imperative of diversified sourcing and vertical integration to protect margins and ensure supply robustness. Segmentation insights reveal rich opportunities in specialized drug classes, pre-filled systems, and outpatient end-user channels, highlighting areas for targeted investment and innovation.

In sum, stakeholders who embrace agility, deepen regulatory engagement, and invest in resilient supply chains will be best positioned to capture value in the dynamic landscape ahead. These conclusions serve as a foundation for strategic planning and investment decisions that align with emerging market realities.

Connect with Ketan Rohom today to unlock comprehensive insights and drive strategic decisions with the full generic injectable market research report

To gain immediate access to the comprehensive report that maps every facet of the generic injectable market and unlocks strategic guidance tailored to your organizational goals, reach out to Ketan Rohom. Armed with in-depth insights spanning transformative market shifts, tariff implications, segmentation intelligence, and regional dynamics, Ketan is prepared to guide you through the decision-making process. His expertise in sales and marketing will ensure that you secure the optimal package to support your growth objectives, whether you are seeking to refine supply chain strategies, benchmark competitive positioning, or identify high-impact investment opportunities. Connect today and take decisive action to stay ahead in the rapidly evolving generics injectable landscape

- How big is the Generic Injectables Market?

- What is the Generic Injectables Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?