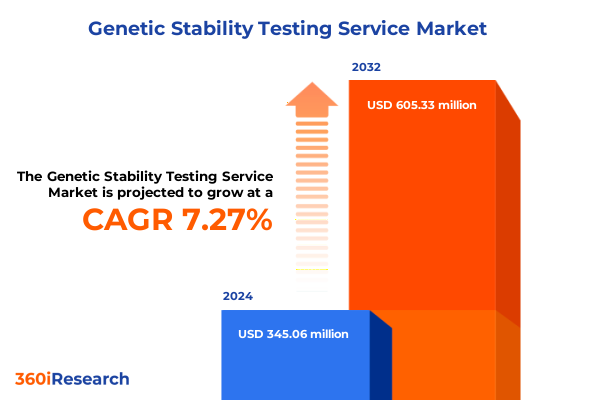

The Genetic Stability Testing Service Market size was estimated at USD 365.61 million in 2025 and expected to reach USD 394.56 million in 2026, at a CAGR of 7.46% to reach USD 605.33 million by 2032.

An impactful overview showcasing why genetic stability testing services are pivotal for advancing biopharmaceutical research and ensuring product integrity

Genetic stability testing services have emerged as an indispensable component of modern biopharmaceutical research and development. As cell lines and biological products become increasingly complex, the need to verify the integrity and consistency of genetic material through successive generations cannot be overstated. By ensuring that cell banks maintain their intended genetic profiles without unwanted mutations or chromosomal aberrations, testing services protect the validity of experimental findings, safeguard clinical safety and support regulatory compliance across global jurisdictions.

Moreover, the accelerating pace of innovation in cell and gene therapies has intensified demand for robust genetic stability assays. Therapeutic modalities such as chimeric antigen receptor T-cell therapies and viral vectors rely on precisely engineered cell lines whose genetic fidelity underpins both safety and efficacy. Any undetected genetic drift or anomaly can lead to compromised product performance or adverse patient outcomes, highlighting the critical role of stability testing as a quality assurance cornerstone.

In this light, stakeholders across pharmaceutical, academic and contract research settings are aligning on best practices to integrate genetic stability testing earlier and more systematically within product development pipelines. This introduction sets the stage for a detailed exploration of the forces reshaping the market, the implications of evolving trade policies, granular segmentation insights and strategic imperatives that will guide decision makers in leveraging these services to achieve scientific, regulatory and commercial success.

The convergence of emerging analytical platforms, such as next-generation sequencing and high-resolution cytogenetic imaging, with traditional assays is further elevating the depth and granularity of stability assessments. As laboratories incorporate multi-modal testing workflows, they gain a comprehensive understanding of genomic integrity at molecular and chromosomal scales, empowering more informed decision-making throughout development.

Disruptive forces reshaping the genetic stability testing landscape through technological innovation and evolving regulatory expectations

The genetic stability testing market is undergoing fundamental transformation driven by rapid advancements in analytical technologies and digital integration. High-throughput next-generation sequencing platforms now enable comprehensive genomic profiling at unprecedented scale, while spectral karyotyping and advanced flow cytometry provide detailed insights into chromosomal integrity and cellular dynamics. Coupled with artificial intelligence-driven data analysis pipelines and laboratory automation, these innovations have accelerated turnaround times, enhanced reproducibility and reduced the manual burden on research teams.

Concurrently, regulatory bodies have heightened their focus on genetic characterization across a broad spectrum of biopharmaceutical modalities. New guidelines and revised expectations from agencies such as the US Food and Drug Administration and international harmonization bodies underscore the necessity of early and continuous stability monitoring. Gene therapies, cellular immunotherapies and precision vaccines now demand rigorous demonstration of genetic fidelity throughout development and manufacturing. As a result, organizations are proactively integrating stability testing into their quality management systems, fostering collaboration between quality assurance and research functions.

Moreover, the service ecosystem itself is evolving, with laboratories offering modular, end-to-end solutions that combine in-house expertise with strategic partnerships. This hybrid delivery model leverages the scalability of large contract research organizations alongside the specialized capabilities of niche technology providers. Ultimately, the confluence of automated workflows, data analytics and stringent regulatory requirements is catalyzing a new era in which genetic stability testing properties drive scientific rigor, operational efficiency and market competitiveness.

Looking ahead, the interplay between emerging cell engineering techniques and next-generation analytical modalities will further redefine service offerings. Single-cell sequencing, droplet digital PCR and machine learning-enabled anomaly detection are poised to deliver deeper molecular insights and predictive risk assessments. Such capabilities will not only streamline regulatory submissions but also inform real-time process controls, empowering developers to anticipate and mitigate stability issues before they impact downstream applications.

Assessing the compounded repercussions of newly introduced United States tariffs on genetic stability testing operations and supply chains

The implementation of new United States tariffs in early 2025 has introduced significant headwinds for laboratories and service providers engaged in genetic stability testing. As tariff rates on key reagents, specialized laboratory instruments and imported consumables rose sharply, organizations faced an immediate uptick in operating expenditures. This cost inflation has particularly affected ordering cycles for flow cytometers, karyotyping dyes and molecular biology kits that are frequently sourced from international manufacturers.

In response to these rising input costs, many service providers have experienced margin compression and have had to reassess pricing strategies. Operators find themselves balancing the need to maintain competitive service rates with the imperative of preserving quality and throughput. Consequently, a wave of cost-control initiatives has emerged, including renegotiation of supplier contracts, prioritization of high-volume reagents and exploration of in-house reagent production. Some organizations have even passed on incremental costs to clients through tiered pricing or surcharges, albeit cautiously, to avoid undermining their market position.

Moreover, the tariffs have exacerbated supply chain bottlenecks, elongating lead times for critical consumables and prompting contingency planning. Laboratories now maintain larger safety stocks of high-value items, while actively seeking secondary suppliers in jurisdictions not subject to the new duties. These measures have improved resilience but also tied up working capital, intensifying cash flow management challenges.

Looking forward, strategic adaptation has taken shape through investments in domestic manufacturing partnerships and localized production capabilities. By forging alliances with regional reagent producers and supporting collaborative consortia aimed at establishing onshore supply clusters, industry participants are gradually mitigating tariff exposure. Such moves could redefine service delivery models and foster greater self-reliance across the genetic stability testing ecosystem.

In-depth segmentation revelations uncover how technology modalities applications end users and sample types define market trajectories

In analyzing the genetic stability testing service landscape through a segmentation lens, technology modalities reveal distinct performance attributes and strategic applications. Cytogenetic techniques, encompassing fluorescence in situ hybridization, karyotyping and spectral karyotyping, continue to offer unparalleled insights into chromosomal integrity, particularly in projects with stringent regulatory oversight. Meanwhile, flow cytometry assays focused on apoptosis analysis and cell cycle analysis deliver rapid, quantitative assessments of cellular dynamics, making them indispensable for both quality control and early‐stage research. The rise of molecular techniques, including next‐generation sequencing, reverse transcriptase PCR, short tandem repeat analysis and single nucleotide polymorphism genotyping, has further expanded the analytical toolkit. These methods provide deep molecular resolution, enabling laboratories to detect subtle genomic variations and streamline variant tracking across cell passage cycles.

Application segmentation uncovers parallel currents shaping adoption patterns. Within academic research, a divide is emerging between fundamental basic research initiatives and translational drug discovery research, both of which rely on stability data to validate experimental models and accelerate candidate screening. Biopharmaceutical manufacturing utilizes genetic stability testing in cell line development and a structured quality control testing framework that incorporates both in‐process and release testing stages, ensuring batches meet predefined genetic specifications before they proceed along the production continuum. In clinical diagnostics, genetic disorder screening, infectious disease testing and oncology panels, particularly those targeting hematological malignancies and solid tumors, leverage stability insights to refine assay performance and interpret complex genomic signatures.

The end‐user perspective highlights the influence of organizational structure and expertise on service uptake. Academic and research institutes, spanning government research organizations and universities, often require flexible, customized protocols to support exploratory investigation. Contract research organizations, divided into clinical and preclinical segments, demand scalable, high‐throughput solutions to service client pipelines with stringent timelines. Diagnostic laboratories, whether hospital‐based or operating independently, prioritize rapid turnaround and regulatory alignment, while pharmaceutical and biotechnology firms strategize around integrated partnerships to embed stability testing into internal R&D and manufacturing frameworks.

Sample type further defines workflow optimization and testing selection. Blood samples, including peripheral blood mononuclear cells and whole blood, offer accessible sources for stability assays, whereas cell line panels ranging from CHO cells and HEK cells to hybridoma cells support recombinant production and antibody discovery. Primary cells, such as fibroblasts and stem cells, present unique challenges in culture heterogeneity that necessitate sensitive detection protocols. Tissue samples, whether organ‐specific or general solid tissues, demand rigorous nucleic acid extraction and preservation methods to maintain genomic fidelity. By weaving these segmentation dimensions together, decision makers can pinpoint high‐value service bundles tailored to technical requirements, application contexts and end‐user competencies, ultimately optimizing resource allocation and competitive differentiation.

This comprehensive research report categorizes the Genetic Stability Testing Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Sample Type

- Application

- End User

Comprehensive regional analysis revealing how the Americas Europe Middle East Africa and Asia Pacific each drive distinct opportunities in genetic stability testing services

Across the Americas, robust investment in biopharmaceutical research and mature regulatory frameworks have positioned the United States and Canada at the forefront of genetic stability testing adoption. A high concentration of academic institutions, contract research enterprises and biomanufacturing hubs fosters collaboration on advanced stability platforms. Furthermore, harmonized guidelines issued by the FDA and Health Canada support standardized approaches, enabling service providers to deploy scalable testing workflows that address both domestic and export regulatory requirements. Latin American markets are gradually accelerating their capacity through partnerships and technology transfers, albeit with localized nuances in infrastructure availability.

Meanwhile, the Europe, Middle East and Africa region exhibits a diverse tapestry of regulatory regimes and funding environments that shape service dynamics. Major Western European markets benefit from strong public-private initiatives, cross-border clinical trials and consolidated quality standards under the European Medicines Agency’s guidance. Laboratories in the Middle East are increasingly adopting stability testing as governments invest in life sciences clusters to reduce import dependence. Africa presents both challenges and opportunities, with nascent biotech ecosystems in South Africa and Egypt paving the way for strategic capacity building and regional collaboration to extend testing capabilities into emerging health research priorities.

In the Asia-Pacific region, the proliferation of biopharmaceutical manufacturing in China, Japan and India serves as a primary growth engine for genetic stability services. National policies prioritizing innovation and regulatory modernization have created favorable conditions for laboratory expansion and technology acquisition. In particular, the emergence of domestic equipment manufacturers and consumable suppliers offers cost benefits that mitigate global supply chain disruptions. Southeast Asian markets such as Singapore and South Korea leverage advanced infrastructure and government incentives to attract clinical research investments, thereby stimulating demand for localized, high-throughput stability testing. Across the region, the convergence of rapid industrialization, diversified end-user profiles and a strong appetite for novel therapeutics underscores the strategic importance of tailoring service offerings to regional regulatory landscapes and technical capabilities.

This comprehensive research report examines key regions that drive the evolution of the Genetic Stability Testing Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic profiles of leading enterprises demonstrating how key market participants shape innovation competition and collaborative ventures in genetic stability testing

Leading enterprises in the genetic stability testing domain are actively driving innovation through a combination of platform development, strategic alliances and geographic expansion. Industry stalwarts such as major laboratory service providers have augmented their portfolios by integrating cutting‐edge molecular diagnostic capabilities with traditional cytogenetic and flow cytometry offerings. Concurrently, specialized technology vendors are forging partnerships with research institutes to co-develop novel assays and validation protocols that address emerging cell and gene therapy applications.

Several global players have embarked on targeted acquisitions to bolster their service capabilities. They have dovetailed these corporate moves with investment in automated, high-throughput laboratories capable of supporting large-scale biomanufacturing quality control as well as bespoke research projects. Other market participants are focusing on digital transformation, leveraging cloud-based data management platforms and AI-driven analytics to deliver end-to-end visibility, from sample receipt through final report generation. This integration of informatics has proven instrumental in standardizing data workflows, enhancing regulatory submissions and enabling real-time decision support.

In parallel, collaborative consortia blending private and academic expertise have emerged as a vital force. These partnerships facilitate the co-creation of performance standards, cross-validation studies and reference material development, thereby raising the overall bar for assay sensitivity and reproducibility. The interplay of competition and collaboration continues to redefine value propositions, as market leaders balance the pursuit of proprietary technologies with the industry-wide benefits of shared research initiatives. As a result, customers gain access to a broader suite of validated services, while service providers capitalize on collective advancements and expanded geographic reach.

Regional footprints are another differentiating factor among key companies. Some actors have established multi-regional centers of excellence to address local regulatory requirements and reduce logistical bottlenecks, while others deploy mobile or modular laboratory units to serve emerging markets. By tailoring infrastructure investments and talent development strategies to distinct market segments, these firms are cultivating resilient service networks that blend global standards with localized responsiveness. Looking ahead, continued emphasis on partnerships, digitalization and specialized assay development will likely dictate the next phase of competitive positioning in this fast-evolving space.

This comprehensive research report delivers an in-depth overview of the principal market players in the Genetic Stability Testing Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Ambry Genetics Corporation

- Amgen Inc.

- Ancestry.com DNA LLC

- ARUP Laboratories

- BGI Group

- Bio-Rad Laboratories Inc.

- Charles River Laboratories International Inc.

- Color Health Inc.

- Creative Biogene

- CRISPR Therapeutics AG

- Eurofins Scientific SE

- Exact Sciences Corporation

- Fulgent Genetics Inc.

- GeneDx Holdings Corp.

- Illumina Inc.

- Laboratory Corporation of America Holdings

- Mapmygenome India Limited

- MyHeritage Ltd.

- Myriad Genetics Inc.

- Thermo Fisher Scientific Inc.

Actionable strategic guidance empowering industry leaders to optimize service portfolios operational resilience and stakeholder engagement in genetic stability testing

To capitalize on the evolving genetic stability testing landscape, industry leaders should undertake a multifaceted strategy that aligns technological capabilities with regulatory foresight and client expectations. Prioritizing investments in integrated analytical platforms-particularly those that combine molecular sequencing, cytogenetic imaging and flow cytometry-can streamline workflows and deliver comprehensive genomic insights in a single operational footprint. By consolidating data streams through unified informatics solutions, organizations can enhance reproducibility, reduce cycle times and accelerate regulatory submissions.

Building on this foundation, diversifying supply chains for critical reagents and consumables is essential to mitigate the impact of trade policy fluctuations and logistical disruptions. Strategic relationships with multiple suppliers, including domestic manufacturers and regional distributors, can ensure continuity of operations and buffer against unforeseen tariff shifts or transportation delays. Complementing these measures, implementing robust vendor performance monitoring and inventory management systems will optimize working capital utilization while maintaining service reliability.

Engaging proactively with regulatory stakeholders and standard-setting bodies offers a further competitive advantage. Establishing open channels of communication-through participation in industry consortia, advisory panels and public consultation forums-enables service providers to anticipate guideline revisions and contribute to the development of harmonized stability testing standards. Experimenting with pilot programs for emerging technologies such as single-cell genomics and AI-driven anomaly detection can position firms as thought leaders and early adopters, attracting collaboration from both commercial and academic partners.

Finally, cultivating a customer-centric approach by offering modular service offerings, flexible pricing models and value-added consultancy expertise will foster deeper client relationships and recurring business. By aligning service portfolios with specific market segments-ranging from biotech startups to established pharmaceutical manufacturers-leaders can tailor their solutions to address distinct technical, regulatory and operational challenges. Through this holistic playbook, organizations will enhance their agility, reinforce their scientific credibility and capture growth opportunities across the global genetic stability testing market.

Robust research methodology describing data collection validation analysis and triangulation processes underpinning the genetic stability testing service insights

This report’s research methodology integrates a structured, multi-layered approach to ensure the integrity, accuracy and relevance of the insights provided. Initially, a comprehensive secondary research phase compiled data from peer-reviewed publications, regulatory agency guidelines and company press releases to map the current genetic stability testing landscape. This desk research established a foundational understanding of technology trends, regional dynamics and service provider activities.

To enrich and validate the secondary findings, primary research engagements were conducted with a curated panel of industry stakeholders, including laboratory directors, quality assurance leaders, regulatory affairs specialists and end-user executives. These interviews provided qualitative context regarding emerging challenges, technology adoption roadblocks and strategic priorities. Where applicable, survey instruments captured quantitative metrics on test volumes, lead times and service satisfaction levels, enabling a holistic view of market performance.

Data triangulation was a critical component of the research framework. Cross-verification of insights occurred by comparing primary interviews with real-world data points drawn from regulatory filings, standard operating procedures and procurement trends. Regional analyses incorporated import and export statistics, tariff schedules and infrastructure assessments, ensuring that geopolitical and economic factors were woven into the narrative. Comparative benchmarking against adjacent testing service segments highlighted areas of differentiation and convergence.

Finally, analytical rigor was enforced through iterative reviews by an internal advisory group of subject matter experts. This governance layer scrutinized assumptions, assessed data integrity and fine-tuned segmentation parameters. The resulting methodology delivers a rigorous, transparent and reproducible blueprint, equipping decision makers with the confidence that the strategic guidance and market perspectives in this report are grounded in verifiable evidence and stakeholder intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Genetic Stability Testing Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Genetic Stability Testing Service Market, by Technology

- Genetic Stability Testing Service Market, by Sample Type

- Genetic Stability Testing Service Market, by Application

- Genetic Stability Testing Service Market, by End User

- Genetic Stability Testing Service Market, by Region

- Genetic Stability Testing Service Market, by Group

- Genetic Stability Testing Service Market, by Country

- United States Genetic Stability Testing Service Market

- China Genetic Stability Testing Service Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3180 ]

Powerful concluding perspectives synthesizing core findings transformative insights and strategic imperatives for the genetic stability testing service arena

In conclusion, the genetic stability testing service market stands at the nexus of scientific innovation, regulatory evolution and global supply chain realignment. The integration of next-generation sequencing, advanced cytogenetic modalities and data-driven analytics is elevating the precision and throughput of stability assessments. Simultaneously, newly implemented trade policies have prompted a strategic reassessment of sourcing, pricing and inventory models, underscoring the importance of operational agility.

Segmentation analysis further illuminates the diverse needs of technology adopters-from cytogenetics laboratories prioritizing chromosomal resolution to molecular-focused enterprises seeking deep genomic insights-and applications spanning academic research, biopharmaceutical manufacturing and clinical diagnostics. Regional dynamics underscore the Americas’ leadership in R&D infrastructure, EMEA’s emphasis on harmonized standards and Asia-Pacific’s manufacturing prowess, each contributing distinctive growth vectors. Leading companies illustrate the impact of strategic alliances, portfolio expansion and digital transformation in shaping market trajectories.

Looking ahead, industry stakeholders who embrace integrated testing platforms, fortify supply chains against tariff volatility and engage collaboratively with regulatory bodies will be best positioned to navigate future challenges. The interplay between cutting-edge methodologies and practical operational resilience will define competitive advantage, with successful organizations delivering end-to-end stability solutions that anticipate scientific complexities and compliance mandates.

Ultimately, this report highlights that the path to sustained market leadership lies in balancing innovation with strategic execution. By applying the insights and recommendations delineated herein, decision makers can systematically address technical requirements, regulatory expectations and market disruptions, thereby unlocking the full potential of their genetic stability testing investments.

Direct invitation encouraging decision makers to engage Ketan Rohom for tailored insights and exclusive access to the comprehensive genetic stability testing market report

To secure a deeper understanding of genetic stability testing nuances and obtain personalized strategic recommendations, readers are invited to reach out to Ketan Rohom (Associate Director, Sales & Marketing). Leveraging extensive expertise and a collaborative approach, Ketan can facilitate access to the full market research report, provide tailored briefings and address specific queries related to technology selection, regulatory compliance and supply chain optimization. Engage today to unlock exclusive insights that will inform high-impact decisions and drive your organization’s competitive edge in the genetic stability testing domain.

- How big is the Genetic Stability Testing Service Market?

- What is the Genetic Stability Testing Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?