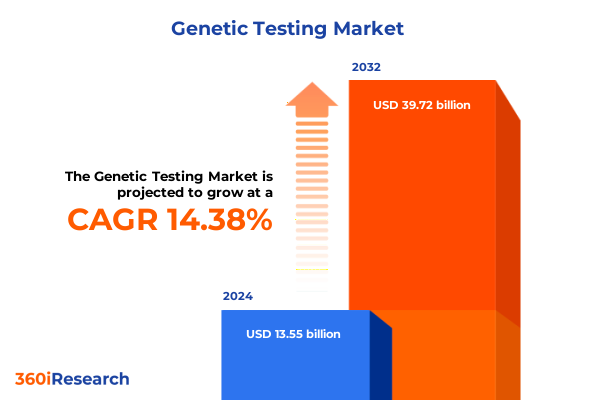

The Genetic Testing Market size was estimated at USD 15.44 billion in 2025 and expected to reach USD 17.60 billion in 2026, at a CAGR of 14.44% to reach USD 39.72 billion by 2032.

Navigating the Genetic Testing Revolution An Executive Overview of Industry Drivers Opportunities and Emerging Challenges Facing Stakeholders

The genetic testing sector has undergone a profound transformation as advances in molecular biology and bioinformatics drive deeper understanding of human health and disease. Once limited to the detection of rare inherited disorders, genetic analysis now informs personalized treatment plans, preventive health strategies, and large‐scale screening initiatives. This rapid evolution has been fueled by breakthroughs in next‐generation sequencing that have drastically reduced the time and cost required to decode genomic information, enabling laboratories and clinics to integrate comprehensive panels into routine care pathways and fueling collaborations between healthcare providers, insurers, and technology companies.

How Breakthrough Technologies Artificial Intelligence and Regulatory Convergence are Reshaping Genetic Testing Across Clinical and Consumer Sectors

Recent developments signal a new era where disruptive technologies, regulatory recalibrations, and shifting patient expectations intersect to redefine industry standards. The proliferation of CRISPR gene editing and expanded whole‐genome insights has complemented the cost efficiencies delivered by next‐generation sequencing platforms, enabling stakeholders to deploy expansive test menus that span oncology, pharmacogenomics, and rare disease diagnostics with unprecedented accuracy and speed. In parallel, artificial intelligence algorithms have begun to streamline variant interpretation and augment predictive modeling, as evidenced by companies leveraging machine learning to accelerate clinical trial recruitment and enhance diagnostic throughput. Simultaneously, evolving regulatory frameworks such as the FDA’s updated premarket review requirements for polygenic risk score tests have introduced new compliance imperatives, prompting organizations to reallocate resources toward validation protocols and clinical evidence generation. This convergence of innovation and oversight is sharply redefining market dynamics, creating both barriers and unprecedented avenues for growth across clinical and consumer segments.

Assessing the Ripple Effects of 2025 U S Tariffs on Genetic Testing Reagents Equipment Supply Chains and Lab Economics in Scientific Research

The imposition of new U.S. tariffs in early 2025 has generated a cascade of operational challenges for genetic testing providers and their supply chains. Tariffs announced in April 2025 impose a 20 percent levy on imports from the European Union and more than 30 percent on critical life science instruments and components originating from China, leading to elevated costs for sequencing machines and analytic platforms. Concurrently, 25 percent duties on products imported from Canada and Mexico have further strained budgets for reagents, consumables, and laboratory infrastructure, prompting concerns over cost pass‐through to clinical laboratories and research institutions. In retaliation, China enacted a ban on the import of certain U.S.‐manufactured gene‐sequencing machines after placing key equipment suppliers on its “unreliable entities” list, effectively doubling tariff rates from 10 percent to 20 percent on those exports and disrupting established distribution networks. Industry observers note that the cumulative burden of these measures has compelled laboratories to explore alternative sourcing strategies, including the relocation of production facilities and diversification of component suppliers. Moreover, a landmark May 2025 ruling in V.O.S. Selections, Inc. v. United States has temporarily enjoined enforcement of select tariff orders, offering a degree of legal relief but underscoring the ongoing uncertainty surrounding trade policy and its impact on instrument costs and project timelines.

Gaining Strategic Clarity Through Product Test Type Technology Application Distribution and End User Insights Driving Genetic Testing Segments

Segmentation analysis reveals that product offerings bifurcate into consumables and equipment versus software and services, with traditional laboratory consumables maintaining baseline revenue while software platforms for data interpretation and digital services are rapidly gaining strategic importance. Likewise, the breakdown by test type-from carrier and diagnostic testing to newborn screening and advanced fields such as pharmacogenomics and preimplantation testing-illuminates opportunity differentials across clinical specialties and direct‐to‐consumer channels. Technological categorization highlights the foundational role of cytogenetics and PCR alongside the accelerating adoption of DNA sequencing and microarrays, each offering unique cost and throughput profiles. Disaggregating applications exposes diverse demand drivers, as genetic testing for cancer and chronic diseases coexists with growing interest in autoimmune and neurodegenerative disorder screening. Distribution channel analysis underscores a dual presence in offline laboratory networks and online delivery models, reflecting a hybrid service approach. Finally, end‐user differentiation emphasizes the importance of diagnostic laboratories and hospitals alongside burgeoning home‐setting adoption, indicating that consumer empowerment and telehealth integration are reshaping the traditional customer base.

This comprehensive research report categorizes the Genetic Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Test Type

- Technology

- Application

- Distribution Channel

- End-User

Regional Outlook Revealing Key Opportunities and Challenges for Genetic Testing Adoption Across the Americas Europe Middle East Africa and Asia Pacific

Across the Americas, investment in advanced sequencing infrastructure and regulatory support for genomics‐based precision medicine have established North America as a leading hub for innovation and clinical adoption. Latin American markets are demonstrating early momentum in newborn screening programs and public‐private partnerships, positioning the region as an emerging growth corridor. In EMEA, European nations benefit from harmonized in vitro diagnostic regulations and collaborative research consortia, while Middle Eastern and African initiatives are focused on building foundational biobanking capabilities and deploying cost‐effective population‐scale screening. Asia‐Pacific exhibits a heterogeneous landscape, where established markets in Japan and Australia integrate genomic assays into national healthcare protocols, and rapidly developing economies in Southeast Asia and India concentrate on expanding access through public health programs and telemedicine platforms. These regional dynamics reveal a mosaic of maturity levels and strategic priorities, underscoring the need for tailored market approaches.

This comprehensive research report examines key regions that drive the evolution of the Genetic Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unpacking the Competitive Landscape Strategic Collaborations Innovation Pathways and Emerging Leadership Among Top Genetic Testing Companies

The competitive terrain is characterized by deep investments in both platform innovation and ecosystem partnerships. Industry leaders in sequencing instrumentation are pursuing collaborations that amplify data analytics capabilities, exemplified by the multi‐stakeholder agreement to build a global genetic database, which attracted investment from major entities including Regeneron and Illumina to fund the assembly of ten million genomic sequences. Meanwhile, companies specializing in liquid biopsy and multi‐cancer early detection are gaining traction; one notable blood‐based test now screens for over fifty cancer types and is under consideration for routine health evaluations pending broader reimbursement coverage. Major diagnostic and life sciences corporations are also refining end‐to‐end workflows, integrating sample preparation, sequencing, and bioinformatics into cohesive offerings that appeal to large hospital networks and research consortia. In parallel, consumer‐oriented firms continue to expand test menus and pursue regulatory approvals-capitalizing on brand recognition and digital engagement strategies-to reinforce their positions in ancestry and health risk testing. The confluence of these strategic moves is engendering an ecosystem that rewards scale, data integration, and cross‐industry alliances.

This comprehensive research report delivers an in-depth overview of the principal market players in the Genetic Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- Bruker Corporation

- Centogene N.V.

- Color Health, Inc.

- CooperSurgical Inc.

- Editas Medicine, Inc.

- Eugene Labs Pty Ltd.

- Eurofins Scientific SE

- F. Hoffmann-La Roche AG

- Fulgent Genetics, Inc.

- Gene by Gene, Ltd.

- GeneDx, LLC

- Illumina, Inc.

- Invitae Corporation

- Laboratory Corporation of America Holdings

- Living DNA Ltd.

- Macrogen, Inc.

- MyHeritage Ltd.

- Myriad Genetics, Inc.

- Natera, Inc.

- Newtopia Inc.

- PathogenDx Corporation

- PerkinElmer Inc.

- Qiagen N.V.

- Quest Diagnostics Incorporated

- Sanofi S.A.

- Thermo Fisher Scientific Inc.

Actionable Strategies for Industry Leaders to Capitalize on Advancements Navigate Policy Changes and Enhance Collaboration in Genetic Testing

Industry leaders should swiftly embrace artificial intelligence and machine learning to fortify variant interpretation pipelines and deliver decision support that enhances clinical utility. By investing in modular and geographically diversified supply chain networks, organizations can reduce exposure to tariff‐related disruptions and ensure reliability in reagent and equipment sourcing. Strategic alliances with biobanks and healthcare systems are essential to broaden data access, while public‐sector engagement helps navigate evolving regulatory requirements and accelerates approval pathways. Cultivating patient education initiatives will build trust around data privacy and test validity, creating a foundation for consumer adoption of advanced testing modalities. Finally, embedding genetic testing services within broader telehealth and digital health ecosystems will maximize reach and create novel touchpoints, positioning companies to capture demand as integrated care models mature.

Methodological Framework Detailing Research Design Data Collection and Analytical Approaches Underpinning Genetic Testing Market Insights

This analysis is grounded in a mixed‐methods approach combining extensive secondary research with targeted primary interviews. Secondary sources included peer‐reviewed literature, regulatory filings, patent databases, and reputable industry publications to establish a robust contextual foundation. Primary research involved structured interviews with senior executives across sequencing firms, diagnostics laboratories, and regulatory bodies, complemented by expert panel discussions to validate emerging themes. Quantitative data were triangulated across multiple provider financial disclosures, customs and tariff records, and public–private consortium reports to ensure accuracy in identifying utilization trends. Sector‐specific insights were further enriched through case study analyses and supply chain mapping exercises, enabling a granular understanding of regional dynamics and cost structures. The resulting framework synthesizes qualitative narratives and quantitative metrics to deliver actionable intelligence for decision‐makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Genetic Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Genetic Testing Market, by Product

- Genetic Testing Market, by Test Type

- Genetic Testing Market, by Technology

- Genetic Testing Market, by Application

- Genetic Testing Market, by Distribution Channel

- Genetic Testing Market, by End-User

- Genetic Testing Market, by Region

- Genetic Testing Market, by Group

- Genetic Testing Market, by Country

- United States Genetic Testing Market

- China Genetic Testing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesis of Critical Findings and Strategic Imperatives Highlighting Genetic Testing’s Evolution and Boundary Breaking Opportunities for Stakeholders

In synthesizing these insights, it becomes evident that genetic testing stands at an inflection point defined by technological convergence, regulatory evolution, and shifting consumer paradigms. Sequencing innovations and bioinformatics advancements are enabling comprehensive analysis across an expanding spectrum of applications. At the same time, trade policy fluctuations and tariff complexities underscore the importance of resilient operational strategies. Market segmentation and regional assessments reveal differentiated growth pathways that align with diverse healthcare infrastructures and regulatory environments. The competitive landscape is increasingly shaped by data‐driven collaborations and cross‐sector partnerships that magnify research capabilities and accelerate commercialization. Moving forward, the capacity to integrate advanced analytics, foster regulatory agility, and engage stakeholders across clinical, consumer, and governmental domains will determine success in this dynamic market arena.

Secure Your Competitive Advantage Today by Engaging Ketan Rohom to Access the Comprehensive Genetic Testing Market Research Report Tailored to Your Needs

For personalized guidance on leveraging these insights, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise in aligning ambitious organizations with tailored market intelligence can help you unlock the full potential of genetic testing opportunities. By engaging directly, you will receive a customized briefing highlighting how emerging trends intersect with your strategic goals, ensuring your investment in this report drives impactful decision-making. Connect with Ketan today to secure your access to this essential market research report and gain a competitive edge.

- How big is the Genetic Testing Market?

- What is the Genetic Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?