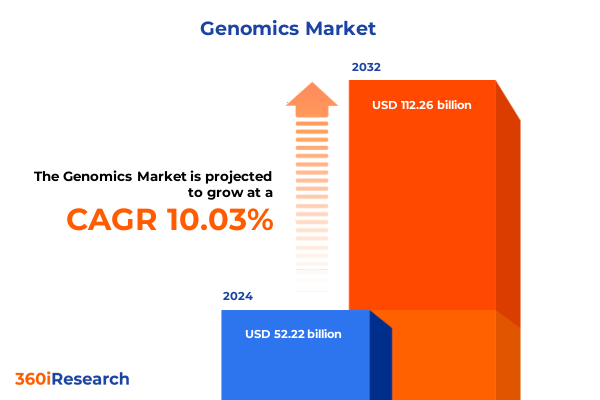

The Genomics Market size was estimated at USD 57.15 billion in 2025 and expected to reach USD 62.60 billion in 2026, at a CAGR of 10.12% to reach USD 112.26 billion by 2032.

Comprehensive Overview of the Genomics Market Landscape and Emerging Opportunities Shaping the Future of Molecular Research and Innovation

The landscape of genomics has undergone a fundamental metamorphosis, propelled by the convergence of high-throughput technologies, advanced bioinformatics, and an intensified focus on precision health. Once a domain reserved for specialized research institutions, genomics is now permeating clinical diagnostics, agricultural innovation, and pharmaceutical development with unprecedented speed. Against this backdrop, stakeholders across academia, industry, and government institutions are navigating an environment defined by rapid technological breakthroughs and evolving regulatory frameworks.

In the wake of dramatic cost reductions for genome sequencing and the proliferation of digital platforms for data analysis, novel applications have emerged at scale. This phase of expansion is characterized by the integration of multi-omic approaches, the application of artificial intelligence to interpret complex datasets, and the deployment of portable sequencing solutions in remote or low-resource settings. As a result, areas such as companion diagnostics, gene editing, and biomarker discovery are experiencing heightened collaboration among technology providers, service laboratories, and end users.

The accelerating pace of innovation has engendered both opportunities and challenges. Research leaders must balance the promise of precision therapeutics with concerns over data privacy, standardization, and equitable access. Meanwhile, industry participants are forging partnerships to streamline workflows from sample collection through interpretation, investing in localized manufacturing to mitigate supply chain risks, and advocating for harmonized regulatory pathways. This introduction sets the stage for a detailed exploration of the transformative shifts, trade impacts, and strategic insights shaping the genomics arena.

Breakthrough Developments and Technological Advancements Reshaping the Genomics Arena with Lasting Impact on Research and Healthcare

Over the past decade, next-generation sequencing platforms have transitioned from niche research tools to foundational instruments in clinical and industrial applications. As throughput has scaled exponentially, novel modalities such as single-cell sequencing and spatial transcriptomics have unlocked granular insights into cellular heterogeneity and tissue microenvironments. These advances are transforming drug discovery pipelines, enabling pharmaceutical companies to identify patient-specific biomarkers and stratify clinical trials with greater precision.

Concurrently, gene editing technologies, spearheaded by CRISPR-Cas systems, have moved from proof-of-concept experiments to early-stage therapeutic programs. The democratization of editing reagents and the establishment of robust delivery platforms have catalyzed research across oncology, rare genetic disorders, and agricultural trait development. At the same time, integration of cloud-native bioinformatics, machine learning algorithms, and federated data models is streamlining the interpretation of vast genomic datasets, supporting real-time diagnostics and adaptive clinical decision support.

These technological breakthroughs are mirrored by evolving collaborations between established instrument manufacturers, emerging startups, and contract service providers. Strategic alliances are focusing on co-development of high-sensitivity assays, automation of sample preparation, and the expansion of in-region service footprints. This confluence of innovation and partnership is redefining competitive paradigms and accelerating the translation of genomic discoveries into tangible health and agricultural solutions.

Assessing the Comprehensive Effects of 2025 United States Trade Tariffs on the Genomics Supply Chain and Research Ecosystems

In early April 2025, the administration enacted sweeping tariffs on life science imports, imposing a 20 percent duty on goods from the European Union and increasing levies on Chinese-sourced products to exceed 30 percent. These measures, framed as responses to perceived unfair trade practices, also extended to Canada and Mexico, where tariffs reached 25 percent on critical research supplies. Industry analysts cautioned that such escalations would raise the cost of consumables, instruments, and reagents, ultimately affecting the affordability of core genomic workflows for laboratories across research and clinical end users.

Major sequencing technology providers promptly adjusted their pricing structures to offset the impact. One leading firm implemented surcharges on new orders, adding 5 percent to consumables, up to 9 percent on instruments, and 3.5 percent on services for its US and European customers. The company projected approximately $85 million in tariff-related expenses for fiscal 2025 and indicated plans to recalibrate surcharges if tariff policies shifted. This reactive pricing strategy aims to preserve supply chain continuity while mitigating margin compression amid heightened input costs.

On the supply chain front, several contract research organizations and biopharma firms began stockpiling critical raw materials and exploring alternative sourcing strategies to buffer against potential delays. Chinese research service providers signaled an accelerated pivot toward domestically manufactured reagents and expanded in-country testing capabilities to sustain project timelines. These adaptive measures underscore the fragility of global trade networks and the necessity for nimble procurement frameworks in the genomics sector.

Strategic Insights into Genomics Market Segmentation by Product, Application, End User, and Technology Pillars Driving Industry Dynamics

The product landscape in genomics is defined by five core categories: microarrays, polymerase chain reaction platforms, reagents and consumables, sequencing services, and benchtop sequencing systems. Within microarrays, gene expression and SNP genotyping arrays continue to offer high-throughput profiling at mature price points, while PCR workflows now encompass both digital PCR for absolute quantification and qPCR for routine gene expression analyses. Reagents and consumables have diversified into specialized enzymes and master mixes, library preparation kits tailored to specific chemistries, and custom probes and primers designed for targeted applications. Sequencing services split into next-generation and Sanger offerings, each catering to distinct throughputs and read-length requirements, and sequencing systems span high-throughput NGS platforms and compact Sanger instruments optimized for smaller labs.

Application-driven segmentation further reveals four principal domains. Agricultural genomics now balances crop trait improvement and livestock health monitoring, while diagnostics leverages cancer genomics, genetic screening, and infectious disease testing to bolster patient care. In drug discovery and development, biomarker discovery platforms and target identification tools are tightly interwoven with preclinical pipelines, and personalized medicine advances through companion diagnostics and precision therapeutics that refine patient stratification.

End-user diversity underscores the breadth of demand. Academic and government institutes drive foundational research, commercial research organizations support outsourced projects, hospitals and clinics integrate genomic testing into patient workflows, and pharmaceutical and biotechnology companies invest in in-house capabilities. Underpinning these segments is a quartet of enabling technologies: microarray gene expression and SNP genotyping arrays, next-generation and Sanger sequencing, digital and qPCR platforms, and bulk as well as single-cell RNA sequencing modalities. Each combination of product type, application, end user, and technology lens offers nuanced insight into adoption drivers, competitive pressures, and opportunity areas within the genomics landscape.

This comprehensive research report categorizes the Genomics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

Regional Differentiators in Genomics Adoption and Infrastructure Trends Spanning Americas, EMEA, and Asia-Pacific Markets

The Americas region remains a nucleus for genomics innovation, supported by robust public and private research funding, a well-established biopharma ecosystem, and a supportive regulatory environment. North American institutions are leading adopters of single-cell and spatial transcriptomics methods, while Latin American agricultural initiatives are increasingly leveraging genomic selection to accelerate crop improvement under shifting climatic conditions. In parallel, Canada’s investment in cloud-based bioinformatics infrastructure is fostering collaborative networks that transcend institutional boundaries.

In Europe, the Middle East, and Africa (EMEA), regulatory harmonization efforts such as the IVDR are reshaping diagnostic product pathways, prompting service providers to enhance analytical validation frameworks and quality management systems. European biotechs are forging pan-regional consortia to distribute clinical sequencing capacity, while Middle Eastern research centers are diversifying into precision medicine projects focused on genetic disease prevalence unique to regional populations. Across Africa, nascent genomics hubs are establishing partnerships to build local sequencing and bioinformatics capabilities, often supported by public-private collaborations aimed at addressing endemic infectious diseases.

Asia-Pacific is characterized by rapid infrastructure build-out and aggressive local manufacturing strategies. China’s genomics industry has expanded its reagent production footprint to reduce import dependencies, and neighboring markets such as India and South Korea are cultivating skilled workforces to support domestic sequencing services. Japan continues to lead in integration of AI-driven diagnostics, and Southeast Asian nations are prioritizing genomics for agricultural resilience and public health surveillance. Together, these regional dynamics underscore the importance of tailoring market engagement strategies to distinct regulatory, economic, and technological environments.

This comprehensive research report examines key regions that drive the evolution of the Genomics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Profiling and Strategic Positioning of Leading Genomics Industry Players and Innovators

A handful of multinational instrument manufacturers continue to anchor the genomics competitive arena. Illumina retains a leading position in high-throughput sequencing systems and consumable workflows, while Thermo Fisher Scientific leverages its broad portfolio of PCR technologies and library prep chemistries. Emerging players such as Pacific Biosciences and Oxford Nanopore are driving market expansion through long-read and portable sequencing innovations, respectively, challenging incumbents to diversify instrument design and application support.

Simultaneously, reagent specialists like QIAGEN and New England Biolabs are deepening their assay libraries to capture niche workflows in molecular diagnostics and epigenetics. Broad-scale service providers, including large contract research organizations and dedicated sequencing centers, are investing in automation and in silico analytics platforms to deliver end-to-end solutions with faster turnaround times. Strategic M&A activities have further reshaped the landscape, as established life science conglomerates acquire disruptive startups to infuse advanced technologies into legacy offerings.

Partnerships between technology vendors and clinical or agricultural research networks are proliferating, focusing on co-development of standardized workflows, data sharing initiatives, and co-marketing strategies. These alliances aim to accelerate application validation, reduce barriers to adoption, and enhance the overall customer experience. Collectively, this dynamic mix of global leaders, challenger brands, and collaborative ecosystems is driving continuous evolution in product capabilities and service delivery models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Genomics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 10x Genomics, Inc.

- Agilent Technologies, Inc.

- Azenta, Inc.

- BGI Genomics Co., Ltd.

- Bio-Rad Laboratories, Inc.

- Color Health, Inc.

- Eurofins Scientific SE

- F. Hoffmann-La Roche Ltd

- Fulgent Genetics, Inc.

- Guardant Health, Inc.

- Illumina, Inc.

- Invitae Corporation

- Myriad Genetics, Inc.

- Natera, Inc.

- Oxford Nanopore Technologies plc

- Pacific Biosciences of California, Inc.

- PerkinElmer, Inc.

- QIAGEN N.V.

- Thermo Fisher Scientific Inc.

- Twist Bioscience Corporation

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Genomics Trends through Agility and Collaboration

To navigate the rapidly evolving genomics ecosystem, industry leaders should prioritize end-to-end supply chain diversification. By establishing dual or multi-regional sourcing strategies for critical reagents and instruments, organizations can mitigate tariff risks and minimize production bottlenecks. Simultaneously, allocating resources to develop in-region service hubs will improve responsiveness and reduce logistical complexities, particularly in high-growth Asia-Pacific and EMEA markets.

Investment in automation and digital integration is imperative. Automating sample preparation and data analysis workflows through robotics and cloud-enabled analytics will not only enhance throughput and reproducibility but also support remote collaboration across distributed research sites. Decision-makers should also explore partnerships with AI-driven software providers to extract actionable insights from multi-omic datasets, thereby accelerating biomarker discovery and clinical translation.

Finally, fostering cross-sector alliances-spanning instrument vendors, reagent manufacturers, service laboratories, and end-user institutions-will drive standardization and interoperability. Such collaborations can yield co-developed assays, harmonized validation protocols, and unified training programs, enabling stakeholders to collectively address regulatory requirements and expand the genomics footprint in emerging application areas.

Robust Research Framework Combining Qualitative and Quantitative Methods to Ensure Comprehensive Genomics Market Analysis

This analysis draws upon a structured research framework integrating both qualitative and quantitative methodologies. Secondary research involved a comprehensive review of scientific literature, patent filings, regulatory announcements, and publicly available financial disclosures to map technological developments and competitive activities. Primary research comprised in-depth interviews with key opinion leaders, R&D executives, procurement specialists, and regulatory advisors to validate emerging trends and identify critical adoption barriers.

Data triangulation techniques were employed to reconcile insights from diverse sources, ensuring robustness and consistency of findings. Detailed vendor profiling and capability assessments were conducted, leveraging proprietary databases and expert consultations. End-user feedback on workflow preferences, pricing sensitivities, and service expectations was captured through structured surveys and follow-up interviews, enriching the qualitative narrative with frontline perspectives.

Analytical tools, including PESTLE analysis, Porter’s Five Forces, and SWOT assessments, were applied to evaluate macro-environmental influences, competitive dynamics, and organizational strengths. Rigorous validation steps, such as peer reviews and cross-referencing against third-party reports, were undertaken to enhance reliability. The resulting methodology underpins a holistic view of the genomics landscape, providing actionable insights for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Genomics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Genomics Market, by Product Type

- Genomics Market, by Technology

- Genomics Market, by Application

- Genomics Market, by End User

- Genomics Market, by Region

- Genomics Market, by Group

- Genomics Market, by Country

- United States Genomics Market

- China Genomics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Summative Reflections on Genomics Market Trajectories and Imperatives for Sustained Innovation and Collaboration

The collective insights presented herein underscore a genomics ecosystem defined by rapid technological innovation, evolving trade policies, and an increasingly diverse set of applications. From the maturation of single-cell and spatial transcriptomics to the strategic recalibrations prompted by trade tariffs, the sector is poised at a critical inflection point. Stakeholders who embrace supply chain agility, invest in digital and automation platforms, and cultivate collaborative networks will be best positioned to harness emerging opportunities.

As regional dynamics continue to diverge-with the Americas focusing on translational research, EMEA refining regulatory frameworks, and Asia-Pacific scaling manufacturing and infrastructure-tailored engagement strategies will be essential. Competitive differentiation will hinge on the ability to integrate advanced technologies into user-friendly workflows and to address localized needs across clinical, agricultural, and industrial domains.

Sustained success in genomics will thus depend on a strategic balance of innovation, operational resilience, and stakeholder alignment. By synthesizing technological, commercial, and regulatory perspectives, decision-makers can chart a course that maximizes impact, drives cost efficiency, and ultimately advances the frontiers of molecular science.

Engage with Associate Director Ketan Rohom to Secure Detailed Genomics Market Research Insights for Strategic Decision Making

For a comprehensive understanding of the latest genomics market dynamics and to gain access to in-depth analysis across product segments, applications, and regional trends, you are invited to connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan can guide you through the suite of subscription and licensing options available, ensuring that you select the solution best suited to your strategic objectives and budgetary considerations.

By engaging directly, you will receive personalized support in navigating the report’s findings, including clarifications on segmentation insights, tariff analyses, and actionable recommendations tailored to your organization’s needs. Whether you seek enterprise-wide access or targeted briefings, Ketan’s expertise will facilitate a seamless purchase process and enable you to derive maximum value from the research.

Reach out to Ketan today to secure your copy of the market research report and equip your team with the intelligence necessary to drive innovation, outperform competitors, and capitalize on emerging genomics opportunities.

- How big is the Genomics Market?

- What is the Genomics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?