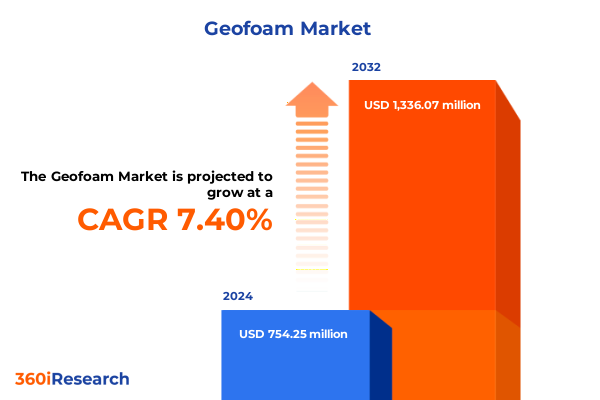

The Geofoam Market size was estimated at USD 836.10 million in 2025 and expected to reach USD 878.54 million in 2026, at a CAGR of 5.26% to reach USD 1,197.20 million by 2032.

Recognizing Geofoam’s Emergence as a Lightweight Construction Material Revolutionizing Infrastructure Durability and Environmental Performance

Geofoam has rapidly emerged as a transformative material in the realm of lightweight construction solutions, offering unparalleled advantages in insulation, subgrade stabilization, and sustainable design frameworks. Originating from high-density expanded polystyrene and extruded polystyrene formulations, geofoam’s core attributes-exceptional compressive strength, thermal insulation, and minimal environmental footprint-have positioned the material at the forefront of innovative engineering applications. As construction stakeholders worldwide seek to optimize project lifecycles and reduce carbon footprints, geofoam systems are increasingly specified in large-scale infrastructure developments, commercial building envelopes, and residential foundations.

The impetus behind geofoam adoption lies in its ability to deliver rapid installation timelines and significant cost savings through reduced earthwork volumes and accelerated project schedules. Beyond these operational efficiencies, geofoam offers designers and contractors a robust means of mitigating settlement risks and insulating sensitive ground structures from frost heave. Consequently, the material’s integration into modern civil engineering paradigms signifies a shift toward more resilient and energy-efficient built environments, paving the way for heightened interest from both public and private sector clients.

Identifying the Paradigm Shifts Transforming Geofoam Applications through Technological Innovations and Evolving Engineering Practices

The geofoam landscape has undergone substantial paradigm shifts driven by a confluence of technological advancements, evolving regulatory landscapes, and heightened demand for sustainable building components. Innovations in polymer chemistry have yielded advanced polyurethanebased foam variants that enhance fire resistance and load-bearing capacities, enabling applications in seismic zones and high-traffic transportation corridors. Concurrently, the integration of digital modeling and Building Information Modeling workflows has streamlined geofoam specification, permitting precision engineering and optimized layout planning for complex infrastructural geometries.

Furthermore, increasing emphasis on circular economy principles has prompted manufacturers to explore bio-based feedstocks and end-of-life recycling protocols, thereby reducing the overall environmental impact of geofoam production. This strategic pivot toward greener formulations resonates with emerging global regulations on embodied carbon and aligns with corporate sustainability commitments across the construction value chain. As a result, industry participants are recalibrating their product development roadmaps to address the dual imperatives of performance innovation and ecological stewardship, reinforcing geofoam’s role as a cornerstone of nextgeneration infrastructure design.

Examining the Comprehensive Effects of Recent United States Tariff Measures on Geofoam Supply Chains and Cost Structures in 2025

In early 2025, new tariff measures implemented by the United States government targeted specific polymer exports, including expanded and extruded polystyrene raw materials, exerting measurable pressure on the geofoam supply chain. These duties, levied at differing percentages based on material origin and processing method, have resulted in elevated import costs for manufacturers reliant on overseas resin supplies. Consequently, cost structures across the value chain have experienced recalibration, prompting foam producers to reassess procurement strategies and negotiate longer-term contracts to mitigate price volatility.

This tariff-induced cost dynamic has also spurred resurgence in domestic resin production investments, as industry players aim to localize feedstock availability and reduce dependency on imported polymers. Moreover, geofoam fabricators are leveraging material optimization techniques and advanced extrusion technologies to maximize yield and lower per-unit resin consumption. These collective responses underscore the industry’s resilience and capacity to adapt to evolving trade policies, even as supply chain stakeholders navigate the complexities of shifting duty landscapes in pursuit of maintaining competitive product pricing and delivery timelines.

Unveiling Critical Segmentation Perspectives to Illuminate Diverse Geofoam Market Niches Spanning Products End Users Channels and Applications

Critical segmentation analysis reveals that the geofoam market’s product portfolio centers on expanded polystyrene, polyurethane foam, and extruded polystyrene variants, each offering distinct mechanical and thermal performance profiles. Expanded polystyrene continues to dominate applications where cost efficiency and ease of installation are paramount, while polyurethane foam is carving out higher-value niches demanding superior compressive strength and flame retardancy. Meanwhile, extruded polystyrene’s closed-cell morphology and enhanced moisture resistance make it the preferred choice for long-term loadbearing and insulation applications in both aboveand below-grade projects.

End-user segmentation further illustrates a diverse spectrum of applications spanning commercial developments, extensive infrastructure initiatives, and residential construction projects. Within the commercial domain, office buildings and retail spaces each benefit from geofoam’s lightweight fill and thermal insulation capabilities, whether in highrise urban complexes or lowrise suburban centers and shopping malls. Infrastructure usage encompasses rail bed stabilization and road and bridge substructures, where geofoam’s capacity to reduce dead loads and prevent frost heave translates into prolonged service life. Residential demand is bifurcated between highrise and lowrise multifamily structures as well as attached and detached single-family homes, with each subsegment leveraging geofoam’s energy efficiency and foundational support attributes.

Distribution channels for geofoam encompass direct sales, dealer networks, and online platforms. Local and regional dealer partnerships ensure rapid material availability for projects with tight schedules, while distributordirect and manufacturerdirect arrangements facilitate customized product solutions and technical support. Online sales channels, accessed through company websites and thirdparty marketplaces, are increasingly enabling smaller contractors and specialty builders to procure standardized geofoam panels with minimal lead times.

Application-based segmentation underscores geofoam’s versatility across agriculture, landfill management, road stabilization, and sports field construction. Field insulation and greenhouse paneling harness the material’s thermal properties to extend growing seasons and protect sensitive crops, whereas landfill capping and cell construction rely on geofoam to create stable, lightweight platform surfaces. Road base and subgrade stabilization benefit from geofoam’s load distribution characteristics, and sports venues, from football fields to golf courses, deploy the material to maintain level, resilient playing surfaces under dynamic load conditions.

This comprehensive research report categorizes the Geofoam market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- End User

- Distribution Channel

- Application

Highlighting Regional Market Variations in Geofoam Adoption Emphasizing the Strategic Opportunities across Americas EMEA and Asia-Pacific Zones

Regional analysis of geofoam adoption highlights distinct market drivers and barriers across the Americas, Europe Middle East and Africa, and Asia-Pacific regions. In the Americas, robust infrastructure investment programs and green building certifications have accelerated the uptake of geofoam in road and railway projects, as well as in cold-climate insulation applications. Government incentives for sustainable construction and improved supply chain logistics support domestic production and foster competitive pricing in North American markets.

In the Europe, Middle East & Africa region, stringent energy efficiency regulations and ambitious decarbonization goals have positioned geofoam as a key component in retrofit and newbuild projects. High-density urban environments and aging transportation networks generate demand for lightweight replacement solutions that minimize traffic disruptions. Concurrently, Middle Eastern megaprojects and African infrastructure modernization programs are beginning to adopt geofoam for rapid site preparation and load reduction, albeit tempered by logistical challenges and variable standards harmonization.

The Asia-Pacific region remains the fastest growing geofoam market, driven by large-scale urbanization, public infrastructure endeavors, and a burgeoning industrial base. Governments across Southeast Asia and Australia are integrating geofoam into flood mitigation works and high-capacity transit expansions, while East Asian manufacturing hubs prioritize lightweight insulation to align with national emission reduction targets. Despite diverse regulatory frameworks and market maturity disparities, geofoam’s scalability and performance consistency continue to spur crossborder collaborations and technology transfers throughout the region.

This comprehensive research report examines key regions that drive the evolution of the Geofoam market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing the Competitive Dynamics among Leading Geofoam Manufacturers Uncovering Strategic Initiatives and Differentiation Factors

Leading manufacturers in the geofoam space are distinguished by their commitment to product innovation, global distribution networks, and strategic partnerships with engineering firms. Major players have invested in advanced extrusion lines equipped with real-time quality monitoring systems that ensure tight density tolerances and elevated moisture resistance. These capital expenditures underscore a collective industry focus on supply chain optimization and performance differentiation.

Collaborative ventures between raw material suppliers and fabricators are driving co-development of proprietary resin blends, enabling geofoam products to meet specialized performance metrics such as enhanced fire retardance for highrise structures and acoustic insulation for urban rail projects. Meanwhile, alliances with technology providers facilitate the integration of digital tracking and logistics solutions, intensifying competition around lead-time reliability and aftersales support. As market participants expand their service portfolios to include technical consulting and design assistance, the competitive landscape is defined not only by product specifications but also by the depth of client engagement and holistic project delivery capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Geofoam market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACH Foam Technologies, Inc.

- Atlas Roofing Corporation

- Atlas Roofing Corporation

- BASF SE

- Carlisle Companies, Inc.

- CREATIVE FOAM

- Johns Manville, Inc.

- Kingspan Group plc

- Michigan Foam Products LLC

- Owens Corning

- Sinocor International, Inc.

- Sunpor Kunststoff GmbH

- The Dow Chemical Company

Providing Actionable Recommendations to Strengthen Leadership Positioning and Foster Innovation in the Dynamic Geofoam Industry Ecosystem

Industry leaders are advised to prioritize vertical integration strategies that ensure secure resin supply and enable greater control over material specifications. Establishing dedicated research partnerships with academic institutions and polymer technology firms can accelerate development of nextgeneration foam formulations with improved environmental profiles. Furthermore, expanding localized production footprints in tariffaffected regions will mitigate cost pressures and reduce lead times, enhancing overall market responsiveness.

Investing in value-added service offerings, including structural design collaboration, on-site installation training, and lifecycle performance monitoring, can differentiate suppliers in increasingly commoditized segments. Embracing digitalization across the value chain-from predictive demand analytics to online ordering platforms-will streamline customer interactions and unlock new e-commerce revenue streams. Finally, aligning product development roadmaps with emerging green building standards and carbon credit mechanisms will position geofoam stakeholders to capture premium project specifications and reinforce longterm sustainability credentials.

Explaining the Rigorous Methodological Framework Employed to Ensure Data Integrity and In-Depth Geofoam Market Analysis Comprehensiveness

Our research methodology combined systematic secondary research with extensive primary interviews to ensure data validity and comprehensive market coverage. The secondary phase encompassed analysis of technical publications, industry standards documents, and public infrastructure project databases, while the primary phase engaged civil engineers, project managers, and materials scientists through structured interviews.

Quantitative data were triangulated by crossreferencing resin production statistics, trade flow records, and construction expenditure indices. Qualitative insights were synthesized through thematic coding of interview transcripts, yielding nuanced understanding of application-specific performance requirements and regional regulatory landscapes. Rigorous data quality protocols, including source verification and consistency checks, underpinned the entire process to deliver a robust analytical framework for geofoam market assessment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Geofoam market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Geofoam Market, by Product Type

- Geofoam Market, by End User

- Geofoam Market, by Distribution Channel

- Geofoam Market, by Application

- Geofoam Market, by Region

- Geofoam Market, by Group

- Geofoam Market, by Country

- United States Geofoam Market

- China Geofoam Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Concluding Insights That Synthesize Key Discoveries and Reinforce the Strategic Imperatives of Investing in Advanced Geofoam Technologies

A holistic evaluation of the geofoam market reveals a sector poised for sustained growth underpinned by technological innovation and evolving sustainability imperatives. The material’s lightweight properties and thermal efficiency continue to drive its adoption across infrastructure, commercial, and residential domains, while tariff dynamics and regional policy frameworks shape supply chain strategies.

Segmentation analysis underscores the breadth of geofoam applications, from large-scale road stabilization projects to precision greenhouse insulation, highlighting the material’s adaptability to diverse engineering challenges. Competitive insights illustrate how industry leaders leverage vertical integration and strategic alliances to differentiate their offerings through enhanced performance and service excellence.

Ultimately, the convergence of advanced polymer science, environmental regulations, and digital transformation constitutes the strategic backdrop against which geofoam will realize its potential as a foundational component of nextgeneration construction. Stakeholders who actively align product development, operational capabilities, and market engagement strategies with these macrodrivers stand to secure leadership positions in this dynamic industry landscape.

Inviting Stakeholders to Connect Directly with Ketan Rohom Associate Director of Sales & Marketing to Secure Comprehensive Geofoam Market Intelligence Report

To explore the in-depth geofoam market intelligence report and discover actionable insights tailored to your strategic priorities, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to ensure your organization gains timely access to comprehensive analysis and expert guidance

- How big is the Geofoam Market?

- What is the Geofoam Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?