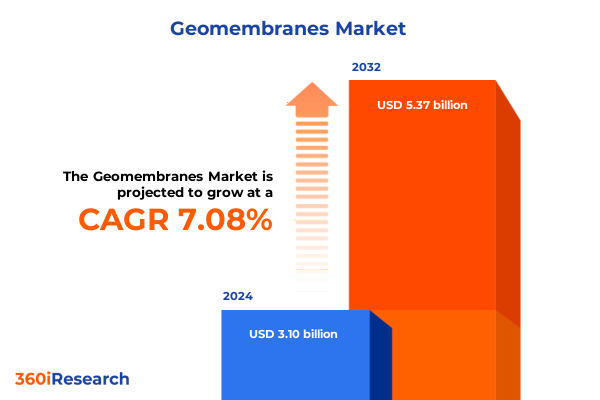

The Geomembranes Market size was estimated at USD 3.31 billion in 2025 and expected to reach USD 3.54 billion in 2026, at a CAGR of 7.13% to reach USD 5.37 billion by 2032.

Pioneering Sustainable Containment Solutions Through Next-Generation Geomembrane Technologies Empowering Environmental and Industrial Protection

Geomembranes have emerged as pivotal components in modern containment and environmental protection initiatives, offering impermeable barriers that safeguard soil, water, and critical infrastructure. Growing concerns around water scarcity and contamination have elevated the role of these advanced liners, particularly in applications spanning agriculture, mining, waste management, and water conservation projects. As pressure mounts to meet stringent regulatory standards and achieve sustainability targets, the demand for high-performance geomembranes is intensifying. Moreover, the expansion of large-scale infrastructure projects-ranging from landfill capping to reservoir construction-underscores the necessity for durable, reliable containment solutions that can endure extreme environmental conditions.

In parallel, stakeholders are increasingly prioritizing materials that balance cost-effectiveness with long-term performance, prompting manufacturers to innovate across a host of polymer types. From chlorosulfonated polyethylene known for its UV resistance to high density polyethylene favored for chemical stability, the diversity of material offerings is reshaping procurement strategies. In conjunction with this, the convergence of digital monitoring technologies and advanced installation techniques is redefining project lifecycles, ensuring that system integrity can be verified in real time. Consequently, the geomembrane market stands at a critical juncture, driven by environmental imperatives, regulatory complexity, and the continuous pursuit of technological advancement.

Revolutionizing Performance Standards with Innovative Material Formulations Digital Integration and Eco-Conscious Manufacturing Driving the Market Forward

The geomembrane sector is witnessing transformative shifts fueled by breakthroughs in polymer science and fabrication processes that enhance mechanical strength and chemical resilience. Innovations within chlorosulfonated polyethylene and ethylene propylene diene monomer formulations have elevated performance benchmarks, enabling liners to withstand wider temperature ranges and resist impactful punctures. Concurrently, advanced extrusion methods are optimizing thickness uniformity and structural integrity, while calendering advancements-particularly in triple roll systems-have reduced production variability and improved surface finish. As manufacturing efficiencies improve, the focus is shifting toward integrating smart monitoring sensors directly into liner systems, facilitating proactive maintenance and early detection of breaches.

In addition to these material and process enhancements, sustainability considerations are catalyzing the adoption of recycled feedstocks and bio-based modifications without compromising barrier properties. Lifecycle assessments are now integral to product development, guiding manufacturers toward solutions that minimize carbon footprints and extend service life. Moreover, digital transformation initiatives have prompted suppliers to embrace Industry 4.0 practices, deploying connected machinery and predictive analytics for quality control. These technological evolutions are collectively fostering a marketplace where performance expectations are being redefined, environmental obligations are being met, and end users are empowered with actionable insights to optimize operational outcomes.

Assessing the Far-Reaching Consequences of United States Tariff Adjustments on Geomembrane Supply Chains Raw Material Costs and Market Dynamics in 2025

United States tariff policies have exerted substantial influence on geomembrane supply chains and pricing structures, culminating in a cumulative impact that is palpable across raw material procurement and finished product distribution. Initial protective measures aimed at bolstering domestic resin producers introduced levies on key polymers, with subsequent adjustments in 2025 targeting import classifications specific to geomembrane liners. These escalating duties have translated into elevated input costs for manufacturers reliant on imported high density polyethylene and linear low density polyethylene resins, compelling many to reassess sourcing strategies and renegotiate long-term contracts.

Furthermore, the tariff environment has incentivized increased local production capacity, as firms seek to mitigate exposure to cross-border trade barriers. This shift has fostered strategic alliances between resin suppliers and converter facilities, accelerating investments in domestic extrusion and calendering capabilities. However, the reorientation toward local sourcing has also introduced complexities, including potential bottlenecks in production scheduling and pressure on regional logistics networks. End users, facing higher upfront expenditures, are placing greater emphasis on lifecycle cost analyses and extended warranty offerings. In sum, the layered tariff adjustments through 2025 have reshaped competitive dynamics and underscored the importance of agile supply chain management.

Unlocking Critical Insights Through a Multifaceted Analysis of Material Types Applications Manufacturing Processes Installation Methods and Thickness Variations

A nuanced understanding of geomembrane segmentation reveals distinct market behaviors driven by material type, application, manufacturing process, installation method, and thickness. Material type differentiation highlights chlorosulfonated polyethylene’s dominance in outdoor environments requiring UV resilience, while ethylene propylene diene monomer’s elasticity positions it favorably for complex lining systems. High density polyethylene maintains its status as the workhorse grade, valued for chemical inertness in mining and waste containment, whereas linear low density polyethylene is gaining traction in water management due to its balance of toughness and flexibility. Polyvinyl chloride, benefiting from ease of fabrication, continues to serve niche sectors where cost sensitivity is paramount.

Applications in agriculture and construction are expanding as crop protections and infrastructure projects integrate advanced liners for irrigation efficiency and subgrade stabilization. Mining operations are increasingly deploying high-performance geomembranes for tailings storage facilities, while waste management facilities prioritize composite systems that combine sheets with geotextiles for leak detection. In water management, both potable and non-potable reservoirs leverage flat film extrusion for precise thickness control and uniformity across large surfaces.

The manufacturing processes themselves exhibit differentiated growth pathways: single roll calendering remains prevalent for standard gauge sheets, whereas the increased throughput and consistency of triple roll calendering are capturing higher-end project specifications. Blown film extrusion is preferred for seamless, homogeneous membranes, while flat film extrusion offers versatility in gauge adjustments. Installation methods also vary by project complexity, with factory welded panels-produced through panel fabrication or tailor-made configurations-ensuring quality under controlled conditions, and field welded sheets requiring specialized techniques like cold adhesive sealing, extrusion welding, and hot wedge welding to accommodate on-site constraints. Lastly, thickness variants from less than 0.75 mm to above 1.5 mm enable end users to align liner selection precisely with project risk profiles and environmental stressors.

This comprehensive research report categorizes the Geomembranes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Manufacturing Process

- Thickness

- Surface Type

- Installation Method

- Application

- Distribution Channel

Evaluating Regional Market Trajectories Across the Americas Europe Middle East Africa and Asia-Pacific Revealing Divergent Growth Drivers

Regional dynamics in the geopolitical landscape have resulted in divergent trajectories for geomembrane adoption across the Americas, Europe Middle East Africa, and Asia-Pacific, with each zone exhibiting unique catalysts and challenges. In North America, regulatory oversight and environmental compliance requirements are stringent, driving demand for high-performance liners and favoring local supply chains strengthened by tariff-induced repatriation of production. In South America, expansive mining and agricultural sectors are catalyzing installations, although logistical hurdles and fluctuating currency valuations can complicate procurement and project planning.

Across Europe, Middle East, and Africa, policy frameworks emphasizing circular economy principles and water conservation are fueling investments in recycled and bio-modified geomembranes, with advanced contract structures incorporating performance-based warranties. Regulatory heterogeneity within the region has prompted regional distribution hubs to optimize inventory management, ensuring compliance and responsiveness to end users. Meanwhile, Asia-Pacific remains the most dynamic market, underpinned by large-scale infrastructure development in water management and waste containment. Rapid urbanization in Southeast Asia alongside significant environmental remediation projects in China and India has accelerated demand for thicker gauge liners and integrated system solutions.

Collectively, these regional patterns underscore the necessity for flexible manufacturing footprints and adaptive market entry strategies to contend with localized policy imperatives, economic cycles, and evolving sustainability mandates.

This comprehensive research report examines key regions that drive the evolution of the Geomembranes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders Highlighting Strategic Alliances Technology Investments and Competitive Positioning within the Geomembrane Sector

Within the competitive landscape, leading companies are fortifying their market positions through a blend of strategic alliances, technological investments, and targeted expansions. Industry frontrunners have forged partnerships with resin producers to secure preferential access to high-performance polymers and to co-develop proprietary formulations that differentiate their product portfolios. Concurrently, investments in state-of-the-art extrusion and calendering lines have not only boosted throughput but also enabled tighter quality tolerances, appealing to customers with zero-defect requirements.

In addition, prominent firms are leveraging digital platforms to streamline project design and execution, providing clients with integrated services ranging from geotechnical analysis to installation training. These vertically integrated models enhance value propositions by reducing coordination risk and ensuring accountability across the project lifecycle. Furthermore, a wave of mergers and acquisitions has reshaped regional power structures, as established players target niche specialists in sensor integration and remote monitoring. Such consolidations are yielding synergies in R&D and distribution, while also expanding global reach into emergent markets rife with infrastructure investment.

As competition intensifies, companies that can differentiate through robust after-sales support, sustainability certifications, and agile production capabilities will maintain leadership, while agile challengers continue to pressure incumbents by innovating in modular installation systems and recycled-content geomembranes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Geomembranes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- agru Kunststofftechnik GmbH

- Atarfil geomembranas

- Carlisle SynTec Systems

- Carthage Mills, Inc.

- Dow, Inc.

- Earth Shield Environmental Technology (Shandong) Co., Ltd.

- Environmental Protection, Inc.

- Gayatri Polymers & Geo-synthetics

- Geofabrics Australasia Pty Ltd.

- Global Synthetics Pty Ltd

- Juta Ltd.

- Layfield Group Ltd.

- Maharshee Geomembrane (India) Pvt. Ltd.

- Megaplast India Private Limited

- Minerals Technologies Inc.

- Naue GmbH & Co. KG

- Officine Maccaferri Spa

- Plastika Kritis S.A.

- Sangir Plastics Pvt. Ltd.

- Shandong Zhuyuan New Materials Co., Ltd.

- Solmax Holding B.V.

- SOTRAFA, S.A.

- Terrafix Geosynthetics Inc.

- Terram Geosynthetics Private Limited

Implementing Actionable Strategies for Market Leaders to Enhance Innovation Strengthen Supply Chains and Capitalize on Emerging Environmental Opportunities

To capitalize on evolving market dynamics and regulatory expectations, industry leaders should prioritize several strategic imperatives. First, accelerating research and development into recycled and bio-based polymer systems will address sustainability mandates while potentially reducing raw material costs. Investing in pilot programs that validate these formulations under field conditions can fast-track commercialization and secure first-mover advantages. Second, diversifying supply chain sources through multi-vendor agreements and regional manufacturing partnerships will mitigate risks associated with tariff volatility and logistical disruptions.

Moreover, embracing digital transformation by integrating IoT-enabled sensors and digital twin models will enhance predictive maintenance capabilities and strengthen client relationships through transparent performance reporting. Companies should also explore collaborative alliances with installation contractors to standardize quality assurance protocols and reduce execution errors. In parallel, aligning product certifications with global standards-such as ISO environmental and quality management frameworks-will facilitate smoother entry into regulated regions and large-scale infrastructure tenders.

Finally, leaders must cultivate a workforce skilled in advanced welding techniques and data analytics to ensure that technical expertise keeps pace with product innovations. By adopting a holistic strategy that bridges material science, digital integration, and stakeholder collaboration, organizations can drive sustained growth and reinforce their competitive edge.

Detailing a Robust Methodological Framework Incorporating Primary Research Secondary Validation and Comprehensive Data Triangulation for Accurate Insights

The insights presented herein are derived from a structured research methodology designed to ensure rigor, validity, and relevance. Primary research involved in-depth interviews with policymakers, supply chain executives, project engineers, and environmental consultants, providing firsthand perspectives on industry challenges and emerging trends. Secondary research encompassed a review of technical papers published by standards bodies, regulatory filings, and trade association guidelines, contextualizing qualitative findings within existing frameworks.

Data triangulation was achieved by cross-referencing interview insights with vendor specifications and third-party performance tests, allowing for the corroboration of key technical claims and market behaviors. Expert validation sessions were convened to solicit feedback on preliminary findings, ensuring that the analysis resonated with real-world experiences. Furthermore, supply chain disruptions and tariff impacts were modeled using scenario planning exercises, which incorporated economic indicators and policy outlooks to anticipate potential market inflection points.

This multifaceted approach integrates both qualitative and quantitative lenses, delivering a comprehensive perspective that balances technical precision with strategic foresight. It ensures that the conclusions and recommendations are anchored in credible evidence and reflect the complex interplay of innovation, regulation, and commercial dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Geomembranes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Geomembranes Market, by Material Type

- Geomembranes Market, by Manufacturing Process

- Geomembranes Market, by Thickness

- Geomembranes Market, by Surface Type

- Geomembranes Market, by Installation Method

- Geomembranes Market, by Application

- Geomembranes Market, by Distribution Channel

- Geomembranes Market, by Region

- Geomembranes Market, by Group

- Geomembranes Market, by Country

- United States Geomembranes Market

- China Geomembranes Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Drawing Strategic Conclusions on Market Evolution Sustainability Imperatives and Competitive Dynamics Shaping the Future of the Geomembranes Landscape

In summary, the geomembrane industry is experiencing a period of accelerated evolution driven by environmental imperatives, technological breakthroughs, and shifting trade dynamics. Advanced polymer formulations and manufacturing enhancements are elevating performance benchmarks, while sustainability considerations and tariff realities are reshaping supply chain configurations. Regional disparities underscore the need for adaptable strategies that align with local regulations and market drivers, and competitive pressures are compelling companies to differentiate through innovation and integrated service offerings.

Looking ahead, stakeholders must remain vigilant to emerging risks associated with raw material availability and regulatory changes, while continuously refining their product portfolios to address the dual demands of cost efficiency and ecological stewardship. By embracing a collaborative approach that unites material science expertise, digital monitoring capabilities, and strategic partnerships, industry participants can unlock new growth avenues and reinforce the resilience of their operations. Ultimately, success will hinge on the ability to navigate complexity, anticipate market inflection points, and deliver turnkey solutions that meet the rigorous standards of contemporary containment applications.

Seize the Opportunity to Unlock In-Depth Market Intelligence by Engaging with Ketan Rohom and Securing the Comprehensive Geomembrane Report

For organizations poised to secure a competitive advantage in the rapidly evolving geomembrane market, a direct conversation with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, is an essential first step. Engaging with an expert who intimately understands both the technical nuances of containment solutions and the strategic implications of global trends will provide unparalleled clarity on how to navigate complex supply chain considerations and regulatory environments. An initial consultation will not only outline the extensive scope of the report but also tailor its insights to address your organization’s unique challenges and growth objectives. By speaking with Ketan Rohom directly, stakeholders can gain customized guidance on leveraging emerging technologies, optimizing material selections, and aligning procurement strategies with sustainability and compliance requirements. Secure your access to this indispensable resource today and transform your approach to risk mitigation and project execution with data-driven intelligence designed to empower decision-makers.

- How big is the Geomembranes Market?

- What is the Geomembranes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?