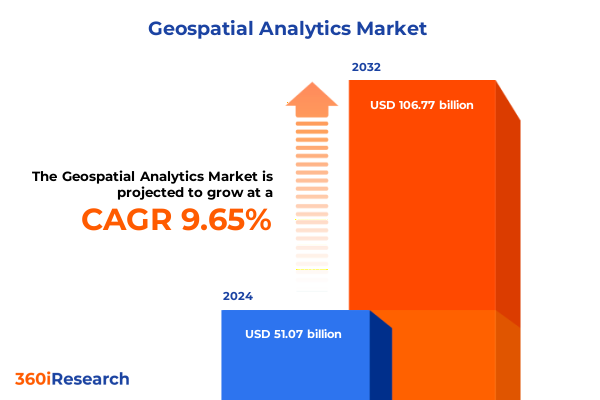

The Geospatial Analytics Market size was estimated at USD 55.78 billion in 2025 and expected to reach USD 60.93 billion in 2026, at a CAGR of 9.71% to reach USD 106.77 billion by 2032.

Unlocking the Power of Geospatial Analytics to Drive Strategic Insights and Innovation Across Industries in a Rapidly Evolving Technological Landscape

Unlocking the strategic potential of geospatial analytics begins with understanding the transformative shift from traditional mapping solutions to advanced location intelligence frameworks. Emerging at the crossroads of big data, artificial intelligence, and cloud computing, geospatial analytics has evolved beyond static cartography into a dynamic toolset that empowers decision-makers across industries. Stakeholders now rely on data-driven visualizations, predictive modeling, and real-time location data to solve complex challenges such as urban congestion, supply chain inefficiencies, and environmental monitoring.

The accelerating integration of remote sensing technologies and geographic information systems has laid a robust foundation for next-generation applications. Organizations leverage high-resolution satellite imagery, multispectral sensors, and IoT-driven geolocation feeds to enrich their spatial databases and unlock deeper insights. Consequently, strategic leaders can anticipate shifts in market demand, optimize resource allocation, and enhance operational resilience in the face of rapid global changes.

As enterprises and government agencies navigate a landscape shaped by digital transformation, the ability to translate geospatial data into actionable intelligence has become a critical differentiator. This introduction sets the stage for exploring how industry pioneers harness these capabilities to drive growth and innovation, establishing geospatial analytics as an indispensable pillar of modern strategic planning.

Exploring the Convergence of Cloud-Native Platforms, AI-Driven Spatial Modeling, and Collaborative Ecosystems Reshaping Geospatial Analytics

The geospatial analytics landscape has undergone a profound metamorphosis over the past decade, driven by breakthroughs in real-time data processing and cloud-native architectures. Traditional desktop GIS platforms have ceded ground to agile, web-based environments that enable seamless collaboration among distributed teams. This shift toward cloud-driven geovisualization and network analytics platforms has significantly reduced barriers to entry, empowering smaller organizations to harness sophisticated spatial models without heavy upfront infrastructure investments.

Simultaneously, advancements in machine learning and AI-enabled spatial modeling have unlocked new possibilities for pattern recognition and predictive analysis. From automating land-cover classification to generating hyperlocal traffic forecasts, these transformative technologies have expanded the scope of actionable insights derived from location data. Moreover, the integration of edge computing has accelerated the shift toward near-real-time decision-making, enabling applications such as autonomous vehicle navigation and emergency response coordination.

In addition, cross-industry collaborations and public-private partnerships have become increasingly common, fostering innovation and standardization across geospatial data ecosystems. Open data initiatives and interoperable APIs now facilitate the seamless exchange of spatial information, driving network effects that enhance data richness and analytical precision. As a result, organizations can respond more effectively to evolving challenges, leveraging shared geospatial assets to amplify impact and drive sustainable value creation.

Assessing the Multifaceted Impact of Recent U.S. Trade Tariffs on Geospatial Hardware Costs and Strategic Supply Chain Adaptations in 2025

The imposition of new tariffs in early 2025 has introduced significant headwinds for the geospatial analytics industry, particularly affecting hardware imports and intricate sensor assemblies. Equipment manufacturers relying on specialized components from overseas suppliers have encountered increased costs, prompting a critical reevaluation of procurement strategies. This shift has in turn driven some technology providers to explore domestic partnerships and localized production to mitigate the impact of import duties.

At the same time, software-centric service providers have experienced mixed effects. While cloud-hosted GIS platforms remain largely insulated from direct tariff increases, the cost of integrating cutting-edge remote sensing feeds-often tied to international satellite operators-has risen incrementally. These evolving cost structures have accelerated consolidation trends, encouraging larger enterprises to negotiate volume-based agreements for sensor data and cloud consumption to offset higher unit prices.

Despite these challenges, the industry response has showcased resilience and adaptability. Companies are diversifying supply chains, investing in modular sensor designs that can be assembled with alternative components, and forging strategic alliances with regional manufacturing hubs. In parallel, value-added service offerings have emerged to guide clients through the complexities of changing trade regulations, ensuring continuity of geospatial operations and safeguarding long-term innovation trajectories.

Uncovering Distinct Growth Trajectories Across Service Verticals, Technology Platforms, Deployment Models, and Industry Applications Shaping the Geospatial Analytics Market

Examining the market through the prism of service and technology segments reveals nuanced pockets of growth and innovation. Within the realm of spatial intelligence, geovisualization solutions continue to be a critical entry point for stakeholders seeking intuitive mapping and dashboarding capabilities. Concurrently, network analytics and location intelligence services address complex routing and connectivity challenges, while surface and field analytics enable detailed environmental and agricultural modeling with unprecedented granularity.

Delving into the core technologies, geographic information systems form the backbone of spatial data management, further branched into sophisticated geospatial modeling tools that predict spatial phenomena and advanced spatial data analysis platforms that extract insights from diverse datasets. Remote sensing technologies complement these systems by providing high-resolution imagery and sensor-based telemetry, expanding the analytical scope to include dynamic environmental monitoring and asset tracking applications.

The shift toward cloud-based deployment modes continues to accelerate, offering on-demand scalability and reducing the need for capital-intensive infrastructure. Nonetheless, on-premise solutions retain a strong foothold among organizations prioritizing data sovereignty and low-latency operations. Across organization sizes, large enterprises are investing heavily in integrated geospatial suites, while small and medium-sized firms are favoring cloud subscription models to access core analytics capabilities with minimized upfront expense.

Application-specific insights underscore the transformative impact of geospatial analytics across critical use cases. In disaster management, detailed earthquake monitoring and flood prediction systems deliver real-time alerts that drive life-saving responses. Natural resource management benefits from forestry health assessments and water resource mapping, enabling sustainable stewardship. Transportation logistics management and vehicle tracking optimize fleet utilization and route efficiency, while urban planning for infrastructure development and smart grid deployment underpins the modernization of cities.

A broad spectrum of industry verticals leverages these capabilities, from agriculture and automotive through banking, defense, energy, and government, to healthcare, logistics, mining, real estate, and security. Each end-user category presents distinct requirements, driving the evolution of specialized geospatial solutions tailored to regulatory, environmental, and operational contexts.

This comprehensive research report categorizes the Geospatial Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Deployment Mode

- Organization Size

- Application

- End-user

Analyzing Diverse Regional Growth Drivers and Regulatory Landscapes Shaping the Geospatial Analytics Ecosystem Across Key Global Markets

The Americas region continues to lead in the adoption of geospatial analytics, driven by advanced infrastructure investments and robust private-sector innovation. North American organizations benefit from well-established cloud ecosystems and extensive high-resolution data repositories, while Latin American markets are increasingly leveraging location intelligence to address urbanization challenges and natural disaster preparedness.

In Europe, the Middle East, and Africa, regulatory frameworks and pan-regional initiatives play a pivotal role in shaping market dynamics. European countries emphasize data privacy and standardization through GDPR and INSPIRE directives, fostering interoperable geospatial infrastructures. Meanwhile, Gulf nations and African hubs are investing in smart city initiatives and natural resource management projects, reflecting diverse demand for environmental monitoring, defense intelligence, and transportation solutions.

The Asia-Pacific region exhibits some of the fastest year-over-year growth rates, propelled by substantial public spending on smart infrastructure and digital mapping initiatives. Countries such as China, India, Japan, and Australia are advancing satellite remote sensing programs and national GIS platforms. Their focus on addressing urban congestion, agricultural productivity, and disaster resilience underscores the strategic significance of geospatial analytics as a cornerstone of national development strategies.

This comprehensive research report examines key regions that drive the evolution of the Geospatial Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Partnerships, Product Innovations, and AI-Driven Enhancements Fueling Competition Among Top Geospatial Analytics Providers

Leading geospatial analytics companies are differentiating through a combination of comprehensive technology stacks and deep domain expertise. Established GIS specialists have expanded their portfolios to include advanced network modeling and cloud-based data services, positioning themselves as end-to-end solution providers. Conversely, emerging providers are targeting niche applications such as precision agriculture and autonomous vehicle navigation with lightweight, purpose-built platforms.

Strategic partnerships between technology vendors and system integrators have become increasingly common, fueling joint innovation in areas like digital twins and edge-to-cloud workflows. These collaborations enable rapid prototyping of use-case–specific solutions, driving time-to-value for clients. In parallel, several prominent software providers have forged alliances with satellite operators to secure exclusive access to high-frequency imagery, creating competitive barriers and enriching their analytical offerings.

Company insights also reveal an intensifying focus on AI-driven analytics, with investments in advanced machine learning frameworks and natural language processing interfaces to democratize spatial intelligence. Moreover, service providers are enhancing customer experience through intuitive visual interfaces and embedded workflow automation, ensuring end users can seamlessly translate geospatial data into actionable decisions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Geospatial Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALTERYX, Inc.

- AtkinsRéalis

- Autodesk, Inc.

- Bentley Systems, Inc.

- Descartes Labs, Inc.

- Environmental Systems Research Institute, Inc.

- Fugro

- General Electric Company

- Geoscience Consulting, LLC

- Geospin GmbH

- Google, LLC by Alphabet Inc.

- Hexagon AB

- Intermap Technologies, Inc.

- L3Harris Technologies, Inc.

- Locana Group

- Lockheed Martin Corporation

- Mapidea, Consultoria em Geografia S.A.

- MapLarge, Inc.

- Maxar Technologies Holdings Inc.

- Orbital Insight, Inc.

- Pitney Bowes Inc.

- Precisely

- RMSI Private Limited

- SAP SE

- Supergeo Technologies Inc.

- Topcon Corporation

- Trimble Inc.

- Variac Systems Pvt. Ltd.

- Woolpert, Inc.

- Zillion Info

Driving Competitive Differentiation Through Agile Technology Investments, Strategic Partnerships, and Targeted Talent Development in Geospatial Analytics

Industry leaders should prioritize an agile technology strategy, balancing investments in cloud-native platforms with scalable on-premise architectures to achieve both flexibility and control. By establishing cross-functional teams that bridge data science, GIS engineering, and business operations, organizations can accelerate the integration of spatial insights into core workflows.

Cultivating strategic partnerships with component suppliers and data providers is essential for mitigating supply chain risks and securing preferential access to high-value datasets. Organizations should explore regional alliances to offset potential tariff impacts and ensure continuity of critical hardware and satellite imagery services.

A focus on talent development is also critical. Investing in upskilling programs that combine spatial data literacy with AI proficiency will empower teams to extract maximum value from advanced geospatial tools. Complementing this internal capability building with collaborative innovation hubs and academic partnerships will foster continuous advancement.

Finally, adopting a use-case–driven deployment model-starting with pilot projects in high-impact areas such as disaster response or logistics optimization-can demonstrate rapid ROI and build stakeholder buy-in. This iterative approach enables phased scaling, ensuring that geospatial analytics initiatives deliver tangible business outcomes and align with evolving organizational priorities.

Ensuring Research Rigor with a Blend of Primary Interviews, Comprehensive Secondary Data Analysis, and Robust Qualitative and Quantitative Methodologies

This research report is grounded in a rigorous methodological framework combining primary and secondary data sources. The primary research component included in-depth interviews with industry executives, geospatial specialists, and subject-matter experts to capture real-world insights and validate emerging trends. These qualitative inputs were supplemented by structured surveys targeting technology providers, end users, and system integrators.

Secondary research encompassed an extensive review of industry publications, regulatory filings, academic papers, whitepapers, and reputable industry news outlets. Data triangulation was achieved by cross-verifying key findings across multiple sources to ensure accuracy and reliability. Proprietary databases and geospatial data repositories provided supplementary quantitative information on technology adoption rates, deployment preferences, and application use cases.

The analytical process incorporated both top-down and bottom-up approaches to assess segment dynamics, market drivers, and competitive landscapes. Scenario analysis was employed to evaluate the potential effects of trade policy changes, and sensitivity testing was conducted to understand the robustness of strategic recommendations. All research findings were subjected to peer review and expert validation to uphold the highest standards of research integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Geospatial Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Geospatial Analytics Market, by Type

- Geospatial Analytics Market, by Technology

- Geospatial Analytics Market, by Deployment Mode

- Geospatial Analytics Market, by Organization Size

- Geospatial Analytics Market, by Application

- Geospatial Analytics Market, by End-user

- Geospatial Analytics Market, by Region

- Geospatial Analytics Market, by Group

- Geospatial Analytics Market, by Country

- United States Geospatial Analytics Market

- China Geospatial Analytics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesizing Key Insights on Technology Evolution, Regulatory Shifts, and Strategic Priorities That Define the Future of Geospatial Analytics

In an era defined by unprecedented data proliferation and technological convergence, geospatial analytics stands out as a critical enabler of strategic insight and operational excellence. The transition from desktop GIS to cloud-native, AI-augmented platforms has expanded the analytical frontier, bringing real-time decision-making within reach of diverse industry stakeholders.

While the introduction of U.S. tariffs in 2025 has added complexity to supply chains and equipment procurement, the industry’s adaptive response underscores its resilience and innovative capacity. By diversifying sourcing strategies and embracing modular designs, technology providers have effectively navigated these headwinds and maintained momentum in product development and service delivery.

Critical segmentation insights reveal a dynamic market landscape where traditional GIS and remote sensing technologies continuously converge with advanced analytics, addressing specialized applications from disaster management to smart city initiatives. Regionally, the Americas lead in infrastructure maturity, EMEA drives standardization and policy innovation, and Asia-Pacific showcases rapid growth underpinned by significant public investments.

Ultimately, organizations that integrate geospatial intelligence into strategic decision frameworks, foster collaborative ecosystems, and invest in talent development will be best positioned to capitalize on emerging opportunities. This report equips decision-makers with the comprehensive knowledge required to chart a course through evolving technological and regulatory landscapes, ensuring sustainable value creation and competitive advantage.

Ready to Leverage Geospatial Intelligence for Strategic Advantage in Your Organization? Contact Ketan Rohom Today to Secure This Comprehensive Market Research Report

Ready to Leverage Geospatial Intelligence for Strategic Advantage in Your Organization? Contact Ketan Rohom Today to Secure This Comprehensive Market Research Report

Bringing geospatial analytics from strategic concept to actionable reality starts with a clear commitment to data-driven decision-making. If you are eager to harness cutting-edge insights into technology trends, regulatory landscapes, and market dynamics, this in-depth market research report offers the definitive guide. Reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to purchase your copy and unlock exclusive access to the analysis, forecasts, and expert recommendations that will shape your organization’s geospatial capabilities.

Take the next step to outpace competition, mitigate risks associated with evolving trade policies, and capitalize on emerging opportunities in geovisualization, network analytics, and field modeling. Engage with our team today to discuss tailored licensing options, custom data packages, and supplementary strategic consultations. Your journey toward optimized geospatial intelligence and sustainable growth begins with a single conversation-connect with Ketan Rohom to make data geography your competitive edge now

- How big is the Geospatial Analytics Market?

- What is the Geospatial Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?