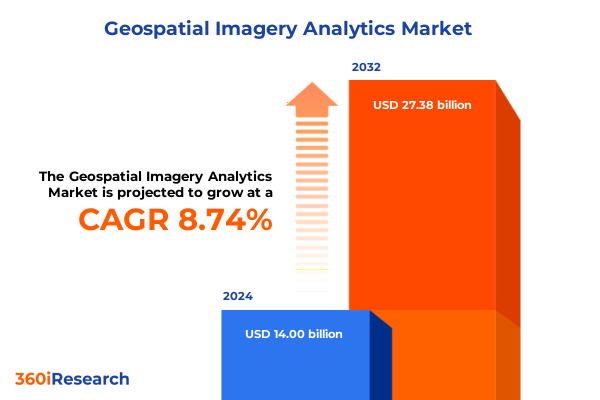

The Geospatial Imagery Analytics Market size was estimated at USD 15.14 billion in 2025 and expected to reach USD 16.40 billion in 2026, at a CAGR of 8.83% to reach USD 27.38 billion by 2032.

Setting the Stage for Next-Generation Spatial Intelligence: How Geospatial Imagery Analytics Delivers Transformative Insights for Agriculture, Defense, and Infrastructure

In an era defined by unprecedented volumes of satellite, aerial, and unmanned aerial vehicle (UAV) imagery, geospatial imagery analytics has emerged as a cornerstone technology for translating vast visual data streams into actionable intelligence. Organizations across agriculture, defense, urban planning, and utilities now leverage sophisticated machine learning and computer vision techniques to detect patterns, monitor change over time, and forecast outcomes. By integrating high-resolution imagery with robust analytical platforms, decision-makers gain real-time situational awareness that drives operational efficiency and strategic planning across multiple industry verticals. This capability is particularly vital as spatial data informs everything from precision farming practices to mission-critical defense applications

Amid surging demand for spatial intelligence, technological advances in cloud computing and data processing have democratized access to petabyte-scale imagery libraries and accelerated analytical workflows. The ability to ingest daily whole-Earth captures and rapidly classify features such as crop health, infrastructure integrity, or maritime traffic underscores the field’s maturity. Simultaneously, sensor innovations-ranging from hyperspectral constellations mapping detailed spectral signatures to synthetic aperture radar (SAR) arrays offering all-weather imaging-have expanded the scope of insights available to stakeholders. These converging trends, driven by lower data acquisition costs and scalable compute resources, are redefining how enterprises and public agencies harness geospatial intelligence to navigate complex challenges and uncover new value

Unprecedented Technological and Data-Driven Shifts Continuously Redefining the Geospatial Imagery Analytics Landscape in 2025

The geospatial imagery analytics landscape is undergoing transformative shifts fueled by breakthroughs in artificial intelligence and cloud-native architectures that enable unprecedented data fusion at scale. Advanced deep learning models now autonomously extract features from multispectral datasets, enhancing detection accuracy for phenomena such as deforestation, mineral exploration, and urban expansion. Concurrently, distributed processing frameworks allow organizations to deploy analysis pipelines that process thousands of square kilometers of imagery in minutes rather than days, significantly compressing time-to-insight. These capabilities are reshaping expectations across sectors, prompting enterprises to adopt real-time monitoring as a strategic imperative rather than a niche innovation.

Moreover, the proliferation of constellation architectures-featuring nanosatellites and microsatellites deployed by both commercial and governmental actors-has accelerated revisit rates and improved spatial coverage. This dense sampling supports dynamic monitoring applications, from emergency response to supply chain optimization. At the same time, emerging open data initiatives and public-private partnerships are broadening data availability, catalyzing new use cases. As business models evolve, the industry is witnessing a pivot from hardware-centric offerings toward end-to-end software and platform solutions that integrate data ingestion, analytics, and visualization. Together, these factors are continuously redefining competitive parameters and demanding agile strategies for market participation

Assessing the Far-Reaching Consequences of 2025 United States Reciprocal Tariff Measures on the Geospatial Imagery Analytics Ecosystem

In early 2025, reciprocal tariff measures introduced by the United States imposed duties ranging from 10% to nearly 50% on key technology imports, excluding certain semiconductors but including specialized sensors and UAV components. These policies aimed to address trade imbalances and national security concerns but have produced significant headwinds for the geospatial imagery analytics ecosystem. Cost pressures from higher duties on camera lenses, radar modules, and other critical hardware have elevated capital expenditures for satellite manufacturers and drone service providers, catalyzing a reassessment of procurement strategies and build-versus-buy decisions

Beyond immediate cost escalations, the tariff environment has complicated global supply chain resilience and extended lead times for high-precision equipment. Many geospatial service firms report procurement delays of several months, as businesses seek alternative suppliers or negotiate exemptions. This reality has accelerated the shift toward software-centric analytics platforms that minimize on-premises hardware dependences and leverage cloud infrastructure. While these adjustments foster long-term flexibility, they also introduce integration challenges and require retraining of specialized technical teams, illustrating the multifaceted impact of trade policies on the geospatial sector

Illuminating Market Dynamics Through Deep and Transformative Holistic Component, Deployment, Data Type, and End-User Segmentation Insights

Deep analysis of the market through holistic segmentation reveals how different components, deployment modes, data types, and end-user applications are shaping competitive dynamics. Component segmentation shows a clear division: services offerings-encompassing managed operations, professional integration services, and ongoing support and maintenance-coexist alongside software solutions that deliver analytical, processing, and visualization capabilities. Each quadrant demands distinct go-to-market strategies, with service providers emphasizing consultative engagements while software vendors prioritize platform extensibility and developer ecosystems.

Examination of deployment modes highlights the trade-off between on-premises control and cloud-hosted scalability. Cloud adoption accelerates innovation cycles through continuous integration of new imagery sources and AI models, whereas on-premises solutions provide deterministic performance and data security for regulated environments. Concurrently, data type segmentation underscores the diverse technical requirements of aerial, drone/UAV, and satellite imagery. Aerial systems deliver ultra-high resolution for localized inspections, drones offer rapid and agile deployments, and satellite constellations ensure global coverage and revisit cadence.

End-user segmentation further refines market opportunities. In agriculture, solutions support crop monitoring and soil analysis; financial services leverage spatial insights for claims management and risk assessment; construction and mining operations depend on resource estimation and site monitoring. Energy and utilities utilize geospatial analytics for oil and gas exploration, power grid management, and renewable energy monitoring. Government and defense agencies apply border surveillance and disaster management capabilities, while media and entertainment sectors benefit from content production and live event coverage. Transportation uses geospatial data for rail infrastructure inspection and road traffic monitoring. This multifaceted segmentation framework informs tailored value propositions and underscores where innovation investments will yield the greatest returns.

This comprehensive research report categorizes the Geospatial Imagery Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Data Type

- End-User

Examining Regional Variances and Strategic Opportunities Across the Americas, Europe, Middle East & Africa, and Asia-Pacific in Geospatial Analytics

Regional analysis of the geospatial imagery analytics market reveals differentiated adoption patterns and strategic focal points. In the Americas, the United States leads with robust investments in cloud-based analytics, driven by defense requirements and precision agriculture initiatives. Canada’s resource-rich territories foster strong demand for satellite-enabled environmental monitoring, while Latin American countries increasingly deploy drone-based surveys for infrastructure development and disaster response.

Across Europe, Middle East & Africa, established European Union policies on spatial data infrastructures and environmental regulations underpin sizable demand for compliance-focused analytics in energy, utilities, and urban planning. Recent agreements such as Poland’s multi-satellite procurement deal with ICEYE underscore the strategic importance of sovereign imaging capabilities. In the Middle East, oil and gas monitoring combined with rapid urbanization are catalyzing extensive geospatial deployments, and African agricultural programs leverage provider partnerships to support sustainability and food security objectives.

In the Asia-Pacific region, national space agencies in India and Japan have accelerated investment in remote sensing constellations, while commercial ventures like Planet Labs’ global basemap program under Norway’s Climate and Forests Initiative illustrate cross-border collaboration in tropical monitoring efforts. Rapid urban growth, climate resilience programs, and supply chain digitization are key drivers across the region, making Asia-Pacific a dynamic arena for both incumbents and new entrants in the geospatial imagery analytics market.

This comprehensive research report examines key regions that drive the evolution of the Geospatial Imagery Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Key Industry Players’ Strategies, Technological Differentiators, Partnerships, and Competitive Advantages in the Geospatial Imagery Analytics Market

A handful of leading companies define the competitive landscape through differentiated technology portfolios and strategic partnerships. Esri’s ArcGIS platform remains the industry standard for GIS software, offering seamless integration of satellite and aerial imagery with powerful spatial analytics and visualization tools that support enterprise-scale deployments worldwide. Orbital Insight set the benchmark for big-data-driven geospatial analysis by pioneering AI-based feature extraction across multi-source imagery, recently enhanced through its acquisition by Privateer Space to integrate satellite-tracking data with TerraScope insights.

Hyperspectral data specialist Pixxel is advancing surface composition analytics by deploying a constellation of hyperspectral imaging satellites capable of revealing material properties down to fine spectral bands, enabling precise applications in agriculture, mining, and environmental monitoring. ICEYE’s SAR constellation offers unique all-weather, day-night imaging, catering to defense and disaster management needs, supported by recent funding rounds that underscore its rapid growth and revenue milestones. Vexcel’s UltraCam and digital aerial imagery services complement these space-based offerings, delivering large-scale, year-over-year datasets for insurance and infrastructure inspection use cases. Together, these firms illustrate diverse strategic approaches-ranging from advanced sensor innovation to software-driven analytics platforms-shaping the future of geospatial imagery analytics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Geospatial Imagery Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Alteryx, Inc.

- AtkinsRéalis

- Bentley Systems International Ltd.

- FlyPix AI GmbH

- Fugro

- General Electric Company

- Geoscience Consulting, LLC

- Geospatial Analytics, Inc.

- Geospin GmbH

- Google, LLC by Alphabet Inc.

- Hexagon AB

- Intermap Technologies, Inc.

- L3Harris Technologies, Inc.

- Locana Group by TRC Companies, Inc.

- Lockheed Martin Corporation

- Mapbox, Inc.

- Maxar Technologies Inc.

- Orbital Insight, Inc. by privateer

- RMSI Private Limited

- SafeGraph LLC

- SAP SE

- Sparkgeo Consulting Inc.

- Supergeo Technologies Inc.

- Topcon Corporation

- Trimble Inc.

- Variac Systems Pvt. Ltd.

- Woolpert, Inc.

- Zillion Info

Implementing Actionable Strategic Recommendations to Drive Innovation, Resilience, and Competitive Growth in the Geospatial Analytics Sector

To capitalize on emerging opportunities and mitigate evolving risks, industry leaders should prioritize a dual focus on technology innovation and supply chain resilience. First, expanding in-house AI and machine learning capabilities is essential to maintain analytical differentiation; enterprises should invest in talent and infrastructure that enable rapid model training and deployment. Expanding partnerships with hyperspectral and SAR sensor providers will diversify data sources and reinforce all-weather monitoring capabilities.

Second, diversifying procurement channels and strengthening domestic manufacturing partnerships can buffer against tariff-related disruptions. Organizations should develop flexible procurement frameworks and pre-negotiated tariff exemptions while integrating cloud-native solutions to reduce dependencies on physical hardware. Additionally, establishing data governance and cybersecurity protocols that align with regional regulations will safeguard both proprietary analytics workflows and customer data.

Finally, collaborating in open data initiatives and consortium-based research efforts can accelerate innovation cycles and lower barriers to advanced analytics adoption. By contributing to shared imagery repositories and algorithm libraries, companies can harness network effects that benefit all stakeholders. Collectively, these strategic actions will enable geospatial analytics leaders to enhance operational agility, preserve cost efficiencies, and sustain competitive advantage in a rapidly evolving market.

Detailing a Robust and Transparent Research Methodology Leveraging Primary Interviews, Secondary Sources, and Advanced Analytical Techniques for Market Insight

This research employs a rigorous, multi-methodology approach designed to ensure the highest standards of accuracy and insight. Primary data collection comprised in-depth interviews with senior executives, technology officers, and domain specialists across leading geospatial firms and end-user organizations, providing firsthand perspectives on market dynamics and strategic priorities. Secondary research sources included peer-reviewed journals, government policy documents, trade association reports, and publicly available investor presentations, enabling comprehensive triangulation of quantitative and qualitative data.

Advanced analytical techniques underpinned segmentation and regional analyses, utilizing thematic coding for interview transcripts and geospatial data processing to validate industry trends. A proprietary framework guided scenario-based assessments of tariff impacts, supply chain shifts, and technology adoption trajectories. Ongoing market surveillance through news monitoring and regulatory filings ensured that the report reflects the most current developments as of mid-2025. This transparent and reproducible methodology enables clients to trace key insights back to original data sources and adapt findings to their specific strategic contexts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Geospatial Imagery Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Geospatial Imagery Analytics Market, by Component

- Geospatial Imagery Analytics Market, by Deployment Mode

- Geospatial Imagery Analytics Market, by Data Type

- Geospatial Imagery Analytics Market, by End-User

- Geospatial Imagery Analytics Market, by Region

- Geospatial Imagery Analytics Market, by Group

- Geospatial Imagery Analytics Market, by Country

- United States Geospatial Imagery Analytics Market

- China Geospatial Imagery Analytics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesizing Comprehensive Conclusions Highlighting Market Opportunities, Challenges, and the Future Trajectory of Geospatial Imagery Analytics

The synthesis of extensive research highlights a rapidly maturing geospatial imagery analytics market characterized by technological convergence, evolving end-user demands, and shifting geopolitical landscapes. Key findings emphasize the imperative for integrated hardware-software ecosystems, where hyperspectral and SAR capabilities complement traditional optical and aerial sources. The cumulative impact of reciprocal tariffs has accelerated a pivot toward cloud-native analytics, underscoring the critical role of flexible deployment models in sustaining operational continuity.

Segmentation analysis reveals differentiated growth pathways, with software-driven analytics platforms and managed services poised to capture rising demand across agriculture, defense, energy, and infrastructure sectors. Regional assessments demonstrate that the Americas lead in defense and precision agriculture, EMEA benefits from regulatory frameworks and industrial digitalization, and Asia-Pacific emerges as a dynamic frontier for constellation expansion and smart city deployments.

As industry leaders navigate competitive pressures and regulatory headwinds, strategic investments in AI, supply chain diversification, and collaborative data initiatives will determine market positioning. Ultimately, organizations that integrate advanced analytics with resilient operational models will thrive in a landscape where geospatial intelligence emerges as a foundational element for informed decision-making and sustainable growth.

Contact Ketan Rohom to Secure Your Customized Market Research Report and Harness Critical Geospatial Imagery Analytics Insights for Strategic Advantage

To gain a comprehensive understanding of the critical drivers, competitive landscape, and actionable insights within the geospatial imagery analytics space, reach out to Ketan Rohom today. Engaging directly will allow you to customize the report to your organization’s unique priorities, whether you seek deeper analysis of regional variations, detailed segmentation breakdowns, or scenario-based risk assessments reflecting the latest tariff developments. By securing this tailored research, you will equip your leadership team with the intelligence necessary to optimize investment strategies, validate technology roadmaps, and identify high-impact partnership opportunities. Don’t miss this opportunity to turn sophisticated spatial data into strategic advantage; contact Ketan Rohom now to access the full market research report and accelerate your geospatial analytics initiatives.

- How big is the Geospatial Imagery Analytics Market?

- What is the Geospatial Imagery Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?