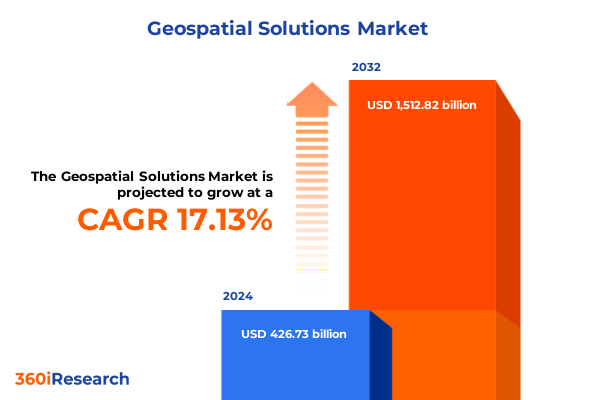

The Geospatial Solutions Market size was estimated at USD 496.73 billion in 2025 and expected to reach USD 578.22 billion in 2026, at a CAGR of 17.24% to reach USD 1,512.82 billion by 2032.

Setting the Stage for an Era of Precision and Strategic Decision-Making in Geospatial Solutions Across Industries and Applications

The rapid proliferation of geospatial technologies across sectors marks a pivotal moment in data-driven decision-making, positioning location intelligence as a cornerstone of innovation. Organizations in agriculture harness high-resolution mapping to optimize crop yields; infrastructure developers leverage precise site surveys to mitigate risk; and logistics operators refine routing algorithms for unparalleled efficiency. In each case, geospatial solutions underpin strategic initiatives by layering intelligence atop existing processes, creating a synergy between operational data and geographic context.

This executive summary encapsulates the critical findings of our comprehensive market study, outlining the prevailing forces reshaping the industry. It introduces the transformative shifts in technology adoption, analyzes the cascading effects of recent economic policies, and uncovers the segmentation dynamics that inform vendor strategies. The conclusion synthesizes these insights into actionable recommendations, equipping stakeholders with a clear vantage point from which to navigate future developments. Commencing with an exploration of foundational trends, this overview invites readers to appreciate the depth and breadth of the geospatial ecosystem and its potential to redefine competitive advantage.

Identifying the Pivotal Market Forces and Technological Disruptions Redefining Geospatial Innovation and Competitive Advantage Today

Emerging technologies such as cloud-native architectures and edge computing have reconfigured the way geospatial data is collected, processed, and disseminated, enabling real-time analytics that were previously constrained by bandwidth and latency limitations. Concurrently, advances in sensor miniaturization and autonomous mapping platforms have democratized access to high-fidelity imagery and point-cloud datasets, fostering an environment where even small enterprises can leverage sophisticated spatial intelligence.

Parallel to these technological shifts, cross-industry collaboration is accelerating innovation at the convergence of geospatial and adjacent domains. For instance, the integration of artificial intelligence in land-use planning algorithms is refining predictive capabilities, while the adoption of digital twin frameworks in smart city initiatives is orchestrating holistic urban management solutions. This interplay between disruptive technologies and collaborative ecosystems underscores a market environment where agility and interoperability become critical differentiators.

Examining the Layers of Economic and Operational Impact from United States Tariffs on Geospatial Components and Services in 2025

The introduction of heightened tariff measures by the United States in 2025 has introduced a multilayered impact across the geospatial value chain, influencing component supply, service delivery costs, and downstream pricing structures. Suppliers of imported hardware components have seen an uptick in unit costs, prompting end users to reevaluate standard procurement models and consider local manufacturing alternatives to mitigate exposure. These cost pressures have, in turn, led service integrators to adjust contract terms, weaving tariff contingencies into their project proposals and risk assessments.

Furthermore, software providers reliant on third-party libraries from impacted regions have reassessed licensing strategies, balancing the need for comprehensive geospatial platforms against the operational complexities of open-source alternatives. While some segments have experienced temporary slowdowns in implementation cycles due to budget recalibrations, others have found opportunities to renegotiate long-term contracts, leveraging strategic partnerships to secure preferential pricing. Overall, the tariff environment has triggered both reactive tactics and strategic realignments among market participants, reshaping procurement practices and partnership models across the ecosystem.

Uncovering Holistic Insights into Component, Application, and End User Segmentation Dynamics Shaping Strategic Opportunities in Geospatial Markets

In examining the component layer of the geospatial solutions market, hardware remains a fundamental driver, with GPS receivers, LiDAR scanners, and sensors each addressing distinct application requirements. GPS receivers serve as the backbone of location tracking, enabling real-time position data for sectors ranging from transportation logistics to precision agriculture. LiDAR scanners, with their high-density point-cloud generation, are indispensable for topographic mapping and infrastructure inspection, offering sub-centimeter accuracy. Advanced sensors, meanwhile, facilitate bespoke data capture in specialized scenarios such as environmental monitoring and asset maintenance.

Turning to the services landscape, consulting engagements guide organizations through technology selection and integration roadmaps, while implementation services ensure the seamless deployment of complex solutions. Ongoing support and maintenance frameworks underpin system reliability, with managed services emerging as a preferred option for enterprises prioritizing predictable operational expenditure. On the software front, cloud-based platforms deliver scalable storage and processing capabilities, integrating data ingestion, visualization, and analytics. Desktop solutions continue to serve power users requiring offline capabilities and advanced geoprocessing tools, while mobile applications extend situational awareness to field operations, supporting tasks such as real-time monitoring and geofencing.

From an application perspective, geospatial technologies empower asset management workflows by enabling both field-level tracking of mobile assets and infrastructure-level oversight of fixed installations. Location-based services leverage geofencing to automate alerts and real-time monitoring to enhance situational response. Surveying and mapping applications span utility mapping, topographic modeling, and volumetric analysis, fueling informed planning decisions. Navigation and tracking span fleet management, personal navigation, and vehicle guidance systems that optimize routes and enhance safety. Precision agriculture combines variable rate application techniques with yield mapping analytics to maximize resource efficiency and bolster crop productivity.

Evaluating end-user segments reveals a diverse set of market drivers. In agriculture, solutions tailored to crop management optimize planting patterns and irrigation schedules, while livestock monitoring systems track animal health and location. Construction and mining applications encompass site planning for building projects and geological surveys for resource extraction. Civil government and defense entities deploy geospatial intelligence for urban planning, emergency response, and strategic decision-making. The oil and gas sector relies on geospatial tools for exploration surveys and pipeline management, ensuring regulatory compliance and operational integrity. Transportation and logistics providers utilize geospatial analytics for route optimization across air, marine, rail, and road networks. Utilities and telecom operators apply power grid mapping and infrastructure monitoring to enhance network resilience and expedite fault detection.

This comprehensive research report categorizes the Geospatial Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- End User

Analyzing Regional Perspectives Across Americas Europe Middle East Africa and Asia Pacific to Highlight Local Drivers and Growth Catalysts

The Americas region is characterized by widespread adoption of next-generation mapping and location intelligence solutions, driven by substantial investments in smart city initiatives and precision agriculture modernization. North American enterprises continue to refine regulatory frameworks around data privacy and satellite licensing, while Latin American markets show rapid growth in asset management deployments, setting the stage for regional collaboration on infrastructure digital twins.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts facilitate cross-border geospatial data exchange, enabling pan-European mapping standards and integrated emergency response systems. Middle Eastern investments in sustainable urban development are bolstering demand for real-time monitoring platforms, and African governments are pursuing geospatial-driven ecosystem management to support agriculture and natural resource stewardship. This heterogeneous landscape underscores the importance of tailored go-to-market strategies that address localized regulatory regimes and infrastructure maturity levels.

In the Asia-Pacific arena, domestic manufacturing capabilities are expanding to meet rising hardware demand, particularly for high-precision sensors and LiDAR modules. Governments in the region are integrating geospatial analytics into national infrastructure plans, with a focus on disaster management and urban congestion mitigation. Collaborative research programs between public agencies and private enterprises are accelerating innovation in cloud software and machine learning–driven mapping solutions, establishing the region as a hotbed for next-generation spatial intelligence.

This comprehensive research report examines key regions that drive the evolution of the Geospatial Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Collaborations Driving Technological Excellence and Market Leadership in Geospatial Solutions

Industry leaders have accelerated strategic collaborations to broaden their technological portfolios and strengthen distribution channels. Esri, a stalwart in desktop GIS software, has deepened alliances with cloud service providers to deliver hybrid deployment models that cater to enterprise scalability requirements. Trimble has expanded its hardware and software integration roadmap by acquiring niche sensor manufacturers, reinforcing its position in precision agriculture and construction segments. Hexagon continues to build out its digital reality suite through targeted acquisitions of software startups specializing in artificial intelligence–based geospatial analysis.

Meanwhile, Leica Geosystems has intensified its focus on end-to-end solution bundles, integrating terrestrial laser scanning with robust software platforms to streamline workflows in civil engineering and asset management. Topcon has prioritized interoperability, advancing open data standards and partnerships with telecommunications operators to embed geolocation services directly into network infrastructures. Emerging players are also disrupting traditional market hierarchies by offering subscription-based, low-code development environments that democratize the creation of custom geospatial applications.

This competitive landscape highlights the strategic importance of ecosystem partnerships, where alliances between hardware manufacturers, service integrators, software developers, and channel partners drive comprehensive value propositions. Success for these companies hinges on their ability to anticipate evolving customer needs, deliver seamless cross-platform experiences, and foster developer communities that accelerate solution adoption.

This comprehensive research report delivers an in-depth overview of the principal market players in the Geospatial Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 1Spatial Group plc

- Autodesk, Inc.

- Bentley Systems, Incorporated

- CARTO, Inc.

- CE Info Systems Limited

- Cyient Limited

- EOS Data Analytics Private Limited

- Esri

- Fugro N.V.

- Google LLC

- HERE Global B.V.

- Hexagon AB

- Mapbox, Inc.

- Maxar Technologies Inc.

- Pix4D SA

- Planet Labs PBC

- Precisely Holdings, LLC

- RMSI Private Limited

- Trimble Inc.

- Woolpert, Inc.

Crafting Targeted Action Plans and Best Practice Roadmaps to Enhance Competitive Positioning and Operational Efficiency in Geospatial Enterprises

To capitalize on the accelerating adoption of geospatial solutions, industry leaders should adopt modular technology architectures that allow rapid integration of new sensors and analytics components. By implementing open APIs and standardized data schemas, organizations can ensure interoperability across existing platforms, minimizing vendor lock-in and facilitating innovation through third-party development.

Establishing center-of-excellence teams focused on geospatial analytics will drive skill specialization and cross-functional knowledge sharing. These teams can pilot advanced use cases-such as predictive maintenance for critical infrastructure or autonomous vehicle navigation-before scaling successful deployments enterprise-wide. Coupled with a robust change management framework, this approach will embed spatial thinking into core business processes, fostering a culture of data-driven decision-making.

Strategic investment in training and upskilling initiatives is essential to bridge talent gaps in geospatial analytics and software development. Partnering with academic institutions and certification programs can create a pipeline of skilled professionals proficient in emerging tools and methodologies. Furthermore, by leveraging collaborative research grants and innovation labs, organizations can co-develop proprietary algorithms that differentiate service offerings and deliver unique insights to end users.

Detailing Rigorous Research Approaches Methodical Data Collection and Analytical Frameworks Underpinning Insights in the Geospatial Solutions Report

The research methodology underpinning this report combined primary interviews with C-level executives, technical leaders, and end users across multiple regions to capture real-world perspectives on geospatial adoption challenges and success factors. These qualitative insights were complemented by a systematic review of industry publications, patent filings, and regulatory frameworks to map the competitive landscape and identify emerging technology clusters.

Quantitative data was sourced from a curated set of reputable trade associations, government repositories, and financial disclosures to ensure a robust foundation for trend analysis. Advanced analytics techniques, including sentiment analysis of executive commentary and machine learning–driven clustering of application use cases, were applied to uncover latent patterns in vendor strategies and technology trajectories.

The study leveraged a triangulation approach, cross-validating findings across independent data sources to enhance reliability. Regional assessments were conducted with localized expert panels, ensuring that geopolitical nuances and infrastructure maturity factors were accurately reflected in the insights. This rigorous, multi-layered research framework provides stakeholders with a transparent view of the methodologies deployed and the evidentiary basis for the strategic conclusions drawn.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Geospatial Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Geospatial Solutions Market, by Component

- Geospatial Solutions Market, by Application

- Geospatial Solutions Market, by End User

- Geospatial Solutions Market, by Region

- Geospatial Solutions Market, by Group

- Geospatial Solutions Market, by Country

- United States Geospatial Solutions Market

- China Geospatial Solutions Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2862 ]

Synthesizing Core Conclusions and Strategic Takeaways to Empower Decision Makers in Navigating the Complex Geospatial Solutions Ecosystem

In summary, the geospatial solutions market is at an inflection point, driven by rapid technological advancements, shifting economic policies, and evolving end-user expectations. Stakeholders must adapt to the realities of tariff-induced cost pressures, leverage segmentation-specific growth levers, and tailor strategies to regional market dynamics. The convergence of hardware innovation, cloud-native architectures, and artificial intelligence heralds a new era of spatially enabled intelligence that extends far beyond traditional mapping applications.

Organizations that successfully integrate geospatial thinking into their operational DNA will unlock unprecedented efficiencies, mitigate risks, and capitalize on emerging opportunities in sectors as diverse as agriculture, construction, logistics, and public safety. By aligning strategic investments with the actionable recommendations outlined in this summary, decision makers can position their enterprises to thrive amidst complexity and uncertainty. The moment for geospatial leadership is now; embracing holistic, data-driven approaches will determine who emerges as the vanguard of this transformative market.

Engaging Next Steps and Personalized Support Invitation to Connect With Our Associate Director for Customized Geospatial Market Intelligence Solutions

As the geospatial solutions landscape becomes increasingly data-driven and client-centric, engaging with an expert partner can crystallize your strategic vision. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to tailor an exploratory discussion on how our in-depth research can address your unique challenges and enable superior market positioning. This personalized session will outline the advantages of the full market intelligence package, emphasize custom analytical modules relevant to your operations, and provide insights into deployment best practices across your organization.

By scheduling this conversation, you will gain clarity on specific sections of the report that align most closely with your business objectives, secure preferential access to forthcoming updates, and explore bespoke advisory support options. Take the next step toward actionable geospatial market leadership by connecting with Ketan Rohom to secure access to the comprehensive report and unlock the competitive edge your enterprise demands.

- How big is the Geospatial Solutions Market?

- What is the Geospatial Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?