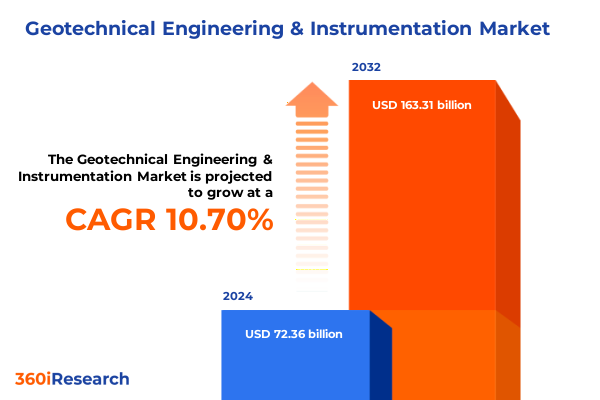

The Geotechnical Engineering & Instrumentation Market size was estimated at USD 80.13 billion in 2025 and expected to reach USD 88.13 billion in 2026, at a CAGR of 10.70% to reach USD 163.31 billion by 2032.

Laying the Groundwork for Next-Generation Geotechnical Engineering through Innovative Instrumentation Strategies and Market Dynamics

In today’s rapidly evolving infrastructure landscape, geotechnical engineering has emerged as a critical discipline for ensuring the safety, resilience, and longevity of major civil works. With increasing urbanization, climate variability, and aging structures, industry stakeholders are placing greater emphasis on precise subsurface data collection and real-time monitoring to mitigate risks and optimize maintenance strategies. The convergence of digital technologies with traditional instrumentation is redefining how projects are planned, executed, and managed, prompting a paradigm shift from periodic manual checks to continuous automated oversight.

This report delves into the core drivers behind the growing reliance on advanced geotechnical instrumentation, highlighting how innovations such as wireless sensor networks, cloud-based analytics platforms, and remote monitoring solutions are transforming site investigation and asset management practices. By integrating these developments, engineers and decision-makers can derive deeper insights into soil behavior, structural responses, and environmental interactions, thereby improving predictive accuracy and reducing the likelihood of costly failures. The following sections provide a comprehensive overview of market shifts, regulatory influences, and technological breakthroughs that are setting new benchmarks for performance and safety in geotechnical applications.

Unveiling Disruptive Technologies and Data-Driven Innovations Reshaping the Geotechnical Instrumentation Landscape Worldwide

The geotechnical instrumentation landscape is experiencing a wave of transformative shifts driven by the convergence of digital innovation and sustainability imperatives. Internet of Things (IoT) devices are enabling real-time data transmission from remote sites, eliminating the latency associated with traditional data logging methods. This shift towards connected instrumentation has unlocked opportunities for predictive analytics, where machine learning algorithms process vast datasets to identify subtle patterns indicative of potential failure or deformation long before they become critical.

Simultaneously, additive manufacturing and advanced materials research are introducing lightweight, low-cost sensors that maintain high accuracy under harsh field conditions. These components integrate seamlessly with existing infrastructure, enabling modular upgrades without extensive retrofitting. Furthermore, the adoption of open data standards is fostering interoperability across different equipment manufacturers, facilitating cohesive monitoring networks and centralized data management. As environmental regulations become more stringent, instruments equipped with self-calibration features and automated fault detection are gaining prominence, ensuring uninterrupted compliance and reducing labor-intensive maintenance cycles.

These technological advances are not isolated improvements but part of a broader movement towards holistic asset management. By embedding intelligence at the sensor level and coupling it with sophisticated analytical platforms, project stakeholders can achieve unprecedented visibility into ground behavior and structural integrity. This comprehensive approach is setting new performance benchmarks, improving decision-making speed, and driving cost efficiencies across the lifecycle of geotechnical projects.

Analyzing the Ripple Effects of 2025 United States Tariffs on Supply Chains Materials Costs and Project Viability in Geotechnical Engineering

The introduction of new tariffs on critical instrumentation components and raw materials in 2025 has exerted a cumulative impact on procurement strategies and project budgets. In particular, increased duties on steel and electronic sensor modules have disrupted established supply chains, leading to extended lead times and higher landed costs. Many manufacturers have been compelled to reevaluate sourcing arrangements, shifting production closer to end markets or partnering with local fabricators to mitigate tariff exposure and currency fluctuations.

These adjustments have resonated throughout the value chain, as engineering firms balance cost pressures with the imperative to maintain high safety and quality standards. Some clients have opted for hybrid deployment models, combining imported high-precision sensors with domestically produced peripherals, while others are exploring long-term supply contracts to hedge against further policy changes. Despite these challenges, the market has demonstrated resilience, with stakeholders leveraging collaborative procurement frameworks and regional distribution hubs to reduce logistical complexity.

Looking ahead, risk management strategies such as multi-supplier qualification, dynamic inventory planning, and just-in-time delivery are becoming standard practice. By diversifying vendor portfolios and establishing inventory buffers for critical items, project teams can sustain continuity in instrumentation deployment even in volatile trade environments. These adaptive measures underscore the sector’s capacity to navigate regulatory headwinds while continuing to deliver reliable subsurface data.

Deep Dive into Product Type Application End User Technology and Deployment Segmentation Revealing Market Opportunity Drivers

A granular understanding of market segmentation reveals the distinct drivers and performance metrics associated with various product categories and deployment scenarios. In the realm of product types, data acquisition systems anchor the infrastructure for comprehensive site monitoring, while measurement instruments such as extensometers and inclinometers provide critical insights into deformation patterns. Load cells quantify applied forces, piezometers track pore water pressures, settlement sensors monitor vertical displacement, and strain gauges capture localized stress changes, each fulfilling a specialized role in holistic asset surveillance.

Application-wise, instrumentation solutions are tailored to diverse use cases, including bridge monitoring for structural integrity assessments, dam monitoring for hydrological and safety evaluations, foundation monitoring to gauge settlement risks, mining monitoring to detect slope instabilities, slope monitoring for landslide early warning, and tunnel monitoring to oversee ground-structure interactions. These scenarios dictate specific sensor configurations, data resolution requirements, and installation methodologies that shape procurement decisions and service contracts.

End users span a broad spectrum of stakeholders, from construction companies that embed sensors during groundwork to energy and power companies monitoring critical infrastructure, mining operations assessing pit wall stability, oil and gas firms safeguarding well sites, and transportation authorities overseeing the performance of roadways and rail corridors. Technological categories bifurcate into wired and wireless instrumentation; cable-based systems and Ethernet networks deliver robust, high-throughput data streams, whereas Bluetooth-enabled modules, cellular telemetry, and radio frequency links offer flexible deployment with minimal trenching. Deployment modalities further divide into permanent installations-comprising embedded sensors cast into concrete or mounted on surface structures-and portable setups realized through handheld devices or trailer-mounted platforms for periodic site surveys.

By decoding these intersecting layers of segmentation, stakeholders can pinpoint growth vectors, customize system architectures, and align investment priorities with application-specific requirements. The interplay between product capabilities, end-use demands, and deployment modalities underpins strategic decision-making, enabling organizations to optimize performance and cost-efficiency across geotechnical programs.

This comprehensive research report categorizes the Geotechnical Engineering & Instrumentation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Deployment Type

- End User

- Application

Exploring Regional Dynamics and Infrastructure Investments Shaping Geotechnical Instrumentation Adoption in Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics exert a profound influence on how instrumentation technologies are adopted and deployed worldwide. In the Americas, infrastructure renewal programs and expansive mining initiatives underpin strong demand for both fixed and portable monitoring systems. North American regulatory frameworks emphasize stringent safety standards, prompting engineering firms to invest in advanced sensor networks that deliver high-frequency data and automated alerts. Meanwhile, Latin American markets are witnessing steady interest in cost-effective monitoring solutions, particularly within the mining sector where real-time stability analysis can avert catastrophic failures.

Europe, Middle East & Africa present a mosaic of regulatory and environmental contexts. In Western Europe, strict directives on dam safety and slope management drive the uptake of integrated monitoring platforms that combine geotechnical data with environmental and hydrological inputs. The Middle East’s rapid urban expansion and oil and gas infrastructure projects require scalable instrumentation that withstands extreme temperatures and arid conditions. Across Africa, governments and development agencies are collaborating on large-scale hydroelectric and transportation programs, prioritizing affordable yet robust sensor technologies to ensure project longevity and community safety.

Within the Asia-Pacific region, aggressive infrastructure spending in China and India propels demand for both wired and wireless monitoring networks capable of supporting urban subway lines, high-speed rail, and cross-border initiatives. Japan’s focus on seismic resilience has fostered innovations in high-precision accelerometers and tiltmeters, while Southeast Asian nations are increasingly integrating remote monitoring systems to manage landslide risks in monsoon-prone zones. These divergent regional imperatives underscore the need for adaptable instrumentation portfolios and localized service models that resonate with specific climatic, geological, and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Geotechnical Engineering & Instrumentation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Instrumentation Innovators Their Strategic Moves Technological Investments and Collaborative Initiatives Driving Industry Leadership

Within the competitive ecosystem of geotechnical instrumentation, certain market participants have distinguished themselves through targeted R&D, strategic partnerships, and geographic expansion. Industry stalwarts are channeling investments into next-generation sensor technologies, including multifunctional probes that concurrently measure strain, temperature, and moisture content. These efforts are complemented by strategic alliances with software providers, enabling seamless integration of hardware outputs into cloud-based analytics platforms and digital twin environments.

Some innovators are leveraging acquisitions to diversify their product portfolios and enhance service offerings, while others are forging joint ventures to co-develop bespoke monitoring solutions for large-scale infrastructure clients. Collaborative pilots with academic institutions are yielding breakthroughs in sensor miniaturization and low-power communications, positioning these companies at the vanguard of remote monitoring capabilities. Meanwhile, a subset of agile startups is capitalizing on the wireless instrumentation trend, introducing plug-and-play modules with user-friendly interfaces and subscription-based data management services.

Beyond product innovation, leading firms are investing in global distribution networks and local field service teams to reduce deployment timelines and ensure rapid technical support. Emphasis on certification programs and end-user training initiatives further cements their reputation as trusted technology partners. This combination of technological leadership, strategic collaboration, and customer-centric support models is driving differentiation in a crowded field, enabling top performers to capture premium project contracts and establish long-term client relationships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Geotechnical Engineering & Instrumentation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aimil Ltd.

- Bauer Maschinen GmbH

- Campbell Scientific, Inc.

- Durham Geo Slope Indicator Company, Inc.

- Encardio-rite Group

- Fugro N.V.

- Geocomp Corporation

- Geokon, Inc.

- Geosense Limited

- GeoSIG Ltd.

- Keller Group plc

- Kinemetrics, Inc.

- Maccaferri Environmental Solutions Pvt. Ltd.

- Measurand Inc.

- Nova Metrix LLC

- RST Instruments Ltd.

- SISGEO S.p.A.

- Soil Instruments Limited

- Trimble Inc.

- Worldsensing S.L.

Actionable Strategic Recommendations Empowering Industry Leaders to Harness Instrumentation Innovations Optimize Operations and Enhance Project Outcomes

To capitalize on emerging opportunities and fortify market positions, industry leaders should adopt a multifaceted strategy that emphasizes both incremental improvements and strategic innovation. First, integrating wireless telemetry with edge computing capabilities can unlock real-time insights and reduce the reliance on extensive cabling, accelerating deployment and lowering maintenance costs. Harnessing AI-driven analytics platforms will enable predictive maintenance programs that preempt structural issues and optimize resource allocation.

Second, expanding cross-industry collaborations can foster the development of standardized communication protocols and open data architectures, improving system interoperability and reducing vendor lock-in concerns. Establishing strategic supply chain partnerships and qualifying multiple component suppliers will mitigate tariff-related risks and ensure continuity of critical hardware availability. Furthermore, investing in modular system designs that accommodate future sensor upgrades can extend asset lifespans and protect capital expenditures against rapid technological turnover.

Lastly, companies should strengthen customer engagement through tailored training programs and digital support tools that facilitate remote diagnostics and troubleshooting. By offering comprehensive service packages that combine equipment leasing, software subscriptions, and performance-based contracts, instrumentation providers can create recurring revenue streams and deepen client loyalty. This holistic approach will not only drive sustainable growth but also position market leaders as indispensable partners in the pursuit of construction safety, operational resilience, and data-driven decision-making.

Detailed Research Methodology Outlining Data Collection Analytical Frameworks Validation Techniques and Quality Assurance Protocols

The research underpinning this analysis was conducted through a systematic methodology designed to ensure both rigor and relevance. Initially, secondary research was performed by reviewing industry white papers, technical journals, and regulatory publications to map the evolution of instrumentation technologies and identify prevailing standards. This phase established the contextual framework for subsequent primary inquiries.

Primary research consisted of in-depth interviews with geotechnical engineers, instrumentation specialists, and project managers across multiple regions, facilitating firsthand insights into application-specific challenges, procurement priorities, and future investment plans. This qualitative data was augmented with a structured survey targeting a broad spectrum of end users, providing quantifiable metrics on technology adoption rates, satisfaction levels, and service expectations.

To validate findings, a triangulation process cross-referenced primary and secondary inputs, ensuring consistency and eliminating potential biases. Data quality was further reinforced through peer reviews by subject matter experts, who assessed the analytical assumptions, methodological integrity, and the interpretive frameworks. This multifaceted approach delivers a balanced perspective, combining empirical evidence with experiential expertise to inform strategic recommendations and market insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Geotechnical Engineering & Instrumentation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Geotechnical Engineering & Instrumentation Market, by Product Type

- Geotechnical Engineering & Instrumentation Market, by Technology

- Geotechnical Engineering & Instrumentation Market, by Deployment Type

- Geotechnical Engineering & Instrumentation Market, by End User

- Geotechnical Engineering & Instrumentation Market, by Application

- Geotechnical Engineering & Instrumentation Market, by Region

- Geotechnical Engineering & Instrumentation Market, by Group

- Geotechnical Engineering & Instrumentation Market, by Country

- United States Geotechnical Engineering & Instrumentation Market

- China Geotechnical Engineering & Instrumentation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summarizing Critical Takeaways from Market Dynamics Technological Advancements and Strategic Imperatives for Future Geotechnical Engineering Success

As the geotechnical engineering sector navigates a complex interplay of digital transformation, trade policy shifts, and region-specific infrastructure imperatives, certain themes emerge as pivotal to future success. The proliferation of connected sensor networks and AI-driven analytics is redefining risk management practices, enabling earlier detection of subsurface anomalies and more effective mitigation strategies. Concurrently, tariff-induced supply chain challenges have prompted a reorientation towards local sourcing and diversified procurement approaches, underscoring the importance of agility in operational planning.

Segmentation analysis highlights the varied needs across product types, applications, end users, technologies, and deployment models, revealing targeted growth corridors in wireless instrumentation, dam safety monitoring, and portable survey solutions for mining and tunneling projects. Regional insights demonstrate that while mature markets emphasize compliance and system integration, emerging regions prioritize affordability and rapid deployment under challenging environmental conditions. Leading companies are distinguishing themselves through technological collaboration, strategic acquisitions, and customer-centric service offerings that deliver end-to-end project support.

These converging forces suggest that organizations that embrace innovation, maintain supply chain resilience, and deliver customized value propositions will secure a competitive edge. By synthesizing data-driven insights with stakeholder-centric strategies, industry participants can steer complex geotechnical initiatives towards safer, more efficient, and financially sustainable outcomes.

Engage with Our Sales and Marketing Expert Ketan Rohom to Secure Comprehensive Market Research Insights Tailored to Your Geotechnical Engineering Needs

Engaging with Ketan Rohom, the Associate Director of Sales and Marketing, provides direct access to an expert who can guide strategic purchasing decisions and customize research deliverables to align precisely with project requirements. His deep understanding of how instrumentation innovations intersect with evolving market needs ensures that clients receive actionable insights rather than generic overviews, empowering them to make data-driven investments with confidence. Prospective customers are invited to connect with him for a confidential discussion of their specific objectives, whether the focus lies in procurement planning, technology evaluation, or competitive positioning.

By initiating a conversation with Ketan, organizations gain clarity on how to leverage the comprehensive market research report to accelerate project timelines, optimize capital allocation, and stay ahead of emerging industry shifts. His consultative approach is designed to translate dense technical findings into strategic roadmaps, helping clients navigate complex supply chain landscapes, comply with regulatory environments, and harness the full potential of advanced instrumentation. Reach out today to secure your copy of the report and transform insights into tangible operational advantages through tailored support and expert guidance.

- How big is the Geotechnical Engineering & Instrumentation Market?

- What is the Geotechnical Engineering & Instrumentation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?