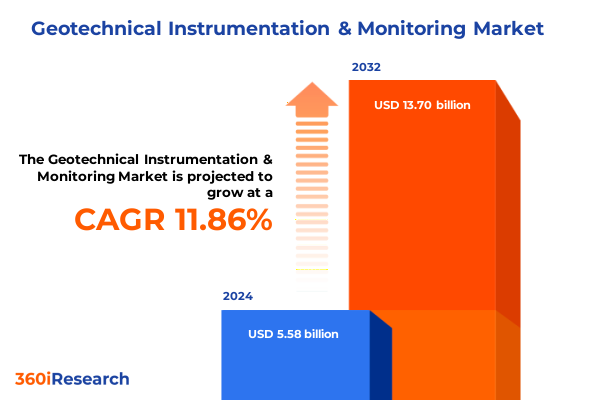

The Geotechnical Instrumentation & Monitoring Market size was estimated at USD 6.24 billion in 2025 and expected to reach USD 6.98 billion in 2026, at a CAGR of 11.88% to reach USD 13.70 billion by 2032.

Setting the Stage for Advanced Geotechnical Instrumentation and Monitoring to Empower Infrastructure Safety Performance and Decision-Making

The geotechnical instrumentation and monitoring landscape underpins the safety assessment and lifecycle management of critical infrastructure projects worldwide. Practitioners rely on a range of sensors and data acquisition systems to accurately measure soil and structural behavior under varying environmental and load conditions. These measurements are vital for detecting early warning signs of instability in dams tunnels embankments and foundations ensuring that potential failures are addressed proactively rather than reactively.

Against this backdrop the discipline has evolved from simple mechanical gauges to sophisticated sensor networks capable of delivering high-resolution data streams in real time. This evolution reflects a broader imperative to improve the reliability and efficiency of infrastructure development and maintenance programs. Moreover the integration of cutting-edge technologies has unlocked new opportunities for remote monitoring enabling stakeholders to manage geographically dispersed assets with greater precision and reduced manual intervention.

In the following sections we explore the major shifts reshaping the industry examine the implications of recent tariff measures on supply chains uncover segmentation patterns and highlight regional trends that will define market trajectories. We also introduce the leading companies driving innovation assess actionable recommendations for executives outline our research methodology and conclude with an invitation to engage further. Collectively these insights provide a holistic perspective that equips professionals with the knowledge to make evidence-based decisions and achieve resilient infrastructure outcomes.

Shifting Paradigms in Geotechnical Monitoring through the Adoption of IoT Connectivity Digital Twin Integration and Sustainable Sensor Solutions

Recent years have witnessed a profound transformation in geotechnical monitoring driven by the convergence of Internet of Things connectivity advanced analytics and evolving environmental regulations. This confluence has catalyzed the shift from periodic onsite inspections to continuous remote surveillance of soil and structural assets. As a result practitioners can now capture performance data at unprecedented temporal and spatial resolutions enabling more accurate risk assessments and faster response protocols.

At the heart of this shift is the widespread adoption of cloud-enabled platforms that aggregate multisensor data and apply machine learning algorithms to detect anomalies. These platforms enhance collaborative workflows by providing real-time dashboards accessible across project teams while reducing latency in decision-making. Concurrently digital twins have emerged as powerful tools for simulating complex geotechnical scenarios by integrating historical monitoring datasets with design parameters. This bridging of virtual and physical domains empowers engineers to test mitigation strategies in silico before implementing costly field interventions.

Moreover sustainability considerations have risen to prominence influencing the choice of materials and deployment methods for instrumentation. Non-invasive sensors and biodegradable materials are being piloted in ecologically sensitive zones to align monitoring programs with stringent environmental guidelines. Together these developments mark a significant leap toward proactive asset management ultimately enhancing resilience and reducing lifecycle costs.

Unpacking the Layered Impact of Section 301 Tariff Increases and Exclusions on Geotechnical Instrumentation Supply Chains and Costs in 2025

Throughout 2024 and into 2025 the United States Trade Representative has incrementally raised duties on a range of Chinese imports under Section 301 of the Trade Act of 1974 affecting semiconductors metals and critical component materials essential to geotechnical instrumentation. In December 2024 tariff rates on solar wafers and polysilicon rose to 50 percent while certain tungsten products saw a 25 percent levy effective January 1 2025. These adjustments complement earlier increases to 100 percent on electric vehicles and 50 percent on key mineral imports intended to bolster domestic manufacturing capacity.

Unlocking Market Dynamics by Instrument Type End User Application Monitoring Modality Platform Installation Method and Technology Choices

Analysis of the market reveals clear demand drivers and risk profiles across distinct instrumentation types end-user segments monitoring methodologies deployment platforms installation modes and connectivity technologies. Accelerometers extensometers and piezometers each serve specialized measurement objectives from dynamic vibration analysis to pore-pressure monitoring and require tailored calibration and maintenance protocols. Construction energy mining oil & gas and transportation sectors exhibit unique project lifecycles and regulatory frameworks that influence instrument selection criteria. Meanwhile geotechnical monitoring applications prioritize subsurface stability and groundwater management whereas structural health monitoring techniques emphasize load-bearing characteristics and deformation tracking. Portable solutions enable rapid deployment for short-term investigations in remote or emergency contexts while stationary systems remain foundational for continuous lifecycle monitoring. Furthermore wired installations via electric cable or fiber-optic lines deliver robust bandwidth and low latency whereas cellular IoT LoRaWAN and satellite wireless networks facilitate flexible coverage in geographically challenging terrains without the need for extensive cabling.

This comprehensive research report categorizes the Geotechnical Instrumentation & Monitoring market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Instrument Type

- Monitoring Type

- Platform

- Installation Type

- Technology

- End User

Examining Regional Variations in Geotechnical Monitoring Adoption and Infrastructure Drivers across the Americas EMEA and Asia-Pacific Markets

The Americas have long set the pace in geotechnical monitoring with heavy infrastructure investments underpinned by public funding initiatives that emphasize asset renewal and resilience. In North America regulatory mandates for dam safety and critical transportation corridors drive high adoption of advanced instrumentation and data analytics. Latin American markets are increasingly integrating remote-sensing tools and cloud-based analytics to manage burgeoning urbanization and seismic risk.

This comprehensive research report examines key regions that drive the evolution of the Geotechnical Instrumentation & Monitoring market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing Strategic Moves and Technological Leadership of Key Global Players Advancing Innovation in Geotechnical Instrumentation and Monitoring

Key industry participants are strategically differentiating through targeted R&D investments and service expansions. Several global sensor manufacturers have unveiled next-generation data loggers and multi-parameter sensor arrays that combine low-power electronics with AI-driven edge computing. Specialist system integrators are forging partnerships with cloud platform providers to deliver end-to-end monitoring as a service solutions that encompass sensor deployment data management and analytics modules. At the same time engineering consultancies are deepening their expertise in digital twin modeling and risk advisory services to provide holistic project assurance. Collaboration between instrumentation vendors and academic research centers further accelerates innovation in sensor materials and measurement techniques.

This comprehensive research report delivers an in-depth overview of the principal market players in the Geotechnical Instrumentation & Monitoring market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Geotechnical, Inc.

- Canterbury Seismic Instruments Ltd

- Deep Excavation LLC

- Eustis Engineering LLC

- Fugro N.V.

- GaiaComm Ltd.

- GEI Consultants

- Geomotion (Singapore) Pte. Ltd.

- Geotechnical Services, Inc.

- Geotechnics Limited

- Innovative Geotechnical Instrumentation

- Keller Group PLC

- Monitoring Solution Providers Pte Ltd.

- Petra Geosciences, Inc.

- PMT Infrascience Pvt. Ltd.

- Quantum Geotechnic Limited

- S. W. Cole Engineering, Inc.

- Sisgeo S.r.l.

- Tetra Tech, Inc.

- Trimble Inc.

- Wardle Drilling & Geotechnical Ltd.

- WJ Groundwater Limited

Actionable Strategies for Industry Leaders to Capitalize on Emerging Technologies Enhance Data Quality and Strengthen Supply Chain Resilience

Industry leaders must prioritize end-to-end digitization to unlock enhanced data quality faster insights and seamless cross-disciplinary collaboration. Integrating sensor networks with unified cloud-native analytics platforms can streamline data ingestion anomaly detection and real-time reporting. Equally important is investing in staff competency through interdisciplinary training programs that merge geotechnical expertise data science and digital engineering. To safeguard operations against geopolitical and trade disruptions enterprises should diversify their supply chains by establishing multiple sourcing relationships and maintaining strategic component inventories. Furthermore piloting emerging sensor technologies such as biodegradable probes and energy-harvesting wireless nodes can reduce maintenance burdens and environmental impact over long-term deployments. By adopting these strategies organizations will bolster their competitive positioning ensure regulatory compliance and drive sustainable growth.

Rigorous Mixed-Methodology Approach Employing Primary Interviews Secondary Data Triangulation and Advanced Analytical Frameworks

This research employs a mixed-methodology framework combining primary and secondary data sources to achieve comprehensive market visibility. Primary insights derive from interviews with senior geotechnical engineers project managers procurement leads and technology innovators across diverse end-user segments. These firsthand perspectives ensure contextual accuracy in evaluating instrument performance requirements and adoption barriers. Secondary data collection encompasses trade association reports regulatory filings academic journals patent databases and tariff notifications under Section 301 of the Trade Act of 1974. Qualitative findings are systematically triangulated with quantitative data from company disclosures and customs records to map historical trends and regulatory impacts. Advanced analytical techniques including SWOT analysis Porter’s Five Forces and scenario modeling underpin the interpretive process and validate strategic imperatives. Throughout the study rigorous data validation protocols are applied to maintain objectivity and reproducibility of key findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Geotechnical Instrumentation & Monitoring market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Geotechnical Instrumentation & Monitoring Market, by Instrument Type

- Geotechnical Instrumentation & Monitoring Market, by Monitoring Type

- Geotechnical Instrumentation & Monitoring Market, by Platform

- Geotechnical Instrumentation & Monitoring Market, by Installation Type

- Geotechnical Instrumentation & Monitoring Market, by Technology

- Geotechnical Instrumentation & Monitoring Market, by End User

- Geotechnical Instrumentation & Monitoring Market, by Region

- Geotechnical Instrumentation & Monitoring Market, by Group

- Geotechnical Instrumentation & Monitoring Market, by Country

- United States Geotechnical Instrumentation & Monitoring Market

- China Geotechnical Instrumentation & Monitoring Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Reflections on the Transformative Trajectory of Geotechnical Instrumentation and Monitoring and Future Imperatives

As geotechnical instrumentation and monitoring continue evolving toward digitally augmented ecosystems the industry stands at an inflection point where data-driven decision-making enhances infrastructure safety and efficiency. The convergence of IoT remote sensing and predictive analytics signals a transition from reactive interventions to proactive resilience management. Despite the challenges posed by tariff fluctuations and supply chain uncertainties the sector’s robust innovation pipeline in sensor materials system integration and cloud analytics promises sustained advancement. Looking ahead practitioners and manufacturers must remain agile embracing modular architectures and open data standards to capture the full potential of emerging technologies. In doing so stakeholders will be better equipped to anticipate risks optimize resource allocation and uphold the integrity of critical infrastructure assets in an era defined by climatic volatility and regulatory complexity.

Connect with Ketan Rohom to Secure Comprehensive Insights and Empower Informed Investment Decisions on Geotechnical Instrumentation Monitoring

We invite decision-makers and technical managers to engage directly with Ketan Rohom Associate Director Sales & Marketing at 360iResearch to explore how this comprehensive market report can inform procurement strategies and guide capital investments. By connecting with Ketan you will gain personalized guidance on leveraging in-depth analysis across instrumentation types monitoring modalities and regional dynamics to support your strategic objectives.

Reach out to arrange a detailed briefing on key insights tailored to your organization’s specific needs and secure access to the full dataset methodologies and executive summaries that will position you ahead of competitors. This is a unique opportunity to harness granular intelligence on segment performance technology adoption and competitive positioning for evidence-based decision-making. Act now to ensure your infrastructure monitoring projects benefit from the latest tools data and industry context indispensable for success in a rapidly evolving market.

- How big is the Geotechnical Instrumentation & Monitoring Market?

- What is the Geotechnical Instrumentation & Monitoring Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?