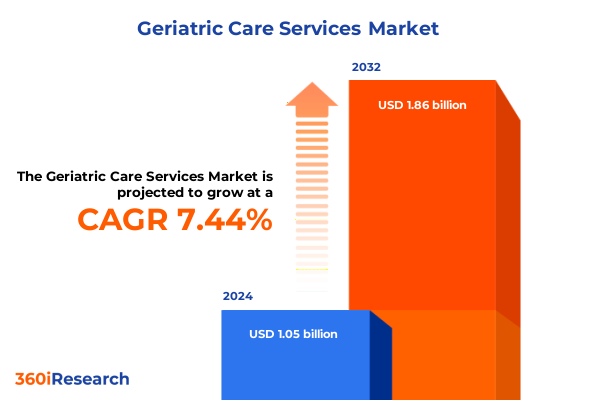

The Geriatric Care Services Market size was estimated at USD 1.12 billion in 2025 and expected to reach USD 1.20 billion in 2026, at a CAGR of 7.49% to reach USD 1.86 billion by 2032.

Understanding the Critical Transformations Driving Geriatric Care Services in Response to Aging Populations, Technological Innovations, and Regulatory Dynamics

The geriatric care landscape in the United States is experiencing unprecedented transformation driven by demographic shifts, evolving care paradigms, and mounting economic pressures. As of mid-2024, adults aged 65 and older accounted for 18.0% of the total population, up from 12.4% in 2004, reflecting an aging nation poised for sustained demand in specialized care services. This surge in senior demographics is not only increasing the volume of individuals requiring long-term and supportive care but also heightening the complexity of clinical and non-clinical needs.

Simultaneously, the ratio of working-age adults to older individuals has started to shrink significantly. According to projections from the Congressional Budget Office, there will be just 2.8 working-age individuals for every person aged 65 or older by 2025, down from higher ratios in prior decades. This shift intensifies pressure on family caregivers, professional providers, and public programs to bridge the widening gap between care demand and available workforce.

Amid these demographic pressures, the affordability of long-term care remains a critical challenge. Two-thirds of caregiving in the U.S. is informal and unpaid, placing enormous strain on household financial stability, particularly among middle-income seniors who fall outside Medicaid eligibility yet cannot bear out-of-pocket private care costs. The convergence of these factors-population aging, workforce contraction, and cost barriers-compels industry stakeholders to rethink care delivery models, funding mechanisms, and value propositions.

Moreover, as chronic conditions such as cardiovascular diseases, diabetes, and cognitive impairments rise, service providers and policymakers must innovate to meet heterogeneous needs. This environment creates both significant challenges and opportunities for organizations prepared to adopt data-driven strategies, foster public-private collaborations, and deliver integrated, patient-centric solutions.

Examining the Major Industry Transformations Reshaping Geriatric Care with Digital Integration, Workforce Innovations, and Policy Advancements

The geriatric care sector is undergoing a digital revolution that is redefining patient engagement, operational efficiency, and clinical outcomes. Telehealth, once a peripheral offering, is now woven into standard care pathways. AARP research indicates that seven in ten adults aged fifty and older report comfort with telehealth services, while seventy-three percent of this cohort used virtual visits at least once in the past twelve months, with nearly all expressing satisfaction. These figures underscore telehealth’s pervasive role in enhancing access, reducing travel burdens, and sustaining continuity of care for seniors with mobility or transportation barriers.

Despite peak utilization of forty-two percent during the COVID-19 pandemic, continued advocacy is essential to preserve these gains. MarketWatch reports that 67.4 million Medicare recipients currently rely on telehealth benefits, and experts caution that without legislative renewal, significant disruptions could ensue by year-end. Concurrently, telehealth usage among traditional Medicare beneficiaries remains robust, with over ten percent of outpatient visits delivered virtually in 2023, fueling bipartisan efforts to extend those policies.

Workforce innovation is also reshaping care delivery. With the number of board-certified geriatricians dwindling, nurse practitioners are stepping into expanded roles. Recent coverage highlights that fifteen percent of advanced practice registered nurses hold geriatric certifications, delivering home-based services that match or exceed traditional care quality metrics. This trend reflects broader efforts to optimize scope-of-practice regulations, augment care capacity, and personalize support for frail elders.

However, systemic pressures persist as caregiver shortages collide with stringent immigration policies. Approximately one-third of home healthcare workers are immigrants, and recent deportation measures have exacerbated staffing deficits, forcing agencies to turn away nearly twenty-five percent of qualified patients due to workforce constraints. Addressing these interconnected shifts demands cohesive strategies that blend technology adoption, professional expansion, and policy advocacy to deliver resilient, high-value geriatric care.

Analyzing the Complex Impact of Recent United States Tariffs on the Geriatric Care Services Supply Chain and Service Delivery Models

In April 2025, the U.S. administration implemented sweeping tariffs targeting a broad spectrum of healthcare imports, including critical products for geriatric care such as pharmaceuticals, medical devices, and mobility aids. With new duties of up to twenty-five percent on supplies like active pharmaceutical ingredients, infusion pumps, wheelchairs, and oxygen concentrators, providers face immediate cost inflation that could be passed to patients or absorbed by agencies operating on thin margins.

The dependence on foreign-manufactured medical devices is acute; roughly sixty-nine percent of devices marketed in the United States are fully produced abroad, leaving care organizations vulnerable to price fluctuations and supply chain disruptions. For geriatric service providers that rely on specialized equipment-from patient lifts to diagnostic imaging-tariff-induced delays and increased logistics expenses threaten continuity of care and operational stability.

Industry associations have mobilized to contest these measures. The American Association for Homecare has actively lobbied USTR officials to secure exemptions for durable medical equipment, emphasizing that fixed reimbursement rates under Medicare and Medicaid prevent suppliers from passing tariff-driven costs to end users without incurring losses. Their appeals highlight the immediate risk to seniors dependent on home medical equipment for safe and independent living.

Concurrently, a global ten percent tariff on imports, effective April 5, 2025, has further driven up prices on active pharmaceutical ingredients and diagnostic tools, prompting pharmaceutical firms to reconsider sourcing strategies and supply contracts. To mitigate these pressures, many medical technology companies are exploring reshoring and near-shoring of production; yet building new domestic capacity requires substantial lead times, potentially extending service delays.

Moreover, expanded tariffs on health IT components and raw materials, including steel and electronics, have slowed infrastructure upgrades and complicated technology refresh cycles. Supply chain analysts note that broad duties on data center equipment and network hardware are causing healthcare organizations to postpone critical IT projects, heightening cybersecurity risks and limiting the deployment of advanced monitoring systems for elderly patients. In this evolving landscape, geriatric care providers must balance immediate cost management with long-term supply chain resilience.

Uncovering Critical Segmentation Insights That Illuminate Service Types, Care Models, and End Users Driving Geriatric Care Market Dynamics

Geriatric care services are organized around several key segmentation frameworks that elucidate distinct demand patterns and operational requirements. The first segmentation by service type distinguishes between community services and in-home care. Within community services, offerings range from adult daycare programs that facilitate social engagement and basic health monitoring, to assisted living facilities designed for seniors needing partial independence, up to nursing care settings that deliver intensive clinical support and rehabilitation. Conversely, in-home care spans hospice care for end-of-life comfort, medication management and administration to ensure adherence and safety, palliative care that alleviates chronic symptom burden, and respite care that provides temporary relief for primary caregivers.

A separate segmentation based on care model highlights the financial and organizational structures guiding service delivery. Fee-for-service arrangements allow providers to bill for each discrete intervention, while managed care frameworks emphasize cost containment and preventative strategies under capitation. Integrated care models coordinate interdisciplinary teams to support holistic health outcomes, and the rise of value-based care models aligns reimbursement with quality metrics, patient satisfaction, and reduced hospital readmissions.

Finally, end-user segmentation identifies the primary recipients and purchasers of geriatric services. Family caregivers, often shouldering the emotional and logistical weight of elder support, seek solutions that alleviate caregiver burden and guarantee continuity. Geriatric care organizations, including home health agencies and senior living operators, require insights into operational efficiencies and regulatory compliance. Individual geriatric patients themselves demand personalized, dignified care experiences that preserve autonomy and enhance quality of life. Together, these segmentation lenses enable stakeholders to tailor offerings, optimize resource allocation, and develop targeted strategies that respond to nuanced market needs.

This comprehensive research report categorizes the Geriatric Care Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Care Model

- End-User

Revealing Regional Performance and Growth Drivers Across the Americas, Europe Middle East & Africa, and Asia Pacific Geriatric Care Markets

Regional markets for geriatric care services display significant variation in regulatory frameworks, reimbursement landscapes, and cultural expectations. In the Americas, the United States and Canada lead in formalized long-term care infrastructure, propelled by government reimbursement programs such as Medicare, Medicaid, and provincial health plans. Private-pay models complement public funding, especially in metropolitan areas where higher disposable incomes support premium assisted living and home health options. Innovations in digital health and remote monitoring are accelerating market growth, with stakeholders leveraging public–private partnerships to expand community-based services and integrate telehealth into continuum-of-care pathways.

Across Europe, the Middle East, and Africa, divergent healthcare systems yield a broad spectrum of geriatric care approaches. Western European nations with universal coverage prioritize subsidized home support and subsidized nursing homes, while Eastern European markets are characterized by growing private-sector participation to fill gaps left by constrained public budgets. In the Middle East, demographic changes have spurred state-led investments in senior living communities and rehabilitation centers. Africa’s geriatric market remains nascent but is emerging in urban centers with pilot programs for community health workers delivering elder care in underserved regions.

The Asia-Pacific region is witnessing some of the fastest aging populations globally, with countries such as Japan and South Korea experiencing profound demographic shifts. National programs incentivize community-based services and multigenerational living, supported by technology platforms offering remote patient management and robotic assistance. In China, pilot long-term care insurance schemes are shaping public policy, while Australia’s National Disability Insurance Scheme includes provisions for aging participants. These diverse regional dynamics underscore the importance of localized strategies, regulatory alignment, and cross-border collaboration to address the unique opportunities and challenges in each geography.

This comprehensive research report examines key regions that drive the evolution of the Geriatric Care Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Companies and Strategic Initiatives That Are Shaping the Competitive Landscape of Geriatric Care Services Today and Tomorrow

Leading companies in the geriatric care services sector are actively refining their competitive strategies to address evolving market demands and policy landscapes. Brookdale Senior Living, a prominent operator of assisted living and memory care communities, is focusing on portfolio optimization and selective expansions into high-growth metropolitan corridors. By enhancing digital engagement platforms and strengthening partnerships with healthcare systems, Brookdale aims to improve care coordination, reduce hospital transitions, and elevate resident satisfaction.

Home Instead Senior Care, a global franchisor of in-home support services, is leveraging workforce management technologies and targeted recruitment campaigns to mitigate caregiver shortages. Their proprietary training programs and digital scheduling tools are designed to enhance service quality, improve caregiver retention, and expand capacity in both suburban and rural markets. The organization’s emphasis on community outreach and family education has solidified its reputation as a trusted provider of personalized home care.

On the acute care side, Kindred Healthcare and Encompass Health are integrating post-acute rehabilitation and home health divisions to create seamless patient journeys. They employ advanced analytics to predict readmission risks, optimize resource allocation, and align clinical interventions with value-based reimbursement models. Additionally, companies such as LHC Group are actively exploring telehealth integrations and remote monitoring services, forging alliances with technology startups to deliver real-time vital sign tracking and medication adherence solutions.

Collectively, these industry leaders are investing in digital transformation, data-driven care pathways, and strategic alliances to strengthen market positions. By balancing cost efficiencies with a commitment to clinical excellence and patient experience, they are reshaping the competitive landscape and setting new benchmarks for comprehensive geriatric care service delivery.

This comprehensive research report delivers an in-depth overview of the principal market players in the Geriatric Care Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Active Day/Senior Care, Inc.

- Atria Senior Living, Inc.

- Barchester Healthcare Ltd.

- BAYADA Home Health Care

- Benesse Holdings, Inc.

- Brookdale Senior Living Inc.

- Care UK Group

- Comfort Keepers by The Halifax Group

- Encompass Health Corporation

- Epoch Elder Care Private Limited

- Erickson Senior Living Management, LLC

- Extendicare Inc.

- Four Seasons Health Care Group

- Genesis HealthCare LLC

- Home Instead, Inc.

- Integracare Inc.

- Interim HealthCare Inc.

- Kites Senior Care

- Knight Health Holdings, LLC

- Life Care Centers of America, Inc.

- Life Care Companies, LLC

- Lincare Holdings Inc.

- Revera Inc.

- St Luke’s ElderCare Ltd.

- Sunrise Senior Living, LLC

Providing Actionable Recommendations for Industry Leaders to Enhance Service Delivery, Operational Efficiency, and Innovation in Geriatric Care

To capitalize on emerging opportunities and address pressing challenges, industry leaders should prioritize the integration of telehealth and remote monitoring solutions across all care settings. By deploying connected sensors and leveraging predictive analytics, providers can intercept adverse events, tailor care plans in real time, and reduce costly hospitalizations. Embedding telehealth into standard operating protocols not only enhances continuity of care but also strengthens patient and caregiver engagement through convenient touchpoints.

Workforce resilience remains a fundamental imperative. Organizations should invest in comprehensive training programs that upskill caregivers in geriatric competencies and digital literacy. In parallel, stakeholders must engage in policy advocacy to streamline visa pathways for immigrant care workers and expand scope-of-practice regulations for advanced practitioners. Strengthening professional networks and mentorship initiatives will foster a pipeline of qualified talent capable of addressing the complexity of elder care needs.

Supply chain resilience must be fortified through diversification of sourcing channels, stockpile management, and selective near-shoring partnerships. By establishing strategic alliances with domestic manufacturers and implementing dynamic procurement platforms, providers can mitigate tariff impacts, reduce lead times, and maintain uninterrupted access to critical medical equipment and pharmaceuticals.

Finally, organizations should leverage performance data and patient feedback to refine value-based care models, aligning incentives with quality outcomes. Building multidisciplinary care teams and adopting interoperable health information systems will facilitate seamless care transitions, elevate patient satisfaction scores, and unlock financial incentives tied to reduced readmission rates. These actionable recommendations serve as a roadmap for industry leaders aiming to drive sustainable growth and deliver high-quality geriatric care.

Detailing the Robust Research Methodology Incorporating Primary and Secondary Techniques to Ensure Comprehensive Geriatric Care Services Market Analysis

This report synthesizes insights through a rigorous research methodology combining both secondary and primary approaches. The secondary research phase encompassed analysis of government databases, peer-reviewed publications, healthcare association reports, and regulatory filings to construct a foundational understanding of demographic trends, tariff policies, and regional market structures. Authoritative sources such as the U.S. Census Bureau, Congressional Budget Office, and industry advocacy letters provided verified data points.

Complementing this, primary research involved in-depth interviews with a diverse array of stakeholders, including clinical leaders, home care executives, policy advisors, and family caregivers. These qualitative engagements offered nuanced perspectives on operational challenges, technology adoption barriers, and evolving care preferences. Interview insights were systematically recorded and coded to identify recurring themes and strategic priorities.

To ensure data integrity, a triangulation process cross-referenced findings from multiple sources, validating key trends and mitigating potential biases. Quantitative data were analyzed using statistical tools to detect patterns in service utilization, workforce dynamics, and cost drivers. The methodology also incorporated peer reviews by external experts in gerontology and healthcare economics to refine analytical frameworks.

Quality assurance measures included a multi-layer editorial review, fact-checking against original source materials, and alignment with ethical guidelines for research transparency. This comprehensive, multi-dimensional approach ensured that the report delivers robust, actionable insights for decision-makers in the geriatric care services landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Geriatric Care Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Geriatric Care Services Market, by Service Type

- Geriatric Care Services Market, by Care Model

- Geriatric Care Services Market, by End-User

- Geriatric Care Services Market, by Region

- Geriatric Care Services Market, by Group

- Geriatric Care Services Market, by Country

- United States Geriatric Care Services Market

- China Geriatric Care Services Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Summarizing Key Findings and Strategic Implications to Guide Future Decision Making in the Evolving Geriatric Care Services Landscape

The findings of this executive summary underscore a dynamic geriatric care environment defined by accelerating demographic pressures, digital innovation, and shifting policy levers. With the senior population expanding to 61.2 million individuals and a diminishing ratio of working-age caregivers, the demand for tailored community-based services and in-home support will intensify. Concurrently, the integration of telehealth and advanced practice providers offers promising avenues to enhance care capacity and maintain quality standards amid workforce constraints.

The implementation of significant U.S. tariffs on imported pharmaceuticals and medical devices has introduced complexity to supply chains, elevating operational costs and compelling stakeholders to reassess sourcing strategies. At the same time, the segmentation of the market across service types, care models, and end users highlights differentiated growth vectors and underscores the importance of targeted solutions. Regionally, variations in reimbursement policies and cultural norms necessitate localized strategies, while leading companies are forging partnerships and deploying digital platforms to secure competitive advantage.

Looking forward, industry success will hinge on collaborative innovation, resilient supply chain design, and agile policy engagement. By adopting value-based frameworks, strengthening workforce pipelines, and leveraging data analytics, stakeholders can deliver high-impact care that aligns with both patient expectations and fiscal sustainability. This convergence of demographic necessity and technological possibility positions the geriatric care services sector for transformative growth.

Take the Next Step to Secure Comprehensive Insights and Drive Growth in Geriatric Care Services by Contacting the Associate Director, Sales and Marketing Today

If you’re ready to harness the full depth of this market research and translate insights into strategic growth, reach out directly to Ketan Rohom, Associate Director, Sales and Marketing at 360iResearch. With a keen understanding of geriatric care service dynamics and decades of industry expertise, Ketan will guide you through the detailed findings, tailor solutions to your organizational needs, and ensure you obtain the competitive intelligence required to make informed decisions. Secure your copy of the comprehensive report today and position your organization to lead in an era where high-quality, patient-centered geriatric care is both an operational imperative and a powerful market differentiator. Contact Ketan to discuss licensing options, customized deliverables, and how this analysis can drive immediate impact.

- How big is the Geriatric Care Services Market?

- What is the Geriatric Care Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?