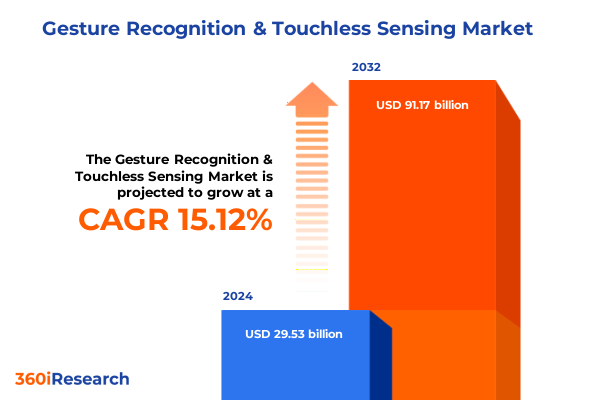

The Gesture Recognition & Touchless Sensing Market size was estimated at USD 33.97 billion in 2025 and expected to reach USD 39.08 billion in 2026, at a CAGR of 15.14% to reach USD 91.17 billion by 2032.

Revolutionizing Human-Machine Interaction through Intuitive Gesture Recognition and Touchless Sensing Technologies

The evolving landscape of human-machine interaction is being reshaped by gesture recognition and touchless sensing, ushering in a new era where intuitive user experiences are paramount. As digital interfaces extend beyond traditional touchscreens, emerging technologies are converging to enable seamless, contactless control across a diverse array of applications. This transformative shift is fueling innovation in consumer devices, automotive systems, healthcare solutions, and smart environments. Moreover, the mounting emphasis on hygiene, accessibility, and hands-free operation in the post-pandemic world has amplified stakeholder interest in these technologies.

At the heart of this revolution lies the convergence of infrared, radar, ultrasonic, and vision-based sensing methods, each offering unique advantages in range, precision, and environmental resilience. Complemented by tailored hardware components-such as specialized cameras, processors, and sensors-alongside sophisticated algorithms and developer toolkits, the ecosystem is becoming increasingly accessible to solution providers. Consequently, industries are accelerating their adoption of touchless interfaces to elevate user safety, convenience, and engagement.

This introduction presents a cohesive overview of the key drivers propelling gesture recognition and touchless sensing toward mainstream implementation. It outlines the essential technical foundations supporting market growth and sets the stage for an in-depth analysis of transformative trends, regulatory headwinds, segmentation insights, regional dynamics, and strategic imperatives that will define the trajectory of this vibrant domain.

Emerging Cross-Industry Collaborations and Technological Convergence Reshaping Touchless Interaction Capabilities

The gesture recognition and touchless sensing arena is undergoing transformational shifts as advancements in machine learning, signal processing, and sensor miniaturization converge to drastically enhance system capabilities. In recent years, cutting-edge algorithms empowered by deep neural networks have improved accuracy in recognizing complex hand and body motions, even under variable lighting and occlusion conditions. Concurrently, the development of low-power radar and ultrasonic transceivers has extended detection range and reliability, enabling contactless control in larger spaces and more diverse environments.

These technological breakthroughs are complemented by the integration of edge computing, which allows for real-time data processing directly on devices. By reducing latency and preserving data privacy, edge-based solutions are overcoming previous limitations associated with cloud-dependent models. Furthermore, the proliferation of open-source development kits and standardized APIs has democratized access to these innovations, encouraging both established corporations and agile startups to explore novel applications.

In addition, cross-industry collaborations are accelerating the adoption of touchless interfaces. Partnerships between semiconductor suppliers, software developers, and system integrators are streamlining solution development, while consortiums are working to establish interoperability standards. As these alliances mature, they are laying the groundwork for mass-market deployments that will transform user experiences across automotive infotainment, healthcare monitoring, consumer electronics, and smart building controls.

Navigating Evolving U.S. Trade Policies and Their Broad Implications on Touchless System Supply Chains

With the enactment of revised United States tariffs in 2025, key components for gesture recognition and touchless sensing solutions have experienced shifts in supply chain economics. Import duties on certain electronic sensors, imaging modules, and processing units have increased complexity for manufacturers who rely on global sourcing strategies. As a result, procurement teams are reevaluating supplier relationships, placing greater emphasis on nearshoring and regional partnerships to mitigate cost uncertainties.

This tariff landscape has also spurred domestic investments, with semiconductor fabs and sensor manufacturers scaling up localized production. Such initiatives not only aim to circumvent tariff burdens but also to reinforce supply chain resilience against future trade policy fluctuations. Furthermore, design engineers are adapting system architectures to optimize component usage, balancing performance requirements with tariff-driven cost constraints.

Despite these headwinds, the industry is witnessing an uptick in strategic alliances between U.S.-based technology firms and international component vendors to share tariff exposures and co-develop optimized product variants. These cooperative models are proving instrumental in sustaining innovation velocity and ensuring continuity of supply. In turn, enterprises downstream are benefiting from improved transparency and diversified sourcing, which enhances their ability to deliver high-quality touchless sensing solutions to end users.

Strategic Insights into Technology, Componentry, and Application-Driven Market Segmentation Paradigms

Understanding market dynamics requires a deep dive into how various categories of gesture recognition and touchless sensing solutions are organized. Across the technology landscape, infrared sensing remains valued for its cost-effectiveness and low-power attributes, while radar-based systems are gaining traction for their superior range and robustness in challenging ambient conditions. Ultrasonic sensing, known for its precise proximity detection, is increasingly applied in medical and industrial scenarios. Simultaneously, vision-based approaches powered by camera modules and AI-driven analytics are expanding possibilities for complex gesture interpretation.

Component-wise, the hardware ecosystem comprises cameras designed for depth perception, high-performance processors optimized for real-time inference, and specialized sensors capable of capturing subtle motion cues. Service offerings have evolved beyond basic installation and maintenance to include comprehensive integration, calibration, and lifecycle support. On the software front, advanced algorithms for gesture classification and developer-friendly kits are accelerating product rollouts and facilitating customization across industries.

Application segmentation highlights a diversified use-case spectrum. In automotive, gesture interfaces are enhancing driver monitoring and in-vehicle infotainment, while consumer electronics brands embed touchless controls in smartphones, tablets, and wearables. Gaming and entertainment companies leverage gesture consoles and virtual reality kits to elevate immersive experiences. Healthcare providers adopt these technologies for rehabilitation therapies, remote patient monitoring, and surgical assistance platforms. Finally, smart home solutions incorporate contactless automation and security systems to bolster convenience and safety.

End-user industries extend from automotive and BFSI to consumer electronics, defense, education, healthcare, and retail, each demanding tailored solutions aligned with unique operational requirements. Form factor innovation is also driving market adoption, with contactless control panels, standalone gesture control devices, and embedded touchless interfaces providing flexible deployment models.

This comprehensive research report categorizes the Gesture Recognition & Touchless Sensing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Form Factor

- Application

- End-User Industry

Comparative Evaluation of Regional Drivers Accelerating Adoption of Contactless Human-Machine Interfaces Worldwide

Regional dynamics are playing a pivotal role in shaping the adoption of gesture recognition and touchless sensing technologies. In the Americas, demand is propelled by consumer electronics hubs and an automotive sector focused on advanced driver experience solutions. Progressive regulatory frameworks around accessibility and digital inclusion are further encouraging investment in contactless interfaces for public infrastructure and healthcare.

Europe, Middle East, and Africa are witnessing growth driven by stringent data privacy statutes and energy-efficiency mandates. Governments and corporations are adopting touchless systems in smart buildings to optimize occupant well-being and reduce operational costs. Meanwhile, defense and education sectors across EMEA are exploring hands-free control for secure command centers and interactive learning environments, respectively.

Asia-Pacific remains the fastest-growing region, led by technology-forward markets in East and Southeast Asia. Local manufacturers are integrating gesture-sensing modules into consumer electronics at scale, while telecom operators deploy touchless solutions at smart city pilot sites. Healthcare providers across APAC are also leveraging remote monitoring capabilities to address the region’s evolving medical infrastructure requirements.

Across all regions, the convergence of supportive government initiatives, growing user awareness, and expanding developer ecosystems is establishing a strong foundation for next-generation human-machine interfaces to flourish globally.

This comprehensive research report examines key regions that drive the evolution of the Gesture Recognition & Touchless Sensing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Dynamics and Innovation Strategies Shaping the Future of Touchless Sensing Ecosystems

The competitive landscape of gesture recognition and touchless sensing is characterized by a blend of established technology conglomerates and agile innovators. Market leaders are investing heavily in research and development to enhance sensor fusion techniques and to refine algorithmic precision. These companies are forming strategic alliances with semiconductor fabricators and cloud service providers to deliver end-to-end solutions that address performance, security, and scalability demands.

Simultaneously, emerging startups are disrupting traditional models by focusing on niche applications and modular product designs. Their ability to rapidly prototype and iterate is attracting partnerships with original equipment manufacturers seeking specialized sensing modules. Additionally, some key players are differentiating through vertical integration, offering both hardware and proprietary software stacks that guarantee optimized performance and streamlined customer support.

As intellectual property portfolios become increasingly significant, competitive positioning is also influenced by patents in gesture recognition methodologies, hardware architectures, and developer toolchains. Firms that maintain open innovation programs while protecting core IP are gaining traction among system integrators, who value collaborative ecosystems paired with clear licensing frameworks. These dynamics are fostering a vibrant marketplace where collaboration and competition coalesce to accelerate technological progress.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gesture Recognition & Touchless Sensing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- Google LLC

- Infineon Technologies AG

- Intel Corporation

- Microsoft Corporation

- PISON Technology

- Pmdtechnologies AG

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- Sony Corporation

- STMicroelectronics N.V.

- Synaptics Inc.

- Texas Instruments Incorporated

- Ultraleap Ltd.

Actionable Strategic Framework for Driving Cross-Functional Collaboration and Ecosystem Growth in Touchless Sensing

To capitalize on the momentum in gesture recognition and touchless sensing, industry leaders should prioritize cross-functional collaboration within their organizations, fostering alignment between R&D, product management, and marketing teams. Establishing innovation sprints that bring together hardware engineers, software developers, and user experience specialists will accelerate prototype validation and ensure solutions meet evolving customer needs.

Organizations must also evaluate their supply chains with a strategic lens, diversifying component sources to mitigate geopolitical risks and tariff-related cost pressures. Engaging in co-development partnerships with regional manufacturers and technology providers can reduce lead times and enhance product localization efforts.

Moreover, companies should invest in developer outreach programs and open API initiatives to cultivate a robust ecosystem around their platforms. By offering comprehensive documentation, training resources, and support channels, they can accelerate third-party integrations and expand use-case diversity. Equally important is the continued focus on data security and privacy, embedding encryption and compliance features at the system level to build trust among end users across regulated industries.

Finally, decision-makers must keep a pulse on emerging standards and actively participate in industry forums. Contributing to interoperability frameworks will not only shape the trajectory of interface protocols but also position their organizations as thought leaders, thereby influencing market direction and capturing early adopter mindshare.

Comprehensive Multi-Layered Research Methodology Integrating Primary Insights and Secondary Analysis for Robust Market Understanding

The insights presented in this report are grounded in a multi-layered research methodology comprising primary and secondary data collection, expert consultations, and technology landscape analyses. Primary research involved in-depth interviews with leading sensor manufacturers, software innovators, and system integrators to capture firsthand perspectives on technical challenges, deployment considerations, and adoption drivers.

Secondary research sources included publicly available regulatory documents, patent filings, academic journals, and industry whitepapers, which were synthesized to map technological evolutions and to identify emerging standards. Market participation data was corroborated through company disclosures and conference presentations, ensuring a balanced view of both established market incumbents and emerging disruptors.

Additionally, case studies of real-world deployments provided practical evidence of solution performance, integration workflows, and user feedback. This qualitative evidence was further augmented by analyst validation, where independent specialists reviewed the findings to enhance reliability and robustness. Finally, cross-verification across diverse information channels ensured that insights are both current and reflective of long-term strategic trajectories within the gesture recognition and touchless sensing landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gesture Recognition & Touchless Sensing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gesture Recognition & Touchless Sensing Market, by Component

- Gesture Recognition & Touchless Sensing Market, by Technology

- Gesture Recognition & Touchless Sensing Market, by Form Factor

- Gesture Recognition & Touchless Sensing Market, by Application

- Gesture Recognition & Touchless Sensing Market, by End-User Industry

- Gesture Recognition & Touchless Sensing Market, by Region

- Gesture Recognition & Touchless Sensing Market, by Group

- Gesture Recognition & Touchless Sensing Market, by Country

- United States Gesture Recognition & Touchless Sensing Market

- China Gesture Recognition & Touchless Sensing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Future Outlook Emphasizing Collaborative Ecosystems and Strategic Resilience in Gesture Recognition Innovation

As gesture recognition and touchless sensing technologies continue to mature, their potential to redefine human-machine interaction becomes increasingly clear. Organizations that embrace these innovations will unlock new opportunities for user engagement, operational efficiency, and competitive differentiation. The convergence of advanced sensing modalities, powerful algorithms, and edge computing sets the stage for a wave of transformative applications across industries.

While recent policy shifts and supply chain pressures present challenges, they also create compelling incentives for reshoring and collaborative development. Companies that strategically navigate these dynamics will strengthen their innovation capacity and build more resilient operations. By aligning product roadmaps with evolving regulatory and end-user expectations, solution providers can secure leadership positions in a market defined by rapid technological evolution.

Ultimately, the future of gesture recognition and touchless sensing hinges on the ability of stakeholders to foster open ecosystems, to champion interoperability, and to uphold rigorous standards of performance and privacy. Those who prioritize strategic partnerships, continuous R&D, and customer-centric design will be best positioned to lead the next generation of contactless interface solutions.

Connect with Ketan Rohom to Unlock Exclusive Insights and Propel Your Organization Ahead with Cutting-Edge Gesture Recognition and Touchless Sensing Intelligence

To seize the growing opportunities in gesture recognition and touchless sensing, engage with Ketan Rohom, Associate Director of Sales & Marketing, to discover how this comprehensive report can give your organization a decisive competitive edge. Reach out today to explore an in-depth analysis of industry trends, strategic recommendations, and actionable use cases tailored to your unique requirements. Harness the future of intuitive human-machine interaction by securing access to critical insights that will drive innovation and growth within your enterprise.

- How big is the Gesture Recognition & Touchless Sensing Market?

- What is the Gesture Recognition & Touchless Sensing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?