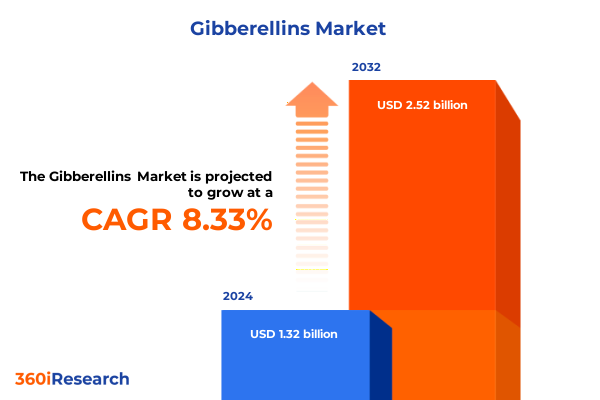

The Gibberellins Market size was estimated at USD 1.43 billion in 2025 and expected to reach USD 1.55 billion in 2026, at a CAGR of 8.41% to reach USD 2.52 billion by 2032.

Unveiling the Strategic Role of Gibberellins in Revolutionizing Crop Development Through Advanced Plant Hormone Science

Gibberellins, a class of pivotal phytohormones, orchestrate fundamental plant growth processes such as stem elongation, dormancy break, flowering induction, and fruit set enhancement. Among these, gibberellic acid (GA₃) has garnered significant attention for its potent role in stimulating cell elongation and activating target genes that drive developmental pathways essential to modern crop management, horticulture, and post-harvest quality control.

Traditionally, industrial production of GA₃ relies on submerged fermentation employing the filamentous fungus Fusarium fujikuroi. Recent advances have focused on using agroindustrial byproducts like citrus pulp and soybean hulls as cost-effective substrates, reducing medium costs by approximately 85% compared to conventional synthetic media. These innovations in semisolid fermentation demonstrate both high productivity and enhanced stability of GA₃ formulations, underscoring the imperative to streamline manufacturing and lower entry barriers for growers in emerging economies.

On the regulatory front, gibberellins are uniquely positioned with an established exemption from tolerance requirements under 40 CFR 180.1098, permitting their application on all food commodities in accordance with good agricultural practices. This federal exemption reflects low mammalian toxicity and minimal dietary exposure risk, providing a robust foundation for widespread adoption across diverse crop segments.

Harnessing Technological Innovation and Sustainable Practices to Redefine Gibberellin Production and Application in Today’s Agriculture

The agricultural landscape is undergoing a profound digital transformation, with precision farming technologies leveraging IoT-enabled sensors, drones, and AI-driven analytics to optimize resource use and maximize crop yields. Farmers worldwide are adopting real-time data platforms that integrate soil moisture readings, nutrient mapping, and climatic forecasts, enabling targeted gibberellin applications that align with plant developmental stages and stress mitigation strategies.

Parallel advancements in fermentation technology are reshaping the economics of gibberellin production. Innovations such as solid-state fermentation using rice and brewing industry residues have demonstrated yields exceeding 10 g of GA₃ per kilogram of substrate, coupled with reduced purification costs. These breakthroughs not only bolster supply chain resilience but also promote circular economy principles by valorizing agroindustrial waste streams.

Concurrently, regulatory frameworks and consumer preferences are favoring bio-based and naturally derived plant growth regulators. The U.S. Environmental Protection Agency’s proposed tolerance exemptions for low-rate gibberellin applications support organic certification pathways, while European fertilizer regulations incentivize fermentation-derived biostimulants. Such policy drivers are accelerating the shift from purely synthetic formulations toward sustainable, eco-friendly solutions that meet stringent environmental and residue criteria.

Moreover, strategic collaborations between agrochemical leaders and biological innovation firms are expanding the portfolio of crop performance enhancers. Recent joint ventures to develop gel-based nutrient assimilation aids and calcium mobility enhancers exemplify how integration of gibberellins with complementary biostimulants can unlock synergistic effects, driving a new era of regenerative agriculture and value-added product offerings.

Analyzing the Compounded Effects of Escalating United States Trade Tariffs on Gibberellin Supply Chains and Cost Structures in 2025

Since 2018, the United States has applied a 20% ad valorem tariff on a broad range of goods from China under IEEPA mandates related to fentanyl, affecting numerous chemical inputs pivotal for gibberellin synthesis. Although a reciprocal 34% tariff announced in April 2025 was suspended following the May 12, 2025 U.S.-China trade de-escalation agreement, the core 20% levy remains in place, sustaining elevated input costs for manufacturers reliant on Chinese feedstocks.

In response, the Office of the U.S. Trade Representative has extended certain Section 301 tariff exclusions through August 31, 2025, mitigating duties on selected machinery and precursor chemicals. This temporary reprieve offers a narrow window for producers to optimize supply chain strategies, although the looming expiration underscores ongoing uncertainty for long-term procurement planning.

On the export side, China’s retaliatory tariffs announced in March 2025 impose a 10% duty on commodities including soybeans, sorghum, and fruits, and a 15% duty on wheat, corn, cotton, and poultry. These measures directly impact U.S. agricultural sectors that represent key end-use markets for gibberellins, threatening to dampen domestic demand and redirect crop flows to alternative destinations.

Farm groups have warned that these layered trade barriers escalate operational expenses and constrain market access. Elevated costs for potash fertilizer imports from Canada compounded by duties on Chinese-sourced adjuvants magnify the financial strain on growers already contending with narrow profit margins, potentially curtailing investments in growth regulators and precision inputs.

Uncovering How Diverse Application, Crop Type, Formulation, Product Type, and Distribution Channels Shape Gibberellin Market Dynamics

The market analysis of gibberellins extends across applications from broadacre agriculture to specialized forestry, intensive horticultural systems, and ornamental production. Each application context demands tailored product performance, whether it is bud break stimulation in fruit trees, internode elongation in sugarcane, or floral regulation in greenhouse ornamentals.

Further dissection by crop type reveals segments such as cereals-including maize, rice, and wheat-commercial cash crops like cotton and tobacco, fruits and vegetables exemplified by banana, potato, and tomato, and oilseeds and pulses such as lentil and soybean. These pathways underscore the necessity of precision dosing and formulation choice to align with crop physiology and agronomic calendars.

Formulation preferences bifurcate between liquid offerings, prized for rapid uptake and compatibility with foliar sprays and irrigation systems, and powder-based formats valued for storage stability and ease of transport. Product types span natural fermentation-derived gibberellins, synthetic analogs, and specialized derivatives. Distribution channels range from direct farm partnerships and distributor networks to emerging e-commerce platforms, each influencing accessibility, pricing, and grower adoption dynamics.

This comprehensive research report categorizes the Gibberellins market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Crop Type

- Form

- Type

- Application

- Sales Channel

Examining the Distinct Growth Drivers, Regulatory Environments, and Adoption Patterns for Gibberellins Across Key Global Regions

In the Americas, the groundwork for adoption of gibberellins is bolstered by a mature agricultural infrastructure and strong research ecosystems. Precision agriculture solutions and digital dashboards are widely piloted, enabling data-driven treatment scheduling that maximizes GA₃ efficacy. This technologically progressive environment, coupled with significant acreage under high-value crops such as fruit and malt barley, sustains robust uptake and continuous product innovation.

Europe’s landscape is marked by stringent residue and environmental standards, prompting a pivot toward organically certified and bio-based PGRs. Grower demand for low-residue horticultural outputs and compliance with EU Fertilizer Regulation initiatives foster a strategic milieu where fermentation-derived gibberellins secure preferential market access. This regulatory push complements established export channels for premium produce, reinforcing sustained market stability.

Asia-Pacific stands as the fastest-growing region for gibberellin deployment, driven by government-led modern agriculture programs in China and India. Subsidies for plant growth regulators and digital extension services accelerate diffusion, particularly in rice, sugarcane, and specialty fruit segments. The region’s expanding brewery and bioethanol industries further amplify demand for gibberellin applications in malting and biomass enhancement, creating a fertile backdrop for continued expansion.

This comprehensive research report examines key regions that drive the evolution of the Gibberellins market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborations Driving Competitive Edge and Value Creation in the Global Gibberellins Industry

Valent BioSciences continues to lead with its ProGibb line, offering high-concentration GA₃ formulations like ProGibb 40SG that deliver superior solubility, uptake, and thermal stability. Their comprehensive quality control-from fermentation through packaging-ensures consistent field performance across key crops including grapes, citrus, and bananas.

Fine Americas and Sichuan Guoguang Agrochemical have expanded their portfolios with novel wettable powders and low-volume liquid products, enhancing user convenience and broadening application windows. These companies leverage strategic R&D collaborations to optimize product efficacy and environmental profiles, reinforcing competitive differentiation in emerging markets.

Syngenta Group, having anticipated minimal impact from U.S. tariffs through forward hedging and supply chain diversification, is intensifying its focus on biological PGRs. Their resilient operational strategies and ongoing investments in R&D partnerships underscore a long-term commitment to integrated crop management solutions.

Collaborations between crop science leaders and biotechnology innovators, such as the Bayer–Kimitec alliance to develop gel-based nutrient enhancers, signal a shift toward multifaceted performance packages that blend gibberellins with complementary actives. These alliances not only enrich product pipelines but also accelerate market penetration for regenerative agriculture inputs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gibberellins market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adama Agricultural Solutions Ltd.

- Aroxa Crop Science Private Limited

- BASF SE

- Bayer AG

- Dow AgroSciences LLC

- Fine Americas, Inc.

- FMC Corporation

- Hubei Veyong Bio-Chemical Co., Ltd.

- Hubei Yuancheng Saichuang Technology Co., Ltd.

- Jiangsu Fengyuan Bioengineering Co., Ltd.

- Jiangxi Xinruifeng Biochemical Co., Ltd.

- Nufarm Limited

- SePRO Corporation

- Shanghai Fuang Agrochemical Co., Ltd.

- Shanghai Pengteng Fine Chemical Co., Ltd.

- Shanghai Tongrui Biotech Co., Ltd.

- Sichuan Guoguang Agrochemical Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Syngenta AG

- UPL Limited

- Valent BioSciences Corporation

- Xinyi (H.K.) Industrial Co., Ltd.

- Zhejiang Deda Biological Technology Co., Ltd.

- Zhejiang Qianjiang Biochemical Co., Ltd.

- Zhengzhou Delong Chemical Co., Ltd.

Implementing Strategic Actions to Enhance Innovation, Sustainability, and Resilience for Future Growth in the Gibberellin Market Ecosystem

Industry leaders should prioritize integration of digital agronomy tools and predictive analytics to optimize gibberellin application timing and dosage. By harnessing AI-driven decision support systems, organizations can transition from reactive sprays to proactive growth management, aligning with agronomic insights demonstrated by precision agriculture pioneers.

Diversifying raw material sourcing and investing in localized fermentation capacity are critical to mitigate trade uncertainties. Stakeholders are urged to explore public-private partnerships that facilitate access to low-cost substrates and scalable bioreactor technologies, thereby reinforcing supply chain resilience and cost competitiveness.

Stakeholders must deepen collaborations across regulatory bodies, distributors, and growers to streamline adoption pathways for bio-based PGRs. Implementation of joint training programs and digital extension platforms can drive awareness of best practices and regulatory compliance requirements, expanding market access for sustainable gibberellin products.

Finally, portfolio diversification through co-formulation of gibberellins with complementary biostimulants and stress-ameliorating agents can create differentiated offerings tailored to evolving grower needs. This strategic layering of functionalities enhances crop performance under abiotic and biotic stressors, positioning companies at the forefront of regenerative agriculture transitions.

Detailing a Rigorous Research Framework and Data Triangulation Approach to Ensure Robust Insights into Gibberellin Market Analysis

This study employed a dual-phase research design beginning with extensive secondary research, aggregating public-domain data from regulatory databases, academic journals, and reputable news outlets. Insights from government sources such as the U.S. Environmental Protection Agency and the Office of the U.S. Trade Representative were cross-referenced to ensure factual rigor and current relevance.

Primary insights were garnered through targeted expert interviews with agronomists, fermentation engineers, and compliance specialists, enabling qualitative validation of quantitative trends and emergent opportunities. Data triangulation techniques were applied to reconcile insights from disparate sources, reinforcing the robustness and credibility of the analysis in line with established market research best practices.

The research framework adhered to systematic sampling of thematic areas-technological innovation, trade policy impacts, segmentation dynamics, regional adoption patterns, and competitive profiling-facilitating a holistic yet detailed view of the gibberellin landscape. Continuous stakeholder engagement and iterative peer reviews ensured that findings remained actionable and aligned with real-world industry imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gibberellins market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gibberellins Market, by Crop Type

- Gibberellins Market, by Form

- Gibberellins Market, by Type

- Gibberellins Market, by Application

- Gibberellins Market, by Sales Channel

- Gibberellins Market, by Region

- Gibberellins Market, by Group

- Gibberellins Market, by Country

- United States Gibberellins Market

- China Gibberellins Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Perspectives Highlighting the Vital Importance of Gibberellins in Driving Agricultural Productivity and Sustainability Advancements

Gibberellins stand at the intersection of agricultural innovation, sustainability imperatives, and strategic trade considerations. Their multifaceted applications-from dormancy break in fruits to stem elongation in cereals-underscore their indispensable role in meeting global food security and quality demands.

Technological advancements in digital agriculture and fermentation processes have created new frontiers for cost-effective production and precision deployment. Simultaneously, regulatory shifts and trade dynamics highlight the necessity for agile supply chain management and diversified sourcing strategies.

As markets evolve, stakeholders who embrace sustainable practices, strategic collaborations, and data-driven decision frameworks will be best positioned to capitalize on the growth potential of gibberellin technologies. The convergence of biological innovation with advanced analytics foretells a resilient, value-driven future for this critical class of plant growth regulators.

Connect with Ketan Rohom to Secure your Customized Gibberellin Market Research Report and Unlock Strategic Competitive Advantages Today

To secure comprehensive insights and data-driven recommendations tailored to your strategic objectives, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, who can guide you through the scope and customization options available for the full market research report. Elevate your decision-making with detailed analysis, competitive benchmarking, and actionable intelligence crafted to optimize your position in the gibberellins market.

- How big is the Gibberellins Market?

- What is the Gibberellins Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?