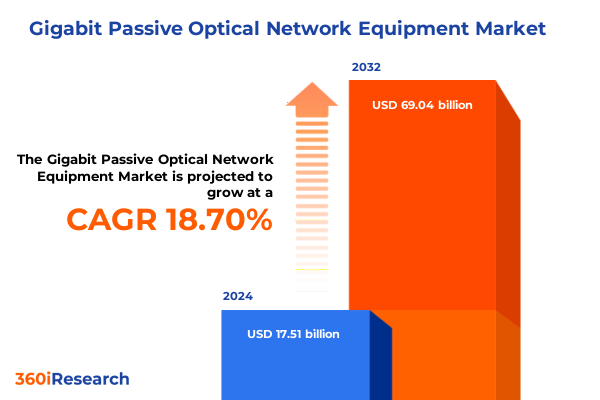

The Gigabit Passive Optical Network Equipment Market size was estimated at USD 20.75 billion in 2025 and expected to reach USD 24.61 billion in 2026, at a CAGR of 18.72% to reach USD 69.04 billion by 2032.

Pioneering the Future of Gigabit Passive Optical Networks with Advanced Infrastructure Strategies and Emerging Technological Drivers

Gigabit passive optical network equipment stands at the forefront of next-generation broadband infrastructure, offering unparalleled bandwidth capabilities that redefine connectivity for enterprises, service providers, and residential users alike. As data consumption soars and applications evolve to demand higher throughput, optical networks have become the backbone of modern digital ecosystems. This introduction outlines the critical role that gigabit passive optical network equipment plays in enabling ultra-fast data transmission, low latency performance, and scalable infrastructure expansion across diverse deployment scenarios.

Building on advancements in fiber-to-the-home and fiber-to-the-premises architectures, this report delves into the technological innovations driving the evolution of optical line terminals, optical network units, and associated passive components. Moreover, it highlights how emerging standards and interoperability initiatives are fostering a robust ecosystem that accelerates adoption. Through a thorough examination of market dynamics, competitive landscapes, and regulatory environments, readers will gain a clear perspective on the key factors influencing the adoption of gigabit passive optical solutions.

By the end of this section, decision-makers will understand not only the foundational elements of gigabit passive optical network equipment but also the strategic imperatives that must be addressed to realize seamless deployment, operational efficiency, and long-term scalability.

Unleashing the Transformational Impact of Cloud Services Broadband Convergence 5G Rollout and Sustainability Imperatives

The landscape of gigabit passive optical networks is being reshaped by converging technological forces and shifting service paradigms that demand higher performance and flexibility. Cloud-based applications, virtualization, and edge computing have escalated the need for networks that can support dynamic bandwidth allocation and rapid reconfiguration. In parallel, the global rollout of 5G mobile networks is driving unprecedented requirements for backhaul capacity, prompting service providers to leverage gigabit passive optical equipment for cost-effective and high-capacity transport solutions.

Sustainability imperatives also play a transformative role, as operators seek to reduce energy consumption and carbon footprints by deploying more efficient passive optical architectures. This trend is reinforced by stringent environmental regulations and corporate commitments to net-zero targets, which have elevated the priority of green engineering practices within network planning and equipment procurement.

Furthermore, the acceleration of remote work and digital collaboration has underscored the importance of robust last-mile connectivity, amplifying investments in fiber-based access networks. By anticipating these shifts-from cloud and 5G convergence to environmental responsibility-stakeholders can position themselves at the vanguard of innovation, capitalizing on emerging opportunities and mitigating disruption in the rapidly evolving gigabit passive optical network domain.

Navigating the Layered Tariff Environment of Section 301 IEEPA Reciprocal Duties and Exclusion Extensions Shaping Gigabit Optical Network Costs

Throughout 2025, the gigabit passive optical network equipment sector has navigated an increasingly complex tariff regime that has injected new cost variables into supply chains. The Office of the United States Trade Representative’s final modifications to Section 301 duties have raised tariffs on a range of strategic technology components, including semiconductors set to encounter a 50% duty rate effective January 1, 2025. These levies compound existing “most-favored nation” duties, amplifying the financial burden on equipment manufacturers reliant on offshore sourcing.

Simultaneously, telecommunications equipment imports of Chinese origin have faced an elevated 35% duty rate as of February 4, 2025, under powers claimed per the International Emergency Economic Powers Act, which overlays additional IEEPA-driven tariffs on networking and storage items. This escalation has applied uniformly to optical network terminals, splitters, and related passive hardware, inflating landed costs and incentivizing procurement teams to explore alternative manufacturing hubs in Southeast Asia and other regions to mitigate expense volatility.

Despite these increases, a series of targeted exclusions for 164 product categories-encompassing telecommunications machinery and optical network components-was extended through August 31, 2025, providing temporary relief and preserving critical equipment flows. However, the patchwork of Section 301, IEEPA, and reciprocal tariff measures necessitates vigilant customs planning, strategic inventory positioning, and the recalibration of supplier relationships to safeguard project timelines and margin integrity.

Harnessing Multifaceted Segmentation Lenses to Decode Technology Topologies End Users and Deployment Strategies Driving the Gigabit PON Market

Effective segmentation offers a prism through which to interpret the nuances of the gigabit passive optical network equipment market, revealing distinct trends across multiple dimensions. When examining the technology layer, stakeholders must compare the merits of GPON, NG-PON2, XG-PON, and XGS-PON platforms, each delivering unique performance envelopes and upgrade trajectories. This technological spectrum underscores the necessity of aligning network architecture decisions with capacity requirements and long-term evolution paths.

Network topology further differentiates solutions, as hybrid, ring, and tree structures present variable resilience, redundancy, and cost characteristics. Service providers evaluating these configurations must balance capital investment against operational complexity, factoring in factors such as fault-tolerance, maintenance overhead, and geographic reach.

End-user segmentation highlights divergent requirements among enterprise customers, residential subscribers, and wholesale telecom operators, who each prioritize differing service-level commitments, security protocols, and billing frameworks. Correspondingly, the deployment mode-whether a brownfield upgrade over existing fiber infrastructure or a greenfield rollout in underserved regions-influences project execution timelines, regulatory approvals, and vendor selection criteria.

By weaving these segmentation threads into an integrated analytical framework, decision-makers can craft deployment strategies that resonate with market realities, ensuring that network expansions and product investments yield maximum alignment with customer expectations and competitive pressures.

This comprehensive research report categorizes the Gigabit Passive Optical Network Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Network Topology

- End User

- Deployment

Illuminating Regional Dynamics in the Americas Europe Middle East Africa and Asia Pacific to Unveil Distinct Growth Patterns and Infrastructure Challenges

The regional dynamics of gigabit passive optical network equipment deployment vary considerably across the globe, reflecting divergent investment priorities, regulatory landscapes, and infrastructure endowments. In the Americas, robust demand for enhanced broadband access drives service providers to accelerate fiber deployments, leveraging public funding initiatives and private capital to bridge the digital divide in both urban and rural communities. This momentum fosters competitive offerings that blend high-speed connectivity with value-added services such as managed LAN solutions and enterprise connectivity.

Meanwhile, the Europe, Middle East & Africa region exhibits a dual character: Western European nations focus on incremental network densification and 10-gigabit service launches, while Middle Eastern markets pursue greenfield fiber initiatives under national digital transformation agendas. In sub-Saharan Africa, the imperative to expand basic broadband reaches has spurred partnerships between governments and operators, culminating in phased rollouts that emphasize cost-efficient passive optical architectures.

Across the Asia-Pacific landscape, evolutionary strides in hyperscale data centers, cloud gaming, and smart city deployments have ignited extensive fiber-to-the-premises programs. China’s domestic manufacturers continue to dominate component production, while regional hubs such as Japan, South Korea, and Australia explore advanced NG-PON2 and XGS-PON use cases. These geographically distinct trends underscore the importance of tailoring market entry and growth plans to the regulatory frameworks, competitive ecosystems, and technology adoption curves unique to each region.

This comprehensive research report examines key regions that drive the evolution of the Gigabit Passive Optical Network Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leaders Collaborators and Innovators Shaping the Competitive Gigabit PON Landscape with Strategic Partnerships and Technology Differentiation

A cadre of global and regional players is shaping the competitive contours of the gigabit passive optical network equipment arena, each leveraging core strengths in component innovation, systems integration, and service support. Leading incumbents with established fiber solution portfolios continue to refine their optical line terminal and network unit offerings, investing in programmable ASICs and open-API frameworks to facilitate network virtualization and software-defined access architectures.

At the same time, emerging vendors specializing in modular, micro-combinable splitter modules and advanced low-loss fiber distribution frames are challenging traditional approaches, enabling more agile deployments in both urban densification and rural extension contexts. Strategic alliances between these manufacturers and system integrators have catalyzed the co-development of turn-key solutions, pairing interoperable hardware with end-to-end orchestration software.

Further differentiation arises from firms focusing on energy optimization, embedding power-management intelligence within their passive optical network units to minimize operational expenditures. These technology differentiators, coupled with expanded service portfolios encompassing end-to-end testing, certification, and managed maintenance, have redefined the value proposition for network operators seeking to balance performance demands with financial prudence.

By tracking vendor roadmaps, partnership ecosystems, and recent product launches, stakeholders can anticipate shifts in competitive positioning and leverage strategic collaborations to secure advantageous supply terms and technical support commitments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gigabit Passive Optical Network Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADTRAN, Inc.

- Alcatel‑Lucent Enterprise

- Allied Telesis Holdings K.K.

- Broadcom Inc.

- Calix, Inc.

- Cisco Systems, Inc.

- Dasan Zhone Solutions, Inc.

- ECI Telecom Ltd.

- Edgecore Networks Corporation

- Ericsson AB

- FiberHome Telecommunication Technologies Co., Ltd.

- Fujitsu Limited

- Genexis B.V.

- Hitachi, Ltd.

- Huawei Technologies Co., Ltd.

- Iskratel, d.o.o.

- Mitsubishi Electric Corporation

- NEC Corporation

- Nokia Corporation

- Sagemcom Broadband SAS

- Sumitomo Electric Industries, Ltd.

- Tellabs, Inc.

- TP‑Link Corporation Limited

- UTStarcom Holdings Corp.

- ZTE Corporation

Empowering Industry Leaders with Strategic Actions for Supply Chain Resilience Innovative Technology Adoption and Sustainable Investment Roadmaps

To thrive in the evolving gigabit passive optical network equipment landscape, industry leaders must adopt a multifaceted strategy that emphasizes resilience, agility, and foresight. First, diversifying supply chains across multiple geographic zones mitigates exposure to tariff shocks and component shortages. Partners in Southeast Asia, India, and Eastern Europe can supplement traditional manufacturing bases, offering competitive lead times and cost buffers.

Second, embracing open-access architectures and collaborative standards helps future-proof infrastructure investments. By aligning with industry consortia and adopting disaggregated hardware-software models, operators can reduce vendor lock-in and accelerate feature deployments. Concurrently, piloting advanced technology trials in controlled environments ensures seamless integration before large-scale rollout.

Third, prioritizing energy-efficient hardware and renewable power sourcing not only supports sustainability goals but also delivers long-term cost savings. Investments in intelligent power-management modules and heat-dissipation innovations enhance network reliability and align with corporate environmental, social, and governance commitments.

Finally, cultivating deep technical partnerships with component innovators and software vendors will drive co-innovation. Establishing joint development agreements and shared testbeds fosters rapid iteration cycles, enabling service providers to introduce differentiated offerings that address evolving enterprise and residential connectivity needs.

Detailing Rigorous Qualitative and Quantitative Research Techniques Data Validation Protocols and Expert Engagement Frameworks Guiding Gigabit PON Insights

This analysis rests upon a structured research methodology that integrates qualitative insights with rigorous quantitative validation. Primary data collection involved in-depth interviews with network architects, procurement specialists, and regulatory experts, capturing firsthand perspectives on deployment challenges, vendor selection criteria, and evolving performance requirements. These insights were systematically coded to identify recurring themes and emergent trends.

Supplementing the primary research, an extensive review of trade publications, regulatory filings, and publicly disclosed vendor technical specifications provided a robust secondary data foundation. Cross-referencing this information with industry standards bodies and open-source interoperability records ensured that technology comparisons remained factually accurate and reflective of the latest specification revisions.

To corroborate findings, a quantitative framework was employed to map supplier portfolios against network topology use cases and end-user segments. Validation protocols included expert panel workshops and peer reviews by independent fiber network consultants, guaranteeing that analytical interpretations align with real-world deployment outcomes.

This methodological rigor underpins the report’s comprehensive insights, ensuring that stakeholders receive a synthesis of evidence-based analysis and actionable intelligence tailored to the dynamic gigabit passive optical network equipment environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gigabit Passive Optical Network Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gigabit Passive Optical Network Equipment Market, by Technology

- Gigabit Passive Optical Network Equipment Market, by Network Topology

- Gigabit Passive Optical Network Equipment Market, by End User

- Gigabit Passive Optical Network Equipment Market, by Deployment

- Gigabit Passive Optical Network Equipment Market, by Region

- Gigabit Passive Optical Network Equipment Market, by Group

- Gigabit Passive Optical Network Equipment Market, by Country

- United States Gigabit Passive Optical Network Equipment Market

- China Gigabit Passive Optical Network Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Critical Findings and Strategic Imperatives for Stakeholders Embarking on Gigabit Passive Optical Network Deployment Insights

In conclusion, the gigabit passive optical network equipment market presents a confluence of technological promise, strategic complexity, and competitive intensity. Stakeholders must navigate transformative shifts-from 5G backhaul demands to sustainability mandates-while managing the layered cost pressures introduced by elevated tariff structures. A nuanced, segmentation-driven approach enables precise alignment of technology choices with network topologies, end-user priorities, and deployment modalities.

Regional dynamics further underscore the need for bespoke strategies, as the Americas pursue digital equity initiatives, Europe, Middle East & Africa balance modernization with infrastructure extension, and Asia-Pacific accelerates advanced use cases and large-scale rollouts. Concurrently, the competitive landscape is being redefined by established leaders and nimble innovators driving open-access solutions, energy efficiency advancements, and integrated service offerings.

Moving forward, the successful deployment of gigabit passive optical networks will hinge on proactive supply chain diversification, adherence to collaborative standards, and earnest investments in research and development partnerships. By synthesizing these strategic imperatives with a clear understanding of market segmentation and regional nuances, industry participants can forge a path toward resilient, future-proof broadband infrastructure.

Connect with Associate Director Sales Marketing Ketan Rohom to Secure Comprehensive Gigabit Passive Optical Network Equipment Insights and Report Purchase

We invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore the full breadth of insights and intelligence encapsulated in our comprehensive report on gigabit passive optical network equipment. Engaging directly with Ketan will enable you to gain personalized guidance on leveraging strategic findings tailored to your organization’s objectives. Through this collaboration, you can secure a detailed understanding of market dynamics, competitive positioning, and actionable recommendations that will inform your infrastructure investments and technology roadmaps.

To initiate your acquisition of this indispensable resource, reach out to Ketan for a confidential discussion on licensing options, report delivery formats, and custom briefing sessions. This streamlined approach ensures you receive not only the data and analysis you need but also expert support in interpreting the implications for your business. Don’t miss the opportunity to harness the full potential of this report to drive growth, resilience, and innovation in your gigabit passive optical network deployments. Contact Ketan Rohom today to finalize your purchase and begin your journey toward informed, strategic decision-making.

- How big is the Gigabit Passive Optical Network Equipment Market?

- What is the Gigabit Passive Optical Network Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?