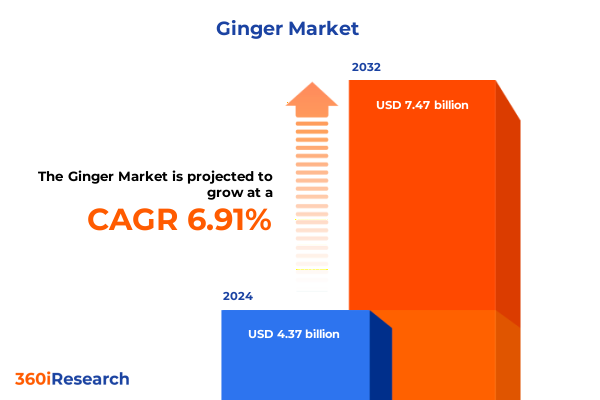

The Ginger Market size was estimated at USD 5.17 billion in 2025 and expected to reach USD 5.46 billion in 2026, at a CAGR of 5.73% to reach USD 7.65 billion by 2032.

Exploring the Dynamic Rise of Ginger as a Core Ingredient in Health, Wellness, and Global Trade Amidst Supply Chain Transformations

The global ginger landscape is evolving at an unprecedented pace, driven by surging consumer demand for natural ingredients and health-oriented offerings. Beyond its traditional culinary role, ginger’s recognized anti-inflammatory, antioxidant, and digestive benefits have cemented its status as a versatile nutraceutical ingredient in functional beverages, supplements, and wellness-focused food innovations. As consumer wellness becomes a primary driver of purchase decisions, ginger-derived products are transitioning from niche health aisles to mainstream grocery shelves, reflecting a broader shift toward preventive health solutions.

Simultaneously, the sheer scale of ginger production underscores its global significance. In 2023, worldwide production reached nearly 4.9 million tonnes, with India alone accounting for roughly 45 percent of the total output. Nigeria and China follow as key producers, demonstrating the crop’s geographic diversity and resilience across varying agroclimatic conditions. This expansive output supports a complex value chain that spans fresh harvests, value-added processing, oil extraction, and powdered formulations.

Together, these factors set the stage for an in-depth exploration of ginger’s dynamic market forces. From shifting consumer preferences and supply chain innovations to trade policy disruptions and emerging regional hubs, the ginger industry stands at a transformative inflection point. In this report, we unpack the critical trends shaping the landscape and equip stakeholders with the insights needed to navigate an increasingly complex market ecosystem.

How Evolving Consumer Demands and Technological Innovations Are Reshaping the Ginger Supply Chain and Market Value Proposition

The ginger industry is undergoing a profound metamorphosis fueled by converging consumer, technological, and environmental drivers. On the demand side, rapid urbanization and health awareness are reshaping dietary patterns. Consumers are seeking convenient, nutrient-rich formulations such as powdered blends and cold-extracted oils that deliver targeted benefits while fitting busy lifestyles. This shift toward functionality has created fertile ground for innovation across dried, fresh, oil and oleoresin, and powder product segments, spurring manufacturers to experiment with microencapsulation and cold-extraction technologies that preserve bioactive compounds during processing.

Supply chains are also realigning to address climate volatility and ethical sourcing demands. Traditional cultivation clusters face weather variability that threatens yield stability. In response, industry participants are investing in resilient farming practices-including soil health initiatives and precision irrigation-to ensure consistent quality. Furthermore, alternative sourcing geographies, from Southeast Asia to Latin American highlands, are being evaluated to diversify risk. These strategic relocations, combined with blockchain and IoT-enabled traceability trials, aim to bolster consumer confidence and validate sustainability claims.

Assessing the Multifaceted Consequences of 2025 U.S. Tariff Policies on the Ginger Supply Chain, Pricing, and Market Access

The recalibration of U.S. trade policy in 2025 has imparted significant cost pressures on the ginger supply chain. Average import tariffs have surged from historical lows around two percent to upwards of fifteen percent, marking the highest levels since mid-century. These elevated duties have manifested as higher landed costs for processors, distributors, and end users. To mitigate immediate price shocks, some importers have front-loaded shipments ahead of tariff implementation windows, while others have sought tariff engineering solutions-such as processing in duty-advantaged zones-to retain cost competitiveness.

However, the constellation of tariff-related uncertainties has also accelerated strategic adaptations. Smaller producers with limited sourcing flexibility are pivoting toward domestic partnerships, investing in local cultivation projects to sidestep elevated duties. Conversely, larger multinationals are leveraging their scale to negotiate consignment agreements that spread duty burdens across broader import volumes. Despite these efforts, the cumulative effect has been a tightening of margin structures and a reevaluation of pricing models across both fresh and processed ginger offerings.

Unveiling Comprehensive Segment-Level Perspectives on Product Types, Applications, Distribution Channels, and End Users in the Ginger Market

Ginger’s product landscape unfolds across four distinct types: dried rhizomes, fresh harvests, oil and oleoresin extracts, and powdered derivatives. Dried ginger retains much of its volatile oil content, making it a reliable staple for spice blends and traditional remedies, while fresh ginger commands premium positioning in culinary and health applications due to its high moisture and aromatic profile. Oil and oleoresin variants concentrate ginger’s pungent compounds, catering to nutraceutical and aromatherapy formulations that demand consistent potency. Powdered ginger offers convenience and uniform dosing, appealing to formulators in food and beverage as well as cosmetic and pharmaceutical industries.

In application contexts, ginger’s versatility extends from sensory-driven aromatherapy experiences to efficacy-focused drug delivery systems. In aromatherapy, its warming aroma is utilized for mood enhancement and respiratory support, whereas in cosmetics and personal care, ginger’s antioxidant properties are leveraged for skin-soothing formulations. Within food and beverage, ginger’s flavor profile and digestive attributes drive its use in teas, sauces, and functional drinks. The pharmaceutical sector harnesses ginger’s bioactives in capsules, tinctures, and topical applications to address inflammation and gastrointestinal discomfort.

Distribution channels bifurcate into offline and online realms. Traditional grocery stores, specialty spice purveyors, and supermarket and hypermarket chains anchor brick-and-mortar accessibility, providing shelf-ready formats and value-added packaging. Parallelly, e-commerce platforms unlock direct-to-consumer engagement, enabling artisanal brands to reach niche audiences with premium variants and subscription-based models. This omni-channel continuum ensures that both household and industrial end users can procure ginger in forms that align with their functional and operational requirements.

This comprehensive research report categorizes the Ginger market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Cultivation Practice

- Variety

- Processing Level

- Packaging Format

- Application

- End User

- Distribution Channel

Deciphering Regional Growth Trajectories and Consumer Preferences in the Americas, Europe Middle East & Africa, and Asia-Pacific Ginger Markets

The Americas region is experiencing a convergence of health-driven consumption and premium flavor innovation. North and South American consumers increasingly incorporate ginger into diet routines through cold-pressed juices, functional teas, and artisanal food products that emphasize clean-label credentials. In parallel, local farmers in regions such as Brazil and Jamaica are exploring cultivation techniques that balance yield with essential oil quality, aiming to capture both culinary and nutraceutical value.

Across Europe, the Middle East, and Africa, market dynamics are shaped by regulatory frameworks and traditional usage patterns. In Western Europe, stringent cosmetic and pharmaceutical regulations drive demand for high-purity ginger extracts that can be validated through third-party testing and certifications. Meanwhile, in the Middle East, ginger features prominently in traditional remedy formats, contributing to a sustained appetite for ground and dried variants. African producers, particularly in Nigeria, leverage cost advantages to supply global value chains, even as they invest in post-harvest infrastructure to reduce losses and preserve quality.

Asia-Pacific remains the dominant force in ginger production and consumption, with nearly half of the world’s raw output concentrated in India and substantial contributions from China and Indonesia. Cultural heritage and institutional support have cemented ginger’s role across culinary, medicinal, and industrial applications, with regional innovation hubs fostering advancements in processing technologies and organic certification schemes. This combination of scale and tradition ensures that Asia-Pacific continues to set global quality benchmarks and cost parameters for the ginger trade.

This comprehensive research report examines key regions that drive the evolution of the Ginger market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation, Sustainability, and Competitive Differentiation in the Global Ginger Market

A handful of industry leaders are defining the competitive contours of the ginger sector through global reach, product innovation, and sustainability commitments. McCormick & Company stands out with its century-old heritage in spice innovation, offering a diverse ginger portfolio that spans ground powders, paste formats, and spice blends, while integrating robust responsible sourcing programs across key growing regions. Archer Daniels Midland leverages its extensive agribusiness infrastructure to provide bulk ginger ingredients for food manufacturers and nutraceutical producers, pioneering digital traceability tools to monitor quality from farm to facility.

Australian-based Buderim Group has carved a niche in premium ginger purees, crystallized segments, and beverage concentrates, capitalizing on advanced processing capabilities and strategic marketing initiatives that highlight Australian quality standards. Meanwhile, global agribusiness powerhouse Olam International integrates ginger sourcing into its broader spice network, combining sustainability audits with farmer training programs to ensure yield optimization and ethical labor practices. The Ginger People, an American specialty brand, collaborates with small-holder farms across Asia and the Pacific, focusing on organic and fair-trade ginger variants that command visibility in health food channels.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ginger market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- McCormick & Company, Inc.

- Olam Group Limited

- Archer-Daniels-Midland Company

- Givaudan SA

- International Flavors & Fragrances Inc.

- DSM-Firmenich AG

- Döhler GmbH

- DOTERRA INTERNATIONAL, LLC

- Kalsec, Inc.

- Buderim Foods Pty Ltd.

- The Ginger People

- Synthite Group

- Frontier Cooperative

- Fuchs Group

- Starwest Botanicals

- Badia Spices, Inc.

- Botaniex Inc.

- AKAY NATURAL INGREDIENTS PRIVATE LIMITED by Oterra Group

- Anhui Huafeng Spices Co., Ltd.

- AOS Products Private Limited

- EVEREST Food Products Pvt. Ltd.

- Gimber SRL

- Great American Spice Company

- Indena S.p.A.

- Indian Organic Farmers Producer Company Limited,

- Layn Natural Ingredients Corp.

- Mane Kancor Ingredients Private Limited

- Oregon’s Wild Harvest, Inc.

- Plant Lipids Private Limited

- Plant Therapy, LLC

- Shandong Dongbao Foodstuff Co., Ltd.

- Shandong Yipin Agro (Group) Co., Ltd.

- TERRASOUL SUPERFOODS

- VINAYAK INGREDIENTS (INDIA) PRIVATE LIMITED

- YOUNG LIVING ESSENTIAL OILS, LC

Strategic Imperatives for Ginger Industry Leaders to Capitalize on Health Trends, Supply Chain Resilience, and Value Differentiation

Industry leaders should prioritize supply chain diversification to mitigate tariff and climate risks. Establishing multi-regional cultivation partnerships and investing in resilient agronomic practices will safeguard raw material quality and supply continuity. Concurrently, organizations can leverage tariff engineering strategies-such as leveraging duty-advantaged processing zones-to minimize the impact of elevated import duties and maintain competitive pricing for processed ginger ingredients.

Emphasizing traceability through blockchain pilots and IoT-enabled farm monitoring will reinforce stakeholder confidence and support premium positioning for certified variants. Brands should also expand into ready-to-consume and ready-to-formulate formats, integrating microencapsulation and cold-extraction technologies to deliver standardized dosing of gingerol and shogaol for health-focused applications. Finally, deepening direct-to-consumer engagement via e-commerce channels can enhance margin profiles and foster brand loyalty, particularly among health-conscious millennials and Gen Z audiences seeking transparency and authenticity.

Outlining a Rigorous Blend of Primary and Secondary Research Approaches to Uncover Ginger Market Insights with Precision and Depth

Our research methodology blends rigorous primary and secondary approaches to ensure comprehensive coverage and data integrity. Primary research involved in-depth interviews with over 25 industry stakeholders, including ginger cultivators, processing executives, distribution partners, and end-user representatives. These conversations provided qualitative insights into cultivation challenges, processing innovations, and evolving buyer preferences across product types and applications.

Secondary research encompassed an extensive review of public databases, such as the United Nations’ FAO production statistics, industry publications, regulatory filings, and trade journals. Over 300 secondary sources were analyzed to map global production volumes, validate emerging trends, and assess the impact of trade policy shifts. Quantitative triangulation techniques ensured that supply chain narratives and tariff implications were anchored in verifiable data points, while thematic coding distilled key strategic themes for actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ginger market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ginger Market, by Product Type

- Ginger Market, by Cultivation Practice

- Ginger Market, by Variety

- Ginger Market, by Processing Level

- Ginger Market, by Packaging Format

- Ginger Market, by Application

- Ginger Market, by End User

- Ginger Market, by Distribution Channel

- Ginger Market, by Region

- Ginger Market, by Group

- Ginger Market, by Country

- United States Ginger Market

- China Ginger Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2862 ]

Synthesizing Insights to Illuminate the Strategic Path Forward for Stakeholders in the Expanding Ginger Industry Landscape

As the ginger market continues to evolve, stakeholders must navigate an increasingly intricate landscape defined by health-driven consumer behavior, supply chain volatility, and shifting trade policies. By embracing technological innovations in processing and traceability, the industry can transform these challenges into differentiating capabilities that enhance product quality and sustainability credentials.

Furthermore, strategic regional diversification and tariff optimization strategies will be essential to securing cost-efficient access to raw materials and preserving margin structures. The collective application of these insights will empower ginger producers, processors, and brand owners to craft compelling value propositions that resonate across culinary, nutraceutical, and personal care domains.

Ultimately, the roadmap for success lies in harmonizing organic growth imperatives with a disciplined approach to risk mitigation and innovation. Stakeholders who integrate these priorities into their strategic planning will be best positioned to lead the next wave of ginger market expansion and to capitalize on the diverse opportunities this dynamic sector presents.

Engage with Associate Director Ketan Rohom to Secure Comprehensive Market Intelligence and Elevate Your Strategic Decision-Making in the Ginger Sector

Are you ready to unlock the full potential of ginger insights and propel your strategic initiatives forward? Contact Ketan Rohom, Associate Director of Sales & Marketing, to request your comprehensive market research report today and empower your organization with actionable intelligence that drives growth and innovation

- How big is the Ginger Market?

- What is the Ginger Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?