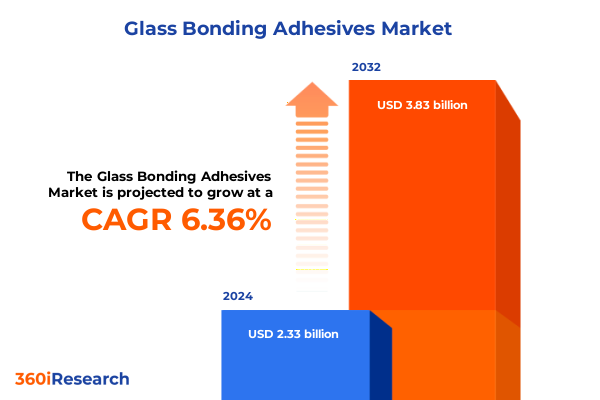

The Glass Bonding Adhesives Market size was estimated at USD 2.48 billion in 2025 and expected to reach USD 2.65 billion in 2026, at a CAGR of 6.75% to reach USD 3.93 billion by 2032.

Setting the Stage for Glass Bonding Excellence Navigating Innovations, Trends, and Market Dynamics Shaping Adhesive Solutions

Glass bonding adhesives have emerged as indispensable enablers of modern manufacturing, transforming how transparent substrates are joined across critical industries. From high-strength structural assemblies in aerospace components to precision medical devices and sleek consumer electronics, adhesive technologies have evolved to meet stringent performance demands. Innovations in polymer chemistry, curing techniques, and application processes are accelerating adoption, spurred by the relentless pursuit of weight reduction, enhanced durability, and seamless aesthetics. As global supply chains become more interconnected, understanding the interplay between material properties and end-use requirements is essential for unlocking new growth opportunities and mitigating risks.

Against this backdrop, executives and decision-makers face mounting pressure to differentiate their product offerings through next-generation adhesives that deliver superior bond strength, environmental resilience, and process efficiency. Regulatory shifts and sustainability imperatives further intensify the need for transparent, low-emission formulations that comply with evolving standards. At the same time, digitalization is reshaping procurement, quality control, and customer engagement, elevating data-driven decision-making to the forefront of strategic planning. This report provides a comprehensive executive summary, setting the stage for an in-depth exploration of transformative market forces, tariff impacts, segmentation insights, regional dynamics, competitive landscapes, and actionable recommendations.

Unveiling the Pivotal Transformations Revolutionizing the Glass Bonding Landscape From Material Innovations to Sustainability Imperatives Driving Evolution

Recent years have witnessed a radical transformation in the glass bonding adhesive market, driven by breakthroughs in polymer synthesis and smart curing mechanisms. Cutting-edge UV cure technologies now enable rapid, room-temperature assembly processes that significantly shorten production cycles and reduce energy consumption. Concurrently, one-part and two-part chemistries-spanning acrylics, epoxies, polyurethanes, and silicones-have been fine-tuned to offer tailored properties such as high-temperature stability, chemical resistance, and flexibility. Material scientists are pushing the boundaries of hybrid formulations, blending polymer classes to achieve unprecedented combinations of toughness and elasticity.

Sustainability has emerged as a central driver of innovation, with research and development focused on bio-based monomers, solvent-free formulations, and recyclable adhesive systems. These eco-friendly advances are complemented by digitized process controls and inline quality monitoring, which ensure consistent bond integrity and reduce waste. In parallel, end-users demand customizable dispensing technologies that integrate seamlessly into automated production lines, enabling precise application and reducing labor costs.

Supply chain digitization and strategic partnerships are reinforcing resilience amid raw material volatility and geopolitical uncertainty. Manufacturers are leveraging advanced data analytics to forecast demand, optimize inventory, and diversify sourcing across multiple regions. As the industry accelerates toward smarter, greener, and more agile operations, these transformative shifts are redefining competitive advantage and setting new benchmarks for performance and sustainability.

Assessing the Comprehensive Ripple Effects of 2025 United States Tariff Adjustments on Glass Bonding Adhesive Supply Chains and Cost Structures

The implementation of revised tariff structures by the United States in early 2025 has had a cascading effect on glass bonding adhesive supply chains and cost models. Higher duties on key raw materials, including specialty monomers and curing agents imported from major suppliers, have incrementally raised landed costs and prompted many manufacturers to reevaluate contract terms. Domestic producers initially attempted to absorb a portion of the incremental fees to maintain price competitiveness; however, sustained pressure from downstream industries has led to a gradual pass-through of these costs, impacting overall pricing for bonded assemblies.

In response to tariff-induced cost escalation, companies have pursued a range of mitigation strategies. Some organizations have diversified procurement to alternative low-duty sources in South America and Asia-Pacific, albeit with longer lead times and potential quality variances. Others have accelerated long-term partnerships with local chemical producers to develop in-region manufacturing capabilities, thereby circumventing import levies. These structural adjustments require significant capital investments and carry execution risks, but they strengthen supply chain resilience and reduce exposure to future policy shifts.

Moreover, regulatory compliance and customs classification have grown more complex, as adhesive blends often contain multiple chemical classes with varying duty rates. Enhanced documentation, auditing, and tariff engineering practices have become paramount to avoid unintentional noncompliance. In this environment, strategic sourcing, rigorous supply chain governance, and proactive policy monitoring are indispensable for maintaining cost stability and safeguarding market share.

Decoding Critical Segmentation Dimensions to Illuminate End Uses Technologies Cure Types Forms Sales Channels and Applications Shaping Adhesive Strategies

Analyzing market segmentation by end use industry reveals distinct performance and innovation priorities across sectors such as aerospace and defense, automotive, building and construction, electronics, and healthcare and medical. In aerospace and defense, adhesives must deliver high bond strength under extreme thermal cycling and vibration, while automotive applications emphasize fast cure speeds and lightweight formulations. The building and construction segment prioritizes longevity and environmental resistance, electronics require minimal ionic contamination and fine-line dispensing, and healthcare and medical devices demand biocompatibility alongside sterilization stability.

When considering technology segmentation, the market divides into acrylic, epoxy, polyurethane, silicone, and UV cure categories. Acrylic adhesives are further differentiated into nonstructural grades for cosmetic glass attachments and structural variants designed for load-bearing joints. Epoxy systems, available as one-part and two-part formulations, offer exceptional mechanical strength and chemical resistance, making them ideal for critical assemblies. Polyurethane options can be found in one-part moisture-cure and two-part versions that balance flexibility with adhesive toughness, whereas silicone adhesives in both one-part and two-part formats provide unparalleled temperature endurance and flexibility. UV cure adhesives deliver rapid polymerization under light exposure, minimizing downtime and energy consumption.

The cure type landscape encompasses heat cure, room temperature cure, and UV cure methods. Heat cure systems achieve deep crosslinking and high bond strength but typically require oven-based processing, whereas room temperature cures offer operational simplicity for on-site assembly. UV cure adhesives enable instantaneous adhesion upon exposure to specific wavelengths, supporting high-throughput production lines. The market also diverges by form into film and liquid formats, with films specializing in thin bond lines for precision applications and liquids offering versatile dispensing across complex geometries.

Sales channel fragmentation further influences adoption trends, as direct engagements facilitate customized technical support, distributors enable rapid regional availability, and e-commerce platforms offer streamlined ordering for smaller volumes. Finally, application-focused segmentation-spanning coating, lamination, sealing, and structural bonding-underscores the versatility of glass bonding adhesives, from protective surface treatments and layered glass laminates to leak-tight seals and load-bearing joints that replace mechanical fasteners.

This comprehensive research report categorizes the Glass Bonding Adhesives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Cure Type

- Form

- Sales Channel

- Application

- End Use Industry

Unraveling Distinct Regional Dynamics and Market Drivers Across the Americas Europe Middle East & Africa and Asia Pacific Fostering Glass Bonding Growth

The Americas region leads with a mature supply chain ecosystem, strong research and development infrastructure, and a concentration of end-use industries such as aerospace, automotive, and electronics. North American manufacturers leverage advanced production facilities and regulatory frameworks that incentivize innovation, while South American markets are emerging as cost-competitive hubs for raw material sourcing. Recent investments in sustainable production practices and nearshoring initiatives have reinforced regional resilience, even as tariff adjustments have prompted some companies to diversify within the hemisphere.

In Europe, Middle East & Africa, diverse regulatory environments and varying infrastructure maturity levels create a complex landscape for adhesive providers. The European Union’s stringent environmental and chemical safety regulations drive demand for low-emission, eco-friendly formulations, and the region’s automotive and construction industries remain significant end users. In the Middle East, infrastructure projects and energy sector expansions are generating opportunities for structural bonding and sealing applications, while certain African markets are beginning to adopt advanced adhesives for healthcare and electronics manufacturing, albeit from a lower baseline.

The Asia-Pacific region continues to exhibit the fastest growth rates, powered by expanding electronics assembly, automotive component manufacturing, and construction booms in developing economies. China, Japan, and South Korea dominate technology innovation, especially in UV cure and advanced epoxy formulations tailored for high-volume electronics assembly. At the same time, Southeast Asian nations are benefiting from foreign direct investment in production zones, where lower labor and operational costs amplify the attractiveness of localized adhesive manufacturing. These regional dynamics collectively underscore the importance of tailored market strategies and supply chain configurations.

This comprehensive research report examines key regions that drive the evolution of the Glass Bonding Adhesives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Innovators and Strategic Alliances Transforming the Competitive Landscape of Glass Bonding Adhesives Through Cutting Edge R&D Collaboration

Global adhesive manufacturers are investing heavily in research and development to maintain differentiation and capture market share. Established chemical conglomerates are leveraging core polymer expertise and extensive application laboratories to accelerate product introductions, while specialty players focus on niche formulations that meet unique performance criteria. Strategic alliances with hardware OEMs, equipment suppliers, and academic research centers are commonplace, enabling co-development of novel adhesive systems and process integration solutions.

Competition also extends to service offerings, as companies enhance technical support through digital platforms that provide real-time dispensing analytics, cure monitoring, and training modules. These digital ecosystems create deeper customer engagement and foster brand loyalty by delivering evidence-based recommendations for process optimization. Meanwhile, mid-tier and emerging regional producers capitalize on cost advantages and local market knowledge, forging partnerships with distributors to reach underserved segments and small-to-medium enterprise customers.

Increasingly, companies are pursuing vertical integration to secure critical raw materials and reduce exposure to tariff fluctuations. Joint ventures with monomer suppliers and catalyst producers ensure consistent quality and streamline innovation workflows. At the same time, acquisitions of technology startups specializing in bio-based chemistries and smart adhesives expand product portfolios and future-proof roadmaps. This dynamic interplay of collaboration, consolidation, and targeted investment is reshaping the competitive hierarchy and setting the stage for the next generation of glass bonding solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Glass Bonding Adhesives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AVERY DENNISON CORPORATION

- BASF SE

- Benson Polymers Limited

- Bohle AG

- Bostik, Inc. by Arkema S.A.

- Delo Services Private Limited

- Dymax Corporation

- GAF Materials LLC

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Hot Melt Technologies, Inc.

- Häfele Adriatic d.o.o.

- KIWO Inc.

- Master Bond Inc.

- Metlok Private Limited

- Owens Corning Corporation

- Panacol-Elosol GmbH

- Permabond LLC

- RELTEK LLC

- Sika AG

- SOLVAY S.A.

- The DOW Chemical Company

- ThreeBond Group

Strategic Roadmap for Executive Decision Makers to Capitalize on Emerging Technological Advances Regulatory Trends and Supply Chain Efficiencies in Glass Bonding

Executive decision-makers should prioritize robust R&D investments in multifunctional adhesive systems that deliver enhanced mechanical, thermal, and environmental performance. Allocating resources to develop hybrid polymer blends and bio-derived monomers can unlock sustainable value propositions and meet evolving regulatory requirements. At the same time, integrating digital process controls and predictive analytics into manufacturing workflows will drive higher yields, reduce scrap rates, and shorten time to market.

Supply chain diversification must be a strategic imperative to mitigate tariff exposure and raw material shortages. Industry leaders are advised to establish multi-sourcing frameworks that balance cost, quality, and proximity to key end-use markets. Collaborations with regional chemical producers and contract manufacturers can provide flexibility while maintaining oversight through rigorous vendor qualification and audit processes. Clear visibility into customs classification and proactive engagement with regulatory bodies will further safeguard operations.

Partnerships that span the value chain-from equipment OEMs to end users-can accelerate co-development and streamline adoption of new adhesive technologies. Joint pilot programs and field trials foster mutual trust and deliver empirical performance data that underpin commercialization efforts. By cultivating an ecosystem mindset, organizations can combine technical expertise, application know-how, and market access to outpace competitors.

Leadership teams should also champion sustainability initiatives that align with corporate environmental goals. Implementing circular economy principles-such as adhesive systems designed for easy disassembly and recycling-enhances brand reputation and opens doors to new customer segments. Transparent communication of environmental benefits and life cycle assessments will differentiate offerings and support premium pricing strategies.

Comprehensive Research Approach Integrating Qualitative and Quantitative Techniques with Rigorous Data Collection and Analytical Framework for Market Insights

This analysis is underpinned by a dual-track research framework combining qualitative insights and quantitative rigor. Primary research included in-depth interviews with industry veterans, technical experts, procurement leaders, and end-users across multiple geographies. These firsthand perspectives informed the identification of key market drivers, technology adoption patterns, and regional nuances.

Secondary research comprised an extensive review of technical journals, patent filings, regulatory databases, and corporate disclosures. Data triangulation ensured consistency between macroeconomic indicators, trade flow statistics, and company-level performance metrics. The segmentation approach leveraged standardized classification methodologies to delineate end-use industries, chemistry platforms, curing techniques, form factors, sales channels, and application categories.

Analytical models integrated regression analysis, scenario planning, and sensitivity testing to surface potential inflection points and risk factors. A rigorous validation process included cross-referencing findings with third-party data, consulting subject-matter panels, and conducting iterative reviews to refine assumptions. This structured methodology ensures that conclusions are robust, actionable, and reflective of current market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Glass Bonding Adhesives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Glass Bonding Adhesives Market, by Technology

- Glass Bonding Adhesives Market, by Cure Type

- Glass Bonding Adhesives Market, by Form

- Glass Bonding Adhesives Market, by Sales Channel

- Glass Bonding Adhesives Market, by Application

- Glass Bonding Adhesives Market, by End Use Industry

- Glass Bonding Adhesives Market, by Region

- Glass Bonding Adhesives Market, by Group

- Glass Bonding Adhesives Market, by Country

- United States Glass Bonding Adhesives Market

- China Glass Bonding Adhesives Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Critical Findings to Illuminate Strategic Imperatives and Growth Opportunities in Glass Bonding Adhesives for Informed Executive Decision Making

The convergence of advanced polymer chemistries, innovative curing technologies, and digital process capabilities is reshaping the glass bonding adhesive market. Tariff pressures have catalyzed new supply chain strategies, while segmentation analysis underscores the need for tailored solutions across industries, technologies, and applications. Regional dynamics highlight both established centers of innovation and emerging growth hubs, demanding differentiated market entry and expansion tactics.

Competitive intelligence reveals that leading companies are strengthening R&D collaboration, pursuing vertical integration, and leveraging digital platforms to reinforce customer value propositions. Meanwhile, sustainability imperatives are redefining product roadmaps and incentivizing bio-based alternatives. For industry leaders, the path forward lies in harmonizing technical excellence with operational agility and environmental stewardship.

By synthesizing these critical findings, organizations can identify strategic imperatives that drive performance, mitigate risk, and unlock new revenue streams. Ultimately, the ability to anticipate market shifts, align resources with priority segments, and engage in collaborative partnerships will determine success in this dynamic landscape.

Begin Your Strategic Advantage Today by Securing the Comprehensive Glass Bonding Adhesives Market Research Report with Guidance from Ketan Rohom

To secure access to the definitive market research report on glass bonding adhesives and transform strategic planning into tangible outcomes, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise will guide you through customized insights and ensure your organization harnesses the full potential of this analysis. Begin advancing your competitive position today by engaging directly with Ketan Rohom to purchase the complete report.

- How big is the Glass Bonding Adhesives Market?

- What is the Glass Bonding Adhesives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?