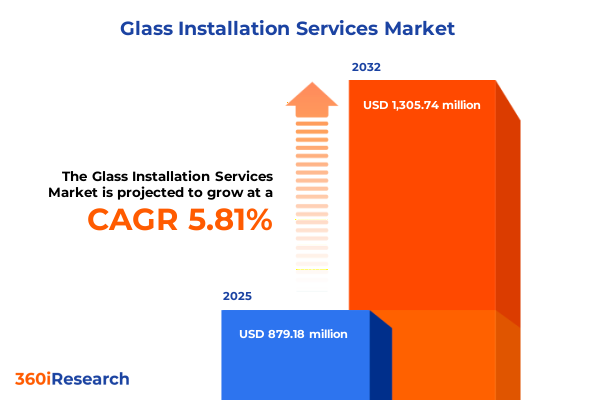

The Glass Installation Services Market size was estimated at USD 879.18 million in 2025 and expected to reach USD 930.99 million in 2026, at a CAGR of 5.81% to reach USD 1,305.74 million by 2032.

Inaugurating the glass installation services market landscape with an overview of emerging priorities and foundational drivers shaping industry momentum

The global glass installation services sector underpins the functionality, aesthetics, and safety of modern built environments, spanning everything from towering skyscrapers to residential homes. Booming construction volumes and rising emphasis on energy efficiency have elevated the importance of high-quality glass installation, increasingly viewed as a critical component of sustainable and resilient building practices. Against this backdrop, service providers are contending with tighter environmental regulations, heightened safety standards, and evolving client expectations for speed and precision. As a result, the market is witnessing a convergence of advanced materials, sophisticated installation methodologies, and digital tools that streamline project workflows and reduce risk.

Navigating this complex ecosystem requires a nuanced understanding of both macroeconomic drivers and on-the-ground operational challenges. The post-pandemic surge in renovation and retrofit work, coupled with renewed investment in commercial real estate, has spurred demand for specialized glass installers adept at working in occupied environments. Meanwhile, the growth of automotive glass replacement and aftermarket segments highlights the cross-sector reach of installation service expertise. In parallel, manufacturers and distributors are forging closer partnerships with contractors to ensure seamless supply chains and comprehensive training programs. Through this executive summary, we introduce the strategic imperatives shaping the glass installation services landscape and outline the foundational trends that businesses must address to thrive.

Revolutionary digital, regulatory, and sustainability innovations are reshaping glass installation services into an agile and eco-resilient sector

The glass installation ecosystem is undergoing a profound transformation as technology, sustainability, and regulatory forces converge to redefine traditional practices. One of the most significant shifts involves the integration of digital project management tools and building information modeling (BIM), which enable stakeholders to visualize installation sequences, anticipate clashes, and optimize resource allocation before crews arrive on site. This digital evolution is complemented by augmented reality solutions that guide installers through complex glazing patterns, enhancing accuracy and reducing rework.

Concurrently, sustainability has emerged as both an ethical mandate and a source of competitive differentiation. Demand for low-emissivity coatings, solar-control glass, and dynamic glazing systems is rising in step with global green building certifications. Service providers are increasingly adopting installation techniques that minimize waste and support circularity, such as modular glass panel assemblies and offsite prefabrication. As a result, installers are transitioning from labor-intensive, on-site processes to factory-aligned workflows that ensure consistency and comply with stringent environmental standards.

Regulatory landscapes are also shifting, particularly in seismic zones and hurricane-prone regions where reinforced anchoring systems and impact-resistant glazing are mandated. This has driven the development of specialized installation frameworks and certification programs for technicians. Taken together, these transformative shifts are forging a more agile, technologically advanced, and sustainability-focused glass installation industry.

Evolving tariff frameworks since 2010 have cumulatively reshaped procurement strategies and operational resilience for glass installation providers in the United States by 2025

Since the initial protective measures in the early 2010s, the United States has progressively expanded tariff regimes affecting imported glass products, culminating in a series of escalatory measures by 2025. These policies have introduced levies on a broad array of float, laminated, and insulated glass imports, prompting stakeholders to recalibrate sourcing strategies. In response, many service providers and manufacturers have sought to localize production capacities or shift procurement toward tariff-exempt regions, thereby safeguarding margins and minimizing disruptions.

The cumulative effect of these tariffs has manifested in increased raw material costs, with installers absorbing a portion of the burden to maintain competitive pricing. Others have opted to pass through surcharges to end customers, triggering tighter negotiations and longer approval cycles. The ripple effects extend to project timelines, as lead times for certain specialty glass types have lengthened due to constrained global supplies and rerouted shipping lanes.

To mitigate these challenges, industry participants have accelerated investments in domestically sourced or vertically integrated glass processing facilities. Strategic alliances between installation firms and regional fabricators have become more common, enhancing supply chain resilience and providing greater transparency around cost structures. As the tariff environment continues to evolve, service providers that proactively diversify sources and forge collaborative partnerships are best positioned to neutralize trade-driven volatility and sustain operational continuity.

Dissecting the glass installation marketplace through multi-tiered segmentation to optimize tailored service delivery and targeted operational strategies

Insight into the glass installation services market becomes clearer when examined through multiple segmentation lenses, each revealing distinct demand drivers and service requirements. Application-based analysis highlights three primary domains: automotive, commercial, and residential. Within automotive, aftermarket work and original equipment installations dictate divergent service protocols, quality standards, and turnaround expectations. In commercial environments, the hospitality sector demands rapid installation schedules to align with guest-focused timelines, office buildings require precision for curtain wall systems that balance aesthetics and energy performance, and retail storefronts prioritize both visual impact and security. Residential installations vary between single-family dwellings, which often emphasize customization and architectural glass features, and multi-family developments where cost efficiencies and repeatable processes drive contractor preferences.

Installation type offers further clarity, distinguishing new construction projects-where installers collaborate closely with architects and general contractors-from retrofit assignments that necessitate minimal disruption to occupied structures. Glass type segmentation reveals that float glass remains a staple for standard glazing, whereas insulated and laminated variants address energy performance and safety regulations respectively. Tempered glass installations have gained traction for their strength and compliance with building codes in high-traffic areas.

Finally, end-use categories such as curtain walls, facades, skylights, and windows & doors encapsulate the technical complexity and performance specifications unique to each frame and glazing system. This multidimensional segmentation approach empowers service providers to tailor offerings, optimize resource allocation, and refine marketing strategies according to precise application needs and design imperatives.

This comprehensive research report categorizes the Glass Installation Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Installation Type

- Glass Type

- Application

- End Use

Uncovering the diverse regional pulse of glass installation services driven by localized regulations, construction trends, and sustainability agendas

Regional dynamics in glass installation services are influenced by local construction patterns, regulatory frameworks, and economic cycles, creating a diverse landscape across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, the United States stands out for robust retrofit demand fueled by aging building stock and federal incentives promoting energy upgrades. Latin American markets exhibit growing appetite for commercial glazing in urban centers, balanced by cost sensitivity and logistical challenges in remote areas.

Within Europe, Middle East & Africa, stringent European Union energy directives and seismic building codes in Turkey and North Africa have elevated requirements for specialized installation competencies. Gulf Cooperation Council nations continue to drive luxury façade projects, while sub-Saharan Africa shows nascent growth anchored in infrastructure development.

In the Asia-Pacific region, rapid urbanization in Southeast Asia and India is spurring new construction, with a strong focus on high-performance glass to address tropical heat gain. Japan and South Korea lead in precision-driven insulated glazing installations, supported by advanced manufacturing ecosystems. Meanwhile, Australian markets emphasize sustainability certifications and cyclone-resistant systems in coastal areas. Recognizing these regional nuances enables service providers to allocate resources, cultivate local partnerships, and develop regionally tailored training programs that align with distinct market drivers and regulatory requirements.

This comprehensive research report examines key regions that drive the evolution of the Glass Installation Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the strategic innovators redefining glass installation services through technology, partnerships, and sustainability leadership

Leading entities in the glass installation services sector have distinguished themselves through strategic expansion, technological innovation, and integrated service models. Key players have invested heavily in proprietary installation equipment and digital platforms that standardize workflows, enabling real-time project tracking and quality assurance. Several organizations have established in-house training academies, certifying technicians to uphold the most rigorous safety and performance benchmarks.

Partnerships with glass manufacturers have become a critical differentiator, granting select installers preferential access to advanced products such as vacuum-insulated glazing and switchable smart glass. Meanwhile, other firms have pursued geographic diversification by opening regional service centers, thereby reducing lead times and minimizing logistic overhead. Collaborative alliances with architecture and engineering consultancies have further embedded certain companies within the design phase, ensuring early integration of installation considerations.

Additionally, a subset of market leaders has embraced sustainability through end-of-life glass recycling initiatives, closing the loop on material use and reinforcing corporate social responsibility commitments. By aligning operational excellence with forward-looking product portfolios and environmental stewardship, these innovators are setting new benchmarks for quality and resilience in glass installation services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Glass Installation Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Inc.

- Apogee Enterprises, Inc.

- China Glass Holdings Limited

- Compagnie de Saint-Gobain S.A.

- Consolidated Glass Holdings, Inc.

- CRH plc

- Fuyao Glass Industry Group Co., Ltd.

- Nippon Sheet Glass Co., Ltd.

- Tecnoglass, Inc.

- Vitro, S.A.B. de C.V.

- Xinyi Glass Holdings Limited

- YKK AP Inc.

Implementing advanced digital, sustainability, and supply-chain strategies to secure competitive agility and long-term service excellence

To navigate the evolving glass installation landscape, industry leaders should prioritize investment in digital integration, deploying advanced project management and BIM platforms to optimize workflows and enhance cross-disciplinary collaboration. Strengthening supply chain resilience is equally critical; proactive diversification of glass sourcing-through regional fabricators and vertically integrated partnerships-can insulate operations from escalating tariff burdens and shipping delays.

Cultivating technician expertise via structured certification programs will not only mitigate safety risks but also elevate service quality and client confidence. Embedding sustainability at the core of service offerings, such as adopting factory-prefabricated panel systems and participating in glass recycling consortia, will position providers to capitalize on tightening green building regulations. Furthermore, aligning early with architectural and engineering teams ensures seamless integration of installation requirements, reducing change orders and expediting project delivery.

Finally, a robust market intelligence practice-grounded in continuous monitoring of regulatory shifts, material innovations, and regional construction trends-will empower decision-makers to anticipate demand fluctuations and refine strategic priorities. By following these actionable recommendations, service organizations can bolster competitive advantage and lead with agility in a dynamically shifting environment.

Describing the comprehensive mixed-method research design that underpins robust insights and validates strategic conclusions

This analysis synthesizes insights drawn from a multifaceted research framework combining both primary and secondary methodologies. Primary data was collected through in-depth interviews with executive leadership at leading installation firms, senior engineers, and supply chain directors across North America, Europe, and Asia-Pacific. Field visits to active project sites provided contextual observation of installation practices and equipment utilization, while structured surveys with architectural and general contracting professionals enriched understanding of client expectations.

Secondary research encompassed a thorough review of industry journals, regional building code databases, and trade association publications, supplemented by academic case studies on advanced glazing systems. Regulatory filings, tariff schedules, and government incentive program documents were analyzed to trace policy impacts. Data triangulation techniques were applied to reconcile quantitative findings with qualitative insights, ensuring robust validation.

Segment definitions and classifications were established in consultation with subject matter experts, aligning with application, installation type, glass variety, and end-use categories pertinent to the sector. Regional delineations were informed by economic block memberships and prevailing construction regulations. This rigorous methodology underpins the reliability of conclusions and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Glass Installation Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Glass Installation Services Market, by Installation Type

- Glass Installation Services Market, by Glass Type

- Glass Installation Services Market, by Application

- Glass Installation Services Market, by End Use

- Glass Installation Services Market, by Region

- Glass Installation Services Market, by Group

- Glass Installation Services Market, by Country

- United States Glass Installation Services Market

- China Glass Installation Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing critical market dynamics and strategic imperatives to guide decision-makers toward informed investments and sustainable growth in glass installations

The glass installation services industry stands at the nexus of technological innovation, regulatory evolution, and sustainability imperatives. As digital tools redefine project coordination and advanced glazing materials raise performance expectations, service providers are compelled to adapt swiftly and invest in specialized capabilities. Concurrently, the ripple effects of cumulative tariff measures underscore the necessity of supply chain diversification and closer manufacturer alliances.

Segmentation analysis reveals nuanced service demands across automotive, commercial, and residential applications, highlighting opportunities to tailor solutions for new construction and retrofit scenarios alike. Regional dynamics underscore the importance of localized expertise, whether navigating EU energy mandates, capitalizing on Asia-Pacific urbanization, or addressing retrofit volumes in the Americas.

Key market leaders demonstrate the value of integrated service models, technician certification, and sustainability initiatives in driving differentiation. By adopting the actionable recommendations outlined-embracing digital integration, bolstering supply chain resilience, and prioritizing environmental considerations-organizations can position themselves at the forefront of a rapidly evolving landscape. This executive summary serves as a strategic compass, guiding decision-makers toward informed investments and long-term growth.

Unlock exclusive data sets and customized strategic insights by contacting Ketan Rohom to elevate your glass installation services intelligence

To secure an in-depth analysis of the glass installation services market and gain access to exclusive forecasts, customized data sets, and comprehensive strategic insights, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan is poised to guide you through tailored offerings that align with your organizational priorities and ensure you receive the precise information needed to inform critical business decisions. Engage with Ketan to explore premium add-ons, country-level deep dives, and bespoke consulting packages designed to elevate your competitive advantage. Don’t miss this opportunity to leverage cutting-edge intelligence and position your company for sustained success in a rapidly evolving industry

- How big is the Glass Installation Services Market?

- What is the Glass Installation Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?