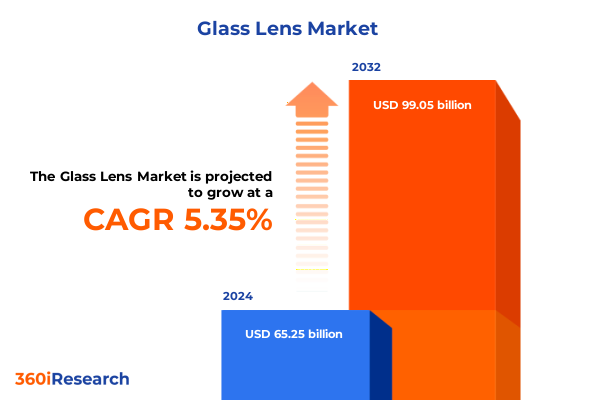

The Glass Lens Market size was estimated at USD 68.59 billion in 2025 and expected to reach USD 72.10 billion in 2026, at a CAGR of 5.38% to reach USD 99.05 billion by 2032.

Setting the Stage for Optical Innovation and Market Dynamics in the Global Glass Lens Industry through a Comprehensive Executive Overview

The global glass lens landscape has entered an era defined by rapid technological convergence and evolving end-use demands. Companies are transitioning from traditional manufacturing paradigms into integrated ecosystems where optical design, advanced materials science, and digital innovation intersect. In this complex environment, stakeholders require a strategic compass that distills multifaceted trends into clear, actionable insights. This executive summary serves as that compass, offering a concise yet powerful overview of the forces shaping the industry’s present and future trajectories.

Beginning with an exploration of transformative shifts, we identify how breakthroughs in material formulations and precision manufacturing are unlocking new performance thresholds. This is followed by an analysis of the cumulative impact that recent United States trade policies have had on cost structures, supply chain strategies, and market positioning. Further sections illuminate critical market segmentation by end use, lens type, material grade, distribution channel, and coating approaches, revealing where demand is intensifying and innovation is most concentrated.

Regional dynamics receive focused attention, highlighting how differentiated regulatory environments and customer preferences are driving distinct growth patterns across the Americas, Europe, Middle East & Africa, and the Asia-Pacific. In parallel, competitive intelligence on leading companies uncovers the strategic initiatives that define market leadership. Finally, we offer targeted recommendations, outline our rigorous research methodology, and present a succinct conclusion that ties together key imperatives for decision-makers.

Navigating the Cutting Edge of Optical Breakthroughs and Material Innovations Shaping the Future of Glass Lens Applications across Industries

The glass lens industry stands at a pivotal juncture fueled by a series of groundbreaking technological and material advancements. High-precision aspherical and freeform optics are enabling more compact and efficient camera modules, catering to the demands of augmented reality devices and advanced driver assistance systems. Simultaneously, breakthroughs in nano-coating processes are delivering next-generation anti-reflective, hydrophobic, and scratch-resistant properties, significantly extending component lifespans in harsh environments.

Moreover, the integration of sophisticated simulation tools and AI-driven optical design platforms is accelerating product development cycles, allowing companies to iterate designs virtually before committing to high-cost tooling. This digital transformation streamlines prototyping, reduces time to market, and enhances the accuracy of performance predictions. Meanwhile, additive manufacturing techniques are being explored for rapid tooling and small-batch production, offering greater flexibility for customized optics in defense, aerospace, and medical specialties.

Additionally, environmental considerations are reshaping material selection and process footprints. Manufacturers are increasingly adopting borosilicate and high-index glasses with lower embodied energy, while exploring recyclable coatings to align with broader sustainability mandates. Strategic partnerships between glass producers, coating specialists, and system integrators are emerging to foster end-to-end innovation ecosystems. Consequently, these converging trends are not only redefining product capabilities but also establishing a new competitive paradigm where speed, sustainability, and digital proficiency are non-negotiable virtues.

Assessing the Trade Policy Ripple Effects of United States Tariffs on Glass Lens Supply Chains and Cost Structures in 2025

The imposition of elevated duties on select glass and optical components by the United States in early 2025 has produced far-reaching consequences for both domestic manufacturers and global suppliers. Elevated import costs have compelled original equipment manufacturers and distributors to revisit sourcing strategies, with many exploring nearshoring options and increased local content integration to hedge against tariff exposure. This strategic shift has triggered investments in domestic capacity expansion, particularly among specialty glass producers and precision optics fabricators.

Concurrently, supply chain partners have intensified collaboration to mitigate volatility. Contract terms now routinely include tariff-adjustment clauses and multi-tiered sourcing commitments, ensuring that any sudden policy alterations do not disrupt production schedules. Increased lead times and cost pass-through mechanisms have also influenced downstream pricing strategies, requiring sales teams to adopt more transparent, value-based dialogue with end-users. In response, service providers are enhancing total cost of ownership models to justify premium pricing by demonstrating reliability and reduced risk.

Furthermore, the desire to minimize tariff impacts has accelerated the adoption of advanced manufacturing automation. Automated polishing, inspection, and coating lines enable on-shore producers to maintain cost competitiveness despite higher duties. As a result, resilient network designs are emerging, blending regional manufacturing hubs with agile logistics corridors. In essence, the 2025 tariff landscape has galvanized the industry to embrace integrated, risk-aware strategies that will reverberate well beyond immediate cost pressures.

Illuminating Market Dynamics through End Use, Lens Type, Material Grade, Distribution Channel, and Coating Segmentation Strategies

When viewed through the lens of end use, the market spans automotive applications ranging from advanced driver assistance systems and lidar sensors to rear-view cameras, and extends into consumer electronics such as smartphones, surveillance cameras, digital cameras, and augmented reality devices. The healthcare and life sciences sector drives demand for precision optics in endoscopy, medical imaging, and surgical tools, while industrial applications emphasize durability and cost efficiency under harsh operating conditions.

Equally impactful is the distinction among lens types: aspherical designs are prized for aberration correction in compact assemblies, cylindrical geometries find favor in beam shaping and line-scan systems, and Fresnel variants are essential to projection platforms and solar concentration modules. Planar optics underpin imaging windows and cover glasses, whereas traditional spherical shapes remain prevalent across general-purpose applications.

Material grade further influences performance and manufacturability. Borosilicate glass is widely adopted for high thermal stability, crown glass balances optical clarity with cost effectiveness, flint glass offers enhanced refractive indices for complex lens stacks, and premium high-index formulations enable slimmer profiles in consumer and automotive optics.

In distribution, direct sales channels cater to large-volume, aftermarket, and OEM customers with tailored service agreements, while distributors bridge mid-tier manufacturers with local markets. Online retail platforms, including specialized e-commerce sites and proprietary manufacturer portals, are growing in importance for rapid order fulfillment and small-batch customization.

Coating strategies round out segmentation insights. Anti-reflective treatments, whether multilayer or single-layer, are critical to reducing signal loss in imaging systems. Hydrophobic and oleophobic finishes improve lens cleaning in outdoor and surgical use cases, and scratch-resistant layers enhance durability in aggressive industrial environments.

This comprehensive research report categorizes the Glass Lens market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Lens Type

- Material Grade

- Coating Type

- End Use Industry

- Distribution Channel

Unveiling Regional Growth Patterns and Strategic Opportunities across Americas, Europe Middle East Africa, and Asia Pacific Markets

Across the Americas, the United States remains a nucleus for innovation in automotive lidar, smartphone camera modules, and medical imaging applications. Leading research universities and government partnerships fuel a cycle of continuous improvement, and local manufacturing incentives have catalyzed new production lines for precision glass and automated coating facilities. Canada and Mexico complement this ecosystem by providing cost-effective fabrication services and specialized component assembly, creating a dynamic North American value chain.

In Europe, Middle East and Africa, stringent regulatory frameworks around product safety, environmental emissions, and data security shape market priorities. European manufacturers focus on high-performance optics for aerospace and defense, leveraging advanced materials and digital design to meet rigorous certification standards. Meanwhile, Middle Eastern investments in smart city initiatives and African healthcare infrastructure are driving demand for robust surveillance optics and portable medical imaging solutions, underscoring diverse regional growth vectors.

Asia-Pacific continues to be the world’s largest production base for glass lens components, home to leading equipment makers, high-volume fabricators, and global electronics assembly hubs. China, Japan, South Korea, and Taiwan dominate mass production of molded and ground optics, while emerging markets such as India, Southeast Asia, and Australia are investing in domestic capabilities to capture higher-value segments. The interplay between cost competitiveness, technological expertise, and evolving end-market requirements renders the Asia-Pacific region both a critical supplier and a fast-rising consumer market.

This comprehensive research report examines key regions that drive the evolution of the Glass Lens market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Competitive Leadership and Innovation Strategies of Leading Global Glass Lens Manufacturers and Optical Solution Providers

Global technology leaders and specialized optics firms alike are racing to establish competitive moats through vertical integration, advanced materials portfolios, and digital service offerings. Legacy glass producers have expanded beyond raw substrate supply, now offering in-house precision grinding, coating, and assembly services to capture greater value. In parallel, optical component specialists are forging partnerships with system integrators in automotive, consumer electronics, and medical sectors to co-develop tailored solutions that address stringent performance requirements.

Notably, manufacturers with strong intellectual property in aspherical and high-index glass formulations are leveraging licensing models to accelerate market adoption, while also collaborating with AI design platform providers to enhance simulation accuracy. Meanwhile, companies with proprietary nano-coating technologies are differentiating on functional performance, delivering ultra-thin hydrophobic and anti-reflective layers that unlock new optical architectures. Strategic acquisitions have further reshaped the competitive arena, with established players bolstering their digital design and automation capabilities by integrating start-ups specializing in machine-vision inspection and additive tooling.

At the distribution level, leading channel partners are adopting platform-based approaches, combining online configurators with real-time inventory visibility and rapid logistics execution. This trend empowers end-users to streamline procurement, accelerate prototype validation, and scale production with minimal administrative overhead. In essence, the interplay of manufacturing excellence, digital innovation, and integrated service models is defining who will lead tomorrow’s glass lens market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Glass Lens market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asahi Glass Co., Ltd.

- BelOMO Optical LLC

- Carl Zeiss AG

- Century Optical Co., Ltd.

- EssilorLuxottica S.A.

- Fujitsu Optical Components Co., Ltd.

- HOYA Corporation

- Hoya Lens Vietnam Co., Ltd.

- Kurtz Marble & Scott Optical LLC

- Largan Precision Co., Ltd.

- Nikon Corporation

- Ohara Inc.

- OptoTech GmbH

- Rodenstock GmbH

- Schott AG

- Seiko Epson Corporation

- Seiko Optical Products Co., Ltd.

- Shenzhen Lingxu Optical Co., Ltd.

- Sumita Optical Glass, Inc.

- Sunny Optical Technology (Group) Co., Ltd.

- Tokai Optical Co., Ltd.

- Toyo Optical Co., Ltd.

- Vision Ease Lens LLC

- Younger Optics, Inc.

- Zhenjiang Jiacheng Glass Lens Co., Ltd.

Empowering Industry Stakeholders with Strategic Roadmaps for Supply Chain Resilience, Technological Advancement, and Sustainable Growth in Glass Lens Market

Leaders seeking to thrive in this dynamic landscape should prioritize the diversification of their supply networks by establishing regional manufacturing nodes and multi-source partnerships. By blending on-shore and near-shore capacity with strategic offshore providers, companies can mitigate tariff exposure, optimize lead times, and ensure supply continuity under shifting policy regimes. Additionally, investment in end-to-end automation-from optical design to final inspection-will drive cost efficiency and accommodate fluctuating order volumes without compromising quality.

Furthermore, organizations should intensify collaboration with material science innovators to co-create new glass compositions and eco-friendly coatings. This collaborative model accelerates go-to-market cycles and delivers differentiated performance attributes that can command premium positioning. At the same time, integrating AI-powered simulation and predictive maintenance platforms will enhance design validation, reduce scrap rates, and support proactive equipment calibration, safeguarding throughput in high-precision fabrication lines.

Equally important is the cultivation of customer-centric digital experiences. Deploying online configuration tools, interactive sampling workflows, and direct-to-end-user support portals not only streamlines procurement but also captures valuable data on usage patterns. Such insights can inform product roadmaps and service models, driving continuous improvement and fostering deeper customer loyalty. Ultimately, a holistic strategy that balances operational resilience, technological leadership, and user engagement will position industry participants for sustainable success.

Detailing Rigorous Qualitative and Quantitative Research Methods, Data Triangulation, and Expert Validation Processes Utilized in Study

This study integrates both qualitative and quantitative research methodologies to ensure the robustness and reliability of its findings. Secondary research was conducted through exhaustive reviews of technical journals, patent filings, industry white papers, and regulatory filings to map historical trends and technological trajectories. Primary research involved confidential interviews with executives, engineers, and procurement specialists across end-use industries, enabling the capture of firsthand insights on emerging requirements and strategic priorities.

Data triangulation was applied by cross-verifying information obtained from competitive intelligence platforms, public financial disclosures, and supply chain surveys. This multi-layered approach allowed for the identification of correlations between policy shifts, material innovations, and market adoption rates without relying on single data sources. Analytical frameworks such as SWOT assessments, Porter’s Five Forces, and scenario planning were employed to synthesize complex variables into clear strategic imperatives.

Rigorous expert validation workshops were held to refine findings and ensure that conclusions accurately reflect the nuanced realities of manufacturing constraints, regulatory influences, and evolving customer expectations. The resulting methodology blends academic rigor with practical industry acumen, delivering a holistic perspective that underpins each recommendation and insight presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Glass Lens market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Glass Lens Market, by Lens Type

- Glass Lens Market, by Material Grade

- Glass Lens Market, by Coating Type

- Glass Lens Market, by End Use Industry

- Glass Lens Market, by Distribution Channel

- Glass Lens Market, by Region

- Glass Lens Market, by Group

- Glass Lens Market, by Country

- United States Glass Lens Market

- China Glass Lens Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Key Insights and Strategic Imperatives to Guide Decision Makers in Navigating the Evolving Landscape of the Glass Lens Industry

Having navigated the pivotal technological transformations, policy disruptions, and nuanced segmentation drivers that define the glass lens market today, decision-makers are now equipped with a clear framework for strategic action. The convergence of advanced material science, precision manufacturing automation, and digital design tools demands a shift from reactive to proactive planning, ensuring that organizations can seize emerging opportunities before competitors.

Strategic imperatives include reinforcing supply chain agility through regional diversification and digital orchestration, harnessing collaborative innovation models with material and coating specialists, and elevating value propositions via customer-centric digital platforms. By synthesizing these insights, companies can refine their product roadmaps, optimize operational investments, and differentiate in crowded markets based on demonstrable performance advantages.

Ultimately, the capacity to integrate these strategic levers into coherent action plans will distinguish market leaders from laggards. As industry boundaries blur and cross-sector partnerships become commonplace, maintaining a forward-looking orientation-supported by rigorous data and adaptive capabilities-will be the hallmark of sustained competitive success in the evolving glass lens landscape.

Connect with Ketan Rohom to Access Exclusive Insights and Secure Your Comprehensive Glass Lens Market Research Report Today

To take the next step toward unlocking the most comprehensive and insightful analysis in the glass lens domain, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. With deep expertise in optical component markets and a track record of matching critical industry needs with tailored strategic intelligence, Ketan can guide you through detailed report features, bespoke data services, and premium advisory support. Connect today to secure immediate access to proprietary research that will equip your organization with the knowledge and competitive edge required in an increasingly complex landscape.

Ketan’s consultative approach ensures that your specific questions around technology adoption, supply chain resilience, and emerging end-use dynamics are addressed through customized deliverables. His team’s commitment to timely delivery and ongoing support will help you translate insights into actionable strategies that drive growth, optimize investments, and anticipate market shifts. Whether you are exploring new applications, evaluating partnership opportunities, or fortifying your product roadmap, a discussion with Ketan will set the stage for informed decision-making with unparalleled clarity.

- How big is the Glass Lens Market?

- What is the Glass Lens Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?