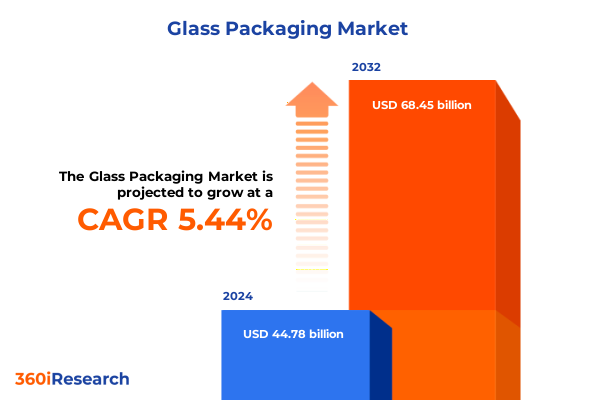

The Glass Packaging Market size was estimated at USD 47.10 billion in 2025 and expected to reach USD 49.55 billion in 2026, at a CAGR of 5.48% to reach USD 68.45 billion by 2032.

Elevating understanding of the glass packaging sector through a comprehensive overview of industry evolution competitive dynamics and strategic imperatives

Glass packaging has long stood as a paragon of durability, purity, and recyclability within multiple industries, encompassing everything from premium spirits to high-value pharmaceuticals. Its inert nature prevents chemical interaction, thereby preserving product integrity and extending shelf life without the need for additional preservatives. As evolving consumer expectations and stringent regulatory frameworks converge, glass packaging has only grown more essential, presenting a resilient option that aligns with strategic brand positioning. Moreover, it serves as a canvas for innovation, where surface treatments and decorative finishes enable brands to differentiate visually while maintaining functional performance.

In recent years, the landscape has been reshaped by an intensified focus on sustainability and environmental stewardship. Heightened scrutiny of plastic waste and an accelerated shift toward circular economy principles have driven manufacturers, brand owners, and legislators to reassess material choices. Concurrently, rapid advancements in production technologies-ranging from precision forming techniques to smart-label integration-have begun to redefine what glass packaging can deliver in terms of lightweighting and consumer engagement. Furthermore, the global regulatory environment continues to evolve, with new rules on recyclability and carbon footprint disclosure emerging as critical factors in strategic decision-making.

This executive summary offers a distilled yet comprehensive narrative of the glass packaging market, synthesizing key developments, tariff impacts, segmentation insights, regional differentials, competitive benchmarks, and actionable recommendations. Through a methodical approach that draws upon both primary stakeholder interviews and extensive secondary research, the following sections present an authoritative perspective on where the industry stands today and how it will navigate future challenges.

Navigating seismic transformations reshaping glass packaging through technological advancements consumer behaviors and sustainability imperatives driving market disruption

The glass packaging sector is experiencing transformative upheaval as sustainability ambitions, technological breakthroughs, and shifting consumer behaviors converge. New production methods have enabled lighter yet stronger containers, mitigating transportation costs and reducing carbon emissions. Precision forming technologies are now being complemented by digital printing and labeling solutions, providing unprecedented opportunities for on-demand customization that resonate with brand storytelling. As a result, packaging has transcended its traditional protective role and emerged as a strategic marketing asset, capable of driving consumer engagement at the point of purchase.

In parallel, the industry’s commitment to circular economy models is reshaping supply chain configurations. Advanced recycling infrastructures and closed-loop initiatives are gaining traction, leading to higher uptake of post-consumer recycled glass cullet in primary manufacturing. Simultaneously, collaborations among packaging converters, brand owners, and waste management firms are catalyzing system-level innovations, such as deposit return schemes and municipal sorting upgrades. Consequently, glass packaging is being recast not merely as a single-use item but as a continuously regenerative resource that supports broader environmental goals.

Finally, evolving consumer preferences are exerting considerable influence on product design and material selection. Heightened demand for transparency in ingredient sourcing and environmental footprint disclosures is prompting brands to integrate smart labeling technologies and traceability features directly onto glass surfaces. These mechanisms generate data-driven touchpoints throughout the consumer journey, facilitating interactive experiences via QR codes or embedded NFC tags. Collectively, these transformations illustrate a sector in dynamic flux, where market players must adeptly balance innovation, sustainability, and consumer appeal to maintain competitive advantage.

Analyzing the cumulative repercussions of the 2025 United States tariff enactments on glass packaging supply chains manufacturing costs and international trade competitiveness

The imposition of new United States tariffs in early 2025 has injected significant volatility into the glass packaging value chain. With additional duties levied on imported containers from key international suppliers, manufacturers relying on offshore production have encountered unexpected cost escalations. These newly applied measures have not only raised the landed cost of finished glass bottles, jars, and vials but also disrupted established procurement models. Consequently, many brand owners have been compelled to re-evaluate sourcing strategies and consider domestic or nearshored alternatives to preserve margin structures.

Moreover, the tariff-induced cost pressures have rippled upstream, influencing raw material markets and energy expenditures. Glass cullet, soda ash, and silica sand suppliers have adjusted pricing to reflect shifting demand patterns, while energy-intensive glass furnace operations have absorbed a degree of margin compression. In turn, some producers have accelerated investments in energy recovery technologies and alternative fuels to offset heightened production expenses. This strategic pivot underscores the broader need for resilience within manufacturing networks, as reliance on a narrow pool of suppliers can exacerbate exposure to trade policy fluctuations.

On the trade front, the tariffs have prompted certain brand owners to redirect international shipments through third countries with preferential trade agreements or negotiate tariff exemptions through product reclassification. These workarounds, however, introduce additional logistical complexity and may invite legal scrutiny. Consequently, companies are increasingly engaging trade compliance experts to navigate the evolving landscape. As the industry adjusts to this new tariff regime, sustained collaboration among supply chain stakeholders will be essential to mitigate disruption and safeguard long-term competitiveness.

Unveiling deep segmentation-driven insights illuminating how packaging type application glass composition and distribution channels influence strategic decision making across the value chain

A nuanced examination of market segmentation illuminates distinct performance trajectories across packaging type, application category, glass composition, and distribution channel. Within the domain of packaging type, bottles maintain a commanding presence, with differentiated volume ranges catering to large-scale industrial clients, medium-sized brand portfolios, and small-batch artisanal producers. Ampoules, vials, and tubes continue to support rigorous pharmaceutical standards, while jars remain integral to cosmetics formulations that demand aesthetic versatility.

Shifting to application categories, the beverage segment exemplifies complex stratification. Alcoholic offerings leverage premium glass designs for beer and wine and spirits, enhancing perceived value through specialized shapes and heavier weights, whereas non-alcoholic variants such as carbonated drinks and still beverages often prioritize lightweight formats for broader distribution efficiency. Food-grade containers, industrial packaging for chemicals, and strict pharmaceutical specifications each present unique performance and regulatory requirements that guide material selection and production techniques.

When considering glass type, borosilicate is prized for thermal resistance and chemical inertness in laboratory and high-temperature applications, while lead glass maintains a strong niche in premium decanters and collectible items that emphasize clarity and brilliance. Soda lime glass, by contrast, represents the workhorse of the industry, balancing cost-effectiveness with broad functional suitability across multiple end markets.

Finally, distribution channels exhibit markedly different dynamics. Offline channels such as modern trade offer large-volume contracts and established logistics networks, whereas traditional trade remains vital for regional and local brand penetration. Online channels, including direct-to-consumer platforms, provide brands unparalleled control over packaging customization and consumer data capture, while third-party e-commerce retailers extend reach to digitally native audiences. Together, these segments underscore the importance of a tailored approach to product design and go-to-market strategy.

This comprehensive research report categorizes the Glass Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Type

- Application

- Glass Type

- Distribution Channel

Exploring critical regional differentials across Americas Europe Middle East Africa and Asia Pacific highlighting unique drivers challenges and growth opportunities in glass packaging

Regional dynamics in the glass packaging market reveal stark contrasts in regulatory momentum, consumer behavior, and infrastructure readiness across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, progressive state-level legislation and robust recycling frameworks have cultivated an environment where circular economy initiatives flourish. Brand owners are leveraging these policies to promote recycled content claims, while packaging converters optimize production lines to maximize cullet incorporation. In parallel, rising consumer demand for craft beverages and premium spirits continues to drive innovation in bottle shape and finish.

Across Europe, Middle East & Africa, strict European Union directives regarding packaging waste and extended producer responsibility have set a benchmark for sustainability practices. Deposit return schemes in northern Europe and tightening waste collection targets in key markets compel manufacturers to redesign packaging for ease of sorting and recycling. Meanwhile, Middle Eastern markets present both challenges in logistics and opportunities in luxury glassware, with high-end hospitality sectors fueling demand for bespoke decanters and artisanal vials.

In Asia Pacific, rapid urbanization and expanding middle-income populations underpin escalating consumption of both alcoholic and non-alcoholic beverages. China and India, in particular, have emerged as hotspots for glass container demand, yet infrastructural bottlenecks in recycling systems temper full circularity ambitions. E-commerce adoption is reshaping distribution models, encouraging manufacturers to explore lightweight and stackable designs that optimize shipping economics across extensive geographies. Collectively, these regional insights emphasize the importance of flexible production strategies and market-specific sustainability roadmaps.

This comprehensive research report examines key regions that drive the evolution of the Glass Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading stakeholders in the glass packaging arena to reveal competitive strengths strategic focus areas and innovation leadership shaping the market’s future landscape

A survey of leading industry participants reveals differentiated strategic priorities and innovation pathways. One prominent global container producer has concentrated on retrofitting existing furnace assets with electric boosting technology, effectively lowering greenhouse gas emissions and enhancing energy efficiency. Another major player has forged partnerships with brand owners in the beverage sector to pilot smart-label applications that deliver traceability and consumer engagement, capitalizing on the convergence of digital and physical packaging.

Meanwhile, specialized glassmakers focusing on pharmaceutical requirements have deepened investments in borosilicate research, introducing proprietary formulations that withstand extreme thermal cycling without compromise. Concurrently, family-owned regional converters are expanding capacity to meet growing demand for premium cosmetics jars, emphasizing artisanal craftsmanship alongside scalable output. All the while, pure-play specialty firms targeting high-end decanters and collectible items continue to leverage small-batch production capabilities, catering to luxury hospitality and collector markets.

Collectively, these corporate initiatives illuminate a competitive environment where sustainability commitments, technological partnerships, and market-specific expertise define leadership. As companies navigate tariffs, evolving regulations, and shifting consumer preferences, their strategic choices will fundamentally shape the trajectory of glass packaging innovation in the years ahead.

This comprehensive research report delivers an in-depth overview of the principal market players in the Glass Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGI Glaspac

- Ardagh Group S.A.

- BA Vidro S.A.

- Beatson Clark Group Ltd.

- C.B. Glass N.V.

- Gerresheimer AG

- Heinz-Glas GmbH & Co. KGaA

- Hindusthan National Glass & Industries Ltd.

- Nihon Yamamura Glass Co., Ltd.

- Owens-Illinois México S.A. de C.V.

- Owens-Illinois, Inc.

- Piramal Glass Ltd.

- Saint-Gobain S.A.

- Saverglass S.A.S.

- SGDP S.A.

- Stölzle Glass Group AG

- Toyo Seikan Group Holdings, Ltd.

- Verallia S.A.

- Vetropack Holding AG

- Vidrala S.A.

- Vidroporto S.A.

- Vitro S.A.B. de C.V.

- Wiegand-Glas Group GmbH

- Zignago Vetro S.p.A.

- Şişecam

Delivering actionable strategic imperatives that industry leaders can implement to capitalize on emerging trends regulatory shifts and evolving consumer expectations within glass packaging

Industry leaders must rapidly align strategic priorities with the evolving demands of sustainability, consumer engagement, and supply chain resilience. Companies should explore investments in advanced cullet processing facilities and circular design practices to preempt emerging regulatory targets for recycled content. Such efforts can be complemented by collaborations with waste management entities to refine collection mechanisms and scale deposit return infrastructures, ensuring reliable feedstock for manufacturing operations.

Furthermore, brands and converters alike can leverage digital printing and smart labeling to create interactive packaging experiences. By embedding traceability features and consumer incentives directly onto glass surfaces, organizations not only bolster brand loyalty but also generate valuable data insights for continuous improvement. In parallel, a diversified sourcing strategy that incorporates domestic and nearshored production can mitigate exposure to volatile tariff regimes, while investments in energy recovery systems and alternative fuels strengthen operational resilience against cost disruptions.

Finally, forging cross-industry partnerships with technology providers, regulatory bodies, and supply chain stakeholders will be critical in co-creating standards that balance performance with environmental stewardship. Through a proactive approach that integrates innovation, collaboration, and strategic risk management, industry participants can position themselves to thrive amid the multifaceted transformations defining the glass packaging landscape.

Elucidating the rigorous research methodology underpinning this analysis including data collection approaches validation protocols and analytical frameworks ensuring robust findings

This analysis is underpinned by a rigorous research methodology designed to ensure depth, accuracy, and actionable clarity. The process commenced with in-depth interviews conducted with executives representing glass manufacturers, brand owners, and raw material suppliers, capturing firsthand perspectives on industry challenges and strategic priorities. These qualitative insights were systematically cross-referenced against published sustainability reports, tariff filings, and regulatory directives to validate emerging themes.

Subsequently, an extensive secondary research phase canvassed trade publications, patent databases, and industry white papers to contextualize technological advancements and material innovations. Regional regulatory frameworks were mapped through official government portals and deposit return scheme documentation, enabling a comparative analysis of sustainability obligations across key markets. Data points were triangulated to resolve discrepancies and reinforce confidence in the findings.

Finally, quantitative frameworks were developed to assess supply chain risk factors and segmentation dynamics, facilitating a structured interpretation of how packaging type, application category, glass composition, and distribution channel intersect to drive strategic decision-making. Validation workshops with subject-matter experts served to refine conclusions and ensure that recommendations reflect the complex realities governing the glass packaging industry today.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Glass Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Glass Packaging Market, by Packaging Type

- Glass Packaging Market, by Application

- Glass Packaging Market, by Glass Type

- Glass Packaging Market, by Distribution Channel

- Glass Packaging Market, by Region

- Glass Packaging Market, by Group

- Glass Packaging Market, by Country

- United States Glass Packaging Market

- China Glass Packaging Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Drawing conclusive reflections on the state of the glass packaging industry and articulating strategic foresight to guide stakeholders through ongoing market evolution and transformation

The glass packaging industry stands at an inflection point characterized by accelerating sustainability mandates, emergent digital capabilities, and geopolitical uncertainties. As tariff pressures reshape procurement strategies, companies must adapt their sourcing networks and accelerate adoption of recycling-centric models. Similarly, the evolution of consumer expectations around transparency and personalization underscores the necessity for smart-label solutions and differentiated design.

Moreover, the intricate segmentation of packaging types, applications, glass types, and distribution channels points to an increasingly complex decision matrix for industry stakeholders. Strategic focus on high-value segments such as pharmaceuticals and premium beverage containers can yield competitive advantage, while flexibility in modern trade and e-commerce distribution strategies will be key to meeting diverse consumer demands across regions.

Looking ahead, those organizations that proactively embrace circular economy principles, leverage technological partnerships, and maintain agile supply chains will be best positioned to flourish. By integrating the insights and recommendations presented here, decision-makers can navigate the dynamic glass packaging landscape with confidence and foresight.

Seize the opportunity now to access in depth glass packaging market insights and connect directly with Ketan Rohom for tailored guidance and report acquisition

To secure comprehensive expert analysis tailored to your strategic objectives and gain immediate access to the full report on glass packaging, you are invited to connect with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Engage directly to explore customized insights, discuss specialized market opportunities, and finalize your purchase for a deeper understanding of the forces shaping this dynamic industry

- How big is the Glass Packaging Market?

- What is the Glass Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?