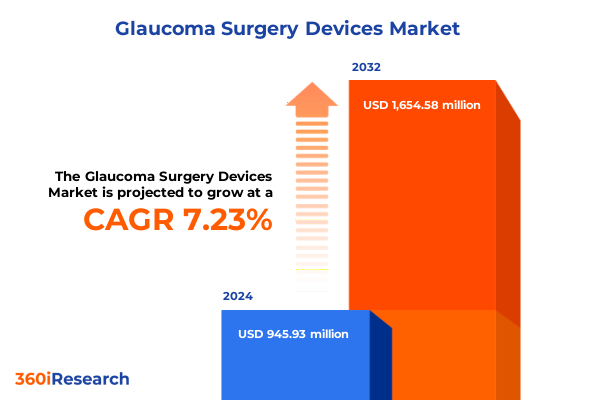

The Glaucoma Surgery Devices Market size was estimated at USD 1.00 billion in 2025 and expected to reach USD 1.06 billion in 2026, at a CAGR of 7.40% to reach USD 1.65 billion by 2032.

Understanding the Critical Role and Expanding Horizon of Glaucoma Surgery Devices Amid Rising Disease Prevalence and Technological Evolution

Glaucoma remains one of the leading causes of irreversible blindness worldwide, characterized by the progressive damage of the optic nerve due to elevated intraocular pressure. In the United States alone, an estimated 4.22 million adults were living with glaucoma in 2022, with 1.49 million individuals experiencing vision-affecting disease stages that demand timely intervention. The chronic nature of glaucoma, coupled with its asymptomatic early progression, underscores the critical need for both early detection and effective surgical solutions. As the global population ages, the prevalence of glaucoma is projected to rise, placing increasing pressure on healthcare systems to adopt advanced surgical approaches capable of preserving vision and enhancing patient quality of life.

Revolutionary Shifts in Glaucoma Management Marked by the Surge of Minimally Invasive Techniques and Regulatory Momentum

The landscape of glaucoma management has undergone a profound transformation as minimally invasive glaucoma surgery (MIGS) techniques have gained widespread acceptance. Landmark evidence, such as the LIGHT trial demonstrating selective laser trabeculoplasty’s superiority over topical medications for newly diagnosed patients, catalyzed clinical guideline updates in Europe and North America and fueled broader adoption of laser-based interventions. Concurrently, changes in reimbursement frameworks-most notably the introduction of separate Medicare payments for standalone MIGS and laser procedures-have incentivized surgeons to integrate these less invasive modalities into outpatient settings, accelerating case volumes in ambulatory surgery centers and ophthalmic clinics. This shift has not only lowered the technical barrier for community ophthalmologists but has also redefined the standard of care by offering safer, faster, and more patient-friendly alternatives to traditional filtering operations.

Assessing the Far-Reaching Implications of the 2025 United States Tariff Measures on Global Glaucoma Surgery Device Supply Chains

In April 2025, the United States implemented a sweeping tariff package that introduced a universal 10% import duty on medical devices, effectively eliminating prior duty-free status for many glaucoma surgery implants and equipment. Under this program, reciprocal tariffs on exports from the European Union were set at 20%, while Japan faced a 24% duty and China was subjected to a punitive total tariff rate of 54%. Although pharmaceuticals received limited exemptions due to successful lobbying, glaucoma drainage implants, microstents, surgical lasers, and related consumables were fully exposed to these new levies. Moreover, Canada and Mexico, initially excluded from reciprocal measures, were separately penalized with 25% tariffs as part of broader trade disputes.

Illuminating Key Segmentation Perspectives to Unlock Targeted Growth Pathways Across Procedures Devices End Users and Distribution Channels

The glaucoma surgery devices market is intricately structured along multiple dimensions that direct development priorities and commercialization strategies. Procedurally, operators differentiate between conventional surgeries-such as trabeculectomy, tube shunts, and glaucoma drainage implants-and microinvasive techniques that leverage internal ablation or bypass approaches, exemplified by IStent, Kahook Dual Blade, Trabectome, and XEN Gel Stent solutions. This procedural segmentation highlights divergent risk and learning curves, shaping hospital and outpatient clinic investment decisions. From a product standpoint, the market is divided into laser devices, shunts, stents, and surgical blades, with each category further refined by subtypes including argon and selective lasers, Ahmed valves, Baerveldt and Molteno implants, Hydrus microstent, and specialty blade instruments. These device classifications guide R&D pipelines and inform targeted clinical education.

This comprehensive research report categorizes the Glaucoma Surgery Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Procedure

- Device

- End User

- Distribution Channel

Exploring Regional Dynamics Shaping the Glaucoma Surgery Devices Landscape in the Americas EMEA and Asia Pacific

Geographical market performance underscores distinct regional dynamics that influence technology adoption and commercial priorities. In the Americas, the United States commands the largest global share, benefitting from advanced reimbursement environments and robust hospital and ambulatory surgery center infrastructures that facilitate rapid uptake of both MIGS and laser platforms. Europe, Middle East & Africa follow closely, though reimbursement variability and the availability of trained specialists produce uneven adoption rates across nations. Regulatory frameworks in the European Union emphasize cost-effectiveness and long-term outcomes, which has driven interest in innovations like sustained-release intracameral implants but tempered high-volume procedural growth in certain markets. Meanwhile, Asia-Pacific is emerging as the fastest-growing region, spurred by rising geriatric and diabetic populations in China and India, expanding ophthalmic clinic networks, and proactive government investments in healthcare modernization.

This comprehensive research report examines key regions that drive the evolution of the Glaucoma Surgery Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Drivers Delivering the Next Wave of Breakthrough Glaucoma Surgery Device Solutions

The competitive landscape of glaucoma surgery devices is led by a cohort of global and specialized firms that are strategically investing in next-generation platforms and value-added ecosystems. Alcon has broadened its portfolio through acquisitions, such as the mid-2024 integration of a direct-selective laser trabeculoplasty system, and continues to leverage its Hydrus microstent franchise while advancing its Voyager DSLT algorithmic targeting technology. Glaukos remains a core innovator with the standalone approval of its iStent Infinite in early 2024, enabling treatment beyond cataract-combined indications and cementing its position in standalone MIGS markets. Johnson & Johnson Vision has bolstered its offering through strategic partnerships and an expanding range of aqueous shunts and goniotomy devices, while Santen and Bausch + Lomb are strengthening their pipelines with novel implant designs and proprietary drug-eluting delivery systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Glaucoma Surgery Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Alcon Inc.

- Bausch + Lomb Corporation

- Beaver-Visitec International

- Carl Zeiss Meditec AG

- Ellex Medical Lasers Ltd.

- Glaukos Corporation

- iSTAR Medical SA

- Ivantis, Inc.

- Johnson & Johnson Vision

- Lumenis Ltd.

- MicroSert LLC

- New World Medical, Inc.

- Santen Pharmaceutical Co., Ltd.

- Sight Sciences, Inc.

Actionable Strategic Imperatives for Industry Leaders to Navigate Market Disruption Maximize Innovation and Strengthen Competitive Advantage

In response to escalating tariff pressures, manufacturers should proactively diversify their supply chains by establishing dual-source arrangements in low-tariff jurisdictions and pursuing industry-wide exceptions through strategic advocacy with trade organizations. This approach will mitigate cost volatility and safeguard margins while preserving patient access to critical devices. Concurrently, medical technology companies must deepen collaborations with ophthalmic societies and Medicare administrative contractors to shape favorable reimbursement pathways for emerging minimally invasive and laser-based procedures. By partnering on real-world evidence generation and clinical registries, stakeholders can accelerate favorable coverage decisions and ensure that surgeons receive appropriate compensation for innovative techniques. Finally, industry leaders are advised to prioritize expansion into high-growth Asia-Pacific markets by tailoring product portfolios for ambulatory surgery centers, fostering direct sales channels alongside digital platforms, and equipping third-party distributors with robust training tools to support localized sales and technical adoption.

Detailing a Rigorous Multi-Method Research Methodology for Unbiased Insights Into Glaucoma Surgery Device Market Trends

This analysis is grounded in a multi-method research framework designed to deliver rigorous, unbiased insights into the global glaucoma surgery devices market. The initial phase involved exhaustive secondary research, encompassing scientific literature, regulatory filings, company investor materials, and public trade databases to map the competitive landscape and identify emerging technological trends. Key regulatory decisions-such as the FDA clearance of new microstent platforms-and tariff announcements by the Office of the U.S. Trade Representative were meticulously documented to ensure timely relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Glaucoma Surgery Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Glaucoma Surgery Devices Market, by Procedure

- Glaucoma Surgery Devices Market, by Device

- Glaucoma Surgery Devices Market, by End User

- Glaucoma Surgery Devices Market, by Distribution Channel

- Glaucoma Surgery Devices Market, by Region

- Glaucoma Surgery Devices Market, by Group

- Glaucoma Surgery Devices Market, by Country

- United States Glaucoma Surgery Devices Market

- China Glaucoma Surgery Devices Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Concluding Reflections on the Evolving Glaucoma Surgery Devices Arena and the Imperative to Embrace Future Innovations

The evolution of glaucoma surgical care reflects a broader shift toward less invasive, more patient-centric interventions supported by technological advances, convergent regulatory support, and strategic reimbursement adaptations. Traditional filtrating procedures remain essential for advanced disease stages, yet the expanding portfolio of microinvasive options is redefining treatment algorithms and enabling earlier intervention. Strategic engagement with policy stakeholders, targeted innovation investments, and geographic expansion into dynamic markets will be essential for sustaining growth and delivering improved clinical outcomes across diverse healthcare settings.

Secure Your Strategic Advantage Today by Connecting With Ketan Rohom to Acquire the Comprehensive Glaucoma Surgery Devices Market Research Report

To delve deeper into these critical insights and secure a strategic advantage in the rapidly evolving glaucoma surgery devices arena, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. Engaging with Ketan will provide you with a personalized overview of the comprehensive market research report, tailored to your organization’s unique needs. Whether you are seeking detailed segmentation data, in-depth competitive analyses, or actionable forecasts on regional growth dynamics, Ketan is ready to guide you through the report’s findings and demonstrate how they can inform your strategic planning and investment decisions. Don’t miss this opportunity to equip your team with the industry intelligence required to navigate market disruptions, optimize product portfolios, and accelerate innovation. Contact Ketan Rohom today to secure your copy of the definitive glaucoma surgery devices market research report and set the course for sustainable growth and competitive leadership.

- How big is the Glaucoma Surgery Devices Market?

- What is the Glaucoma Surgery Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?