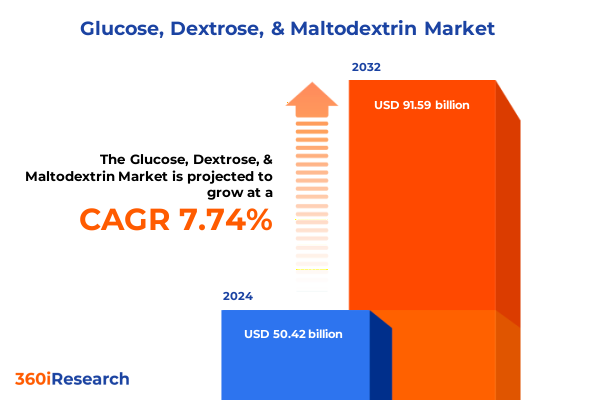

The Glucose, Dextrose, & Maltodextrin Market size was estimated at USD 54.30 billion in 2025 and expected to reach USD 58.24 billion in 2026, at a CAGR of 7.75% to reach USD 91.59 billion by 2032.

Introduction to the dynamic landscape of glucose, dextrose, and maltodextrin unlocking insights into definitions applications and market potential

The global ingredients sector has experienced a paradigm shift driven by evolving consumer preferences, regulatory pressures, and technological breakthroughs. Within this dynamic milieu, glucose, dextrose, and maltodextrin stand out as versatile carbohydrate sources that power a myriad of applications across food and beverage, nutraceuticals, pharmaceuticals, and beyond. At their core, these ingredients encapsulate a spectrum of functional attributes-from sweetness modulation to textural enhancement and shelf stability-that underpin countless formulations.

Concurrently, sustainability mandates and clean-label trends have amplified the demand for naturally derived, non-GMO, and traceable sugar alternatives, thrusting developers into an innovation race. Meanwhile, advancements in enzymatic hydrolysis and refined purification processes have unlocked new opportunities to tailor molecular weight distributions and dextrose equivalent values, enhancing performance in targeted end uses. As consumer awareness heightens around health impacts of added sugars and glycemic response, industry players are recalibrating their portfolios, forging partnerships with bioprocessing pioneers, and pivoting to next-generation carbohydrate platforms.

Against this backdrop, it is essential for stakeholders to grasp the foundational characteristics of each ingredient type, understand key drivers of adoption across segments, and anticipate how regional policy developments-most notably the United States tariff regime-will reshape supply chains. This introduction lays the groundwork for a nuanced exploration of market transformations, policy headwinds, and strategic imperatives guiding the future trajectory of the glucose, dextrose, and maltodextrin landscape.

Revolutionary technological and consumer driven shifts are reshaping how carbohydrate ingredients deliver functionality purity and sustainability benefits

In recent years, the glucose, dextrose, and maltodextrin market has been redefined by transformative forces arising from consumer health consciousness, digitized supply chains, and sustainability imperatives. As clean-label and functionality combine to dictate purchasing decisions, formulators are leveraging advanced enzymatic hydrolysis to deliver precisely engineered carbohydrate profiles that satisfy both performance and labeling criteria. This shift has catalyzed the development of specialized product offerings that align with evolving nutritional standards and regulatory frameworks globally.

Beyond processing innovations, digital traceability solutions have vaulted to the forefront, enabling provenance tracking from field to factory. Blockchain and IoT integration now facilitate real-time quality assurance, thereby reinforcing consumer trust in origin transparency and safety standards. At the same time, the industry’s heightened focus on circular economy principles has spurred investments in waste valorization-repurposing byproducts of starch extraction into value-added maltodextrin streams, reducing environmental footprint, and driving cost efficiencies.

Taken together, these transformative shifts have not only broadened the functional utility of glucose-based ingredients but also reoriented business models toward co-innovation ecosystems. Collaborative partnerships among ingredient suppliers, bioprocessing technology firms, and end-use brand owners are now commonplace, fueling product differentiation and reinforcing resilience against regulatory and raw material volatility.

Comprehensive evaluation of the extended 2025 United States tariff structure reveals multifaceted effects on cost models feedstock sourcing and manufacturing strategies

The introduction of expanded tariff measures in 2025 has fundamentally altered the cost calculus for stakeholders in the United States carbohydrate ingredients market. By imposing duties on imported sugar and starch derivatives, policy makers aimed to protect domestic agriculture yet inadvertently injected volatility into upstream raw material sourcing. Producers reliant on imported corn starch for enzymatic hydrolysis faced immediate cost escalations, prompting a reevaluation of supplier portfolios and procurement strategies. Simultaneously, the increased duties on specialty glucose syrups have compressed margins for formulators in high-growth segments such as confectionery and nutraceutical beverages.

In response, many ingredient manufacturers accelerated capacity expansions at domestic facilities, reallocating investments to optimize economies of scale and mitigate import exposure. This strategic pivot, however, triggered competitive friction as overcapacity risks weighed on pricing power. Furthermore, cross-border trade adjustments prompted by the new tariff structure have spurred a shift toward alternative feedstocks, including cassava and wheat, elevating the importance of flexible processing infrastructure and agile supply chain networks.

Overall, the cumulative impact of the 2025 tariff regime extends beyond immediate price adjustments, influencing long-term strategic planning around plant location, feedstock diversification, and collaborative ventures. Companies that have proactively navigated these headwinds by enhancing domestic integration and establishing dual-sourcing frameworks are now better positioned to capitalize on market growth while sustaining resilience against future policy shifts.

In depth segmentation analysis demonstrates how multifaceted product types forms grades processes packaging applications and channels drive differentiated demand

A nuanced examination of market segmentation illuminates how product type, form, grade, process, packaging, application, and distribution pathways converge to shape demand patterns and competitive positioning. Across the product continuum of dextrose, glucose, and maltodextrin, manufacturers are aligning molecular weight profiles to deliver sweetening, bulking, or texturizing functionalities tailored to specific end uses. In powder and syrup formats alike, the choice between crystalline and liquid presentations is driven by processing considerations, handling efficiencies, and formulation compatibility. Grade considerations bifurcate offerings into food-level and pharmaceutical-grade tiers, reflecting divergent purity thresholds and regulatory requirements. Production methods further differentiate portfolios, as acid hydrolysis yields cost-effective base-level syrups, while enzymatic approaches unlock high-value specialty ingredients with precise dextrose equivalent specifications. Packaging options ranging from consumer-friendly sachets and premeasured bags to industrial drums and bulk shipments influence logistical strategies, shelf life management, and channel suitability. The broad spectrum of application segments-from animal feed enhancements and personal care formulations to complex multisensory food matrices in bakery, beverages, confectionery, dairy and frozen treats, nutraceutical bars, and savory snacks-underscores the adaptability of carbohydrate ingredients. Within each subcategory, such as bread, cakes, dairy drinks, fruit juices, gummies, or ice cream, the selection of a specific carbohydrate type hinges on functionality requirements, regulatory pathways, and cost optimization. Finally, distribution channels spanning direct sales, third-party distributors, and e-commerce platforms dictate go-to-market approaches, affecting lead times, margin structures, and customer relationships.

This comprehensive research report categorizes the Glucose, Dextrose, & Maltodextrin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Grade

- Process

- Packaging Type

- Application

- Distribution Channel

Comparative regional performance highlights divergent supply chain strengths regulatory drivers and consumer demand patterns across key global markets

Regional dynamics within the glucose, dextrose, and maltodextrin market reveal distinct growth trajectories shaped by local agricultural infrastructure, regulatory frameworks, and consumption patterns. In the Americas, a robust corn industry underpins vast domestic starch processing capacities, fostering integrated supply chains that support high-volume food and beverage production. The region’s escalating demand for clean-label formulations has also catalyzed innovations in non-GMO and traceable carbohydrate streams, with leading producers investing in joint ventures to bolster regional footprint and certification capabilities.

Within Europe, Middle East & Africa, stringent labeling laws and sugar reduction mandates have accelerated the shift toward low-glycemic alternatives, elevating interest in specialty glucose variants. Concurrently, regional efforts to advance circular economy objectives have spurred partnerships aimed at valorizing agricultural residues for starch extraction. Meanwhile, expanding food processing industries in the Gulf Cooperation Council and North African markets are generating new avenues for maltodextrin-based formulations in savory snacks and dairy desserts.

In Asia-Pacific, burgeoning population centers and rising disposable incomes are fueling rapid growth across confectionery, bakery, and beverage segments. Countries such as China and India are aggressively scaling enzymatic hydrolysis facilities to secure local supply and import substitution, while Southeast Asian producers leverage cassava feedstocks to compete on cost. The region’s diverse regulatory landscapes and evolving consumer tastes present both complexity and opportunity, prompting flexible strategies that balance global best practices with localized innovation.

This comprehensive research report examines key regions that drive the evolution of the Glucose, Dextrose, & Maltodextrin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analysis of leading global and regional ingredient suppliers underscores competitive strategies in integration innovation and targeted partnerships

Competitive landscapes continue to consolidate as leading ingredient suppliers invest in capacity expansions, innovation centers, and strategic acquisitions. Industry stalwarts such as Cargill and Archer Daniels Midland maintain a formidable presence through vertically integrated operations spanning feedstock cultivation, starch processing, and specialty ingredient formulation. Their expansive R&D infrastructures facilitate rapid prototyping of enzyme-enhanced syrups and high-purity maltodextrins, catering to stringent pharmaceutical standards and premium clean-label segments.

In parallel, firms like Tate & Lyle and Roquette are differentiating through novel product platforms-leveraging proprietary enzyme cocktails to develop tailored dextrose equivalent ranges and texturizing blends that address both taste modulation and functional performance. These companies are also forging co-development agreements with global food manufacturers to accelerate application trials and secure long-term offtake commitments. Emerging players and regional champions are further intensifying competition by capitalizing on cost-arbitrage opportunities in under-served markets, focusing on feedstock diversification and agile processing nodes.

Collectively, these competitive maneuvers underscore a broader industry imperative: the need to harmonize scale economies with product differentiation strategies. Entities that can synergize advanced process technologies, robust quality systems, and strategic partnerships are poised to capture value in both mature and frontier markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Glucose, Dextrose, & Maltodextrin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- Beneo GmbH

- Cargill, Incorporated

- Coöperatieve Vereniging AVEBE U.A.

- Grain Processing Corporation

- Ingredion Incorporated

- Roquette Frères

- Südzucker AG

- Tate & Lyle PLC

- Tereos S.A.

Strategic blueprint for ingredient suppliers to enhance adaptability innovation speed and supply chain robustness amid evolving market demands

Industry leaders seeking to fortify market positioning should prioritize three core initiatives: optimizing feedstock flexibility, accelerating value-added product development, and reinforcing supply chain resilience. By investing in modular processing platforms capable of accommodating diverse starch inputs-from corn and wheat to cassava-manufacturers can mitigate tariff-induced cost shocks and adapt swiftly to raw material fluctuations. Simultaneously, co-innovation partnerships with enzyme technology providers and research institutes will expedite the launch of specialized glucose and maltodextrin grades that satisfy emerging clean-label and low-glycemic demands.

Furthermore, stakeholders must harness digital traceability and predictive analytics to enhance transparency, reduce waste, and forecast demand shifts with greater accuracy. Such capabilities not only elevate operational efficiency but also provide a competitive narrative around sustainability credentials. Finally, companies should explore strategic alliances and joint ventures to secure downstream offtake agreements and expand regional footprints-particularly in high-growth Asia-Pacific and Middle East markets. These collaborations can unlock co-marketing opportunities, streamline distribution networks, and drive shared innovation roadmaps.

Comprehensive research methodology combining primary interviews secondary data analysis and rigorous triangulation to validate market insights

The insights presented in this report derive from a rigorous methodology integrating primary and secondary research layers, underpinned by data validation and triangulation principles. Primary research encompassed in-depth interviews with senior executives in ingredient manufacturing, processing technology firms, and food brand formulation teams to obtain firsthand perspectives on tariff impacts, innovation trajectories, and regional growth strategies. Complementing this qualitative input, secondary research involved comprehensive analysis of industry white papers, peer-reviewed journals, trade association publications, and government policy documents.

Quantitative underpinnings emerged through synthesis of publicly available import-export databases, customs filings, and official agricultural statistics to assess shifting trade flows and production capacities. Data triangulation ensured consistency across multiple information sources, while expert panels vetted key assumptions and interpretations. This hybrid research design delivered a cohesive view of market dynamics, enabling robust segmentation analyses, competitive benchmarking, and policy impact assessments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Glucose, Dextrose, & Maltodextrin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Glucose, Dextrose, & Maltodextrin Market, by Product Type

- Glucose, Dextrose, & Maltodextrin Market, by Form

- Glucose, Dextrose, & Maltodextrin Market, by Grade

- Glucose, Dextrose, & Maltodextrin Market, by Process

- Glucose, Dextrose, & Maltodextrin Market, by Packaging Type

- Glucose, Dextrose, & Maltodextrin Market, by Application

- Glucose, Dextrose, & Maltodextrin Market, by Distribution Channel

- Glucose, Dextrose, & Maltodextrin Market, by Region

- Glucose, Dextrose, & Maltodextrin Market, by Group

- Glucose, Dextrose, & Maltodextrin Market, by Country

- United States Glucose, Dextrose, & Maltodextrin Market

- China Glucose, Dextrose, & Maltodextrin Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Synthesis of key findings underscores strategic imperatives for thriving amid shifting consumer preferences policy landscapes and technological advancements

The evolving landscape of glucose, dextrose, and maltodextrin is defined by the convergence of health-oriented consumer trends, dynamic policy environments, and rapid technological advancements in processing and traceability. Stakeholders that embrace feedstock diversification, leverage advanced enzymatic processes, and fortify supply chain transparency stand to capture value in an increasingly competitive arena. The 2025 United States tariff adjustments have underscored the necessity of agile sourcing strategies and domestic integration capabilities, while segmentation insights reaffirm the importance of product, format, and application specificity in capturing niche growth pockets. Regional nuances further attest to the need for localized innovation frameworks, particularly in fast-growing Asia-Pacific and the regulatory-intense Europe, Middle East & Africa markets.

As leading firms recalibrate investments toward clean-label formulations, high-value specialty grades, and digital traceability infrastructures, the stage is set for a new era of carbohydrate ingredient innovation. Those who align strategic priorities with emerging consumer priorities, regulatory developments, and technological enablers will not only navigate current headwinds but will also chart the course for future market leadership.

Engage with the Associate Director of Sales and Marketing for tailored access to the definitive market research on glucose, dextrose, and maltodextrin

To explore the full breadth of market insights regarding glucose, dextrose, and maltodextrin including detailed tariff analyses, segmentation deep dives, regional breakdowns, and competitive benchmarking, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He will guide you through our comprehensive report, customized to your strategic objectives. Secure timely access to this vital intelligence to inform your product development, supply chain planning, and go-to-market strategies by contacting Ketan and purchasing the complete study today.

- How big is the Glucose, Dextrose, & Maltodextrin Market?

- What is the Glucose, Dextrose, & Maltodextrin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?