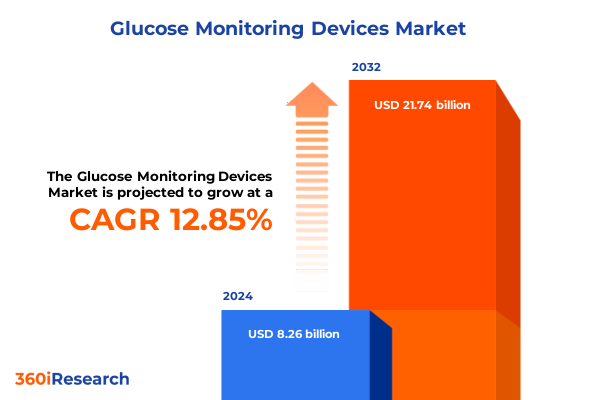

The Glucose Monitoring Devices Market size was estimated at USD 9.34 billion in 2025 and expected to reach USD 10.36 billion in 2026, at a CAGR of 12.81% to reach USD 21.74 billion by 2032.

Exploring the Advancements and Market Drivers Shaping Modern Glucose Monitoring Solutions to Empower Healthcare Providers and Patients with Real-Time Insights

In recent years, the landscape of glucose monitoring has evolved far beyond its traditional roots, propelled by relentless innovation and mounting demand for more patient-centric care. Advances in sensor technology and data analytics have enabled continuous glucose monitoring systems to shift diabetes management from episodic testing to seamless, real-time surveillance. This transition has empowered both clinicians and patients with unprecedented visibility into glycemic patterns, translating into improved therapeutic outcomes and quality of life.

Identifying the Pivotal Technological and Regulatory Transformations Redefining the Glucose Monitoring Device Landscape and Clinical Practice

Technological breakthroughs have catalyzed a paradigm shift in glucose monitoring, moving the focus from isolated blood glucose meters to integrated digital health ecosystems. Enhanced algorithmic processing now allows predictive alerts that preempt glycemic excursions, while cloud-based connectivity ensures data accessibility across care teams and remote monitoring platforms. Regulatory bodies have responded in kind by streamlining approval pathways for next-generation devices, reflecting a broader commitment to harnessing digital innovation for chronic disease management.

Assessing the Aggregate Consequences of Recent United States Tariff Policies on the Glucose Monitoring Device Supply Chain and Industry Economics

The introduction of elevated tariff rates on imported components and finished glucose monitoring devices in 2025 has reverberated across the supply chain, prompting manufacturers to reassess sourcing strategies. Heightened costs associated with sensor elements, microelectronic chips, and sterile packaging materials have been partially absorbed upstream, yet some impacts are filtering down to end users in the form of increased device pricing. Consequently, organizations are exploring localized manufacturing partnerships and dual-sourcing arrangements to mitigate cost pressures and maintain margin integrity.

Uncovering Deep-Dive Insights into Market Segmentation That Illuminate Device, Technology, Application, End-User, and Distribution Channel Dynamics

Insight into market segmentation reveals nuanced demand patterns that inform product development and go-to-market strategies. Based on device type, the market encompasses continuous glucose monitoring, flash glucose monitoring, and self-monitoring of blood glucose, with continuous systems further distinguished by personal and professional applications. Technology segmentation differentiates invasive, minimally invasive, and non-invasive platforms, where invasive solutions break down into colorimetric and electrochemical amperometric methods, minimally invasive options focus on subcutaneous sensors, and non-invasive approaches leverage optical spectroscopy and transdermal extraction techniques. Application segmentation highlights distinct needs across gestational diabetes, type one diabetes, and type two diabetes populations, each presenting opportunities for tailored feature sets and monitoring protocols. End-user insights underscore utilization in ambulatory care, home care, and hospitals, with private and public hospital settings influencing procurement dynamics. Finally, distribution channel analysis emphasizes hospital pharmacies, online stores-through company websites and e-commerce platforms-and retail pharmacies, including chain and independent operators, each shaping access and patient engagement.

This comprehensive research report categorizes the Glucose Monitoring Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Technology

- Application

- End User

- Distribution Channel

Delving into Distinct Regional Market Dynamics across North America, Europe Middle East and Africa, and Asia-Pacific to Reveal Growth Catalysts

Across the Americas, market expansion is underpinned by robust reimbursement frameworks and widespread adoption of digital health initiatives, driving uptake of continuous and flash glucose monitoring solutions in both clinical and home settings. In Europe, the Middle East, and Africa region, heterogeneous regulatory environments and variable healthcare infrastructures present challenges and opportunities; Western European markets prioritize interoperability and data security, while emerging economies in the Middle East and Africa focus on affordability and basic monitoring access. Asia-Pacific dynamics are characterized by rapid innovation hubs and growing public-private partnerships, particularly in countries where diabetes prevalence is escalating; local manufacturing gains momentum as governments incentivize domestic production to lower healthcare costs and reduce import dependencies.

This comprehensive research report examines key regions that drive the evolution of the Glucose Monitoring Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives and Competitive Positioning of Leading and Emerging Glucose Monitoring Device Manufacturers Driving Industry Advancement

Leading industry players are accelerating research collaborations and strategic acquisitions to fortify their technology portfolios and expand geographic footprints. Large medtech corporations have broadened their offerings through alliances with digital health startups, integrating mobile apps and cloud platforms to enhance user engagement and clinical decision support. Concurrently, smaller innovators are differentiating with sensor miniaturization, extended-wear applications, and advanced predictive algorithms that anticipate glycemic trends. Competitive positioning is increasingly defined by the ability to deliver seamless patient experiences while ensuring data integrity and regulatory compliance across jurisdictions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Glucose Monitoring Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AgaMatrix, Inc.

- ARKRAY, Inc.

- Ascensia Diabetes Care

- Bigfoot Biomedical, Inc.

- Dexcom, Inc.

- EKF Diagnostics Holdings plc

- ForaCare Inc.

- GlucoRx Ltd

- i-SENS, Inc.

- Insulet Corporation

- LifeScan, Inc.

- Medtronic plc

- Menarini Diagnostics

- Nova Biomedical Corporation

- Roche Diagnostics

- Senseonics Holdings, Inc.

- Sinocare Inc.

- Tandem Diabetes Care, Inc.

- Ypsomed AG

Implementing Targeted Strategic Recommendations to Optimize Growth, Enhance Supply Chain Resilience, and Foster Innovation in the Glucose Monitoring Market

To navigate evolving market dynamics, industry participants should prioritize partnerships that reinforce supply chain resilience and localize critical component production. Investing in advanced data analytics capabilities will enable real-time insights that enhance product differentiation and clinical value propositions. Moreover, organizations can accelerate time-to-market by engaging proactively with regulatory stakeholders to shape guidelines for emerging technologies. By aligning R&D efforts with unmet clinical needs-such as non-invasive monitoring and integrated digital therapeutics-manufacturers can secure competitive advantage and foster deeper provider and patient engagement.

Outlining the Comprehensive Research Methodology Integrating Primary and Secondary Approaches for Accurate Analysis of Glucose Monitoring Device Market Trends

This research integrates a rigorous methodology combining primary insights from interviews with endocrinologists, diabetes educators, and procurement leaders, alongside secondary analysis of regulatory filings, clinical trial databases, and peer-reviewed literature. Market segmentation and competitive landscape evaluations were validated through triangulation techniques, ensuring consistency across multiple data sources. Regional and tariff impact assessments were informed by customs records, policy documents, and expert consultations, delivering a comprehensive perspective on economic shifts and their operational implications. The synthesis of qualitative and quantitative inputs underpins the credibility of findings and supports actionable strategic guidance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Glucose Monitoring Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Glucose Monitoring Devices Market, by Device Type

- Glucose Monitoring Devices Market, by Technology

- Glucose Monitoring Devices Market, by Application

- Glucose Monitoring Devices Market, by End User

- Glucose Monitoring Devices Market, by Distribution Channel

- Glucose Monitoring Devices Market, by Region

- Glucose Monitoring Devices Market, by Group

- Glucose Monitoring Devices Market, by Country

- United States Glucose Monitoring Devices Market

- China Glucose Monitoring Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing Key Findings and Strategic Implications to Provide a Cohesive Outlook on Future Directions in the Glucose Monitoring Device Industry

Overall, the glucose monitoring device market is poised at a critical inflection point where technological innovation, regulatory evolution, and economic headwinds converge to reshape industry dynamics. Stakeholders who leverage deep segmentation insights and regional intelligence will be best positioned to tailor solutions that meet the diverse needs of patient cohorts and care settings. As the competitive landscape intensifies, those who invest in supply chain agility and seamless digital integration will capture emerging opportunities and deliver sustainable value. This cohesive outlook underscores the importance of agile strategy formulation in an environment marked by rapid change and growing demand.

Connect with Ketan Rohom to Secure Comprehensive Glucose Monitoring Device Market Insights and Empower Your Strategic Decisions with In-Depth Research

To explore the full breadth of insights and strategic analyses on the glucose monitoring device market, reach out to Ketan Rohom, Associate Director of Sales & Marketing, for personalized guidance tailored to your organizational needs. Engaging directly with an experienced specialist ensures you receive dedicated support in interpreting the findings and integrating them into your strategic roadmap. By initiating a conversation, your team can uncover bespoke recommendations and leverage exclusive data that drive competitive advantage. Don’t let uncertainty hinder your decision-making; connect today to secure the intelligence that empowers informed choices and sustains growth in a rapidly evolving market.

- How big is the Glucose Monitoring Devices Market?

- What is the Glucose Monitoring Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?