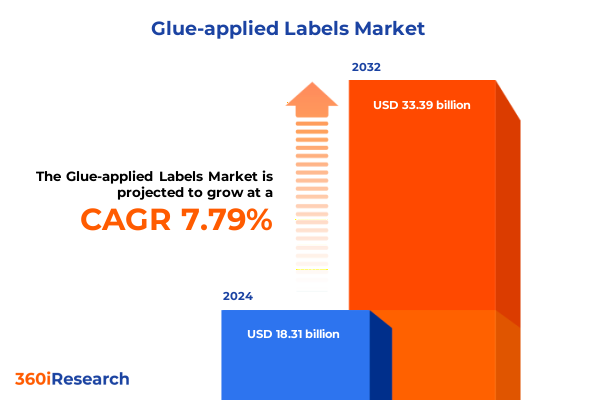

The Glue-applied Labels Market size was estimated at USD 19.67 billion in 2025 and expected to reach USD 21.14 billion in 2026, at a CAGR of 7.85% to reach USD 33.39 billion by 2032.

Unlocking the Critical Importance of Glue-Applied Labels in Enhancing Brand Identity, Regulatory Compliance, and Packaging Efficiency Worldwide

Glue-applied labels serve as a critical interface between brands and consumers, combining visual appeal with essential product information. As packaging applications grow increasingly complex, manufacturers rely on these labels to deliver regulatory compliance, anti-counterfeiting measures, and on-shelf differentiation simultaneously. According to leading industry analysis, brand owners are channeling significant investment into next-generation printing technologies, smart packaging platforms, and sustainable label stocks to meet both consumer expectations and corporate responsibility objectives.

Beyond their aesthetic function, glue-applied labels remain the second most valuable segment by volume within the broader labeling landscape. Their inherent versatility supports application on a wide range of substrates, from rigid containers to flexible films, enabling labeling solutions across diverse conditions. Industry authorities highlight that while pressure-sensitive labels maintain value leadership, wet glue variants continue to secure substantial volume share due to their cost efficiency and performance in high-speed production runs.

Moreover, advanced glue-applied labels now integrate anti-counterfeiting features such as holographic foils, tamper-evident seals, and serialized data carriers. This integration enhances product authentication and extends brand trust in global marketplaces. Simultaneously, the adoption of NFC and RFID capabilities transforms these traditional labels into interactive touchpoints for supply chain tracking and consumer engagement, solidifying their strategic importance within modern packaging ecosystems.

Convergence of Sustainability, Digital Printing, and Smart Technologies Redefining Glue-Applied Labeling Practices Across Key Market Verticals

Sustainability has emerged as a driving force reshaping the glue-applied labels market. Label converters and brand owners are vigorously adopting eco-friendly substrates including post-consumer recycled paper and bio-based film stocks, while water-based and low-VOC adhesives reduce environmental impact. Regulatory developments around recyclability and material recovery further incentivize investment in circular label solutions that support end-of-life processing and brand commitments to the circular economy.

At the same time, digital printing technologies are redefining production paradigms. Inkjet and digital toner platforms now enable variable data printing, short-run customization, and rapid prototyping without the constraints of traditional tooling. This shift not only accelerates time to market for promotional and seasonal packaging but also lowers inventory overhead, as converters can produce on-demand labels tailored to regional or product-specific requirements.

Concurrently, the integration of smart labeling functionalities such as NFC and RFID transforms glue-applied labels into dynamic digital interfaces. These technologies facilitate real-time supply chain visibility, improve inventory management, and unlock new consumer engagement channels via interactive content. As a result, labels evolve beyond static identifiers to become integral components of connected product ecosystems.

Finally, pressing regulatory requirements for product traceability and serialization continue to compel label innovation. Stakeholders must embed more detailed information on labels, ranging from allergen declarations to pharmaceutical batch codes. This imperative drives the development of high-resolution printing techniques and multi-layer label constructions designed to accommodate growing data demands while maintaining fast application speeds.

Evaluating the Cumulative Effects of Broad-Based US Tariffs on Glue-Applied Label Supply Chains Material Costs and Import Patterns in 2025

The United States’ implementation of broad-based tariffs in 2025 has introduced material cost volatility and supply chain complexities that reverberate across the glue-applied labels sector. Industry associations warned that arbitrary tariff escalations on imported machinery and raw materials would inflate production expenses and hinder competitive balance. In May 2025, the leading trade body for tag and label manufacturers emphasized the need for product-specific, justified tariff measures to avoid undue disruptions to domestic and global supply chains.

A significant impact arises from the 10 percent tariff applied to European machinery imports, which elevates capital expenditure for converters acquiring new label application and finishing equipment. As this machinery often represents high-value assets, even a modest duty increase can shift investment priorities and delay modernization projects. These added costs eventually tend to transfer downstream, affecting label pricing for brand owners and end users alike.

In parallel, raw material import patterns have shifted markedly. Tariffs on self-adhesive paper from China led to a nearly 24 percent reduction in first-quarter 2025 imports versus the prior year, while purchases from Canada and Mexico increased by approximately 10 percent and 26 percent, respectively. This redistribution underscores the agility required for raw material sourcing strategies in response to evolving trade barriers.

Moreover, these tariff-induced changes ripple through the consumer goods ecosystem, as brands adjust container bookings and production volumes to manage cost pressures. Container flow data revealed a near 60 percent decline in bookings from China during high-tariff periods, followed by a 300 percent rebound once rates were eased. These fluctuations directly influence label demand, underscoring the intertwined nature of trade policy and packaging material consumption.

Illuminating Critical Market Segments of Glue-Applied Labels Through End-Use Industries Material Types and Adhesive Technologies

The glue-applied labels market serves a diverse array of end-use industries, each with unique performance requirements and growth trajectories. In the automotive sector, labels must withstand temperature fluctuations, chemical exposure, and mechanical abrasion, underscoring the demand for high-performance adhesives and robust facestocks. Consumer goods and food & beverage applications continue to drive the highest volume growth due to extensive packaging needs and regulatory labeling mandates, while the healthcare industry prioritizes tamper-evident and serialization-ready designs. Logistics and transportation stakeholders leverage integrated RFID and barcode capabilities to enhance product tracking across global supply chains.

Material type remains a pivotal segmentation axis. Paper labels dominate where recyclability and cost efficiency reign supreme, with converters transitioning to post-consumer recycled content to align with sustainability goals. Film-based substrates, including polypropylene and polyester, prevail in moisture- and chemical-resistant labeling applications, while synthetic constructions support extreme-temperature and outdoor exposures. The emergence of novel mono-material film structures further streamlines recycling processes by eliminating multi-layer separations.

In terms of form factor, roll labels command the production lines of high-speed converters due to their continuous-feed compatibility and efficiency in large-volume runs, offering minimal downtime for splicing and changeovers. Conversely, sheet labels excel in short-run, promotional, or seasonal applications where manual or cut-and-stack workflows better accommodate frequent design shifts and customization demands.

Adhesive technology segmentation underscores the dominance of permanent formulations, prized for their strong bond, durability, and resistance to environmental stressors. Meanwhile, water-based formulations are gaining market share thanks to their eco-friendly profile and low volatile organic compound emissions. Specialty adhesives such as hot-melt, removable, and repositionable variants expand application versatility, accommodating reuse scenarios and damage-free label removal requirements.

Printing technology further differentiates market approaches. Flexographic printing retains its leading status for narrow-web, high-speed operations, while offset and gravure processes gradually cede share to pressure-sensitive and digital platforms. Digital printing continues its rapid ascent, offering variable data capabilities and swift setup that empower personalized packaging initiatives and on-demand production without compromising print quality.

This comprehensive research report categorizes the Glue-applied Labels market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Product Type

- Adhesive Type

- Printing Technology

- End-Use Industry

Exploring Regional Dynamics Influencing the Demand and Innovation of Glue-Applied Labels Across Americas EMEA and Asia-Pacific Markets

In the Americas, a mature regulatory environment and advanced packaging infrastructure underpin sustained demand for glue-applied labels. North American manufacturers lead the adoption of digital label presses, sustainability-focused substrates, and linerless solutions to optimize both environmental footprints and operational efficiencies. The presence of major brand owners and e-commerce leaders further catalyzes innovation in label design and application methods across this region.

Within Europe, Middle East & Africa, stringent traceability regulations and anti-counterfeiting mandates continue to drive label complexity. The European Union’s forthcoming serialization requirements for pharmaceuticals, along with expanded food labeling directives, compel label converters to integrate high-resolution printing and secure features. Simultaneously, growth in the Middle East’s e-commerce sector has spurred demand for robust shipping labels capable of withstanding transit challenges.

Across Asia-Pacific, rapid urbanization and rising consumer spending have fueled significant expansion in packaged food & beverage and personal care segments. Emerging market economies in Southeast Asia and South Asia are investing heavily in cost-effective label solutions to meet growing domestic appetite for consumer goods. At the same time, leading converters in developed markets such as Japan and Australia focus on integrating smart labeling technologies to enhance supply chain visibility and reduce counterfeit risks in high-value product categories.

This comprehensive research report examines key regions that drive the evolution of the Glue-applied Labels market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Shaping the Glue-Applied Labels Sphere Through Strategic Investments And Technological Advancements

Avery Dennison remains at the forefront of the glue-applied labels market by combining robust adhesive formulations with advanced digital printing platforms. Their latest innovations include PCR film stocks and water-based adhesive systems, reinforcing brand sustainability objectives while supporting high-clarity print quality. The company’s commitment to linerless and direct thermal solutions further diversifies its portfolio to meet evolving converter requirements.

CCL Label has strategically expanded its smart labeling capabilities through investments in RFID and NFC-enabled facestocks, enabling brand owners to incorporate interactive consumer engagement features directly onto glue-applied labels. This focus on IoT integration positions CCL as a key partner for manufacturers seeking enhanced supply chain transparency and anti-counterfeiting safeguards.

Multi-Color Corporation continues to drive market traction by deploying multi-substrate digital label presses that support short runs and versioning without sacrificing throughput. Their modular print systems facilitate seamless transition between aden digital data-driven labeling formats and conventional workflows, affording converters greater operational agility.

UPM Raflatac leads the push for sustainable label solutions by advancing bio-based adhesives and mono-material paper facestocks. The company’s R&D initiatives focus on enhancing recyclability and reducing greenhouse gas emissions across the label lifecycle, reflecting rising brand demand for eco-friendly materials.

Other prominent players such as Smyth Companies, Fort Dearborn, and ALTANA continue to reinforce their positions through regional capacity expansions and strategic partnerships that enhance service offerings in niche application areas such as healthcare labeling and industrial identification. Collectively, these leaders shape the competitive landscape through a blend of technology investment, sustainability commitment, and global supply chain optimization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Glue-applied Labels market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Americk Packaging Corporation

- Avery Dennison Corporation

- CCL Industries Inc.

- Constantia Flexibles Group GmbH

- Coveris Holdings S.A.

- Darley Packaging Group Inc.

- Fort Dearborn Company

- Fuji Seal International, Inc.

- H.B. Fuller Company

- Hammer Packaging Corporation

- Henkel AG & Co. KGaA

- Herma GmbH

- Huhtamaki Oyj

- Inland Label & Marketing Services, LLC

- Jindal Films Limited

- Lintec Corporation

- Multi‑Color Corporation

- SATO Holdings Corporation

- Smyth Companies, LLC

- Tapp Label Company

- Tpfer Kulmbach GmbH

- UPM Kymmene Corporation

- WestRock Company

- WS Packaging Group, Inc.

Empowering Industry Leadership Through Sustainable Innovation Agile Supply Chain Strategies And Smart Technology Integration

Prioritize the adoption of eco-friendly adhesive formulations and recycled facestocks to align product portfolios with mounting sustainability mandates. Investing in water-based and bio-based adhesive systems not only reduces environmental impact but also positions converters and brand owners as responsible stewards of the circular economy, resonating with consumer preferences for green packaging solutions.

Accelerate the shift toward digital printing capabilities to enable variable data production and rapid order turnaround. Digital platforms unlock the potential for personalized and region-specific labeling while minimizing inventory risk and setup costs. This agility fosters increased responsiveness to market fluctuations and promotional cycles, driving enhanced customer satisfaction.

Diversify raw material and equipment sourcing across multiple geographies to mitigate exposure to tariff volatility and trade disruptions. Establishing alternate supplier relationships and leveraging regional production hubs can stabilize input costs and ensure continuity under shifting trade policies, safeguarding operational resilience in a complex global environment.

Integrate smart labeling technologies such as RFID, NFC, and QR codes into glue-applied substrates to augment supply chain visibility and consumer engagement. These connected labeling solutions deliver real-time tracking, anti-counterfeiting protection, and interactive brand experiences that differentiate product offerings in crowded marketplaces.

Forge collaborative partnerships with key brand owners and channel stakeholders to co-develop customized labeling solutions that address specific end-use requirements. By aligning product development efforts with downstream needs in industries like food & beverage, healthcare, and industrial logistics, converters can drive deeper client relationships and secure long-term volume commitments.

Leverage integrated labeling software and data analytics platforms to streamline production workflows and enable continuous improvement. Systems that connect ERP, PLM, and labeling applications facilitate real-time proofing, regulatory compliance tracking, and performance monitoring, delivering actionable insights that optimize throughput and reduce defects.

Explaining Our Rigorous Multi-Phase Research Methodology Combining Primary Interviews Secondary Data Analytics And Expert Validation Techniques

Our research methodology combined extensive secondary data analysis with targeted primary engagement to ensure comprehensive market coverage and robust findings. Initially, we conducted a systematic review of industry publications, trade association reports, and academic journals to establish a foundational understanding of market trends and regulatory drivers. We then collected detailed information on segmentation, competitive landscapes, and regional dynamics from authoritative sources and company disclosures.

To enrich our desk research, we executed in-depth interviews with senior executives at label converters, adhesives manufacturers, and brand owners to capture firsthand perspectives on emerging technologies, operational challenges, and strategic priorities. These qualitative insights were supplemented by quantitative surveys administered to a cross-section of industry stakeholders, providing granular visibility into purchase criteria, technology adoption rates, and growth drivers.

We applied rigorous triangulation and data-validation techniques, comparing primary responses against secondary benchmarks to verify consistency and accuracy. Advanced analytics were employed to discern patterns, quantify relative segment performance, and identify high-impact opportunities. Finally, our findings underwent expert review by independent industry practitioners to validate interpretations and ensure that recommendations align with evolving market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Glue-applied Labels market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Glue-applied Labels Market, by Material Type

- Glue-applied Labels Market, by Product Type

- Glue-applied Labels Market, by Adhesive Type

- Glue-applied Labels Market, by Printing Technology

- Glue-applied Labels Market, by End-Use Industry

- Glue-applied Labels Market, by Region

- Glue-applied Labels Market, by Group

- Glue-applied Labels Market, by Country

- United States Glue-applied Labels Market

- China Glue-applied Labels Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Insights On Market Dynamics Challenges And Opportunities For Glue-Applied Labels To Guide Strategic Decision-Making

The glue-applied labels market occupies a pivotal role at the intersection of brand communication, regulatory compliance, and packaging innovation. Our analysis underscores how sustainability imperatives, digital printing advances, and smart label integrations are collectively reshaping market expectations and competitive dynamics.

Trade policy shifts, particularly the broad-based tariffs enacted in 2025, have introduced new layers of complexity to cost structures and supply chain strategies, compelling industry participants to diversify sourcing and optimize production footprints. Meanwhile, segmentation insights reveal that end-use applications from food & beverage to healthcare, along with material and adhesive choices, continue to define differentiated growth paths for converters and brand owners.

Regional dynamics within the Americas, EMEA, and Asia-Pacific further illustrate how regulatory landscapes, consumer behaviors, and economic development influence labeling requirements and innovation priorities. Leading companies such as Avery Dennison, CCL Label, and UPM Raflatac are exemplifying best practices through strategic investments in sustainable substrates, digital platforms, and smart technologies.

Ultimately, the strategic recommendations provided equip stakeholders with actionable pathways to fortify market positions, capitalize on emerging opportunities, and drive operational resilience. By embracing a holistic approach that integrates sustainability, technology adoption, and supply chain agility, industry leaders can navigate evolving challenges and unlock new avenues for value creation.

Take the Next Step: Secure Comprehensive Glue-Applied Labels Market Intelligence To Drive Growth And Outpace Competitors Today

We invite you to partner with Associate Director, Sales & Marketing Ketan Rohom to access the full-depth analysis of the glue-applied labels market. By securing this comprehensive report, you will obtain unparalleled insights into evolving industry trends, supply chain dynamics, and competitive strategies. This actionable intelligence will empower your organization to optimize product development, refine go-to-market approaches, and capitalize on emerging opportunities across end-use segments and geographical regions. Reach out to Ketan Rohom to discuss how this research can support your strategic objectives and fuel sustainable growth in a rapidly shifting marketplace.

- How big is the Glue-applied Labels Market?

- What is the Glue-applied Labels Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?