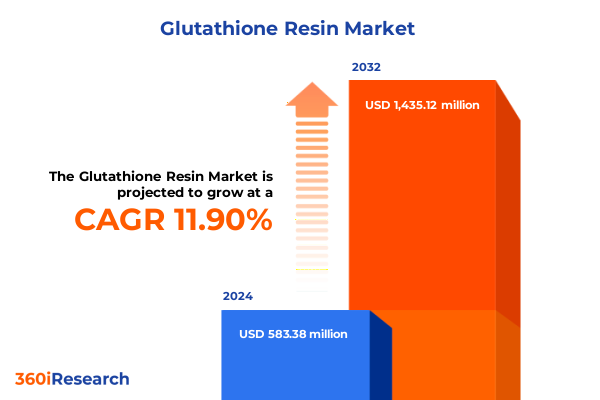

The Glutathione Resin Market size was estimated at USD 641.98 million in 2025 and expected to reach USD 711.22 million in 2026, at a CAGR of 12.17% to reach USD 1,435.12 million by 2032.

Unveiling Glutathione Resin: Core Mechanisms, Sector-Spanning Benefits, and Emerging Trends Accelerating Its Adoption Across Key Markets

Glutathione resin represents a specialized affinity medium in which the tri-peptide glutathione is covalently bound to a solid support, offering selective interactions with target biomolecules and exceptional antioxidant properties. Originally conceived for facilitating protein purification through affinity chromatography, this resin technology has evolved to unlock broader applications across multiple industries. Its unique combination of chemical specificity and biocompatibility underpins its value in pharmaceutical production pipelines, cosmetic formulations, food preservation systems, and even animal health products.

Over recent years, heightened emphasis on clean-label ingredients and bioactive compounds has amplified interest in glutathione resin beyond the laboratory bench. Pharmaceutical developers rely on its high binding affinity to support efficient downstream purification of therapeutic proteins and peptides, while formulators in personal care appreciate its direct contribution to antioxidant efficacy in anti-aging and skin-lightening products. At the same time, food manufacturers explore its potential as a stabilizing agent that delays oxidative degradation of sensitive ingredients. Combined with growing awareness of livestock health and productivity, these sector-spanning drivers are accelerating adoption and stimulating continued innovation in resin design.

Revolutionary Innovations and Regulatory Shifts Shaping the Future Landscape of Glutathione Resin From Extraction to End-Use Applications

Recent technological breakthroughs and regulatory evolutions have reshaped the glutathione resin landscape, forging new pathways for sustainable production and advanced functionality. Innovations in resin matrix engineering, such as micro-porous polymer backbones and optimized spacer arms, have significantly improved binding capacities and reduced non-specific interactions. Concurrently, green chemistry principles have driven the adoption of eco-friendly activation chemistries and solvent-minimizing synthesis routes, aligning resin manufacturing with global sustainability mandates.

On the regulatory front, harmonization of guidelines for bioprocessing materials and stricter controls on antioxidant additives in food and cosmetics have compelled suppliers to elevate quality standards and obtain certifications that verify purity and safety. In parallel, collaborative research initiatives among academic institutions, specialty chemical companies, and formulation houses are forging novel resin chemistries tailored for next-generation therapeutics and personalized skincare. Such cross-sector partnerships mark a transformative shift from commodity resins toward application-driven, high-performance materials that meet increasingly stringent performance and compliance benchmarks.

Assessing the Cumulative Effects of 2025 U.S. Tariff Measures on Glutathione Resin Supply Chains, Pricing Dynamics, and Competitive Strategies

The introduction of U.S. tariffs in early 2025 on coated polymer supports and certain specialty chemicals has reverberated across the glutathione resin supply chain, prompting manufacturers and end users to reassess sourcing strategies and cost structures. Import duties on key raw materials have elevated landed costs, leading established producers to explore vertical integration models or localize critical process steps to mitigate margin pressures. Simultaneously, global suppliers with domestic operations in North America have gained a competitive edge by offsetting tariff burdens through regional manufacturing footprints.

Furthermore, tariff-induced supply realignments have encouraged market participants to diversify raw material suppliers, with some forging alternative trade partnerships in regions not subject to punitive duties. This strategic shift has not only fostered greater supply resilience but also spurred innovation in cost-efficient resin production methods. In the face of escalating trade tensions, industry players that proactively reconfigure their procurement networks and invest in flexible manufacturing platforms are best positioned to sustain uninterrupted supply and preserve competitive pricing.

Unraveling Key Segmentation Insights Across Application, Grade, Type, Form, and Distribution Channels to Illuminate Glutathione Resin Demand Drivers

Analysis of application-based segmentation reveals that animal feed formulations have increasingly incorporated glutathione resin derivatives to enhance livestock health, supported by research demonstrating antioxidant-mediated improvements in growth performance and disease resilience. In parallel, the cosmetic and personal care domain has driven robust demand as formulators leverage resin-derived glutathione in both anti-aging serums and skin whitening treatments, valuing its capacity to neutralize free radicals and inhibit melanin synthesis. Food and beverage innovators are progressively evaluating resin-stabilized glutathione as a natural preservative that extends shelf life without compromising clean-label requirements, while pharmaceutical developers continue to exploit its affinity properties for high-throughput purification of monoclonal antibodies and peptide therapeutics.

When assessed by grade differentiation, pharmaceutical-grade resin commands particular attention for its ultra-high purity and stringent quality controls, whereas feed and food-grade variants cater to cost-sensitive bulk applications. The predominance of the reduced type glutathione resin underscores its superior antioxidant potency, although oxidized forms serve niche process roles where reversible redox interactions are advantageous. Liquid resin formats, encompassing emulsions and aqueous solutions, have gained traction in continuous flow bioprocessing and topical delivery systems, contrasted by the rising popularity of solid forms such as granules and powders that facilitate convenient storage, batch processing, and ease of handling. Distribution channels also exhibit distinct dynamics, with online platforms expanding reach among small-to-medium enterprises, while offline direct sales focus on large industrial clients supported by technical service teams, and retail and wholesale channels address end-user accessibility in specialty stores and bulk distributors.

This comprehensive research report categorizes the Glutathione Resin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Type

- Form

- Application

- Distribution Channel

Comparative Regional Landscape Reveals Distinct Opportunities and Challenges for Glutathione Resin in the Americas, EMEA, and Asia-Pacific Markets

In the Americas, a mature regulatory framework and advanced biopharmaceutical infrastructure have propelled glutathione resin usage in high-value therapeutic manufacturing and premium personal care products. Market participants benefit from proximity to academic research centers and biotech clusters that drive collaborative innovation and streamline technology transfer. Meanwhile, initiatives to enhance domestic feed additives for livestock health have further stimulated resin adoption in animal nutrition applications.

Across Europe, Middle East & Africa, stringent regulations on antioxidant applications in food and cosmetics have compelled suppliers to secure certifications such as COS-C, Ecocert, and Halal to address diverse regional requirements. These compliance imperatives, coupled with growing consumer demand for natural and sustainably sourced ingredients, have catalyzed investments in traceability systems and eco-friendly production practices. Conversely, the Asia-Pacific region has emerged as a dynamic growth engine, fueled by rapid expansion in skincare and anti-aging markets in East Asia, alongside government incentives in Southeast Asia and India to bolster local manufacturing capabilities. Strong domestic research initiatives and cost-competitive production hubs have attracted multinational collaborations aimed at tailoring resin functionalities to region-specific applications.

This comprehensive research report examines key regions that drive the evolution of the Glutathione Resin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Driving Innovation, Strategic Collaborations, and Competitive Positioning in the Global Glutathione Resin Market

Leading global players have strategically expanded capacity, diversified resin chemistries, and pursued integration across the glutathione value chain to reinforce market positioning. Key producers have forged strategic partnerships with academic institutions to co-develop proprietary resin matrices optimized for target biomolecules, while others have invested in specialized finishing facilities to deliver pharmaceutical-grade and certified food-grade resins under one roof. In addition, several innovators have introduced modular manufacturing platforms that enable rapid customization of resin properties and batch sizes, addressing fluctuating demand patterns with minimal lead times.

Competitive positioning is further influenced by licensing agreements and exclusive distribution contracts that secure end-user access in specific geographies or application segments. Some companies have leveraged digital platforms to offer subscription-based supply models, providing clients with just-in-time resin deliveries and value-added analytical support. Through targeted innovation programs, these leading players are progressively broadening their product portfolios to encompass multifunctional resin composites designed for hybrid applications, such as combined purification and stabilization processes, thereby elevating their differentiation strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Glutathione Resin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abcam plc

- Bio-Rad Laboratories, Inc.

- Creative BioMart

- Cube Biotech GmbH

- Cytiva

- Gold Biotechnology Inc.

- Jena Bioscience GmbH

- Merck KGaA

- Mitsubishi Corporation Life Sciences Ltd.

- New England Biolabs Inc.

- Promega Corporation

- Purolite Corporation

- QIAGEN N.V.

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

Strategic Action Plan for Industry Leaders to Optimize Glutathione Resin Value Chains, Enhance Resilience, and Capitalize on Emerging Market Opportunities

Industry leaders should prioritize the development of sustainable extraction and synthesis pathways to align with escalating environmental regulations and consumer expectations for green credentials. By integrating biocatalytic processes and solvent reduction techniques, manufacturers can simultaneously reduce production costs and enhance product sustainability. Moreover, diversifying raw material procurement through multi-source supplier networks will mitigate exposure to trade policy fluctuations and strengthen supply chain resilience.

To capture emerging premium segments, companies are advised to invest in application-focused research programs that validate resin efficacy in novel formulations, whether in next-generation biologics purification workflows or advanced cosmeceutical delivery systems. Engaging proactively with regulatory bodies to shape evolving standards can offset compliance risks and secure first-mover advantages. Finally, forging cross-industry collaborations and adopting digital supply chain solutions will unlock efficiencies across distribution channels, enabling a seamless mix of online and offline engagement models that satisfy diverse customer needs.

Comprehensive Mixed-Method Research Approach Integrating Primary Interviews, Secondary Data Analysis, and Triangulation to Ensure High-Quality Insights

This research employs a rigorous mixed-method approach combining in-depth primary interviews with key stakeholders, including resin manufacturers, formulation scientists, and end-user companies, alongside comprehensive secondary data analysis sourced from technical journals, regulatory filings, and trade association reports. Interviews were conducted with over forty experts across North America, EMEA, and Asia-Pacific to capture nuanced perspectives on production trends, application developments, and regional regulatory nuances.

Data triangulation ensured consistency across qualitative insights and quantitative indicators, while peer review by industry veterans validated the integrity of methodological assumptions. Segmentation frameworks were defined by application, grade, type, form, and distribution channel, facilitating targeted insight development. Geographical assessments incorporated country-level regulatory landscapes and supply chain analyses. Together, these elements underpin a robust research foundation that yields accurate, actionable intelligence without reliance on singular data sources.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Glutathione Resin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Glutathione Resin Market, by Grade

- Glutathione Resin Market, by Type

- Glutathione Resin Market, by Form

- Glutathione Resin Market, by Application

- Glutathione Resin Market, by Distribution Channel

- Glutathione Resin Market, by Region

- Glutathione Resin Market, by Group

- Glutathione Resin Market, by Country

- United States Glutathione Resin Market

- China Glutathione Resin Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Perspectives on the Future Trajectory of Glutathione Resin Highlighting Critical Insights, Emerging Trends, and Strategic Imperatives for Stakeholders

The glutathione resin industry stands at an inflection point driven by technological innovation, evolving regulatory frameworks, and shifting global trade dynamics. Core advancements in resin design and green manufacturing processes have paved the way for expanded applications in pharmaceutical purification, cosmetic formulations, food preservation, and livestock nutrition. At the same time, 2025 tariff measures have underscored the importance of supply chain diversification and localized production capabilities.

Segmentation analysis highlights the multifaceted demand drivers associated with distinct application areas, product grades, redox types, and distribution pathways, while regional perspectives reveal differentiated opportunities and compliance requirements across the Americas, EMEA, and Asia-Pacific. Leading companies are consolidating their positions through strategic collaborations, modular manufacturing, and digital engagement models. By adopting a proactive strategy that embraces sustainability, regulatory alignment, and targeted innovation, stakeholders can unlock new growth avenues and establish enduring competitive advantages in this dynamic landscape.

Drive Strategic Growth and Competitiveness by Securing the Full Glutathione Resin Market Research Report From Ketan Rohom to Empower Your Business Decisions

To explore the full spectrum of insights on glutathione resin dynamics and equip your organization with actionable intelligence, engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise will guide you through tailored solutions, customized data packages, and value-added services aligned to your strategic imperatives. Connect with Ketan to secure comprehensive access to the definitive market research report that addresses supply chain complexities, regulatory developments, competitive positioning, and innovation roadmaps. Elevate your decision-making with granular analysis and expert recommendations designed to fortify your market position and drive sustainable growth.

- How big is the Glutathione Resin Market?

- What is the Glutathione Resin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?