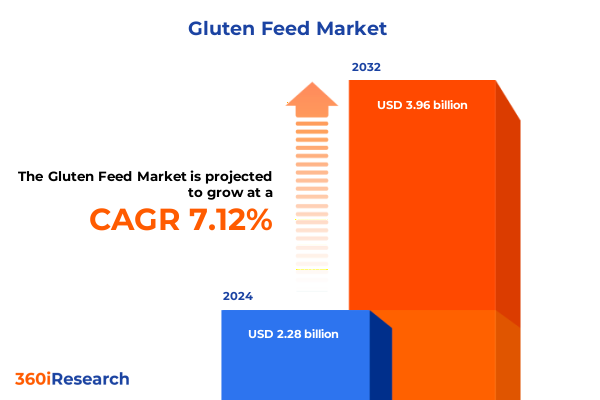

The Gluten Feed Market size was estimated at USD 2.45 billion in 2025 and expected to reach USD 2.59 billion in 2026, at a CAGR of 7.11% to reach USD 3.96 billion by 2032.

An In-Depth Exploration of Gluten Feed Market Dynamics Highlighting Emerging Drivers and Stakeholders Shaping Future of Co-Products in Animal Nutrition

The gluten feed market has emerged as a crucial segment within the broader animal nutrition landscape due to its dual function as a cost-effective protein source and a sustainable by-product of grain processing. As global demand for animal-derived proteins continues to rise, livestock producers are increasingly focused on optimizing feed formulations to strike the ideal balance between nutritional value, supply consistency, and environmental stewardship. Gluten feed, derived from both corn and wheat milling processes, offers a versatile nutrient profile that supports a range of species from ruminants to aquaculture, making it an indispensable commodity for feed manufacturers and integrators alike.

Transitioning from niche applications to mainstream acceptance, gluten feed is benefiting from broader recognition of its role in circular economy models and waste minimization strategies. Several factors are converging to elevate the market’s prominence: growing regulatory emphasis on feed traceability and quality assurance; technological advancements in milling and feed additive integration; and an increased appetite among end-users for ingredients that combine economic efficiency with proven animal performance benefits. As these dynamics persist, stakeholders across the value chain are recalibrating supply structures and innovation roadmaps to capture emerging opportunities within the gluten feed domain.

A Comprehensive Overview of Transformative Shifts Rewriting Supply Chains and Operational Strategies in the Global Gluten Feed Industry Landscape

Over the past several years the gluten feed market has undergone transformative shifts that extend beyond traditional supply and demand parameters. Digital traceability solutions are now enabling real-time monitoring of ingredient provenance and quality attributes, reinforcing stakeholder confidence and bolstering feed safety protocols. Concurrently advanced processing technologies are enhancing nutrient bioavailability, allowing producers to tailor protein and fiber levels precisely to the requirements of different species and growth stages. This convergence of digitalization and process innovation is redefining value creation and efficiency benchmarks across the gluten feed ecosystem.

Furthermore sustainability imperatives are reshaping sourcing strategies and product portfolios. Companies are investing in low-carbon footprint milling processes and exploring novel co-products to maximize resource utilization. At the same time evolving consumer expectations concerning animal welfare and clean labels are driving feed formulators to prioritize transparency and to seek ingredients with clear trace-back documentation. Collectively these dynamics are prompting both large-scale integrators and regional specialists to revisit their go-to-market models and forge strategic partnerships across agriculture, biotechnology, and logistics sectors to maintain competitive advantage.

Understanding the Comprehensive Consequences Imposed by United States Tariff Policies in 2025 on Trade Flows and Competitive Dynamics within the Gluten Feed Sector

United States tariff adjustments in 2025 have exerted a cumulative impact on gluten feed trade flows and competitive dynamics, prompting importers and exporters to reassess sourcing itineraries and pricing structures. Tariff escalations on selected agricultural co-products have elevated landed costs for certain wheat gluten feed consignments from key exporting regions, creating an incentive for domestic feed producers to ramp up corn gluten feed production and fortify local supply chains. In turn this has driven greater investment in milling capacity and underscored the strategic importance of regulatory forecasting for market participants.

At the same time reciprocal tariff measures implemented by trading partners have introduced volatility in export revenues, particularly for U.S. feed mills reliant on cross-border distribution to Latin American and Asia Pacific markets. This complex policy environment has accentuated supply diversification as a risk-mitigation strategy. Forward-looking companies are now prioritizing flexible procurement frameworks that blend domestic production with competitively priced imports, aligning inventory management practices with evolving tariff schedules to preserve margin integrity and ensure uninterrupted feed availability for end users.

Key Segmentation Insights Illuminating the Diverse Product Categories Channels Applications and Forms Driving Demand in the Gluten Feed Market

Analysis of product segmentation reveals distinct consumption patterns between corn gluten feed and wheat gluten feed, with corn gluten feed commanding a larger share in regions where corn milling is predominant, while wheat gluten feed exhibits regional strengths in mature markets with established wheat processing infrastructures. Distribution channels underscore a bifurcation between traditional bulk sales through offline grain merchants and emergent online platforms offering just-in-time delivery and value-added logistics services. Observing form factors highlights a clear divide where wet gluten feed is favored in proximate feedlot operations close to milling sites, whereas dry gluten feed appeals to feed formulators requiring stabilized shelf life and streamlined transport.

Application segmentation further accentuates market heterogeneity. Aquaculture producers are increasingly leveraging the high protein digestibility of gluten feed to enhance feed conversion ratios, whereas pet food manufacturers value the consistent amino acid profile for premium formulations. Poultry and ruminant sectors continue to rely on gluten feed for energy and fiber contributions respectively, and swine operations are incorporating it as a complementary ingredient to optimize growth performance. These insights collectively illustrate the nuanced demand drivers at play across product types, channels, physical forms, and end-use segments.

This comprehensive research report categorizes the Gluten Feed market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Form

- Application

- Distribution Channel

In-Depth Regional Perspectives Exposing Unique Growth Drivers Challenges and Opportunities across the Americas Europe Middle East Africa and Asia Pacific

Regional analysis exposes unique growth drivers and challenges across the Americas Europe Middle East Africa and Asia Pacific. In the Americas expanding ethanol production is directly augmenting corn gluten feed availability in North America while emerging biofuel initiatives in South America are stimulating incremental milling co-product volumes. Conversely Europe Middle East and Africa markets are characterized by a strong import reliance on wheat gluten feed driven by limited domestic wheat processing capacity in some markets and sustained livestock production growth in North Africa and the Gulf Cooperation Council states.

Asia Pacific dynamics are defined by accelerating fishmeal substitution in aquaculture hubs and rising pet ownership in urbanized economies. These trends are boosting demand for high-quality digestible proteins, positioning gluten feed as an attractive alternative especially in coastal regions. Logistics infrastructure enhancements across ports and inland corridors are also reducing lead times and spoilage risks, enabling broader geographic reach for both dry and wet gluten feed suppliers. Collectively these regional insights underscore the imperative for market players to adopt tailored strategies that align with local supply chain structures, regulatory environments, and species-specific feed requirements.

This comprehensive research report examines key regions that drive the evolution of the Gluten Feed market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical Competitive Company Insights Unveiling Strategic Priorities Innovations Collaborations and Market Positioning of Leading Gluten Feed Producers Worldwide

The competitive landscape within the gluten feed market is populated by a mix of global agribusiness conglomerates and specialized regional mills. Industry leaders have escalated R&D investments in feed enhancement technologies while forging alliances with biotechnology firms to develop enzyme-enriched formulations that amplify nutrient uptake. Several enterprises have also deployed digital platforms offering traceability solutions and integrated supply chain services, reinforcing their value proposition to feed producers and integrators.

Smaller and mid-tier companies are capitalizing on niche applications by customizing product blends for high-margin segments such as specialty aquafeeds and premium pet foods. These firms often emphasize local sourcing and rapid-response logistics, catering to customers seeking agility and personalized service. Meanwhile strategic mergers and acquisitions are reshaping market shares, with larger players acquiring capabilities in targeted geographies and complementary feed ingredients to broaden their portfolios. Across the spectrum, agility in responding to regulatory shifts, tariff recalibrations, and evolving nutritional requirements has become a defining factor in market positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gluten Feed market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aemetis Inc

- AGRANA Beteiligungs-AG

- Alltech

- Archer Daniels Midland Company

- Ardent Mills LLC

- Bunge Ltd

- Cargill Incorporated

- Commodity Specialists Company

- Crespel & Deiters GmbH & Co. KG

- Grain Processing Corporation

- Ingredion Incorporated

- Kröner-Stärke GmbH

- Lantmännen Group

- Manildra Group

- MGP Ingredients

- Molinos Juan Semino SA

- Nutreco N.V.

- Prorich Agro Private Limited

- Santosh Starch Products Ltd

- Sayaji Industries Ltd

- Südzucker AG

- Tate & Lyle Plc

- Tereos

- The Roquette Group

- Universal Starch Chem Allied Ltd

Actionable Strategic Recommendations Empowering Industry Leaders to Enhance Resilience Optimize Operations and Seize Growth Prospects in the Gluten Feed Domain

To capitalize on emerging opportunities and mitigate risks in the gluten feed market, industry leaders should prioritize a multifaceted strategic approach. Accelerating investment in precision milling and feed additive technologies will enhance product differentiation while improving resource efficiency. Simultaneously diversifying sourcing portfolios to include both domestic and global co-products can shield operations from tariff-induced margin pressures and supply disruptions.

Fostering deeper collaborations with end-user segments-through co-development agreements, technical support programs, and shared R&D endeavors-will strengthen customer loyalty and open pathways for value-added product introductions. Additionally, embracing digitalization across procurement, quality assurance, and logistics processes will yield real-time insights essential for navigating market volatility. Finally, embedding sustainability targets throughout the value chain-such as carbon footprint reduction and waste valorization-will not only align with regulatory mandates but also resonate with increasingly eco-conscious feed buyers, securing a competitive edge.

Rigorous Research Methodology Disclosing Comprehensive Qualitative and Quantitative Approaches Underpinning the Gluten Feed Market Analysis and Data Integrity

The research methodology underpinning this analysis integrates both qualitative and quantitative approaches to ensure comprehensive coverage and data integrity. Primary research involved direct interviews with senior executives at milling facilities, feed formulators, and distribution partners to capture firsthand insights on operational challenges and strategic priorities. In parallel a structured survey was conducted among end-users across aquaculture poultry ruminant and swine sectors to quantify usage patterns and procurement preferences.

Secondary research encompassed a systematic review of public financial filings industry association publications and regulatory databases to validate market drivers and policy developments. Data triangulation techniques were employed to reconcile discrepancies between sources and to refine key trend assessments. Furthermore geographic segmentation analysis leveraged import-export data and regional feed consumption metrics to map demand flows. Rigorous validation workshops with domain experts ensured that the final report reflects both empirical evidence and forward-looking projections, providing stakeholders with a robust foundation for decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gluten Feed market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gluten Feed Market, by Source

- Gluten Feed Market, by Form

- Gluten Feed Market, by Application

- Gluten Feed Market, by Distribution Channel

- Gluten Feed Market, by Region

- Gluten Feed Market, by Group

- Gluten Feed Market, by Country

- United States Gluten Feed Market

- China Gluten Feed Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Conclusive Reflections Emphasizing Strategic Imperatives and Core Insights Shaping the Future Trajectory of the Global Gluten Feed Market Dynamics

In conclusion the gluten feed market is poised for transformative growth driven by evolving nutritional priorities, regulatory landscapes, and innovation in processing technologies. The interplay between corn and wheat gluten feed segments underscores the importance of flexible sourcing strategies and regional customization of product offerings. As tariff environments shift and sustainability imperatives intensify, market participants with agile supply chain frameworks and robust value-added capabilities will be best positioned to capture expanding opportunities.

Strategic imperatives for stakeholders include deepening collaborations across the value chain, investing in technology-driven nutrient optimization, and embedding sustainability metrics into core operations. By synthesizing insights on segmentation, regional dynamics, competitive strategies, and methodological rigor, this report equips industry professionals with the knowledge and tools required to navigate complexity and drive informed decision-making. Ultimately, success in the gluten feed market will rest on balancing efficiency with innovation and responsiveness to ensure sustained growth in an increasingly dynamic animal nutrition landscape.

Engage Directly with Ketan Rohom Associate Director Sales Marketing to Access Exclusive Gluten Feed Market Research Insights and Drive Your Strategic Success

To delve deeper into the nuances of the gluten feed market and secure a comprehensive understanding tailored to your strategic objectives, we invite you to connect with Ketan Rohom Associate Director at 360iResearch specializing in Sales and Marketing. Ketan brings a wealth of experience in interpreting complex data and translating it into actionable insights that drive competitive advantage. By partnering directly with him you can gain early access to proprietary findings and detailed analyses that will empower your organization to stay ahead of market trends and navigate evolving regulatory landscapes.

Whether you seek a bespoke briefing on tariff impacts, a deep dive into regional demand drivers, or specialized segmentation analysis encompassing product types and end-use applications, Ketan stands ready to offer personalized guidance and facilitate access to the full gluten feed market research report. Engage with Ketan to explore customizable service options, arrange an interactive presentation, or secure volume licensing for your entire team. This is a unique opportunity to leverage premium market intelligence curated by leading analysts and ensure your decision-making is informed by the most reliable and comprehensive data available. Reach out today to reserve your executive briefing and transform insights into strategic action.

- How big is the Gluten Feed Market?

- What is the Gluten Feed Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?