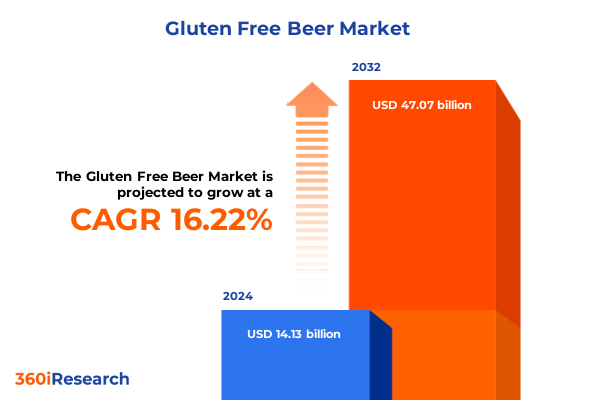

The Gluten Free Beer Market size was estimated at USD 16.39 billion in 2025 and expected to reach USD 19.01 billion in 2026, at a CAGR of 16.26% to reach USD 47.07 billion by 2032.

Discover How the Gluten Free Beer Landscape Is Being Redefined by Evolving Consumer Preferences, Innovative Ingredient Breakthroughs, and Changing Market Dynamics

The gluten free beer market has evolved from a niche offering for individuals with celiac disease and gluten intolerance into a vibrant segment driven by broad consumer demand for health-conscious, inclusive beverage options. What began as a specialized category has rapidly gained traction among mainstream consumers who seek both the sensory experience of traditional beer and the assurance of gluten-safe ingredients. This shift is underpinned by a growing body of research highlighting the benefits of gluten-reduced diets, coupled with rising awareness of digestive health and dietary restrictions. As a result, manufacturers are innovating with novel raw materials-such as millet, buckwheat, and sorghum-as well as advanced enzymatic processes that break down gluten proteins without compromising flavor.

In parallel, the landscape has been shaped by intensifying competition among craft and large-scale brewers alike, each vying to deliver premium product experiences while ensuring rigorous quality standards and clear labeling. Increasingly, certification by recognized bodies has become a hallmark of trust, and transparent communication on packaging educates consumers at the point of sale. With distribution channels expanding from specialty health retailers to mainstream supermarkets and digital platforms, accessibility has never been greater. As the market enters its next phase of maturity, stakeholders must balance product innovation, regulatory compliance, and consumer education to sustain growth and establish enduring brand loyalty.

Examining the Major Transformative Shifts Driving the Gluten Free Beer Market, from Health-Conscious Consumer Trends and Ingredient Breakthroughs to Emerging Retail and Digital Distribution Models

The gluten free beer sector is experiencing a wave of transformative shifts powered by converging forces across health, technology, and retail domains. On the health front, consumers are gravitating toward beverages that align with clean-label and functional attributes, prompting brewers to explore alternative grains and hybrid fermentation techniques. Innovations such as targeted protease enzymes and precision brewing equipment now enable the removal or neutralization of residual gluten while preserving classic beer characteristics, closing the taste gap that once hindered mainstream adoption.

Simultaneously, the proliferation of direct-to-consumer e-commerce and on-demand distribution models has disrupted traditional retail paradigms. Brewers are forging partnerships with digital marketplaces and subscription services to deliver curated gluten free collections directly to consumers’ doors. This shift is complemented by data-driven personalization, leveraging purchase history and taste profiling to recommend new varieties and maintain engagement. Moreover, sustainability has become a central narrative, with brands emphasizing eco-friendly packaging, upcycled byproducts, and carbon-neutral production processes. Taken together, these developments are recalibrating the value proposition of gluten free beer, positioning it as a cutting-edge segment that seamlessly integrates consumer wellness, technological progress, and environmental stewardship.

Analyzing the Cumulative Impact of the 2025 United States Tariff Adjustments on Ingredient Sourcing, Production Costs, and Competitive Positioning in the Gluten Free Beer Sector

In 2025, adjustments to U.S. tariffs on agricultural imports and brewing equipment have cumulatively reshaped cost structures across the gluten free beer value chain. Import duties on specialty grains such as sorghum and quinoa have incrementally increased, elevating raw material expenses for brewers dependent on these gluten-safe alternatives. At the same time, tariffs on filtration membranes and enzyme preparations-critical to refining gluten removal processes-have contributed to higher operating costs. These combined levies have prompted producers to reassess sourcing strategies, shifting toward domestic suppliers and nearshore partnerships to mitigate exposure to volatile trade policies.

The ripple effects extend to packaging, where steel and aluminum tariff adjustments have driven up keg and can prices, while glass bottle procurement from select international markets has become more cost-intensive. Faced with these headwinds, some brewers are absorbing surcharges, while others are optimizing batch sizes and investing in local supply agreements to preserve price stability. Additionally, forward-looking companies are leveraging tariff planning tools and working closely with customs brokers to navigate complex compliance requirements. Ultimately, the 2025 tariff landscape has underscored the importance of supply chain agility, compelling industry players to diversify ingredient portfolios and reinforce domestic partnerships to maintain profitability and competitive agility.

Unlocking Key Segmentation Insights That Reveal Consumer Preferences Across Beer Types, Packaging Formats, Distribution Channels, Brand Profiles, Price Ranges, Alcohol Strengths, Flavor Profiles, and Demographics

Segmentation analysis reveals a multifaceted consumer landscape where preferences and purchasing behaviors vary significantly across product type, packaging, distribution, brand identity, price tier, alcohol strength, flavor profile, and demographic cohort. When examining product type, ales-particularly pale ale variants-continue to lead adoption, buoyed by signature hop-driven aromas and approachable flavor profiles. Within the lager family, consumers show a growing appetite for crisp American pilsners, while traditional stout subtypes like dry stout attract niche followings. Wheat beer formulations, including American wheat and Hefeweizen styles, have also gained traction for their light mouthfeel and subtle fruit esters.

Packaging formats further differentiate consumer experiences, with bottles and cans dominating retail shelves and kegs facilitating on-premise draft offerings. Bottled presentations in both 330ml and 500ml volumes appeal to gift and specialty occasions, whereas 330ml and 440ml cans suit convenience and outdoor consumption. Keg formats ranging from 30L to 50L underscore the importance of bars, pubs, and event venues. Distribution channels mirror evolving shopper journeys: off-trade outlets such as convenience stores, specialty beer shops, and supermarkets anchor everyday purchases, while bars, hotels, and restaurants foster experiential tastings. Rapidly growing direct-to-consumer platforms and retailer websites have also become vital conduits for curated collections and subscription bundles.

Brand identity stratifies the market into craft, mainstream, and private-label tiers, each reflecting distinct value propositions. Price segmentation spans economy to premium, with economy offerings subdivided into standard and ultra-economy, and premium tiers differentiated by signature ingredients and artisanal processes. Alcohol content segments range from non-alcoholic or low-alcohol formulations to standard 4–6 percent beers and high-strength variants exceeding eight percent ABV. Flavor profiling by fruity, hoppy, or malty attributes facilitates targeted product development, while age cohorts from young adults to mature drinkers inform marketing narratives and communication tone.

This comprehensive research report categorizes the Gluten Free Beer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Packaging

- Brand Type

- Price Range

- Alcohol Content

- Flavor Profile

- Consumer Age Group

- Distribution Channel

Mapping Critical Regional Insights Across the Americas, Europe Middle East & Africa, and the Asia-Pacific to Understand Varied Consumer Behaviors, Regulatory Landscapes, and Market Opportunities

Regional nuances play a pivotal role in shaping the gluten free beer landscape, with market drivers diverging notably between the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, the segment is characterized by robust consumer education programs and an established network of craft brewers pioneering gluten free lines. Retail penetration is deep, spanning national supermarket chains to specialized health food retailers, and on-premise venues are increasingly curating dedicated gluten free menus. Regulatory environments are relatively harmonized, enabling streamlined certification and clear labeling standards that bolster consumer confidence.

Within Europe Middle East & Africa, market dynamics are influenced by a mosaic of regulatory frameworks, with the European Union’s 20 parts per million standard setting a gold standard for gluten thresholds. Craft breweries in Western Europe are leveraging heritage brewing techniques and local grains to create distinct gluten free offerings, while in emerging markets, consumer awareness is on the rise, supported by partnerships between brewers and celiac associations. Distribution channels remain fragmented, blending traditional hospitality venues with burgeoning e-commerce platforms.

The Asia-Pacific region exhibits the fastest growth in consumer awareness, driven by rising disposable incomes and expanding retail infrastructure. Regulatory bodies are progressively adopting codified gluten standards, and large domestic producers are investing in dedicated gluten free product lines. Online marketplaces and digital-first breweries are capitalizing on direct consumer engagement, while cross-border e-commerce introduces an array of imported and niche offerings. Together, these regional forces underscore the need for tailored strategies that account for local tastes, regulatory requirements, and distribution complexities.

This comprehensive research report examines key regions that drive the evolution of the Gluten Free Beer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves, Portfolio Diversification, and Collaboration Efforts Among Leading Breweries and Emerging Producers Shaping the Gluten Free Beer Competitive Landscape

Leading companies in the gluten free beer space are executing multifaceted strategies to capture emerging opportunities, from targeted product innovation to strategic alliances. Craft pioneers are differentiating through proprietary grain blends and novel yeast strains, while mainstream brewers are leveraging scale and distribution networks to deliver accessible gluten free options. Several firms have forged joint ventures with ingredient technology providers to secure exclusive access to advanced enzyme systems that ensure gluten reduction without sacrificing flavor.

Innovation extends beyond the brew kettle, with businesses investing in sustainable packaging solutions-from lightweight cans to paper-based labels-and integrating circular economy principles by repurposing spent grain for alternative protein products. Distribution partnerships are expanding the reach of gluten free lines into nontraditional channels, including subscription boxes, meal kit integrations, and health-oriented hospitality venues. Brand collaborations with nutrition experts and fitness influencers are amplifying credibility in health circles.

On the M&A front, acquisitions of boutique gluten free breweries by larger beverage conglomerates have accelerated, combining craft authenticity with operational scale. Private-label initiatives by major retailers are also intensifying competition, compelling established producers to elevate quality benchmarks and storytelling. Through these diverse approaches, leading companies are forging resilient competitive moats and positioning themselves to capitalize on both current demand and future market evolution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gluten Free Beer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALT Brew, LLC

- Anheuser‑Busch InBev

- Armored Cow Brewing Co., LLC

- Bard’s Tale Beer Company, LLC

- Brasserie de Brunehaut S.A.

- BrewDog plc

- Burning Brothers Brewing Company

- Carlsberg A/S

- Cooper Brewing Company

- Damm S.A.U.

- Dogfish Head Craft Brewery, LLC

- Ghostfish Brewing Company

- Glutenberg Inc.

- Green’s Gluten Free Beers

- Ground Breaker Brewing Company

- Heineken N.V.

- Holidaily Brewing Co., LLC

- Lakefront Brewery, Inc.

- Molson Coors Beverage Company

- New Belgium Brewing Company, Inc.

- New Planet Beer Company, LLC

- Omission Brewing Company, LLC

- Redbridge

- Stone Brewing Co.

- Two Brothers Brewing Company

Providing Targeted, Actionable Recommendations for Industry Leaders to Optimize Ingredient Strategies, Tailor Segmentation Approaches, Expand Distribution Networks, and Strengthen Brand Differentiation

Industry leaders seeking to thrive in the gluten free beer segment should prioritize targeted actions that address supply chain resilience, consumer engagement, and product differentiation. First, establishing multi-source partnerships for alternative grains and enzyme technologies will mitigate tariff-related cost pressures and safeguard production continuity. Early collaboration agreements with domestic growers and ingredient innovators can lock in favorable pricing and co-create novel formulations.

Second, investing in robust digital commerce platforms and loyalty programs will deepen consumer relationships and generate actionable purchasing data. Personalized recommendation engines, complemented by virtual tasting events, can drive repeat purchase and advocacy. Third, optimizing packaging formats to align with consumption occasions-from single-serve cans for on-the-go shoppers to mini kegs for home gatherings-will maximize shelf impact and improve unit economics.

Fourth, articulating transparent certification processes and leveraging third-party endorsements will build trust among health-focused consumers. Fifth, tailoring product portfolios to specific market segments-whether based on alcohol strength preferences, flavor profiles, price sensitivity, or demographic cohorts-will enable more precise marketing spend and higher conversion rates. Finally, committing to sustainability and social responsibility-such as reducing water usage, utilizing renewable energy, and supporting local celiac associations-will resonate with purpose-driven buyers and enhance brand equity.

Outlining the Rigorous Research Methodology Incorporating Primary Interviews, Proprietary Surveys, Quality Assurance Protocols, and Data Triangulation Techniques Underpinning This Study

This research leveraged a multi-tiered methodology combining primary, secondary, and qualitative analytical techniques to ensure comprehensive, reliable insights. Primary data was gathered through in-depth interviews with senior executives at breweries, ingredient suppliers, and distribution partners, alongside consumer surveys designed to capture purchasing motivations, taste preferences, and willingness to pay for gluten free beer offerings. Secondary data sources included trade association publications, regulatory guidelines, and publicly available industry reports, all of which were critically evaluated to maintain independence from proprietary forecasting firms.

Qualitative analysis involved synthesis of thematic insights from focus groups spanning diverse demographic and geographic cohorts, while quantitative validation employed triangulation techniques to cross-verify trends across multiple data streams. Data integrity was upheld through rigorous cleansing protocols and peer-review checkpoints, ensuring that conclusions reflect robust evidence rather than anecdotal observations. Throughout the study, adherence to industry best practices in sample design, question formulation, and bias mitigation underpinned the reliability of our findings and supported actionable strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gluten Free Beer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gluten Free Beer Market, by Type

- Gluten Free Beer Market, by Packaging

- Gluten Free Beer Market, by Brand Type

- Gluten Free Beer Market, by Price Range

- Gluten Free Beer Market, by Alcohol Content

- Gluten Free Beer Market, by Flavor Profile

- Gluten Free Beer Market, by Consumer Age Group

- Gluten Free Beer Market, by Distribution Channel

- Gluten Free Beer Market, by Region

- Gluten Free Beer Market, by Group

- Gluten Free Beer Market, by Country

- United States Gluten Free Beer Market

- China Gluten Free Beer Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 3816 ]

Concluding Insights Summarizing Strategic Imperatives, Health-Driven Market Drivers, Regulatory Considerations, and Competitive Outlook Crucial for Stakeholders Navigating the Gluten Free Beer Arena

In closing, the gluten free beer segment presents a dynamic confluence of health-driven consumer demand, technological breakthroughs, and shifting regulatory frameworks. Stakeholders who embrace ingredient innovation and fortify supply chain agility will be best positioned to navigate tariff fluctuations and ingredient cost volatility. Strategic segmentation-spanning product type, packaging format, distribution channel, brand profile, price tier, alcohol content, flavor attribute, and consumer age group-enables targeted market penetration and elevated consumer resonance.

Moreover, region-specific approaches that account for local regulatory thresholds, cultural taste profiles, and distribution infrastructure will unlock incremental growth opportunities across the Americas, Europe Middle East & Africa, and the Asia-Pacific. Competitive intensity will intensify as both established and emerging players pursue differentiation through sustainability initiatives, digital engagement, and strategic partnerships. By internalizing these insights and implementing our recommendations, companies can cultivate resilient brands, optimize operational efficiencies, and deliver superior consumer experiences, ensuring long-term success in this rapidly maturing segment.

Engage with Associate Director Ketan Rohom to secure your comprehensive market research report and empower strategic decisions in the Gluten Free Beer Sector

To secure your organization’s competitive edge and capitalize on the burgeoning gluten free beer market, engage with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to gain immediate access to our comprehensive market research report. By connecting with Ketan, you will receive a tailored briefing that outlines the most pertinent insights, empowers your strategic planning, and provides the actionable intelligence required to refine product portfolios, optimize distribution strategies, and anticipate regulatory shifts. Don’t miss the opportunity to leverage in-depth analyses of consumer trends, segmentation dynamics, tariff impacts, and regional nuances-contact Ketan Rohom today to transform these insights into actionable growth initiatives tailored to your organization’s goals and accelerate your path to market leadership

- How big is the Gluten Free Beer Market?

- What is the Gluten Free Beer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?