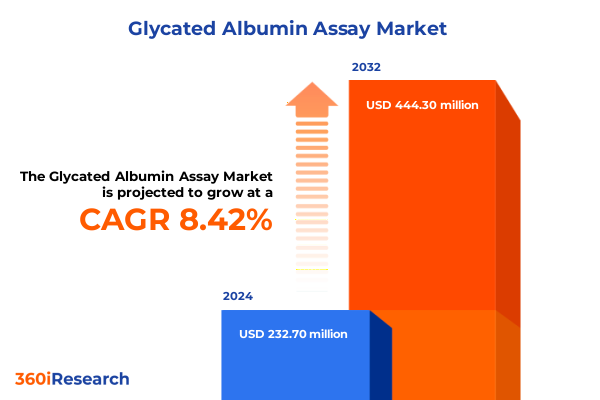

The Glycated Albumin Assay Market size was estimated at USD 251.06 million in 2025 and expected to reach USD 274.84 million in 2026, at a CAGR of 8.49% to reach USD 444.29 million by 2032.

Understanding the Growing Importance of Glycated Albumin Assays in Modern Clinical Diagnostics to Enhance Diabetes Management and Improve Patient Outcomes Across Diverse Healthcare Settings

The global healthcare community is witnessing a critical inflection point in diabetes management, as traditional biomarkers such as glycated hemoglobin (HbA1c) reveal limitations in reflecting short-term glycemic fluctuations and conditions like hemoglobinopathies. In this context, glycated albumin assays have emerged as a complementary diagnostic tool that captures intermediate glycemic control over a two- to four-week period. This allows clinicians to detect transient hyperglycemic episodes and adjust therapeutic regimens more responsively than with HbA1c alone.

Beyond improved temporal sensitivity, glycated albumin measurements offer distinct advantages in patient populations where red blood cell turnover is altered, such as those with anemia, chronic kidney disease, or recent blood transfusions. By providing a more accurate reflection of glycemic exposure independent of erythrocyte lifespan, these assays facilitate better-informed treatment decisions and help mitigate long-term complications associated with poor glucose control.

As diabetes prevalence continues to escalate globally, there is growing recognition among clinicians, laboratorians, and healthcare administrators that an integrated testing strategy-including glycated albumin-can optimize disease monitoring, enhance patient outcomes, and reduce costs tied to preventable complications. This introduction underscores the imperative for stakeholders to understand the evolving role of glycated albumin assays within modern clinical diagnostics.

Revolutionary Advances in Assay Chemistry Automation and Decentralized Testing Redefining the Glycated Albumin Assay Market Dynamics

The glycated albumin assay market is undergoing a paradigm shift propelled by advancements in assay chemistries and delivery formats. Laboratories are increasingly adopting dual-reagent colorimetric kits alongside single-reagent variants that streamline workflows by combining multiple reaction steps into a single tube, thereby accelerating turnaround times while maintaining analytical accuracy. These colorimetric methods continue to dominate high-throughput diagnostic laboratories due to their cost-effectiveness and compatibility with automated analyzers.

Concurrently, enzymatic assays have evolved from basic UV-based protocols to more sophisticated fluorometric enzymatic formats that enhance specificity and lower limits of detection. This evolution has been particularly valuable in research settings where precise quantification is critical. Mass spectrometry–based approaches, notably time-of-flight and triple quadrupole configurations, have further elevated analytical performance, enabling multiplexed detection of glycated proteins and related biomarkers for comprehensive metabolic profiling.

Perhaps the most transformative shift is the decentralization of testing through point-of-care platforms. Manufacturers are introducing ready-to-use kits that integrate reagents into self-contained cartridges, making glycated albumin testing feasible in outpatient clinics and community health centers. Digital connectivity, including wireless data transmission to electronic health records, supports remote monitoring and telehealth initiatives, positioning glycated albumin assays as a cornerstone of patient-centered diabetes care.

Analyzing the Far-Reaching Consequences of 2025 United States Tariff Adjustments on Glycated Albumin Assay Supply Chains and Costs

Recent developments in U.S. trade policy have introduced new complexities for global supply chains in the glycated albumin assay sector. In January 2025, the Office of the United States Trade Representative finalized substantial increases in Section 301 tariffs on selected materials, including reagents and intermediate components sourced from China. Tariffs on chemical precursors and specialized polymers surged by up to 50 percent, directly affecting the cost structures of assay kits and bulk reagents.

These elevated duties have compelled assay developers and reagent manufacturers to reassess sourcing strategies. Some companies are pivoting toward alternative suppliers in Southeast Asia and Europe, while others are exploring domestic production incentives to mitigate tariff burdens. However, such transitions often involve rigorous validation processes to ensure analytical equivalence, potentially extending product development timelines.

The cumulative impact of these tariff adjustments extends beyond cost pressures; it has prompted strategic partnerships and contract renegotiations. Organizations with vertically integrated supply chains have leveraged in-house capabilities to buffer against duty increases, whereas smaller innovators have pursued collaborative agreements to access tariff-exempt raw materials under preferential trade schemes. Looking ahead, ongoing monitoring of U.S.–China trade relations and potential tariff modifications will be essential for maintaining supply chain resilience and cost predictability.

Uncovering Critical Insights Across Product Types Analytical Methods End User Profiles and Application Scenarios Shaping the Market

A nuanced examination of the glycated albumin assay market reveals four critical segmentation dimensions that inform strategic decision-making. By product type, the market bifurcates into kits and reagents, with kits encompassing laboratory kits optimized for automated high-throughput platforms and point-of-care kits designed for rapid bedside use. Reagents further divide into bulk formulations tailored for centralized laboratories that process large sample volumes and ready-to-use preparations that simplify workflow and reduce manual handling risks.

When considering analytical method, colorimetric assays remain foundational due to their integration into existing laboratory infrastructure. The colorimetric category itself splits between dual-reagent systems, which combine color-developing and stabilizing agents, and single-reagent formats that embed necessary cofactors into a unified mixture. Enzymatic assays differentiate into fluorometric enzymatic techniques, prized for their high sensitivity in detecting low-level modifications, and UV-based enzymatic protocols favored for their robustness in routine testing. LC-MS methodologies are further distinguished by time-of-flight instruments, which offer broad mass-range detection, and triple quadrupole platforms known for targeted quantification of glycated peptides.

End users span diagnostic laboratories that demand throughput and reproducibility, hospital-based laboratories that require rapid integration with clinical workflows, and research institutes focused on biomarker discovery and method development. Across applications, glycated albumin assays play a pivotal role in diabetes monitoring, supporting gestational diabetes management, and contributing to risk assessment protocols for microvascular and macrovascular complications. This segmentation framework underscores the importance of tailored product strategies and targeted marketing initiatives to address the distinct needs of each segment.

This comprehensive research report categorizes the Glycated Albumin Assay market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Method

- Application

- End User

Comparative Regional Trends Driving Glycated Albumin Assay Adoption Across the Americas Europe Middle East & Africa and Asia-Pacific Markets

Regional dynamics significantly influence the uptake and evolution of glycated albumin assays. In the Americas, established healthcare infrastructure and favorable reimbursement policies have accelerated adoption in both hospital networks and large diagnostic laboratories. The United States, in particular, benefits from well-established regulatory pathways that facilitate the integration of new assay formats into routine practice. Meanwhile, Latin American markets are experiencing gradual expansion driven by increased disease awareness and investments in laboratory modernization.

In Europe, Middle East & Africa, a heterogeneous mix of healthcare systems shapes market potential. Western Europe showcases rapid assimilation of advanced platforms, supported by strong research ecosystems and collaborative public–private initiatives. Emerging economies in Eastern Europe, the Gulf Cooperation Council, and Sub-Saharan Africa are at varying stages of infrastructure development, yet there is a shared recognition of the need for accessible, point-of-care diagnostics to manage rising diabetes prevalence.

Asia-Pacific represents the fastest-growing region, driven by large patient populations and proactive public health campaigns. Markets such as Japan and Australia demonstrate early adoption of LC-MS and enzymatic assays, while China and India prioritize cost-effective colorimetric and point-of-care solutions to meet burgeoning demand. Government-led screening programs and strategic partnerships between local distributors and global manufacturers further reinforce the region’s momentum.

This comprehensive research report examines key regions that drive the evolution of the Glycated Albumin Assay market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players’ Strategic Initiatives Collaborations and Innovations Steering the Competitive Landscape

The competitive landscape of the glycated albumin assay market is characterized by the interplay between large diagnostics conglomerates and specialized biotech firms. Established players have leveraged expansive R&D budgets to develop next-generation enzymatic and LC-MS platforms, often complemented by bundled service offerings that include method validation and technical support. These companies capitalize on global distribution networks to ensure rapid market penetration and maintain incremental product upgrades through regular kit enhancements.

Conversely, emerging companies are differentiating through niche capabilities and agile innovation. By focusing on single-reagent chemistries or proprietary cartridge designs for point-of-care testing, these firms can address unmet needs in outpatient and community settings. Strategic alliances between instrument manufacturers and reagent specialists are also driving integrated solutions that minimize compatibility risks and reduce total cost of ownership for end users.

Mergers and acquisitions have emerged as a common tactic to consolidate technological leadership and expand geographic reach. Larger organizations are acquiring emerging innovators to bolster their product portfolios, while smaller entities seek partnerships to access established sales channels. This dynamic has led to a more diversified ecosystem where collaborative ventures and co-development agreements are critical to sustaining long-term growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Glycated Albumin Assay market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbexa Limited

- Abcam PLC

- Abnova Corporation

- AFG Bioscience LLC

- Asahi Kasei Corporation

- Beijing Jiuqiang Biotechnology Co., Ltd.

- Biomatik Corporation

- Cardinal Health, Inc.

- Crystal Chem Inc.

- Cusabio Technology LLC

- Diazyme Laboratories, Inc.

- DxGen Corp.

- EKF Diagnostics Holdings PLC

- Epinex Diagnostics Inc.

- Hzymes Biotech

- Kikkoman Corporation

- Laboratory Corporation of America Holdings

- LifeSpan BioSciences, Inc.

- Merck KGaA

- Novatein Biosciences Inc.

- Sekisui Chemical Co., Ltd.

- Thermo Fisher Scientific Inc.

- Thomas Scientific LLC

- Weldon Biotech, Inc.

- Wuhan Fine Biotech Co., Ltd.

Strategic Imperatives and Tactical Recommendations for Industry Leaders to Thrive in the Evolving Glycated Albumin Assay Landscape

Industry leaders should prioritize the development of flexible assay portfolios that address both high-volume laboratory demands and decentralized testing requirements. Investing in modular platforms capable of accommodating colorimetric, enzymatic, and mass spectrometry methods will ensure adaptability as customer preferences evolve. Furthermore, establishing strategic partnerships with local distributors in growth markets can accelerate adoption and provide critical on-the-ground insights into regulatory and reimbursement landscapes.

To mitigate supply chain risks exacerbated by tariff fluctuations, organizations should evaluate dual-sourcing strategies and consider nearshoring of key reagent components. Engaging in active dialogue with policymakers regarding potential tariff relief or exclusion processes can also help secure more favorable trade terms. Additionally, leveraging digital tools for remote monitoring and data analytics will enhance service offerings, fostering deeper customer engagement and demonstrating clear value in clinical decision support.

Finally, companies should invest in thought leadership initiatives that educate healthcare providers on the clinical utility of glycated albumin assays, particularly in scenarios where traditional markers fall short. By sponsoring clinical studies, presenting at key conferences, and publishing peer-reviewed findings, industry leaders can reinforce the assay’s role in comprehensive diabetes management and position themselves as trusted partners in patient care.

Robust Multi-Stage Research Methodology Combining Primary Interviews Secondary Analysis and Rigorous Data Validation Processes

This research combines a multi-stage methodology to ensure comprehensive and reliable insights. Secondary research began with an extensive review of peer-reviewed journals, regulatory documents, and trade publications to establish foundational understanding of assay technologies, clinical applications, and policy frameworks.

Primary research involved in-depth interviews with industry stakeholders, including clinical laboratory directors, procurement managers, assay developers, and regulatory experts. These qualitative discussions provided nuanced perspectives on end-user requirements, pricing pressures, and adoption barriers. Insights gleaned from primary sources were cross-validated against secondary data to confirm consistency and accuracy.

Quantitative analysis leveraged historical market data, shipment volumes, and revenue trends-sourced from public company filings, government databases, and customs records-to identify patterns in product uptake and regional performance. Rigorous data triangulation and quality checks were applied throughout the process, ensuring that the conclusions and recommendations are grounded in robust evidence and reflective of the current market environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Glycated Albumin Assay market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Glycated Albumin Assay Market, by Product Type

- Glycated Albumin Assay Market, by Method

- Glycated Albumin Assay Market, by Application

- Glycated Albumin Assay Market, by End User

- Glycated Albumin Assay Market, by Region

- Glycated Albumin Assay Market, by Group

- Glycated Albumin Assay Market, by Country

- United States Glycated Albumin Assay Market

- China Glycated Albumin Assay Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Consolidating Core Findings and Strategic Perspectives to Navigate Future Opportunities in the Glycated Albumin Assay Market

The collective analysis underscores the increasing strategic relevance of glycated albumin assays as complementary tools for diabetes monitoring, particularly in clinical scenarios where HbA1c falls short. Technological advancements across colorimetric, enzymatic, and mass spectrometry platforms are expanding the assay’s applicability from high-throughput laboratories to decentralized point-of-care settings. Regulatory and reimbursement environments in key regions continue to influence adoption trajectories, necessitating agile go-to-market strategies.

Trade policy developments, notably the 2025 tariff adjustments, have introduced both challenges and opportunities for supply chain resilience. Companies that proactively diversify sourcing and engage in policy advocacy are better positioned to navigate cost pressures while sustaining innovation pipelines. Moreover, the competitive landscape is evolving through strategic alliances, M&A activity, and differentiated offerings that blend assay performance with digital connectivity and service excellence.

Looking ahead, stakeholders who align product development with clinical education initiatives, embrace digital integration, and tailor offerings to regional market dynamics will be best equipped to capture emerging growth opportunities. The market’s maturation signals a favorable environment for continued investment, consolidation, and novel collaborations that will strengthen the role of glycated albumin assays in optimizing diabetes care.

Engage with Ketan Rohom to Access In-Depth Glycated Albumin Assay Market Insights and Empower Your Strategic Decision-Making

If you are ready to elevate your strategic positioning and gain granular insights into the evolving glycated albumin assay landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. With direct access to in-depth analysis, competitive benchmarking, and tailored data on product innovations, regulatory shifts, and regional dynamics, you can make informed decisions that drive growth and resilience. Contact Ketan to secure your definitive market research report today and empower your organization to capitalize on emerging opportunities before your competitors.

- How big is the Glycated Albumin Assay Market?

- What is the Glycated Albumin Assay Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?