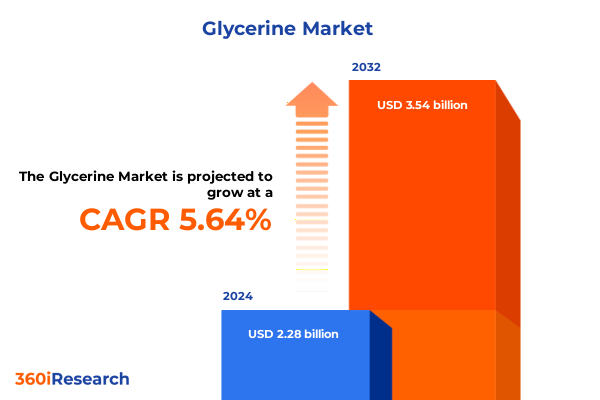

The Glycerine Market size was estimated at USD 2.41 billion in 2025 and expected to reach USD 2.55 billion in 2026, at a CAGR of 5.64% to reach USD 3.54 billion by 2032.

Unlock the Multifaceted Potential of Glycerine by Exploring Its Chemical Nature Diverse Sourcing and Versatile Industrial Applications

Glycerine, also known as glycerol, is a tri-functional alcohol renowned for its hygroscopic properties that make it indispensable across diverse industries. As a colorless, odorless liquid, it functions as a chemical backbone in numerous formulations, prized for its ability to retain moisture and enhance texture in end products. Beyond its inherent versatility, glycerine’s compatibility with both water and organic solvents allows it to bridge gaps between polar and nonpolar systems, underpinning its role as a critical ingredient in specialized manufacturing processes. Its multifunctional nature has solidified glycerine’s reputation as a go-to additive for applications ranging from consumer goods to technical industries, underscoring its strategic importance in modern value chains

Originating from sources as varied as animal fats, petrochemical propylene streams, and vegetable oils, glycerine’s supply dynamics reflect the industry’s continuous evolution toward renewable feedstocks. The biodiesel industry, in particular, has emerged as a major crude glycerine provider, reinforcing the co-dependency between renewable energy initiatives and chemical supply chains. This intersection of sustainability and production efficiency continues to drive investment in processes that convert byproducts into high-purity grades suitable for sensitive applications

In the realm of end-use, glycerine’s broad spectrum encompasses food and beverage formulations where it serves as a sweetener and texturizer, fuel sectors as a biodiesel derivative, industrial uses as a solvent and antifreeze precursor, and personal care and pharmaceutical products where its humectant and excipient functionalities are indispensable. Such extensive application diversity ensures glycerine remains a focal point for formulators and engineers aiming to optimize performance and cost-effectiveness across product portfolios

Amid shifting regulatory landscapes and consumer preferences for clean-label ingredients, glycerine’s established safety profile and bio-based sourcing opportunities position it to meet stringent quality standards while supporting environmental stewardship goals. This synergy of performance and sustainability sets the stage for glycerine’s enduring relevance as industries pivot toward green chemistry solutions.

Navigating Sustainability and Technological Innovations Driving a Radical Transformation in the Global Glycerine Landscape

Rapidly intensifying sustainability mandates and technological breakthroughs are reshaping the glycerine market, driving companies to rethink supply chain structures and product portfolios. Heightened regulatory scrutiny in regions such as Europe has led to tighter purity requirements for pharmaceutical and food-grade glycerine, compelling producers to invest in advanced purification systems capable of removing trace impurities. These technological advancements not only improve product consistency but also unlock new high-value applications in bioplastics and green chemicals, where material performance and safety are paramount

Simultaneously, the global push for renewable energy has fueled biodiesel output, generating increased volumes of crude glycerine that challenge existing refining capacities. Companies that adapt by implementing modular, scalable purification units are better positioned to capitalize on fluctuating feedstock availability and maintain margin stability. Innovative membrane separation and catalytic purification techniques are gaining traction, offering lower energy consumption and reduced waste compared to traditional distillation methods. Early adopters of these technologies enjoy faster turnaround times and enhanced flexibility to meet diverse purity specifications across industry segments

Digital transformation is also influencing market dynamics, as real-time analytics and supply chain visibility tools enable stakeholders to anticipate feedstock disruptions, optimize logistics routes, and align production schedules with shifting demand patterns. By leveraging data-driven insights, organizations can mitigate risks associated with price volatility and import bottlenecks, ensuring a more resilient value chain. As sustainability commitments deepen and technological innovation accelerates, the glycerine landscape is poised for continued evolution that rewards agility and strategic foresight.

Assessing the Far-Reaching Effects of the 2025 United States Tariff Regime on Glycerine Supply Chains and Cost Structures

In April 2025, the United States implemented a comprehensive Reciprocal Tariff Policy that imposes a baseline 10% ad valorem duty on most imports, with higher country-specific rates phased in for designated trading partners. This policy aims to encourage domestic manufacturing and address perceived non-tariff barriers abroad. Under the initiative, goods entered for consumption on or after April 5 face the 10% levy, with more stringent tariffs taking effect on April 9 for specific nations identified in the Presidential Executive Order

Although a 90-day pause on targeted new duties spared a range of high-volume chemicals from steeper rates, glycerine was notably absent from the exemption list. The administration’s exclusions primarily covered polymers, petrochemicals, and pharmaceutical intermediates, leaving glycerine imports subject to the general reciprocal schedule. This gap has introduced uncertainty for glycerine-dependent manufacturers and importers, who now face potential cost increases as the moratorium evolves or lapses

Industry groups such as the American Chemistry Council and SOCMA have warned that additional tariffs on essential chemical inputs could drive up raw material expenses and disrupt established supply chains. With glycerine serving as a feedstock for multiple downstream sectors, the added duty risks narrowing margins for resin producers, cosmetic formulators, and pharmaceutical manufacturers alike. Some stakeholders have responded by accelerating domestic refinement initiatives and renegotiating long-term supply agreements to hedge against tariff volatility

Looking ahead, companies are closely monitoring Federal Register notices and CSMS advisories to determine drawback eligibility and plan logistics accordingly. By diversifying sourcing strategies, exploring tariff-advantaged trade lanes, and investing in local purification capacity, stakeholders aim to mitigate the immediate cost pressures while aligning with the broader industrial policy objectives driving these measures.

Revealing Critical Market Segments Shaping Glycerine Demand From Applications and Sources to Purity and Distribution Dynamics

Understanding glycerine demand requires a nuanced view of its applications, where the Food & Beverage segment leverages glycerine’s sweetness and moisture retention properties to enhance product texture and shelf life. Within fuel markets, biodiesel producers rely on glycerine as a co-product, balancing renewable energy mandates with feedstock economics. Industrial end users deploy glycerine as a solvent and antifreeze precursor, capitalizing on its chemical stability under extreme conditions. Meanwhile, the Personal Care & Pharmaceuticals segment encompasses formulations ranging from skin moisturizers to medicinal syrups, where glycerine’s excipient and humectant functionalities ensure product efficacy and patient safety. These application-driven distinctions guide investment in purification infrastructure and regulatory compliance pathways to meet diverse quality standards

Diving deeper into sourcing dynamics, Animal-derived glycerine sourced from tallow provides a traditional supply route for industrial-grade applications, while petrotechnical glycerine derived from propylene feeds into specialty chemical manufacturing. Vegetable-derived sources such as palm, rapeseed, and soybean have gained prominence thanks to biodiesel integration and sustainability benchmarks. This shift toward plant-based feedstocks aligns with eco-conscious branding initiatives and certification schemes, albeit at the expense of more complex supply chain traceability and potential feedstock price fluctuations

Purity grade segmentation further refines market opportunity: Food Grade glycerine demands rigorous microbial and impurity controls, Industrial Grade prioritizes cost efficiency over stringent specifications, Pharmaceutical Grade adheres to pharmacopeia regulations for safe human consumption, and Technical Grade serves as an economical solution for non-critical applications. These gradations influence capital allocation toward tailored purification processes and quality assurance frameworks that underpin product positioning across end-market channels

Distribution channels play a critical role in market reach, with direct sales enabling bulk chemical buyers to secure customized contracts, online retail serving niche personal care brands seeking agility and brand differentiation, and wholesale distributors facilitating logistics efficiencies for high-volume industrial applications. Effective channel management ensures optimal inventory levels and customer service across diverse geographies and buyer profiles. Functionality-based segmentation underscores glycerine’s roles as an Emollient in skincare formulations, a Humectant that locks in moisture, and a Solvent for active pharmaceutical ingredients and specialty resins, guiding R&D investments and product innovation strategies.

This comprehensive research report categorizes the Glycerine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Purity Grade

- Functionality

- Application

- Distribution Channel

Examining Regional Dynamics Influence on Glycerine Demand and Production Patterns Across Americas EMEA and Asia-Pacific Markets

In the Americas, evolving biofuel policies and renewable energy incentives continue to drive biodiesel output, creating variable volumes of crude glycerine that challenge domestic refining capacity. The first half of 2025 witnessed tighter U.S. glycerine supply as weakened soy methyl ester production and persistent import logistics bottlenecks generated short-term shortages in kosher crude streams. Market participants responded by optimizing inventory allocation and exploring alternative feedstock partnerships to maintain production continuity under these constraints

Across Europe, Middle East & Africa, stringent sustainability directives and clean-label consumer trends are reshaping glycerine sourcing strategies. Regulatory enforcement around synthetic additive limitations has accelerated the shift toward bio-based glycerine, particularly in personal care and pharmaceutical applications. Manufacturers in the region have invested in integrated biorefinery models and circular economy partnerships to align with EU directives and meet rising demand for certified renewable ingredients, while balancing cost and traceability considerations

Asia-Pacific remains the largest glycerine production hub, benefiting from robust industrial infrastructure and supportive government mandates for biodiesel blending. Major producers in China and India leverage large-scale vegetable oil and palm oil feedstocks to maintain pricing power, even as quality variations between refined and crude streams persist. Rapid urbanization and growing personal care consumption fuel high-purity glycerine demand, prompting capacity expansions and collaborative ventures between leading chemical firms and downstream users in key markets such as Japan, South Korea, and Southeast Asia

This comprehensive research report examines key regions that drive the evolution of the Glycerine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Initiatives of Leading Glycerine Producers to Capitalize on Sustainability Innovation and Market Expansion Opportunities

Cargill has significantly expanded its focus on producing eco-friendly glycerine derived from plant-based raw materials, boosting refining capacity to address surplus crude glycerine generated by biodiesel co-production. By enhancing its purification infrastructure, the company aims to serve emerging bioindustrial applications such as bioplastics and green chemicals, reinforcing its commitment to circular economy objectives and improving operational flexibility in response to fluctuating feedstock supplies

Wilmar International’s Agri-Hub model integrates smallholder farmers into its supply network, ensuring consistent feedstock quality and supply reliability. Operating large-scale palm oil and biodiesel facilities, the company channels waste glycerine through cost-efficient biorefineries to produce refined grades for cosmetic and food segments. This approach not only secures raw material inputs but also aligns with broader ESG goals, as evidenced by double-digit growth in bio-based glycerine exports to key pharmaceutical markets in 2023

BASF distinguishes itself through circular economy partnerships, supplying bio-based glycerine to personal care giants under its ChemCycling™ program. By reprocessing glycerine byproducts from biogas plants into specialty chemicals, BASF achieves substantial carbon footprint reductions compared to fossil-based equivalents. Collaborative ventures with leading consumer brands ensure direct alignment between production capabilities and end-product sustainability requirements, strengthening market positioning in Europe and North America

Procter & Gamble has intensified its use of plant-based glycerine in skincare and hygiene product lines, integrating renewable glycerine formulations into flagship brands to meet rising consumer demand for natural ingredients. Strategic investments in refining capacity and R&D partnerships have enabled P&G to optimize glycerine sourcing and maintain supply chain resilience for high-margin personal care applications

Emery Oleochemicals and Dow are leveraging their oleochemical expertise to expand specialty glycerine portfolios, focusing on advanced purification technologies and customized solutions for pharmaceutical and industrial clients. Both firms are pursuing joint ventures and capacity expansions in North America and Asia to capitalize on evolving purity requirements and sustainability trends.

This comprehensive research report delivers an in-depth overview of the principal market players in the Glycerine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAK AB

- Archer Daniels Midland Company

- Asfara Global

- BASF SE

- Cargill, Incorporated

- Clariant Ltd.

- Emery Oleochemicals

- Evonik Industries AG

- Global Green Chemicals Public Company Limited

- Godrej Industries Limited

- IOI Oleochemical

- Kao Corporation

- KLK OLEO

- Louis Dreyfus Company

- Pacific Oleochemicals Sdn Bhd

- PT SMART Tbk

- PT. Sumi Asih

- Sakamoto Yakuhin kogyo Co., Ltd.

- Thai Glycerine Co., Ltd.

- The Dow Chemical Company

- The Procter & Gamble Company

- Twin Rivers Technologies, Inc.

- Vance Group Ltd.

- Vitusa Products, Inc.

- Wilmar International Limited

Implementing Targeted Strategies to Optimize Glycerine Operations Enhance Resilience and Drive Growth in a Rapidly Evolving Industry

Industry leaders should prioritize investment in flexible purification infrastructure that accommodates shifting feedstock compositions, enabling rapid adaptation to biodiesel production fluctuations and changing quality demands. Upgrading to membrane and catalytic systems can lower operational costs while ensuring compliance with stringent purity standards for high-value applications. Embracing modular, scalable technologies also facilitates incremental capacity expansions without disrupting existing operations

To mitigate tariff-related uncertainties, companies should diversify sourcing strategies by exploring tariff-advantaged trade corridors, negotiating long-term supply contracts with built-in drawback provisions, and developing domestic partnerships for local glycerine refining. Effective engagement with trade associations and government agencies can provide early visibility into policy shifts, enabling proactive adjustments to logistics and procurement plans while minimizing exposure to sudden duty changes

Enhancing supply chain transparency through digital platforms allows stakeholders to track glycerine provenance and quality across multiple tiers, reducing risk and reinforcing sustainability claims. Collaborative initiatives with feedstock suppliers and downstream customers foster trust and improve forecasting accuracy. Investing in data analytics tools to monitor real-time market signals, logistics bottlenecks, and price movements will further strengthen decision-making capabilities in a volatile landscape

Finally, organizations should cultivate strategic partnerships with R&D institutions and technology providers to accelerate product innovation, focusing on next-generation glycerine derivatives and biobased formulations. By aligning research priorities with emerging consumer and regulatory trends, companies can sustain competitive differentiation and capture growth opportunities in value-added segments.

Detailing Rigorous Research Methods Leveraging Multiple Data Sources Expert Insights and Robust Analysis to Ensure Report Credibility

This report leverages a comprehensive research framework combining secondary data analysis and primary engagement with industry experts. Secondary sources include regulatory filings, trade publications, patent databases, and corporate documentation to map historical trends and emerging policy developments. Proprietary databases and specialized journals provided technical insights into purification advancements and feedstock innovations.

Primary research comprised in-depth interviews with C-suite executives, process engineers, and supply chain managers across leading glycerine producers, distributors, and end users. Structured questionnaires and follow-up consultations enriched quantitative findings with qualitative perspectives on operational challenges, technology adoption, and strategic priorities.

Data triangulation methodologies ensured accuracy, cross-validating qualitative inputs with trade volume statistics, import-export records, and logistics performance indicators. Segment-specific analysis reflected five dimensions-Application, Source, Purity Grade, Distribution Channel, and Functionality-each evaluated for growth drivers, regulatory considerations, and technological enablers.

Regional assessments integrated geopolitical factors, policy landscapes, and consumer behavior patterns to outline differentiated strategies for the Americas; Europe, Middle East & Africa; and Asia-Pacific markets. Company profiles were developed through a synthesis of annual reports, sustainability disclosures, and investor presentations, focusing on capacity expansions, partnership models, and innovation pipelines.

Rigorous quality control measures, including peer review by subject matter specialists and iterative validation with participating stakeholders, underpin the report’s reliability and actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Glycerine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Glycerine Market, by Source

- Glycerine Market, by Purity Grade

- Glycerine Market, by Functionality

- Glycerine Market, by Application

- Glycerine Market, by Distribution Channel

- Glycerine Market, by Region

- Glycerine Market, by Group

- Glycerine Market, by Country

- United States Glycerine Market

- China Glycerine Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Key Findings on Glycerine Market Dynamics and Strategic Imperatives for Stakeholders in an Era of Supply Chain Complexity

The glycerine market stands at a pivotal juncture, where sustainability imperatives and technological innovations converge to redefine supply chains and product development pathways. Stakeholders must navigate a complex matrix of feedstock variability, tariff regimes, and purity requirements to maintain competitive positioning across diverse end-use segments.

Our analysis highlights the critical importance of agility in refining processes and supply chain strategies, as fluctuating biodiesel outputs and trade policies introduce both risks and opportunities. Advanced purification technologies and digital supply chain tools emerge as essential enablers for meeting stringent quality standards while safeguarding margin integrity in a tightened market environment.

Segmentation insights underscore the multiplicity of value pools within the glycerine landscape-from food and beverage formulations reliant on sweetness and texture enhancements to high-purity pharmaceutical and cosmetic applications demanding uncompromising standards. Regional distinctions further shape strategic imperatives, with the Americas contending with import bottlenecks, EMEA aligning with rigorous sustainability mandates, and Asia-Pacific harnessing scale and cost advantages.

Leading companies demonstrate the benefits of integrated bio-refinery models, circular economy partnerships, and targeted R&D investments in driving product differentiation and operational resilience. As the industry continues to evolve, proactive collaboration among producers, regulators, and end-user sectors will be vital to realizing the full potential of glycerine as a cornerstone of bio-based chemistry ecosystems.

Take Action Today and Engage with Ketan Rohom to Secure In-Depth Insights and Unlock Competitive Advantage Through Our Glycerine Report

Ready to gain unparalleled insights into the evolving glycerine market? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, for a personalized consultation and immediate access to the comprehensive report. Leverage expert analysis to stay ahead of supply chain disruptions, regulatory shifts, and competitive strategies.

Secure your copy today to explore in-depth research on transformative market trends, tariff impacts, and strategic segmentation. Partner with our team to align your business objectives with actionable intelligence and drive growth in a complex global environment. Ketan Rohom is available to discuss tailored solutions that meet your organization’s needs and unlock competitive advantage in the glycerine sector.

- How big is the Glycerine Market?

- What is the Glycerine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?