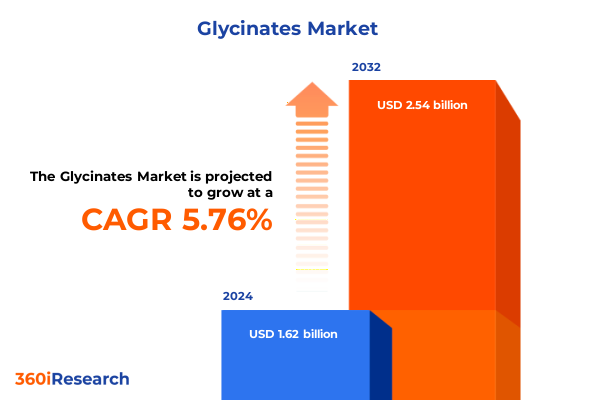

The Glycinates Market size was estimated at USD 1.71 billion in 2025 and expected to reach USD 1.80 billion in 2026, at a CAGR of 5.75% to reach USD 2.54 billion by 2032.

Laying the Foundation for Glycinate Market Dynamics by Unveiling Core Drivers, Market Forces, and Emerging Opportunities Shaping Industry Trajectories

The glycinates market has emerged as a pivotal segment within specialty chemicals and nutritional ingredients, driven by the distinctive chelation properties that improve mineral solubility, stability, and bioavailability. As formulators seek to address nutritional deficiencies and performance optimization in humans and animals alike, glycine-bound minerals have gained traction across dietary supplements, functional foods, pharmaceuticals, and animal feed formulations. This introduction sets the stage by examining how core drivers such as scientific innovation, shifting consumer preferences, and regulatory alignment converge to shape strategic imperatives in the broader chelated mineral landscape.

Scientific advancements in chelation processes have enabled more efficient production methods that yield high-purity chelated complexes with predictable performance characteristics. These developments, combined with increasing investments in research and development, have led to the introduction of novel delivery formats, including encapsulated powders, liquid suspensions, and sustained-release tablets. At the same time, evolving consumer demand for personalized nutrition, wellness-focused formulations, and clean-label ingredients has accelerated the adoption of glycinates, particularly those with proven clinical efficacy and traceable origin.

In parallel, global and local regulatory bodies have intensified scrutiny over nutrient labeling standards, contaminant thresholds, and quality assurance protocols, prompting suppliers to bolster analytical testing capabilities and implement robust supply chain traceability measures. Consequently, partnerships between raw material producers, contract manufacturers, and end-use brands have become more strategic, emphasizing transparency, compliance, and co-development models. By mapping these intersecting forces, this executive summary provides a foundational understanding of the dynamics driving glycinate market evolution and highlights the opportunities and challenges that industry leaders must navigate.

Uncovering the Transformational Shifts Steering Glycinate Market Evolution through Technological Innovation, Regulatory Change, and Consumer Demand Trends

The glycinates market has undergone profound transformation as technological innovation has redefined manufacturing efficiency and product performance. Modern chelation techniques leverage advanced catalysts and optimized reaction conditions to achieve greater metal-binding precision, reducing by-products and energy consumption. Simultaneously, digitalization of supply chain management has enabled real-time monitoring of raw material quality and logistic flows, driving down lead times and minimizing risk exposures in volatile global markets.

Regulatory landscapes have kept pace with scientific progress, introducing harmonized guidelines for purity grades and contaminant limits. These evolving frameworks demand rigorous quality control systems, pushing manufacturers to adopt in-house analytical laboratories and third-party certification programs. At the same time, emerging health claims regulations for functional ingredients have prompted companies to invest in clinical studies and evidence-based labeling, fostering greater consumer trust and driving sustained demand across both human and animal nutrition segments.

Consumer preferences have also exerted transformative pressure, favoring clean-label products, eco-conscious sourcing, and personalized nutrition solutions. As a result, formulators are exploring innovative product forms-from powdered blends that dissolve rapidly into beverages to microencapsulated liquid preparations that mask off-flavors and enhance shelf stability. The growth of e-commerce platforms and digital marketing channels has further enabled brands to engage directly with end users, tailoring offerings to specific dietary needs and lifestyle aspirations.

Together, these technological, regulatory, and consumer-driven shifts are reshaping the competitive landscape, accelerating innovation cycles, and creating new value propositions. Industry stakeholders must therefore adapt by integrating cross-functional expertise, leveraging data-driven insights, and forging strategic alliances to stay ahead in this dynamic environment.

Assessing the Comprehensive Impact of 2025 United States Tariffs on Glycinate Supply Chain, Pricing Structures, and Domestic Manufacturing Competitiveness

In early 2025, the United States implemented a series of targeted tariffs on imported chelated minerals and key precursors, aimed at protecting domestic producers and incentivizing local manufacturing investments. These measures have had a cascading effect throughout the glycinate supply chain, influencing sourcing strategies, production costs, and downstream pricing structures. Importers faced immediate cost increases on raw glycine and metal salts, while manufacturers needed to reassess supplier contracts and adjust procurement plans to mitigate tariff impacts.

Supply chain disruptions emerged as importers shifted volumes toward tariff-exempt suppliers and reconfigured logistics networks to optimize landed costs. Some domestic producers experienced temporary capacity constraints as they sought to ramp up output to fill the gap, and inventory buffers tightened in the first half of 2025. Consequently, logistical complexity rose, leading to longer lead times and increased working capital requirements for intermediate distributors and formulators across multiple end-use industries.

Pricing dynamics also shifted markedly, as higher input costs were progressively passed through to ingredient buyers. While some formulators absorbed a portion of the tariff-driven cost escalation to maintain price parity for end consumers, many implemented incremental price increases in nutritional supplement and animal feed formulations. This adjustment impacted cost-sensitive segments, prompting certain end users to explore alternative chelation technologies or revisit formulation strategies with less tariff-exposed ingredients.

Conversely, the tariff landscape created a favorable environment for domestic capacity expansions. Several local producers accelerated plans for new manufacturing lines, invested in process optimization projects, and pursued strategic partnerships with raw material suppliers. These developments are expected to strengthen U.S. competitiveness in the medium to long term, although stakeholders must carefully navigate potential trade diversion risks and continuously monitor policy shifts that could recalibrate cost and supply dynamics.

Revealing Key Market Segmentation Insights by Integrating Product Types, Forms, Applications, Channels, Purity Grades, and End Use Nuances Driving Growth Patterns

Analyzing glycinates through the lens of type reveals distinct performance and adoption patterns. Calcium chelate formulations are frequently selected for antacid and bone health applications, while iron chelates address deficiency challenges in both human nutrition and livestock feed. Magnesium chelate variants have seen surges in demand for their role in muscle recovery and cognitive support, and zinc chelate compounds are increasingly incorporated into cosmetic formulations and immune-support supplements. These type-specific dynamics shape R&D priorities and influence portfolio strategies across the value chain.

Product form significantly affects both functional performance and consumer acceptance. Capsule delivery remains a staple for clinical-dose applications, yet liquid glycine complexes and powder blends have gained momentum in beverage and functional food markets due to their rapid solubility and ease of incorporation. Tablet formats continue to serve traditional supplement channels, though manufacturers are exploring thinner, multi-layer designs to enable combination stacks and controlled release profiles without increasing pill counts.

Application segmentation highlights the breadth of glycinate utilization. Animal feed producers rely on feed-grade chelates to enhance nutrient uptake in poultry, ruminants, and swine, while pet nutrition brands differentiate their offerings for cats and dogs with targeted mineral profiles. In cosmetics, chelated zinc serves as a stabilizer and skin-soothing agent, and dietary supplement formulators leverage both food-grade and pharmaceutical-grade chelates to satisfy diverse regulatory and purity requirements. Functional foods and beverages incorporate glycinates to meet clean-label and fortification trends, and pharmaceutical applications demand the highest purity grades to ensure compliance with strict pharmacopoeial standards.

Distribution channels are also evolving. Traditional offline outlets such as retail pharmacies, specialty stores, and supermarkets remain critical for mass-market penetration and professional recommendation channels. Meanwhile, digital platforms that include leading e-commerce marketplaces and direct-to-consumer manufacturer websites have accelerated growth, offering enhanced transparency, subscription models, and direct consumer engagement. Purity grade considerations-ranging from feed-grade to pharmaceutical-grade-drive margin differentiation, and end-use segmentation between human and animal markets underscores the nuanced demand drivers in each category. In livestock feed, high-volume bulk shipments predominate, whereas premium-grade chelates for pet nutrition and pharmaceutical formulations command higher margins.

This comprehensive research report categorizes the Glycinates market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product Form

- Purity Grade

- Application

- Distribution Channel

- End Use

Analyzing Regional Dynamics with In-Depth Perspectives on the Americas, Europe Middle East & Africa, and Asia-Pacific Driving Glycinate Consumption Patterns

The Americas region remains a dominant force in glycinates consumption, fueled by mature dietary supplement markets, robust animal nutrition sectors, and advanced manufacturing infrastructure. The United States leads in demand for high-purity formulations tailored for clinical and sports nutrition applications, while Canada and Brazil are emerging as growth markets for functional food fortification and livestock feed enrichment. Trade policies and tariff structures continue to shape cross-border flows of raw materials and finished products within the hemisphere.

Across Europe, the Middle East, and Africa, stringent regulatory frameworks and high consumer awareness of health and wellness trends drive demand for traceable, certified-quality chelates. Western European markets emphasize pharmaceutical-grade glycinates and novel wellness formulations, whereas emerging economies in Eastern Europe and the Middle East seek cost-effective feed-grade solutions to support agricultural productivity. Africa’s nascent supplement market shows promise, particularly in South Africa, where private-label brand expansions and e-commerce proliferation are accelerating product accessibility.

In Asia-Pacific, rapid industrialization, expanding middle-class populations, and significant investments in contract manufacturing and R&D have positioned the region as both a major production hub and a fast-growing consumer market. China and India lead capacity investments for metal chelate precursors, while Japan, South Korea, and Australia focus on innovation in delivery formats and clinical validation studies. Southeast Asian economies, buoyed by rising healthcare expenditure and nutritional awareness, are emerging hotspots for plant-based functional beverages and food fortification programs.

Collectively, these regional dynamics underscore the importance of tailored market strategies that align product portfolios, regulatory approaches, and distribution models with local needs and competitive landscapes. Stakeholders must continuously monitor shifting trade policies, regional regulatory developments, and consumer preference trajectories to optimize regional positioning.

This comprehensive research report examines key regions that drive the evolution of the Glycinates market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Key Glycinate Industry Players Unveiling Strategic Initiatives, Collaborative Partnerships, and Innovation Efforts Shaping Market Leadership Dynamics

Leading companies in the glycinates space are redefining competitive boundaries through strategic investments, partnerships, and product innovations. One major producer has expanded its global manufacturing footprint to increase local responsiveness and reduce logistical bottlenecks, while another leader has formed joint ventures with raw material suppliers to secure long-term contracts and hedge against input volatility. These collaborations underscore the industry’s shift toward integrated supply chain models.

Product innovation remains a focal point, with top players launching next-generation chelate platforms that combine multiple mineral elements in single-serving formulations. Some innovators are exploring hybrid delivery systems that blend glycinates with complementary bioactive ingredients, such as plant extracts or probiotics, to address emerging wellness applications. Additionally, several companies have introduced eco-conscious production processes, leveraging green chemistry principles to reduce water usage and minimize by-product generation.

Mergers and acquisitions continue to shape market structure, as established chemical corporations and nutritional ingredient specialists seek to enhance their portfolios with targeted glycinate technologies. These transactions are often accompanied by capital infusions into processing facilities and analytical laboratories, strengthening quality assurance capabilities and accelerating new product introductions. Meanwhile, specialized contract manufacturers have gained traction by offering flexible, small-batch production services, catering to niche brands and start-ups that require agile supply solutions.

Through a combination of strategic alliances, technology licensing agreements, and capacity expansion projects, key industry participants are positioning themselves to capitalize on the expanding demand for chelated minerals. Their actions illustrate a broader movement toward value-added differentiation, operational resilience, and sustainability leadership in the global glycinates market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Glycinates market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aditya Chemicals

- Ajinomoto Co., Inc.

- Albion Laboratories Inc.

- Balchem Corporation

- BASF SE

- Cargill, Incorporated

- Clariant AG

- Dunstan Nutrition Ltd.

- Elementis Plc

- Evonik Industries AG

- Galaxy Surfactants Ltd

- Glanbia PLC

- ICL Group Ltd.

- Innospec Inc.

- Jost Chemical Co.

- Kemin Industries, Inc.

- Koninklijke DSM N.V.

- Kyowa Hakko Chemical Co., Ltd.

- Novotech Nutraceuticals Inc.

- Pancosma SA

- Pharmavit

- Schaumann GmbH & Co. KG

- Shijiazhuang Donghua Jinlong Chemical Co Ltd.

- Solvay S.A.

- UNO VETCHEM

Driving Strategic Excellence with Actionable Insights to Navigate Tariff Challenges, Diversify Portfolios, and Capitalize on Emerging Glycinate Opportunities

To maintain resilience amid evolving tariff landscapes and supply chain uncertainties, industry leaders should diversify raw material sourcing across multiple geographies and supplier tiers. Establishing alternative procurement channels can mitigate the risk of sudden policy changes while ensuring consistent access to high-grade glycine and metal precursors. Strategic supplier development programs and long-term off-take agreements will further enhance supply security and cost predictability.

Investing in advanced chelation research and development is critical to differentiate offerings and capture premium market segments. By expanding capabilities in pilot-scale experimentation and analytical characterization, companies can accelerate time-to-market for novel formulations and optimize production yields. Simultaneously, embracing digital transformation-through process automation, data analytics, and supply chain visibility platforms-will bolster operational efficiency and support robust quality control across global manufacturing networks.

Enhancing regulatory compliance and traceability frameworks should be a top priority. Implementing blockchain-enabled tracking systems and securing third-party certifications will build trust with end users, regulators, and distribution partners. Proactive engagement with health authorities and industry associations can also shape evolving standards, granting early insight into emerging requirements for purity grades and labeling claims.

Pursuing strategic partnerships and selective acquisitions allows organizations to access specialized technologies, expand geographic reach, and fill portfolio gaps. Whether collaborating on co-development projects or acquiring niche contract manufacturing capabilities, these alliances can accelerate growth and diversify risk. Finally, leaders must strengthen consumer education initiatives by providing transparent, evidence-based content that highlights the benefits of chelated minerals. Such programs foster brand loyalty, drive adoption across both human and animal health segments, and support premium positioning in a competitive market.

Outlining Rigorous Research Approach Leveraging Multi-Source Data, Expert Interviews, and Advanced Analytical Frameworks to Ensure Market Intelligence Rigor

This study integrates a multi-pronged research methodology designed to deliver high-integrity market intelligence. Primary research included in-depth interviews with procurement managers, R&D directors, and industry experts across key regions, capturing firsthand perspectives on supply chain dynamics, product innovation, and regulatory shifts. These qualitative insights were complemented by structured surveys distributed to leading manufacturers, distributors, and end-user brands to quantify adoption patterns and identify growth drivers.

Secondary research involved comprehensive reviews of technical publications, trade association reports, and regulatory filings to validate product specifications, purity standards, and tariff schedules. This was augmented by a rigorous patent analysis to track emerging chelation technologies and identify key intellectual property trends. Publicly available financial disclosures and press releases were also examined to map capacity expansions, merger activity, and strategic investments across the competitive landscape.

Quantitative data was triangulated through cross-verification, ensuring consistency between reported volumes, import-export statistics, and historical demand growth benchmarks. Advanced analytical frameworks, including scenario planning and sensitivity analyses, were applied to assess the potential impact of policy changes, raw material price fluctuations, and consumer preference shifts. Geographic and segmentation matrices were developed to highlight regional nuances and prioritize high-potential subsegments.

By combining robust primary insights with thorough secondary validation and data-driven modeling, the research delivers a nuanced, evidence-based understanding of the glycinates market. This methodological rigor underpins the report’s strategic recommendations and empowers stakeholders to make confident, forward-looking decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Glycinates market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Glycinates Market, by Type

- Glycinates Market, by Product Form

- Glycinates Market, by Purity Grade

- Glycinates Market, by Application

- Glycinates Market, by Distribution Channel

- Glycinates Market, by End Use

- Glycinates Market, by Region

- Glycinates Market, by Group

- Glycinates Market, by Country

- United States Glycinates Market

- China Glycinates Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesizing Core Findings to Illuminate the Future Trajectory and Strategic Imperatives of the Glycinate Market Ecosystem

This executive summary has synthesized the pivotal trends, regulatory influences, and strategic imperatives shaping the glycinates industry. Advanced chelation technologies and consumer demand for clean-label, high-bioavailability formulations continue to drive innovation across product types, delivery formats, and application domains. Simultaneously, the introduction of targeted tariffs in the United States underscores the importance of supply chain resilience and diversified sourcing strategies.

Segmentation analysis revealed that metal-specific chelates, particularly magnesium and zinc glycinate, command strong growth momentum in both human nutrition and animal feed markets. Meanwhile, powder and liquid delivery forms are displacing traditional capsules and tablets in emerging functional food applications. Regional dynamics vary considerably, with the Americas focusing on clinical and performance nutrition, EMEA emphasizing regulatory compliance and quality assurance, and Asia-Pacific emerging as both a production powerhouse and a rapidly expanding consumer base.

Key industry players are responding with strategic partnerships, capacity expansions, and portfolio innovations, while smaller specialized manufacturers leverage agile production models to serve niche demands. Actionable recommendations highlight the necessity of investing in advanced R&D, enhancing traceability, and forging alliances to navigate policy fluctuations and capitalize on new market opportunities.

Looking ahead, stakeholders equipped with comprehensive market intelligence and robust strategic frameworks will be best positioned to address evolving regulatory landscapes, shifting consumer preferences, and competitive pressures. By aligning innovation efforts with downstream needs and regional priorities, companies can accelerate growth and establish long-term leadership in the global glycinates ecosystem.

Engage with Associate Director Ketan Rohom Today to Secure Exclusive Glycinate Market Insights and Elevate Your Strategic Decision Making

To unlock the full potential of these insights and secure a competitive advantage in the evolving glycinate market, contact Associate Director Ketan Rohom today to arrange a personalized briefing and explore how this in-depth research report can support your strategic planning. With direct access to the underlying data, detailed segmentation analyses, and expert perspectives, you will be positioned to make informed decisions on product development, supply chain optimization, and partnership opportunities. Engaging now ensures early access to exclusive addendums and advisory sessions tailored to your organization’s unique requirements. Partner with our team to translate comprehensive glycinate market intelligence into actionable roadmaps, accelerate time-to-market for new formulations, and future-proof your operations against regulatory and tariff headwinds. Ketan Rohom stands ready to provide a tailored demonstration of key findings, forecast scenarios, and targeted recommendations, enabling you to rapidly capitalize on emerging opportunities. Reach out today to secure your copy of the report and initiate a strategic dialogue that will empower your business to thrive in the dynamic world of chelated minerals.

- How big is the Glycinates Market?

- What is the Glycinates Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?