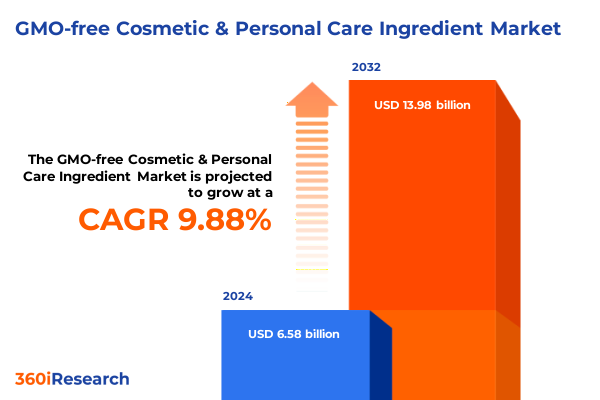

The GMO-free Cosmetic & Personal Care Ingredient Market size was estimated at USD 7.22 billion in 2025 and expected to reach USD 7.89 billion in 2026, at a CAGR of 9.90% to reach USD 13.98 billion by 2032.

Exploring the Rising Imperative of GMO-Free Ingredients as a Cornerstone of Clean Beauty and Consumer Confidence

GMO-free ingredients have rapidly transitioned from niche curiosities to mainstream necessities within the global cosmetic and personal care landscape. Heightened consumer scrutiny around ingredient provenance, amplified by social media advocacy and heightened transparency demands, drives brands to reevaluate their formulations. In parallel, regulatory frameworks are evolving to support traceable supply chains and robust labeling practices, reinforcing the credibility of GMO-free claims. Against this backdrop, manufacturers and suppliers must navigate shifting values that prioritize ecological stewardship, ethical sourcing, and product integrity, all while maintaining performance and sensory appeal.

The burgeoning emphasis on clean beauty has elevated GMO-free status to a critical differentiator. Consumers are increasingly equating non‐GMO credentials with overall product safety and environmental responsibility, influencing purchasing decisions across demographic groups. This intensifying focus compels ingredient producers to adopt rigorous quality assurance protocols, engage in transparent communication, and validate compliance through third‐party certifications. Ultimately, the intersection of consumer activism, regulatory oversight, and corporate sustainability commitments delineates a dynamic ecosystem in which GMO-free innovation will continue to flourish and define competitive positioning.

Understanding How Sustainability, Digital Traceability, and Compelling Storytelling Are Altering GMO-Free Ingredient Sourcing and Brand Positioning

A wave of transformative shifts is redefining how stakeholders approach GMO-free cosmetic ingredients, fundamentally altering procurement, product development, and branding strategies. Foremost among these changes is the integration of sustainability throughout the value chain. Industry leaders are pursuing green chemistry solutions that minimize environmental impact while ensuring efficacy, catalyzing partnerships with biotech firms and ingredient innovators. Concurrently, advanced analytics and digital traceability platforms enable full ingredient lifecycle mapping, granting brands and consumers alike unprecedented visibility into cultivation, extraction, and processing stages.

Moreover, the proliferation of omnichannel retail and social media platforms has amplified the importance of storytelling. Brands that can articulate compelling narratives around GMO-free sourcing, cultural heritage, and community impact are capturing consumer loyalty and commanding premium positioning. These narrative-driven approaches coalesce with a robust focus on efficacy, as formulators leverage cutting-edge delivery systems to meet performance benchmarks. Collectively, these shifts underscore a market in which transparency, authenticity, and holistic sustainability are not mere buzzwords but business imperatives driving strategic investment and competitive differentiation.

Analyzing the Immediate and Strategic Market Repercussions of Recent Tariff Enhancements on Imported GMO-Free Cosmetic Compounds

In 2025, the United States introduced new tariff measures that directly affect the importation of select botanical extracts and plant-derived cosmetic components. These adjustments create both logistical challenges and strategic opportunities for ingredient suppliers and brand manufacturers. On one hand, elevated duties have compressed import margins, compelling companies to reassess pricing models and, in some instances, pass incremental costs to end consumers, which may influence purchasing behavior at the premium segment.

Conversely, these tariff realignments have galvanized a shift toward regional supply chain localization. Stakeholders are intensifying partnerships with domestic growers, investing in onshore extraction facilities, and exploring joint ventures to mitigate duty exposure. As a result, supplier diversification strategies are gaining traction, with many firms integrating dual‐sourcing frameworks that balance cost efficiency with supply continuity. Long term, these dynamics are expected to catalyze innovation in cultivation practices and processing technologies, reinforcing the resilience of GMO-free ingredient pipelines in a tariff-sensitive environment.

Illuminating the Multifaceted Structure of GMO-Free Ingredient Market Segments Spanning Product Types, Forms, and Distribution Channels

Through a lens of product type, GMO-free formulations now span color cosmetics, fragrances, hair care, oral care, and skincare segments, each with distinct growth pathways. In color cosmetics, innovation is evident in eye makeup, face makeup, foundation, and lip care categories, where formulators marry vibrant pigments with clean, non‐GMO binders to deliver both performance and peace of mind. The fragrance arena has evolved to feature body sprays and deodorants crafted from non‐GMO botanical isolates, responding to consumer preferences for naturally fragranced products. Hair care brands are reformulating conditioners, shampoos, styling products, and targeted treatments using plant‐based proteins and natural oils that reinforce hair health without synthetic additives. In oral care, dental gels, mouthwash, and toothpaste lines are emerging that leverage GMO-free botanical extracts for freshening and remineralization, appealing to wellness‐minded consumers. Meanwhile, skincare portfolios incorporate cleansers, creams and lotions, masks, and serums that capitalize on non‐GMO plant extracts to address hydration, brightening, and anti‐aging concerns.

When viewed through an ingredient type framework, botanical extracts, natural oils and butters, natural pigments, natural waxes, and plant-based proteins form the backbone of the market. Within botanical extracts, specialized flower, fruit, and herb extracts are harnessed for targeted functional benefits. Natural oils and butters such as argan, coconut, jojoba, and shea butter have attained iconic status for their multifunctional skincare and hair care properties. From a form perspective, the market accommodates cream, gel, liquid, powder, and solid delivery systems, each optimized for stability, sensory characteristics, and ease of application. Finally, distribution channels bifurcate into offline and online realms, with brick-and-mortar prestige counters coexisting alongside digitally native clean beauty platforms, underscoring the imperative for integrated channel strategies.

This comprehensive research report categorizes the GMO-free Cosmetic & Personal Care Ingredient market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredient Type

- Form

- Distribution Channel

Revealing How Diverse Regional Drivers and Regulations Shape the Trajectory of GMO-Free Ingredients Across Key Global Markets

In the Americas, consumer enthusiasm for GMO-free personal care ingredients is anchored by robust sustainability mandates and strong retail infrastructure. Brands in North America are pioneering partnerships with regenerative farms and investing in cutting‐edge extraction techniques to reinforce supply chain transparency. Latin American markets, characterized by rich biodiversity, are attracting investments to cultivate indigenous plant species for non-GMO ingredient development, unlocking unique differentiation opportunities.

Across Europe, the Middle East, and Africa, regulatory rigor and consumer sophistication converge to elevate GMO-free formulations in the premium and luxury space. Stricter labeling laws and eco‐certification frameworks spur innovation in natural pigments and waxes, while demand for body sprays and deodorants infused with regionally sourced botanical extracts continues to expand. In the Asia-Pacific region, rapid urbanization and digital retail adoption fuel burgeoning interest in clean beauty, particularly within skincare and hair care categories. Local manufacturers are collaborating with ingredient innovators to harness novel plant proteins and fruit extracts, positioning GMO-free credentials as a hallmark of efficacy and wellness. Thus, region-specific drivers and regulatory landscapes shape bespoke strategies for market entrants and incumbents alike.

This comprehensive research report examines key regions that drive the evolution of the GMO-free Cosmetic & Personal Care Ingredient market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Role of Strategic Collaborations and Technological Leadership Among Top Ingredient Suppliers and Brand Innovators

Leading chemical and biotech suppliers are at the forefront of GMO-free ingredient innovation, leveraging proprietary extraction platforms and sustainable cultivation partnerships. These entities have forged alliances with onshore growers, enabling them to offer just-in-time supply solutions that mitigate the impact of tariff fluctuations. Cosmetic brands spanning prestige to mass segments are similarly recalibrating their innovation pipelines, embedding plant-based proteins and non-GMO botanical extracts to align with burgeoning consumer expectations.

Collaborative ventures between ingredient houses and research institutions have yielded breakthrough formulations that optimize bioavailability and stability of natural pigments and waxes. Additionally, digital-native clean beauty brands are disrupting traditional supply chains by forging direct procurement relationships with smallholder farms, enhancing traceability and supporting local communities. Together, these players are driving a vibrant ecosystem where continuous R&D investment, strategic partnerships, and a relentless focus on sustainability coalesce to redefine the boundaries of GMO-free personal care ingredients.

This comprehensive research report delivers an in-depth overview of the principal market players in the GMO-free Cosmetic & Personal Care Ingredient market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashland Global Holdings Inc.

- BASF SE

- Cargill Incorporated

- Ciranda Inc

- Croda International Plc

- DSM-Firmenich SA

- Earth Supplied Products LLC

- Evonik Industries AG

- FloraTech

- Givaudan SA

- Greenfield Global Inc

- Inolex Inc

- International Flavors & Fragrances Inc

- Lonza Group AG

- Robertet SA

- Symrise AG

- The Hain Celestial Group

- The Herbarie at Stoney Hill Farm Inc

- The Lubrizol Corporation

- Univar Solutions LLC

Building a Resilient GMO-Free Ingredient Strategy Through Supply Chain Diversification, Green Chemistry, and Integrated Channel Engagement

Industry leaders should prioritize the decentralization of supply networks to build resilience against policy shifts and tariff volatility. By cultivating relationships with regional growers and advancing onshore processing capabilities, companies can safeguard margin structures and reduce exposure to import duties. Simultaneously, investment in digital traceability systems will not only ensure regulatory compliance but also serve as a compelling brand narrative that resonates with eco-conscious consumers.

Moreover, stakeholders must accelerate research into green chemistry pathways, particularly those that enhance the performance of non-GMO pigments, waxes, and proteins. Joint development agreements with biotech firms and academic partners can catalyze the discovery of cutting-edge extraction techniques and functional delivery systems. Finally, a holistic go-to-market strategy that integrates online and offline touchpoints will enable brands to capture the full spectrum of consumer engagement. Transparent storytelling around GMO-free credentials, supported by third-party certifications, will reinforce trust and drive premium positioning in an increasingly crowded marketplace.

Outlining a Robust Mixed-Method Research Design Integrating Executive Interviews and Comprehensive Regulatory and Technical Analyses

The insights presented in this report derive from a rigorous research framework combining primary and secondary methodologies. Primary research encompassed in-depth interviews with senior R&D executives, procurement directors, and sustainability leads across ingredient suppliers, brand manufacturers, and regulatory bodies. These qualitative engagements were designed to unveil firsthand perspectives on tariff impacts, sourcing challenges, and innovation priorities.

Secondary research included a comprehensive review of regulatory publications, scientific journals, and trade association reports to validate evolving policy environments and technological advancements. Data triangulation was achieved by cross-referencing interview findings with publicly available patent filings, conference proceedings, and industry white papers. All insights underwent a multi-stage validation process involving peer review and expert panel discussions to ensure accuracy, relevance, and impartiality, thereby strengthening the reliability of the strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our GMO-free Cosmetic & Personal Care Ingredient market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- GMO-free Cosmetic & Personal Care Ingredient Market, by Product Type

- GMO-free Cosmetic & Personal Care Ingredient Market, by Ingredient Type

- GMO-free Cosmetic & Personal Care Ingredient Market, by Form

- GMO-free Cosmetic & Personal Care Ingredient Market, by Distribution Channel

- GMO-free Cosmetic & Personal Care Ingredient Market, by Region

- GMO-free Cosmetic & Personal Care Ingredient Market, by Group

- GMO-free Cosmetic & Personal Care Ingredient Market, by Country

- United States GMO-free Cosmetic & Personal Care Ingredient Market

- China GMO-free Cosmetic & Personal Care Ingredient Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Key Market Dynamics and Strategic Imperatives That Will Define Success in the GMO-Free Ingredient Sector

The GMO-free cosmetic and personal care ingredient landscape stands at a pivotal juncture where regulatory shifts, consumer activism, and technological innovation converge. Rising tariff pressures have prompted strategic supply chain realignments, while segmentation analysis reveals diversifying demand across product types, ingredient classes, and distribution channels. Regional nuances underscore the importance of tailored approaches, from premium EMEA markets to fast-growing Asia-Pacific economies.

Looking ahead, sustained investment in green chemistry, digital traceability, and collaborative R&D will determine which players emerge as category leaders. The imperative for transparency and authenticity will only intensify as consumers deepen their engagement with clean beauty narratives. By adopting the actionable recommendations delineated herein, stakeholders can transform present-day challenges into sustainable growth engines, securing their competitive advantage in a market where GMO-free credentials are synonymous with credibility and innovation.

Unlock Exclusive Access to In-Depth GMO-Free Cosmetic Ingredient Insights by Connecting Directly with a Senior Market Intelligence Expert

If you seek to harness the full potential of the GMO-free cosmetic and personal care ingredients landscape, reach out to Ketan Rohom, the Associate Director of Sales & Marketing at 360iResearch. Ketan brings a wealth of expertise in connecting industry leaders with actionable insights and tailored intelligence. His deep understanding of market drivers, regulatory environments, and evolving consumer demands positions him as the ideal partner to guide your strategic procurement decisions and innovation roadmaps. Engage with Ketan today to secure your comprehensive report, gain an unparalleled competitive edge, and transform challenges into growth opportunities within the GMO-free ingredient domain.

- How big is the GMO-free Cosmetic & Personal Care Ingredient Market?

- What is the GMO-free Cosmetic & Personal Care Ingredient Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?