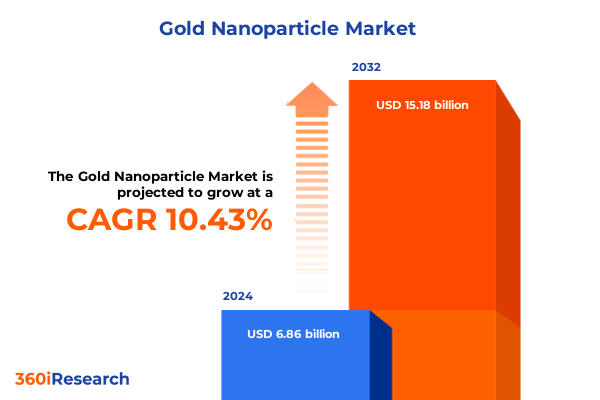

The Gold Nanoparticle Market size was estimated at USD 7.54 billion in 2025 and expected to reach USD 8.30 billion in 2026, at a CAGR of 10.51% to reach USD 15.18 billion by 2032.

Exploring the Cutting-Edge Landscape of Gold Nanoparticles and Their Revolutionary Role in Medicine, Electronics, and Environmental Applications

Gold nanoparticles exhibit exceptional optical and chemical properties that have propelled them to the forefront of nanotechnology research and commercial applications. Their localized surface plasmon resonance yields strong light absorption and scattering capabilities, facilitating breakthroughs in biosensor development and precise surface-enhanced Raman spectroscopy detection of biomolecules. In the realm of therapeutics, gold nanoparticles serve as versatile platforms for targeted drug delivery and photothermal therapies, enabling localized treatment of malignant tissues with minimal systemic toxicity. These intrinsic characteristics have cemented gold nanoparticles as critical enablers in diagnostics, imaging, and nanomedicine, driving sustained interest from both academic and industry stakeholders seeking to harness their multifunctional potential.

Significant public and private investments have underpinned the rapid acceleration of gold nanoparticle innovation over the last decade. In the United States, the National Nanotechnology Initiative secured more than USD 2.2 billion in funding for FY 2025 to support nanoscale research and commercialization efforts, bolstering advanced materials development across biomedical and electronics applications. Concurrently, venture capital participation has increased, with notable emphasis on green synthesis techniques and next-generation nanotherapeutics. This confluence of funding sources has enabled a robust ecosystem, where translational research moves swiftly from laboratory proof-of-concept to scalable manufacturing processes, setting the stage for transformative market advancements.

Technological innovations in synthesis and scale-up have addressed historical challenges around cost, reproducibility, and sustainability. Researchers and manufacturers have refined chemical reduction protocols, leveraging optimized reagent ratios and reaction conditions to deliver high-yield colloidal suspensions with narrow size distributions. Simultaneously, green synthesis approaches using botanical extracts and mild reducing agents have emerged, minimizing hazardous byproducts and aligning production with global environmental goals. Seed-mediated growth methods further enable precise shape control, facilitating the generation of cage, rod, shell, and spherical morphologies across targeted size regimes. These advancements not only reduce operational expenses but also open new possibilities for customizing nanoparticle performance in diverse applications.

Identifying Transformative Technological and Regulatory Shifts Redefining Gold Nanoparticle Synthesis, Functionalization, and Commercial Adoption Across Multiple Verticals

Gold nanoparticle research and commercialization have been reshaped by breakthroughs in synthesis techniques and regulatory frameworks that foster faster translation of laboratory findings to market-ready products. Advances in ligand engineering and surface functionalization now allow robust conjugation of therapeutic agents and targeting ligands, elevating the efficacy of drug delivery platforms. Concurrent regulatory engagement has expedited approval pathways for nanoparticle-enabled diagnostic assays, with several gold nanoparticle-based lateral flow tests and contrast agents achieving clearance for clinical use. The synergy between scientific innovation and regulatory support has catalyzed a new era of precision nanomedicine, where tailored nanoparticle formulations address unmet clinical needs.

In parallel, the integration of artificial intelligence and machine learning into process design has accelerated property optimization and scale-up. Data-driven approaches now predict reaction kinetics and morphological outcomes, reducing reliance on iterative trial-and-error experimentation. Coupled with advanced in-line monitoring systems, manufacturers can maintain stringent quality attributes and traceability, ensuring consistency across batches. These digital transformations have broadened access to high-performance gold nanoparticles while lowering production risks, supporting a diverse array of applications from high-sensitivity biosensors to conductive inks for next-generation flexible electronics.

Stakeholders have also witnessed a shift toward sustainable and circular manufacturing models, driven by global environmental imperatives and cost considerations. Green chemistry principles now guide the selection of solvents and reducing agents, reducing toxic byproducts and water consumption. Collaborative initiatives between industry consortia and academic institutions have established closed-loop recovery processes that reclaim gold from spent biomedical devices and catalyst supports. This emphasis on resource efficiency not only mitigates supply chain volatility but also reinforces the strategic importance of gold nanoparticles in eco-conscious markets, positioning them as critical components in the broader sustainability agenda.

Analyzing the Cumulative Impact of 2025 United States Tariff Policy on Gold Nanoparticle Supply Chains, Imports, and Cost Structures in Advanced Technology Sectors

The United States has implemented extensive tariff measures affecting a broad spectrum of imported high-tech materials and components. Following the four-year review of Section 301 tariffs, duty rates on select technology products increased to as much as 25 percent ad valorem, effective January 1, 2025, altering cost dynamics for many nanoscale supply chains. These adjustments were designed to address unfair trade practices and protect domestic manufacturing capabilities, substantially raising import expenses for critical precursor chemicals and specialized equipment used in nanoparticle production.

However, gold nanoparticles benefit from specific tariff exemptions recognizing their status as precious metals. U.S. policy explicitly excludes bullion and colloidal precious metals from new reciprocal tariffs, ensuring that gold compounds imported for industrial and research purposes remain duty-free. This exemption has helped stabilize input costs for manufacturers that source gold colloids from global suppliers, mitigating direct tariff impacts on the nanoparticle sector. Nevertheless, broader supply chain disruptions, including elevated shipping fees and complex customs clearance procedures, have translated into incremental logistical expenses that influence downstream product pricing.

Despite these exemptions, ancillary tariffs on packaging materials, solvents, and glassware introduced under related trade measures have incrementally increased operational costs for nanoparticle facilities. Organizations report that the cumulative effect of higher duties on support materials has driven procurement teams to diversify sourcing strategies, exploring nearshoring options and consolidated logistics partnerships. Consequently, cost structures now reflect a nuanced balance between preserved duty-free status for gold compounds and heightened expenses across the complete production and distribution lifecycle.

Uncovering Critical Segmentation Insights Based on Nanoparticle Type, Size, Synthesis Methods, Application Domains, and End-User Markets in the Gold Nanoparticle Industry

Insights derived from key segmentation frameworks reveal distinct drivers and constraints across nanoparticle attributes and market uses. Based on nanoparticle type, the industry encompasses cage, cube, rod, shell, and spherical geometries, each offering unique optical and surface area properties that influence their suitability for sensing, imaging, or catalytic applications. These morphological variants demonstrate differential behavior in biological environments, guiding target selection for drug delivery and immunoassay development. By understanding the interplay between shape-specific performance and production complexity, companies can align their portfolios with application-specific requirements to optimize value.

Size remains a critical determinant of nanoparticle biodistribution and interaction dynamics. Categories spanning 0–20 nm, 20–50 nm, and above 50 nm frame distinct operating regimes, where smaller particles facilitate deep tissue penetration and rapid clearance, while larger constructs support enhanced surface functionalization and stability. This segmentation informs product design for targeted therapies and imaging contrast agents, enabling precision tuning of pharmacokinetics and diagnostic sensitivity. Recognizing these size-dependent effects empowers researchers and manufacturers to tailor nanoparticle variants for optimal performance in clinical and industrial settings.

The synthesis method is another pivotal axis, with chemical reduction, green synthesis, and seed-mediated growth defining distinct cost and scalability profiles. Chemical reduction processes offer high throughput and reproducibility for commercial-scale operations, whereas green synthesis aligns with sustainability goals by reducing toxic byproducts. Seed-mediated approaches provide exceptional control over morphological uniformity, essential for high-performance sensor and photothermal platforms. Balancing these methodological trade-offs allows stakeholders to navigate regulatory requirements and environmental mandates while meeting application-specific quality standards.

This comprehensive research report categorizes the Gold Nanoparticle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Size

- Synthesis Method

- Application

- End User

Decoding Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia Pacific for the Global Gold Nanoparticle Market

The Americas region continues to lead in research intensity and end-user demand, with academic research institutes, biotechnology companies, and pharmaceutical firms driving substantial interest in diagnostic imaging and targeted therapies. Regulatory frameworks in the United States and Canada support expedited clinical evaluation of nanoparticle-enabled devices and therapeutics, fostering rapid commercialization. Moreover, robust venture capital ecosystems across North America fuel early-stage innovation, ensuring a steady pipeline of novel nanoparticle applications and strategic collaborations between startups and established life science enterprises.

In Europe, Middle East and Africa, harmonization of regulatory standards under frameworks like the European Medical Device Regulation has streamlined market entry for nanoparticle-based diagnostics and contrast agents. Concurrently, growing investments in environmental monitoring and water treatment have spurred demand for gold nanoparticle catalysts in pollution control and sensor technologies. Regional initiatives promoting green manufacturing and circular economy principles further encourage adoption of sustainable synthesis and recovery methods, positioning EMEA as a key growth hub for eco-conscious nanoparticle solutions.

Asia-Pacific stands out as a major manufacturing powerhouse, with China, India, and South Korea expanding production capacities for gold nanoparticles at competitive cost points. Infrastructure investments, such as the establishment of new blending and processing facilities, reflect a strategic emphasis on domestic capability and export readiness. Government incentives for advanced materials under regional industrial policy frameworks further accelerate technology adoption, making APAC a dynamic arena for both upstream synthesis innovations and downstream application development in sectors ranging from electronics to cosmetics.

This comprehensive research report examines key regions that drive the evolution of the Gold Nanoparticle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Gold Nanoparticle Innovators Highlighting Strategic Initiatives, R&D Investments, and Competitive Positioning in a Rapidly Evolving Industry Landscape

Leading companies in the gold nanoparticle space are distinguished by their integrated R&D capabilities, manufacturing scale, and strategic partnerships that span healthcare, diagnostics, and industrial sectors. Merck KGaA, through its Sigma Aldrich brand, has invested over USD 67 million in enhancing its life sciences infrastructure, focusing on expanded capacity for colloidal gold production and stringent quality control to support critical diagnostics applications. These investments bolster Merck’s ability to deliver high-purity nanoparticles for global distribution while reinforcing its market leadership in specialty chemicals.

Cytodiagnostics Inc. maintains a strong position through a diverse product portfolio that includes stabilized gold nanoparticle platforms and ready-to-use kits for ELISA and lateral flow assays. Its strategy emphasizes innovation through organic growth and collaborations with academic institutions, ensuring it remains at the forefront of assay development for cancer biomarkers and infectious diseases. The company’s acquisition of a nano gold imaging startup in mid-2023 has expanded its technological offerings, underscoring its commitment to end-to-end solutions in biosensing.

BBI Solutions has carved a niche by developing custom conjugation services and advanced lateral flow assay formats, leveraging gold nanoparticles to achieve lower detection thresholds and improved assay robustness. Strategic alliances with rapid test platform providers and digital diagnostics firms have enabled the company to integrate nanoparticle-based reagents into point-of-care solutions, addressing urgent public health needs and driving new revenue streams in emerging markets. These concerted efforts underscore the competitive advantage derived from end-to-end capability in nanoparticle assay development.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gold Nanoparticle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Elements

- Ames Goldsmith Corporation

- Applied Nanotech, Inc.

- Aurion Ltd

- BBI Solutions

- CD Bioparticles

- Cerion LLC

- Cytodiagnostics Inc.

- DOWA Electronics Co., Ltd.

- Fortis Life Sciences, LLC

- Hongwu New Material Co., Ltd.

- Inframat Corporation

- Johnson Matthey Plc

- Meliorum Technologies, Inc.

- Merck KGaA

- Nanocs, Inc.

- NanoHybrids Inc.

- Nanopartz, Inc.

- Nanoshel, LLC

- NovaCentrix, Inc.

- SkySpring Nanomaterials Inc.

- Strem Chemicals, Inc. by Ascensus Specialties

- Tanaka Kikinzoku Kogyo Co., Ltd.

- Thermo Fisher Scientific Inc.

Delivering Actionable Strategic Recommendations for Industry Leaders to Navigate Technological Disruption, Regulatory Complexity, and Competitive Pressures in Gold Nanoparticles

Industry leaders should prioritize the integration of advanced data analytics and automation to drive operational excellence and product differentiation. By leveraging machine learning models to predict synthesis outcomes and optimize batch consistency, manufacturers can reduce time-to-market and mitigate quality variances. Moreover, the deployment of in-line monitoring tools enhances real-time process control, enabling rapid corrective actions and maintaining stringent regulatory compliance for clinical applications. Investing in digital infrastructure will be critical for scaling production while sustaining competitive margins.

Sustainability must remain a central strategic pillar, with companies expanding green synthesis routes and closed-loop recovery processes to address environmental imperatives. Adopting renewable feedstocks and minimizing hazardous waste not only align with global ESG goals but also reduce operational risk associated with tightening environmental regulations. Collaborations with academic and governmental consortia to pilot recovery and recycling initiatives can further strengthen resource security and brand reputation in eco-conscious markets that increasingly value circular economy practices.

A proactive regulatory engagement strategy is essential to navigate evolving approval pathways and establish clear guidelines for novel nanoparticle applications. Industry consortia can collaborate with regulators to define standardized characterization methods and safety assessment protocols, accelerating clinical adoption of gold nanoparticle-based therapeutics and diagnostics. This collaborative approach reduces uncertainty, shortens development cycles, and positions organizations at the vanguard of regulatory innovation, facilitating early market entry for high-value products.

Detailing the Rigorous Research Methodology Employed in Evaluating Data Sources, Analytical Frameworks, and Quality Assurance Procedures for Gold Nanoparticle Insights

This research report synthesizes insights from a diverse array of primary and secondary sources, including in-depth interviews with academic experts, industry executives, and procurement leaders. Proprietary databases covering patent filings, clinical trial records, and government funding allocations were analyzed to identify innovation hotspots and commercialization trajectories. Complementing these inputs, a systematic literature review of peer-reviewed journals provided a foundational understanding of nanoparticle properties, biological interactions, and application performance metrics.

Quantitative data were validated through triangulation across multiple channels, including customs statistics, supplier pricing indices, and corporate financial disclosures. Qualitative insights underwent rigorous quality assurance via cross-validation with subject matter experts and iterative feedback loops. Analytical frameworks such as SWOT analysis, Porter’s Five Forces, and regulatory impact assessment were applied to contextualize findings and deliver actionable intelligence. This structured methodology ensured that the research is comprehensive, transparent, and defensible for strategic decision-making by industry stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gold Nanoparticle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gold Nanoparticle Market, by Type

- Gold Nanoparticle Market, by Size

- Gold Nanoparticle Market, by Synthesis Method

- Gold Nanoparticle Market, by Application

- Gold Nanoparticle Market, by End User

- Gold Nanoparticle Market, by Region

- Gold Nanoparticle Market, by Group

- Gold Nanoparticle Market, by Country

- United States Gold Nanoparticle Market

- China Gold Nanoparticle Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Drawing Powerful Conclusions on Market Evolution, Technological Trends, and Strategic Imperatives Shaping the Future of Gold Nanoparticles Across Diverse Industries

As the gold nanoparticle industry transitions from foundational research to mature commercial applications, strategic imperatives have emerged around scalability, sustainability, and regulatory alignment. Manufacturers that balance high-performance material properties with cost-effective production and environmental stewardship will secure leadership positions. Similarly, early collaboration between R&D and regulatory affairs teams will facilitate smoother market entry for complex diagnostic and therapeutic products. Looking ahead, the convergence of nanotechnology with artificial intelligence, digital manufacturing, and green chemistry promises to unlock unprecedented value across sectors, from healthcare to electronics.

Stakeholders equipped with comprehensive segmentation insights and regional intelligence are poised to navigate competitive pressures and capitalize on emerging opportunities. By aligning internal capabilities with external market dynamics-from morphological specialization to localized regulatory landscapes-organizations can architect resilient strategies that withstand tariff fluctuations, supply chain disruptions, and shifting end-user demands. This holistic perspective underscores the enduring strategic importance of gold nanoparticles as a foundational component of industry innovation roadmaps.

Engaging Senior Stakeholders with a Customized Call To Action to Secure In-Depth Gold Nanoparticle Market Intelligence Through Direct Engagement with Our Sales Leadership

We invite senior executives, R&D leaders, and procurement specialists to engage directly with Ketan Rohom, Associate Director, Sales & Marketing, to explore tailored research packages and unlock unparalleled insights that will drive strategic decision-making and innovation in the gold nanoparticle space. Take the next step toward gaining a competitive edge by discussing your specific requirements and securing exclusive access to the full market research report.

- How big is the Gold Nanoparticle Market?

- What is the Gold Nanoparticle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?