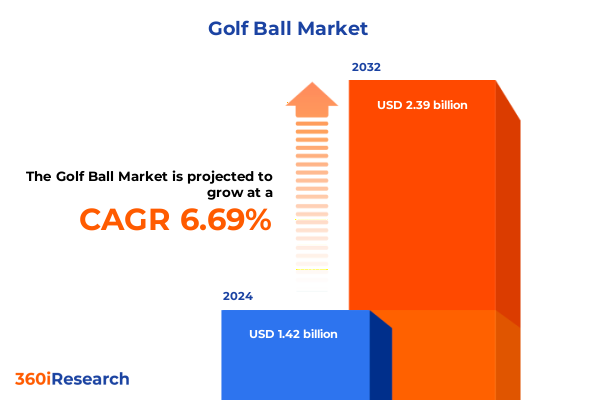

The Golf Ball Market size was estimated at USD 1.52 billion in 2025 and expected to reach USD 1.61 billion in 2026, at a CAGR of 6.70% to reach USD 2.39 billion by 2032.

Exploring the Intricacies of Golf Ball Technology Evolution and Market Drivers That Are Shaping Competitive Dynamics and Consumer Preferences Worldwide

The golf ball has transformed from a simple, wound-core sphere to an engineered high-performance product that defines the modern game. Over decades of material science breakthroughs and aerodynamic experimentation, each new generation of ball has introduced finer spin control, optimized launch angles, and enhanced energy transfer. Innovations in mantle layers and core formulations have unlocked levels of play once reserved for tour professionals, gradually permeating through amateur and recreational segments. As expectations evolve, manufacturers face mounting pressure to push boundaries of design, while navigating shifting raw material availability and evolving standards.

Moreover, the intersection of consumer lifestyles and digital engagement has fueled demand for customization and real-time performance feedback. Golfers now seek balls that not only deliver technical advantages but also resonate with personal values, such as sustainable sourcing and traceability. This trend has prompted companies to rethink traditional business models, partnering with suppliers to integrate eco-friendly materials and leveraging advanced telemetry to gather real-world usage data. Consequently, the golf ball market stands at a pivotal juncture, where the confluence of science, technology, and consumer expectations will shape the next wave of product development and competitive differentiation.

Examining the Ongoing Transformative Shifts Reshaping Golf Ball Design Manufacturing and Distribution in Response to Sustainability and Digital Integration Trends

The landscape of golf ball development is undergoing transformative shifts fueled by three parallel forces: sustainability imperatives, digital integration, and manufacturing automation. In recent years, leading brands have accelerated the adoption of bio-based polymers and recycled composites to reduce environmental impact without compromising performance. This shift toward greener materials reflects a broader industry commitment to circular-economy principles, responding to both regulatory pressures and growing consumer awareness. As a result, the material science underpinning core and cover compositions is being reengineered to achieve balance between resilience, spin, and eco-credentials.

Digital integration represents a second vector of change. Advanced telemetry built into hitting mats and launch monitors enables the collection of granular data on ball spin rates, launch angles, and velocity retention. Manufacturers are using these insights to refine dimple patterns, layer thicknesses, and cover hardness to deliver optimized performance profiles for different player archetypes. Furthermore, machine-learning algorithms applied to usage data are beginning to drive predictive maintenance of molds and cutting dies, enhancing consistency in large-scale production.

Finally, the embrace of Industry 4.0 automation has revolutionized manufacturing agility. Robotic assembly lines equipped with vision-system quality checks ensure each ball meets exacting tolerances, while additive manufacturing trials are exploring rapid prototyping of new core geometries. Together, these technological advancements are crafting a new era in golf ball production-one defined by speed to market, precision engineering, and deep alignment with golfer needs.

Analyzing the Cumulative Effects of 2025 United States Tariff Policies on Golf Ball Supply Chains Cost Structures and Manufacturer Strategic Responses in North America

In 2025, adjustments to United States trade policy introduced incremental duties on imported golf balls and component materials, exerting compounded effects throughout the supply chain. As tariffs on covered sporting goods rose, raw material costs increased, prompting manufacturers to reevaluate procurement strategies. Many incumbent producers responded by shifting assembly operations to jurisdictions with free-trade agreements or lower labor overhead, while selectively localizing critical stages of production to mitigate duty burdens. Despite these countermeasures, manufacturers continue to absorb additional costs, translating to modest price increases passed along to distributors and end consumers.

Simultaneously, the tariff environment has accelerated the quest for alternate sourcing of ionomer and urethane polymers. Suppliers in Southeast Asia and Latin America have gained traction by offering competitively priced materials that adhere to international quality standards. This diversification not only spreads geopolitical risk but also fosters partnerships that drive joint innovation in cover chemistry and core resilience. From a strategic perspective, companies that pivoted rapidly to multi-country sourcing models have maintained healthier margins and preserved speed-to-market advantages.

Overall, the cumulative impact of 2025 tariff measures has underscored the importance of supply chain agility. Rather than relying solely on cost arbitrage, manufacturers are investing in regional production hubs and long-term supply agreements. This shift is reshaping the competitive landscape, rewarding organizations that blend operational flexibility with technological prowess to navigate an increasingly complex global trade environment.

Uncovering Strategic Insights from Multi-Dimensional Golf Ball Market Segmentation Revealing Consumer Preferences Across Product Types Materials User Profiles and Sales Channels

Segmenting the golf ball market by product type reveals clear distinctions in player priorities. Control-oriented offerings, characterized by three- and four-piece constructions, appeal to golfers seeking fine-tuned spin modulation and trajectory management around the greens. Conversely, distance-focused formulations spanning two-piece builds to advanced multi-layer designs cater to players prioritizing maximum ball speed and minimized spin off the tee. Recreational two-piece balls serve entry-level enthusiasts with a forgiving, cost-effective performance profile, while tour-level three- and four-piece innovations deliver elite spin control and responsiveness.

Turning to core material segmentation, Ionomer balls differentiated by high-acid or medium-acid formulations balance durability and energy transfer, making them popular across mid-range price tiers. Surlyn covers, available in hard or soft variants, provide a combination of resilience and feel, while urethane options-cast and reaction-injection-offer premium spin characteristics demanded by skilled players. These material choices dovetail with end-user segmentation: amateurs and juniors often gravitate toward resilient two-piece constructions with resilient Surlyn or Ionomer cores, whereas professionals prioritize tour-level four-piece Urethane designs that deliver nuanced shot control.

Distribution channel dynamics further shape market approaches. Offline outlets such as pro shops and specialty golf retailers continue to serve as experiential hubs where golfers test samples and seek professional fitting. In parallel, online platforms-from branded e-commerce sites to global marketplaces-are unlocking broader reach and customized ordering. Finally, color segmentation, encompassing classic white alongside blue, red, and yellow variants, as well as glow-in-dark and high-visibility specialty finishes, underscores consumer desire for personalization and enhanced on-course visibility. By overlaying these segmentation layers, stakeholders gain a holistic view of demand drivers across product dimensions, materials, user profiles, sales channels, and visual preferences.

This comprehensive research report categorizes the Golf Ball market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Core Material

- Color

- End User

- Distribution Channel

Comparative Regional Overview of Golf Ball Market Dynamics Highlighting Growth Trajectories Consumer Behaviors and Distribution Nuances in Americas EMEA and Asia-Pacific

Distinct regional nuances shape the trajectory of golf ball demand and innovation. In the Americas, strong participation in both recreational and competitive golf underpins a robust market for premium multi-piece constructions and performance-oriented materials. Country-level pro shop networks and specialty retailers serve as primary touchpoints, driving collaborations with manufacturers to co-promote new product launches and player-focused events. Meanwhile, e-commerce penetration continues to climb, enabling direct-to-consumer strategies that complement traditional brick-and-mortar channels.

Across Europe, the Middle East, and Africa, market dynamics are influenced by regulatory frameworks, course infrastructure investments, and golf tourism trends. Here, distance-enhancing two-piece balls maintain popularity among casual players, whereas four-piece Urethane models find traction in advanced golf academies and tour events. Distribution networks exhibit hybrid models, where select sports retailers partner with online marketplaces to extend geographic coverage. Sustainability credentials resonate strongly with EMEA consumers, prompting manufacturers to highlight eco-friendly cover materials.

The Asia-Pacific region stands out for rapid growth driven by rising amateur participation and youth programs. Brands are tailoring product portfolios to the distinct swing speeds and weather conditions common in emerging markets, emphasizing multi-layer designs that balance distance and control. Online marketplaces dominate urban centers, while pro shops and specialty outlets cater to established golf hubs. Localization strategies, including region-specific color palettes and material blends, are becoming critical for resonating with diverse consumer segments across this dynamic region.

This comprehensive research report examines key regions that drive the evolution of the Golf Ball market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Golf Ball Manufacturers and Industry Entrants to Illustrate Competitive Positioning Innovation Portfolios and Strategic Objectives Shaping Market Leadership

Leading manufacturers continue to define the competitive contours of the golf ball market through differentiated innovation, brand equity, and global distribution partnerships. Titleist, renowned for its precision-guided research and premium Urethane multi-layer balls, remains the benchmark for tour-level performance and commands strong loyalty among professional players. Callaway has leveraged digital fitting platforms and mobile applications to drive consumer engagement, coupling its multi-layer reinvention of distance-focused designs with data-driven marketing innovations.

Bridgestone has carved a niche by emphasizing core resilience and spin stability, attracting both dedicated amateurs and touring professionals seeking consistent feel in diverse weather conditions. TaylorMade maintains momentum with proprietary cover technologies and high-visibility color variants, often collaborating with leading athletes to amplify brand resonance. Wilson and Srixon continue to fortify their market positions by extending premium material options and expanding distribution through specialty sporting goods networks, appealing to value-conscious recreational golfers.

Emerging entrants and private-label brands are also shaping competitive dynamics by targeting specific segments, such as junior development programs and beginner-friendly two-piece constructions. Partnerships with digital retailers and co-branding arrangements with golf lifestyle influencers underscore a growing emphasis on brand storytelling and direct consumer outreach. Collectively, these strategic maneuvers among incumbent and challenger brands illustrate the multifaceted approaches to capturing value in a crowded global marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Golf Ball market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acushnet Holdings Corp

- Bridgestone Golf, Inc

- Costco Wholesale Corporation

- Dixon Golf, Inc

- Dunlop Sports Co., Ltd

- Golf Balls Inc

- Honma Golf Co., Ltd

- Mizuno Corporation

- OnCore Golf Technology, Inc

- Pinnacle Golf

- Snell Golf, Inc

- Sumitomo Rubber Industries Ltd

- TaylorMade Golf Company, Inc

- Topgolf Callaway Brands Corp

- Toppoint Marketing Co., Ltd

- Vice Golf GmbH

- Volvik Inc

- Wilson Sporting Goods Co

Formulating Actionable Strategic Recommendations for Industry Stakeholders to Capitalize on Emerging Technologies Evolving Regulations and Shifting Consumer Demands in Golf Ball Markets

To capitalize on evolving market conditions and sustain competitive advantage, industry leaders should intensify investments in sustainable raw materials, exploring novel bio-polymers and recycled composites that resonate with environmentally conscious golfers. Embracing co-development agreements with chemical suppliers can accelerate the integration of next-generation cores and covers, while regulatory incentives for eco-friendly packaging may enhance brand differentiation.

Simultaneously, firms must fortify supply chain resilience by diversifying manufacturing footprints across duty-friendly regions and strengthening strategic partnerships with logistics providers. This approach will mitigate tariff exposure and reduce lead times, ensuring timely fulfillment amid global trade uncertainties. Furthermore, enhancing digital customer journeys-through advanced ball-fitting kiosks, augmented-reality visualization tools, and AI-powered performance analytics-can deepen consumer loyalty and support premium pricing strategies.

Finally, companies should adopt a segmented go-to-market strategy that aligns product innovations with local consumer preferences and distribution channels. By tailoring color offerings, performance profiles, and marketing narratives for distinct amateur, junior, and professional cohorts, manufacturers can optimize portfolio mix and maximize throughput across offline and online touchpoints. Collectively, these strategic imperatives will enable industry stakeholders to navigate an increasingly intricate golf ball ecosystem and capture emerging growth opportunities.

Detailing the Comprehensive Research Methodology Employed to Gather Quantitative and Qualitative Insights on Golf Ball Market Trends Competitive Landscape and User Preferences

This research exercise employed a mixed-methods approach combining both primary and secondary data sources to deliver a comprehensive perspective on the golf ball market. Primary research involved in-depth interviews with chemical suppliers, manufacturing executives, and select distribution channel partners across major golfing regions. In parallel, surveys of amateur, junior, and professional players captured firsthand insights on performance expectations, color preferences, and purchase motivations. Expert panel discussions with industry veterans validated emerging themes and provided context to evolving regulatory and trade dynamics.

Secondary research encompassed a thorough review of trade association publications, patent databases, customs and tariff announcements, and manufacturer technical papers. Company annual reports, sustainability disclosures, and marketing collateral were analyzed to map competitive positioning and R&D trajectories. Quantitative data from customs filings and industry shipping volumes informed the assessment of supply chain shifts and regional flow patterns.

Data triangulation techniques were applied to reconcile qualitative feedback with quantitative indicators, ensuring analytical rigor and reducing bias. Throughout the process, methodological safeguards-including sample stratification by region, end-user segment, and product type-were instituted to enhance representativeness. The resulting insights reflect a holistic analysis of market drivers, competitive dynamics, and future strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Golf Ball market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Golf Ball Market, by Product Type

- Golf Ball Market, by Core Material

- Golf Ball Market, by Color

- Golf Ball Market, by End User

- Golf Ball Market, by Distribution Channel

- Golf Ball Market, by Region

- Golf Ball Market, by Group

- Golf Ball Market, by Country

- United States Golf Ball Market

- China Golf Ball Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Core Findings on Golf Ball Market Innovations Regulatory Impacts and Consumer Segmentation to Inform Strategic Decision Making for Industry Stakeholders

The findings underscore a golf ball market in the midst of profound transformation, driven by material innovation, digital integration, and geopolitical factors. Renewable and recycled components are pioneering more sustainable product lines, while automation and data analytics are refining manufacturing precision and performance consistency. Trade policy shifts have reinforced the imperative for supply chain agility, compelling firms to pursue regional diversification and strategic sourcing partnerships.

Segmentation analysis has clarified distinct value propositions across product types, core materials, end-user cohorts, channels, and color preferences, equipping stakeholders with actionable insights for portfolio optimization. Regional examinations reveal divergent growth dynamics that demand tailored go-to-market approaches, from the premium-driven Americas to the sustainability-focused EMEA and the rapidly expanding Asia-Pacific. Meanwhile, competitive profiling highlights the importance of brand equity, R&D investments, and digital engagement tactics in capturing market share.

In aggregate, these insights form a strategic blueprint for industry decision-makers. By aligning innovation roadmaps with emerging consumer values, fortifying operational resilience, and refining market segmentation, companies can navigate complexity and uncover new avenues for growth. The convergence of technology, sustainability, and strategic trade management promises to redefine performance benchmarks and elevate the golfer experience in the years ahead.

Take the Next Step Toward Competitive Advantage by Partnering with the Associate Director of Sales & Marketing to Obtain the Definitive Golf Ball Market Research Report

To explore comprehensive insights into the golf ball market and secure the full suite of analyses, approaches, and strategic frameworks, please reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360i. He will guide you through the report’s extensive coverage of performance innovations, tariff impacts, segmentation dynamics, and regional nuances, tailoring the deliverable to your specific decision-making needs. Engaging with Ketan will ensure you receive personalized recommendations for optimizing product development, supply chain strategies, and go-to-market plans. His expertise in translating detailed market intelligence into actionable business initiatives makes him the ideal partner for equipping your organization with the knowledge and tools required to stay ahead in a highly competitive global landscape. Connect with Ketan to discuss licensing options, customized data modules, and executive briefings designed to accelerate your strategic planning and investment priorities in the golf ball sector

- How big is the Golf Ball Market?

- What is the Golf Ball Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?