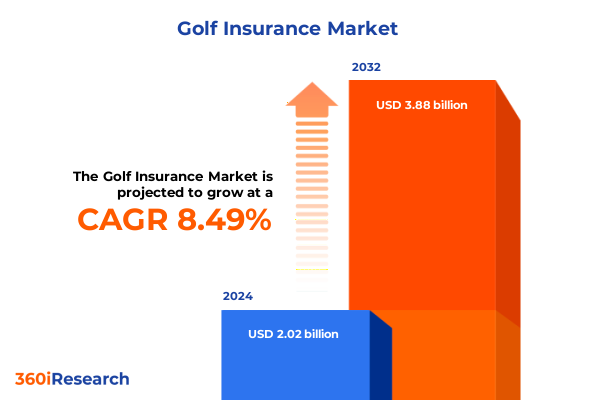

The Golf Insurance Market size was estimated at USD 2.19 billion in 2025 and expected to reach USD 2.37 billion in 2026, at a CAGR of 8.53% to reach USD 3.88 billion by 2032.

Introducing the Dynamic Golf Insurance Landscape That’s Revolutionizing Risk Management Practices and Strategic Opportunities

The golf insurance sector has emerged as an indispensable element for protecting investments, liabilities, and reputations across diverse stakeholders within the industry. Over the past decade, there has been a marked shift in how course operators, golf clubs, and individual players perceive the necessity of comprehensive coverage, with an increasing emphasis on tailored solutions that address both physical and financial risks. As the sport continues to grow in popularity and infrastructural complexity, so too does the demand for specialized insurance products that can accommodate the nuanced exposures inherent in this market.

Within this environment, insurers have recognized the importance of balancing risk mitigation with customer-centric services. Innovative underwriting models are being developed to better assess potential liabilities, while digital platforms are empowering end users with greater transparency and convenience. Furthermore, the rise of professional and amateur tournaments has underscored the need for dynamic policy structures capable of responding to unique event-related risks. This confluence of factors has catalyzed a transformative period, setting the stage for a thorough exploration of the emerging trends and strategic imperatives that define the contemporary golf insurance landscape.

Exploring the Transformative Technological, Behavioral, and Environmental Shifts Shaping Modern Golf Insurance Practices

Recent years have witnessed fundamental shifts reshaping the fabric of golf insurance, driven by technological innovation, evolving consumer expectations, and emergent risk vectors. Digital transformation has ushered in data-driven underwriting, leveraging advanced analytics and telematics to refine risk assessments and pricing strategies. Insurers are now harnessing wearable devices, geographic information systems, and play-pattern analytics to tailor coverage and improve loss prevention, thereby enhancing both efficiency and customer satisfaction.

Concurrently, consumer behavior has trended toward seamless, on-demand solutions, prompting the proliferation of direct-to-consumer and online distribution channels. This shift challenges traditional broker models and necessitates agile strategies for both digital engagement and personalized service. Additionally, environmental and climate considerations are increasingly influencing policy design, with stakeholders seeking resilience against weather-related disruptions and environmental liabilities. These transformative shifts underscore the urgency for insurers and risk managers to adapt proactively, ensuring that coverage remains fit for purpose in a landscape defined by rapid change and complex stakeholder demands.

Analyzing the Ripple Effects of 2025 United States Tariffs on Cost Structures and Risk Management in Golf Insurance

In 2025, the introduction of new United States tariffs has exerted a cascading influence on the golf insurance market, altering cost structures and compelling stakeholders to reassess risk exposures. Tariffs on imported equipment and construction materials have elevated replacement and repair costs, while increased duties on international goods have reshaped the supply chain dynamics for course operators. This scenario has amplified the potential financial impact of covered events, subsequently affecting underwriting models and premium calculations.

The heightened costs have prompted insurers to refine policy terms and conditions, intensifying scrutiny of risk mitigation measures and encouraging greater collaboration between stakeholders to minimize loss frequencies. Course operators have accelerated the adoption of advanced maintenance technologies to reduce downtime and avert major repair expenses, while individual policyholders have sought optional endorsements to safeguard against inflation-driven cost escalations. As a result, the market has entered a phase of recalibrated expectations, where tariff-induced shifts call for nuanced approaches to both coverage design and risk management strategies.

Uncovering Critical Segmentation Insights That Drive Personalized Solutions Across Diverse Stakeholder Profiles

Deepening our comprehension of stakeholder needs begins with a granular examination of end-user categories and their distinct requirements. Course operators navigate a unique risk matrix that encompasses liability, property damage, and regulatory compliance, while golf clubs contend with multidimensional exposures ranging from facility maintenance to reputational safeguards. At the individual level, professional players demand coverage that parallels elite sporting standards, including high-value equipment protection and tournament-specific liability, whereas amateur enthusiasts prioritize accessible policies that cover personal accident and third-party liability during recreational play.

Distribution channels further influence the customer journey, with brokers leveraging industry expertise to negotiate bespoke solutions, direct sales enabling close insurer-client relationships, and online platforms driving convenience through aggregator portals and insurer websites. Each channel presents distinct value propositions and cost considerations, shaping how products are marketed, underwritten, and serviced. Meanwhile, the insurance type spectrum-liability, personal accident, and property-must be balanced against subcategories such as bodily injury, third-party liability, and coverage for clubhouse assets. Policy structure introduces another layer of complexity, distinguishing between annual commitments and single-event passes, including one-day and tournament-specialized options. Finally, premium tier segmentation highlights the necessity of offering scalable coverage across high-, medium-, and low-tier brackets to meet varying financial capacities and risk appetites. This intricate segmentation framework underscores the imperative for insurers to deliver highly customized solutions that align with each stakeholder’s profile and operational priorities.

This comprehensive research report categorizes the Golf Insurance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Insurance Type

- Product Type

- Premium Tier

- End User

- Distribution Channel

Examining Divergent Regional Dynamics Influencing Market Maturation and Competitive Positioning

Regional dynamics play a pivotal role in sculpting the competitive and regulatory contours of the golf insurance market. In the Americas, mature markets exhibit robust insurance ecosystems underpinned by established distribution networks and sophisticated risk management protocols. Market participants here benefit from clear regulatory guidelines and widespread adoption of digital platforms, yet they also face heightened competition and stringent liability expectations, particularly in areas with dense golfing populations.

In contrast, the Europe, Middle East & Africa region presents a tapestry of varied insurance maturity levels and regulatory frameworks, where luxury golf destinations coexist with emerging markets striving to establish foundational coverage norms. Regulatory divergence between nations necessitates tailored product strategies and adaptive underwriting practices to accommodate local legal and cultural considerations. Meanwhile, the Asia-Pacific landscape is characterized by rapid market expansion fueled by rising middle-class interest and significant infrastructure investments in new courses. This growth trajectory is accompanied by evolving regulatory regimes and an increasing focus on environmental sustainability, compelling insurers to innovate product offerings that integrate green risk management solutions. Across all regions, the interplay of local regulations, market sophistication, and stakeholder expectations demands a nuanced approach to regional strategy formulation and execution.

This comprehensive research report examines key regions that drive the evolution of the Golf Insurance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Insurers Combining Technological Innovation and Domain Expertise to Forge Competitive Advantages

Leading companies within the golf insurance domain are distinguished by their strategic emphasis on innovation, customer engagement, and risk expertise. Insurers with advanced digital capabilities have harnessed telematics and play-pattern analytics to introduce usage-based policies that align premiums to actual risk exposures. These offerings have gained traction among tech-savvy individual players seeking transparent pricing and real-time coverage adjustments.

Meanwhile, established specialty insurers have leveraged longstanding relationships with course operators and clubs to offer integrated risk management services, encompassing preventative maintenance audits, on-site risk consultations, and tailored loss control programs. Collaboration with professional associations and tournament organizers has further solidified their reputation for comprehensive coverage and responsive claims handling. New market entrants are differentiating through niche endorsements-such as environmental liability add-ons and weather-related business interruption coverage-addressing emerging pain points and reinforcing the market’s adaptive capacity. Collectively, these companies exemplify how a blend of technological acumen, deep domain knowledge, and strategic partnerships can create sustainable competitive advantages in a specialized insurance market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Golf Insurance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allianz SE

- American Express Travel Related Services Company, Inc.

- American International Group, Inc.

- Assicurazioni Generali S.p.A.

- Aviva plc

- AXA S.A.

- Chubb Limited

- Golf Care Ltd

- Hiscox Ltd

- Insure4Sport Ltd

- InsureandGo Ltd

- Liberty Mutual Insurance Group

- Mapfre, S.A.

- Marsh & McLennan Companies, Inc.

- Nationwide Mutual Insurance Company

- Sompo International Holdings, Ltd.

- Staysure Ltd

- The Hartford Financial Services Group, Inc.

- The Travelers Companies, Inc.

- Tokio Marine Holdings, Inc.

- Tokyo Marine HCC

- Willis Towers Watson plc

- Zurich Insurance Group Ltd

Implementing Strategic Recommendations Centered on Data, Collaboration, and Innovative Policy Design for Sustainable Growth

To navigate the shifting terrains of the golf insurance market, industry leaders must prioritize strategic agility, digital transformation, and stakeholder collaboration. Insurers should invest in advanced data analytics capabilities that integrate telematics and environmental risk modeling, enabling more precise underwriting and dynamic pricing structures. By adopting modular policy frameworks, companies can rapidly customize coverage to meet evolving end-user expectations, from amateur players to elite professionals.

Furthermore, strengthening partnerships with distribution intermediaries and leveraging online platforms will be crucial to expanding market reach and enhancing customer engagement. Embracing an omnichannel approach ensures consistent brand experiences and supports cross-selling opportunities across liability, personal accident, and property lines. Additionally, risk mitigation services-such as preventive maintenance audits, climate resilience planning, and safety training programs-can be bundled to differentiate offerings and drive client loyalty. Finally, active engagement with regulators and industry associations will help shape favorable policy environments, ensuring that new tariff impacts and sustainability requirements are addressed proactively. These recommendations form a cohesive roadmap for insurers to capitalize on emerging trends, mitigate threat vectors, and secure long-term growth.

Detailing a Robust Multimethod Research Framework Combining Primary Interviews and Comprehensive Secondary Analysis

This analysis is underpinned by a comprehensive research methodology that integrates primary and secondary data sources, rigorous qualitative interviews, and robust comparative analyses. Primary research included structured interviews with senior executives from course operators, golf clubs, insurance brokers, and technology providers, ensuring diverse perspectives on risk exposures and coverage requirements. These insights were complemented by in-depth consultations with regulatory experts and environmental risk specialists to capture emergent trends in tariff impacts and sustainability considerations.

Secondary research aggregated industry reports, public filings, and regulatory documents to construct a cohesive framework of market dynamics and stakeholder behaviors. Technology adoption patterns were assessed using case studies of digital underwriting implementations and usage-based policy pilots. Regional insights were derived from comparative regulatory analyses and macroeconomic indicators, while segmentation profiles were validated through end-user surveys and claims data review. Throughout the research process, methodological rigor was maintained through cross-validation of findings, peer reviews of qualitative interpretations, and adherence to ethical research standards.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Golf Insurance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Golf Insurance Market, by Insurance Type

- Golf Insurance Market, by Product Type

- Golf Insurance Market, by Premium Tier

- Golf Insurance Market, by End User

- Golf Insurance Market, by Distribution Channel

- Golf Insurance Market, by Region

- Golf Insurance Market, by Group

- Golf Insurance Market, by Country

- United States Golf Insurance Market

- China Golf Insurance Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Market Drivers, Strategic Imperatives, and Success Factors for Future-Proofed Growth

In summary, the golf insurance market is at a pivotal juncture, shaped by technological innovation, evolving consumer preferences, and complex regulatory shifts. Stakeholders must contend with the dual imperatives of mitigating intensified cost pressures resulting from new tariffs and meeting elevated expectations for personalized, digitally enabled services. The confluence of segmentation intricacies-from end-user profiles to premium tiers-and regional heterogeneity underscores the necessity for adaptive product strategies and agile operational models.

Market leaders will differentiate through strategic investments in data analytics, modular policy architectures, and integrated risk management services. Collaboration across distribution channels and proactive engagement with regulatory bodies will further enhance resilience and competitive positioning. As the industry continues to evolve, the ability to anticipate change, craft bespoke solutions, and deliver compelling, value-driven experiences will define success. This executive summary serves as both a navigational guide and a strategic blueprint for decision-makers seeking to capitalize on the significant opportunities within the expanding golf insurance landscape.

Empower Your Strategic Decisions with Expert Insights and Personalized Support from Our Sales and Marketing Leader

If you are prepared to gain a competitive edge and unlock comprehensive insights into the golf insurance market, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore the full scope of our in-depth research report. His expertise can help ensure that your organization benefits from the latest strategic analyses and actionable intelligence necessary to thrive in an evolving landscape. Secure your copy today to inform your decision making with robust data, expert commentary, and bespoke recommendations designed for informed growth.

- How big is the Golf Insurance Market?

- What is the Golf Insurance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?