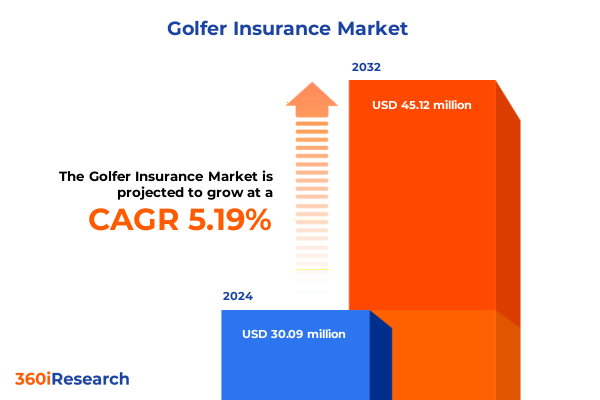

The Golfer Insurance Market size was estimated at USD 31.34 million in 2025 and expected to reach USD 33.14 million in 2026, at a CAGR of 5.34% to reach USD 45.12 million by 2032.

Comprehensive Overview of the Golfer Insurance Landscape Establishing Context and Strategic Objectives for Diverse Market Participants

The golfer insurance sector has emerged as a specialized domain addressing the unique liability, equipment, and bodily injury exposures faced by enthusiasts and professionals on the green. As participation continues across age groups and skill levels, understanding the intricate tapestry of risks-from equipment theft to on-course accidents-has never been more critical. This report sets out to deliver a comprehensive foundation, defining the scope of golfer insurance and situating it within the broader landscape of niche sports underwriting.

Drawing on a thorough examination of market drivers, regulatory influences, and consumer preferences, our introduction articulates the purpose of this analysis: to guide insurers, brokers, club operators, and technology providers toward informed strategic decisions. By establishing key terms, outlining prevalent policy frameworks, and highlighting the roles of intermediaries and direct channels, this section primes stakeholders to navigate ensuing discussions on segmentation, regional dynamics, and tariff-induced cost pressures. Ultimately, this introduction frames the golfer insurance market as a dynamic microcosm of innovation and specialized risk management, setting the stage for deeper exploration and clear strategic direction.

Transformative Shifts Reshaping Golfer Insurance Amid Digital Innovation Emerging Risks and Evolving Customer Expectations

Recent years have witnessed transformative shifts reshaping the golfer insurance domain, driven by rapid digital innovation, evolving risk profiles, and mounting regulatory scrutiny. Traditional policy underwriting, once reliant on static risk assessments, is giving way to dynamic models that integrate telemetric data from wearable devices and course sensors. These technologies not only refine loss predictions for bodily injury and property damage but also enable personalized premiums that reflect actual play patterns.

Simultaneously, climate variability has introduced new risk vectors-unpredictable weather events affecting course availability and hazard exposure-while global economic fluctuations influence disposable income allocation for recreational pursuits. Concurrently, consumer expectations have pivoted toward seamless digital experiences, empowering policyholders to purchase or claim coverage via mobile apps and aggregator platforms without intermediary friction. This convergence of technology adoption and risk complexity has catalyzed a market recalibration, challenging legacy carriers to partner with insurtech innovators and embrace agile product design. As a result, both incumbent insurers and new entrants are reevaluating distribution strategies, customer engagement models, and risk-sharing mechanisms, laying the groundwork for a more responsive and data-driven golfer insurance ecosystem.

Cumulative Impact of United States Tariffs in 2025 on Golfer Insurance Premium Structures Supply Chains and Policy Design

In 2025, the imposition of heightened United States tariffs on imported golf equipment-ranging from clubs and bags to high-performance balls-triggered a cascading effect throughout the golfer insurance market. Insurers recalibrated equipment coverage policies to account for increased replacement costs, prompting many providers to tighten coverage limits or introduce separate deductibles specifically for overseas-manufactured gear. This shift necessitated a delicate balance between maintaining competitive premium levels and safeguarding profitability against upward pressure on claim payouts.

Beyond equipment, tariff-induced cost inflation has influenced the broader supply chain for repair and maintenance services. As domestic workshops adjust labor charges in response to raw material expenses, insurers have responded by renegotiating service agreements or incorporating pricing clauses that tie repair reimbursements to standardized labor rates. Moreover, sensitivity to tariff volatility has prompted carriers to develop flexible endorsement options, allowing policyholders to upgrade coverage mid-term should equipment valuation thresholds shift significantly. Together, these adjustments underline the market’s ability to adapt policy design and pricing structures to external economic levers, ensuring that golfer insurance remains both viable for carriers and valuable for insureds.

Key Segmentation Insights Unveiling Diverse Coverage Preferences Customer Profiles and Distribution Channels Driving Market Dynamics

Delving into segmentation reveals how disparate policy types, customer profiles, coverage offerings, pricing tiers, distribution avenues, and age demographics collectively shape market dynamics. Coverage choices span the conventional dichotomy between annual policies, designed for frequent players seeking comprehensive protection, and single-round policies that cater to casual or occasional golfers. Meanwhile, customer typologies range from professional athletes requiring elevated liability limits and bespoke endorsements to junior players, whose unique risk exposures mandate tailored parental liability considerations, and amateur enthusiasts prioritizing foundational equipment safeguards.

In terms of coverage, combined protection packages that integrate equipment and liability components have gained traction, yet niche demand persists for standalone equipment policies focused on accessories, golf balls, and clubs, each subcategory reflecting distinct valuation profiles. Conversely, liability-only options remain crucial for facilities requiring proof of coverage without ancillary equipment endorsements. Price tiers bifurcate into basic, budget-friendly solutions, standard midrange offerings that balance cost sensitivity with robust coverage features, and premium plans that deliver expanded limits and value-added services such as concierge replacement and expedited claims processing. Distribution channels further diversify access: captive and independent agents maintain personal advisory roles, brokers facilitate multi-carrier comparisons, direct mail campaigns target renewal audiences, and online channels-ranging from aggregator platforms to insurer websites and mobile applications-cater to digitally proficient buyers. Underlying these segments, generational preferences emerge: golf enthusiasts under 30 gravitate toward seamless digital onboarding and usage-based pricing, those aged 30 to 50 prioritize reputation and comprehensive liability coverage, while players over 50 often value personalized service and senior-friendly premium structures.

This comprehensive research report categorizes the Golfer Insurance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Policy Type

- Coverage Type

- Price Tier

- Age Group

- Customer Type

- Distribution Channel

Regional Insights Revealing Unique Market Characteristics Growth Drivers and Challenges across Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics illustrate that the Americas, Europe Middle East & Africa, and Asia-Pacific each present unique growth drivers and challenges. In the Americas, mature markets such as the United States and Canada benefit from extensive golf course networks, well-established underwriting frameworks, and a high penetration of club membership schemes. Insurers in this region leverage direct mail renewal strategies while enhancing digital self-service portals to retain a demographic base skewed toward experienced players.

In contrast, the Europe, Middle East & Africa region exhibits pronounced regulatory diversity, with varying liability standards and equipment valuation practices driving localized product adaptations. Western European nations emphasize green fee protection and high-limit liability policies, whereas emerging markets in the Middle East focus on event-based single-round coverages linked to golf tournaments and resort experiences. African markets, though nascent, show potential for bundled athletic insurance solutions as golf tourism expands.

The Asia-Pacific region stands out for its accelerating participation rates and rapidly evolving distribution landscape. Digital platforms, including mobile-based policy aggregators and insurer applications, have become primary acquisition channels in markets like China and Australia. Moreover, demographic shifts toward younger golfers under 30, coupled with rising disposable incomes, spur demand for annual policies complemented by tech-enabled benefits such as real-time hazard alerts and telemedicine support for on-course injuries. Collectively, these regional distinctions underscore the necessity of tailored go-to-market strategies aligned with local regulatory, cultural, and technological contexts.

This comprehensive research report examines key regions that drive the evolution of the Golfer Insurance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Company Insights Spotlighting Strategic Alliances Product Innovations and Competitive Differentiators in the Golf Insurance Sector

Leading insurers and insurtech pioneers are navigating the golfer insurance sector through strategic alliances, innovative product rollouts, and targeted acquisitions. Established carriers have partnered with golf course operators and equipment manufacturers to embed insurance offerings into membership packages and point-of-sale transactions, thereby enhancing distribution reach and cross-selling opportunities. Concurrently, digital-native startups have introduced usage-based liability endorsements and seamless equipment valuation tools, leveraging AI-driven appraisal engines to streamline underwriting and claims settlement.

In parallel, several major players have undertaken bolt-on acquisitions of specialized risk management firms to bolster their expertise in event coverage and group policy administration. These transactions enhance portfolio diversification, granting access to corporate tournaments and recreational leagues seeking integrated risk solutions. Product innovation remains a central differentiator, with some companies launching tiered telemedicine support services, while others emphasize environmental liability coverage addressing emerging concerns over turf damage and wildlife disturbance.

Through these concerted efforts-ranging from co-branded partnerships and embedded insurance frameworks to aggressive digital expansion and M&A activity-key organizations are carving out distinct competitive advantages. Their strategies reflect a shared commitment to meeting the nuanced needs of diverse golfer cohorts, while harnessing technological and operational efficiencies to drive sustained profitability and market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Golfer Insurance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allianz SE

- American International Group, Inc.

- Aon plc

- AXA SA

- Berkshire Hathaway Inc.

- Chubb Limited

- Liberty Mutual Holding Company Inc.

- Marsh & McLennan Companies, Inc.

- Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München

- State Farm Mutual Automobile Insurance Company

- Tokio Marine Holdings, Inc.

- Willis Towers Watson Public Limited Company

- Zurich Insurance Group AG

Actionable Recommendations Guiding Industry Leaders to Leverage Emerging Trends Optimize Operations and Enhance Customer Engagement

Industry leaders seeking to capture incremental growth should prioritize digital transformation of customer journeys, integrating intuitive mobile applications and real-time policy management capabilities. This digital-first approach not only enhances acquisition efficiency but also fosters ongoing engagement through personalized risk prevention tips and loyalty incentives. Insurers should also explore dynamic pricing algorithms that incorporate environmental and behavioral data, enabling precise alignment of premiums with actual risk exposure and encouraging safer on-course practices.

Furthermore, forging partnerships with equipment manufacturers and golf course operators will create co-branded insurance bundles that simplify purchase decisions and exploit high-traffic touchpoints. To mitigate tariff-driven cost escalations, carriers can negotiate standardized repair rate agreements with domestic service networks and introduce flexible endorsement options that adjust equipment valuation limits in response to supply chain fluctuations. Segmentation-based product refinement-such as junior-targeted liability waivers or under-30 digital onboarding pathways-will unlock new customer segments while deepening penetration among existing cohorts.

Finally, a regionally nuanced go-to-market strategy is essential. In the Americas, reinforcing direct marketing campaigns with digital self-service tools will improve retention, while in Europe Middle East & Africa, localizing policy wordings and compliance protocols ensures regulatory alignment. In Asia-Pacific, accelerating digital aggregator partnerships and embedding telemedicine features can differentiate offerings. By executing these recommendations, industry leaders will be well-positioned to harness evolving opportunities and solidify their competitive standing.

Rigorous Research Methodology Detailting Data Collection Validation and Analytical Framework Underpinning the Golfer Insurance Study

This study employs a multi-stage research methodology combining extensive secondary and primary data gathering. Initially, a comprehensive review of publicly available sources-including carrier annual reports, regulatory filings, industry associations, and academic publications-provided a foundational understanding of golfer insurance practices and historical market evolution. Competitive landscape analyses further illuminated prevailing underwriting models and distribution frameworks.

Subsequently, primary data were collected through structured interviews with senior executives at leading insurers, insurtech founders, golf course operators, and regulatory bodies. These conversations yielded qualitative insights into strategic priorities, technology adoption trajectories, and emerging risk concerns. Complementing this, a targeted survey of policyholders across diverse demographics captured firsthand perspectives on coverage preferences, claims experiences, and digital service expectations.

Data triangulation techniques were applied to reconcile discrepancies between secondary and primary inputs, ensuring analytical rigor. Segmentation matrices were developed to map product types, customer cohorts, coverage options, price tiers, distribution channels, and age groups against key performance indicators. Regional frameworks were constructed by overlaying regulatory parameters, distribution maturity, and demographic trends. The final analytical framework synthesized these dimensions to generate actionable insights and strategic recommendations, underpinned by validated data and expert interpretation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Golfer Insurance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Golfer Insurance Market, by Policy Type

- Golfer Insurance Market, by Coverage Type

- Golfer Insurance Market, by Price Tier

- Golfer Insurance Market, by Age Group

- Golfer Insurance Market, by Customer Type

- Golfer Insurance Market, by Distribution Channel

- Golfer Insurance Market, by Region

- Golfer Insurance Market, by Group

- Golfer Insurance Market, by Country

- United States Golfer Insurance Market

- China Golfer Insurance Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Comprehensive Conclusion Synthesizing Critical Findings Strategic Imperatives and Future Outlook for the Golfer Insurance Market

The evolving golfer insurance market demands agile strategies that align with shifting risk landscapes, regulatory stimuli, and consumer expectations. Our analysis has highlighted the transformative influence of digital innovation on underwriting precision and customer empowerment, the adaptive responses to 2025’s tariff environment, and the nuanced segmentation patterns driving product design. Regional insights underscore the importance of localized strategies, whether optimizing direct mail renewals in established Americas markets or accelerating mobile-first acquisitions in Asia-Pacific.

Key company actions-ranging from embedded insurance collaborations to telemedicine-enabled offerings-illustrate how incumbents and new entrants alike are recalibrating competitive positioning. Actionable recommendations prioritize digital platform investments, dynamic pricing mechanisms, and partnership ecosystems to harness operational efficiencies and deepen market penetration. By embracing these imperatives, insurers can respond proactively to cost pressures, climatic variabilities, and generational preferences, turning challenges into avenues for differentiation.

In sum, stakeholders equipped with the insights and methodologies outlined in this report will be well-prepared to navigate an increasingly sophisticated golfer insurance landscape. The strategic imperatives distilled here provide a clear roadmap for achieving sustainable growth, delivering superior customer experiences, and securing long-term profitability in a sector defined by its specialized risk profile and dynamic evolution.

Connect with Ketan Rohom Associate Director Sales Marketing to Unlock Full Golfer Insurance Market Research Report and Drive Strategic Decisions

If you are ready to gain strategic advantage through unparalleled insights into the golfer insurance market, reach out to Ketan Rohom, Associate Director of Sales and Marketing at our firm. His expertise in translating in-depth research into actionable sales strategies will ensure you have the tailored data and competitive intelligence needed to accelerate growth, mitigate emerging risks, and outperform rivals. By collaborating with Ketan, you will secure direct access to the full report, receive personalized briefings on key segments and regional developments, and benefit from ongoing support to implement findings effectively. Empower your team with the clarity and confidence to make data-driven decisions and capitalize on the dynamic opportunities in golfer insurance. Engage today to transform insights into measurable results and establish a leadership position in this evolving market.

- How big is the Golfer Insurance Market?

- What is the Golfer Insurance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?