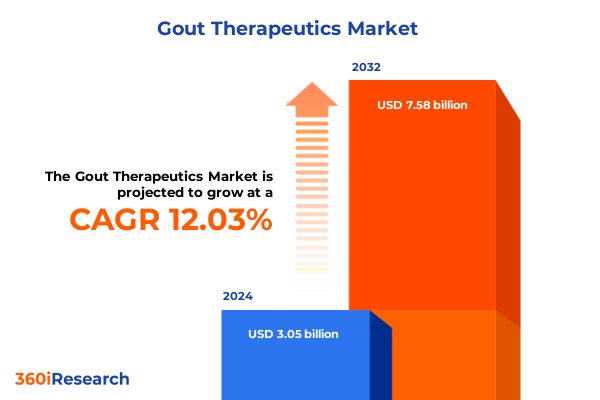

The Gout Therapeutics Market size was estimated at USD 3.40 billion in 2025 and expected to reach USD 3.78 billion in 2026, at a CAGR of 12.13% to reach USD 7.58 billion by 2032.

Unveiling the Transformational Shifts and Breakthrough Innovations Defining the Future of Gout Therapeutics and Patient-Centered Care

Gout, characterized by painful acute flares and chronic joint damage, has emerged as a significant global health challenge affecting tens of millions of patients worldwide. Driven by an aging population, rising prevalence of metabolic comorbidities such as obesity and kidney dysfunction, and evolving dietary patterns, the disease burden continues to climb. According to the Global Burden of Disease Study 2021, the age-standardized prevalence of gout reached 659.3 cases per 100,000 population in 2020, marking a 22.5% increase since 1990 and underscoring the escalating impact of this inflammatory arthritis on healthcare systems globally. The higher prevalence in males-over three times that of females-combined with projected growth in population and longevity, signals a persistent unmet need for both acute management and long-term therapies.

How Emerging Treatment Modalities and Technological Advancements are Redefining the Gout Therapeutics Landscape for Enhanced Patient Outcomes

The landscape of gout therapeutics is undergoing transformative shifts as novel modalities and precision medicine approaches converge to address both symptomatic flares and chronic urate control. Emerging biologics, including fully human monoclonal antibodies targeting interleukin-1β, have demonstrated rapid pain relief during acute attacks and promising reductions in recurrence rates. The GUARD-1 trial results for Firsekibart revealed non-inferior efficacy compared to corticosteroids with the potential for sustained anti-inflammatory benefits, sparking anticipation for its regulatory approval in multiple markets. Concurrently, small molecules such as arhalofenate, combining uricosuric and anti-inflammatory actions through PPARγ activation and crystal-mediated cytokine suppression, are advancing through late-stage development and offering dual-mechanism strategies for hyperuricemia management.

Assessing the Cumulative Impact of 2025 U.S. Tariff Policies on the Gout Therapeutics Supply Chain Resilience and Cost Structures

The introduction of broad-based tariffs on pharmaceutical imports by the United States in 2025 has introduced significant cost pressures and supply chain complexities for the gout therapeutics sector. An EY-commissioned analysis projects that a 25% tariff on finished pharmaceutical products could elevate U.S. drug expenditures by nearly $51 billion annually, potentially driving price increases of up to 12.9% if tariffs are fully passed to consumers. In the short term, leading drugmakers are expected to absorb much of the cost to preserve patient affordability and maintain contractual relationships with payers, yet margins for generic uric acid–lowering agents-which account for the majority of gout prescriptions-remain razor-thin, heightening vulnerability to tariff shocks.

Unlocking Growth Opportunities through Detailed Analysis of Route of Administration Therapy Lines Drug Classes and Distribution Channels

Market participants navigating the gout therapeutics arena are intensely focused on the route of administration, distinguishing between injectable formulations delivered intravenously or subcutaneously and oral therapies designed for ease of chronic use. This bifurcation informs not only patient adherence and acute versus maintenance strategies but also dictates manufacturing complexity and distribution logistics. Therapy line segmentation further shapes investment priorities, as first line interventions pivot on established NSAIDs, colchicine and xanthine oxidase inhibitors like allopurinol and febuxostat, whereas second and third line agents-encompassing uricosurics, corticosteroids, and uricase products-address refractory disease and severe tophaceous presentations. Alongside these clinical divisions, drug class analysis underscores the interplay between anti-inflammatory agents, uricosurics, and xanthine oxidase inhibitors in treatment algorithms, while distribution channel insights highlight the evolving roles of hospital pharmacies, retail outlets, and online platforms in ensuring timely patient access.

This comprehensive research report categorizes the Gout Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Route Of Administration

- Therapy Line

- Drug Class

- Distribution Channel

Evaluating Regional Dynamics and Emerging Trends Across the Americas Europe Middle East Africa and Asia Pacific Key Markets

Regional dynamics in the gout therapeutics space reflect diverse epidemiological patterns, healthcare infrastructures, and policy environments across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, high-income North America experiences among the steepest increases in gout-related disability rates, driven by prevalent obesity and metabolic syndrome, with age-standardized years lived with disability rising by over 74% between 1990 and 2020 according to recent findings. Prescription and reimbursement frameworks in this region prioritize rapid access to both acute-phase biologics and long-term urate lowering, necessitating tailored commercialization strategies. Europe, the Middle East, and Africa encompass a broad spectrum of disease rates and healthcare capabilities; while Western Europe benefits from advanced diagnostic and specialty care networks, emerging economies within EMEA face challenges in drug affordability and supply chain resilience, prompting opportunities for generic and biosimilar entrants. Meanwhile, Asia Pacific is witnessing rising gout prevalence in urbanizing centers, with countries like Japan and South Korea leading in adoption of novel therapies, and rapidly growing markets in China and India presenting high potential for both oral and injectable innovations as regulatory pathways evolve.

This comprehensive research report examines key regions that drive the evolution of the Gout Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Emerging Disruptors and Strategic Partnerships Shaping the Competitive Landscape of Gout Therapeutics

Leading global pharmaceutical corporations and emerging biotech innovators are shaping the competitive contours of the gout therapeutics sector through strategic investments, partnerships, and pipeline diversification. AstraZeneca’s recently unveiled $50 billion commitment to U.S. manufacturing expansion underscores the industry’s preemptive response to tariff uncertainty and reflects a broader trend of reshoring critical production assets. Concurrently, traditional players such as Eli Lilly and Johnson & Johnson have reinforced their U.S. footprints, leveraging existing biologics expertise to explore next-generation anti-inflammatory modalities and urate-lowering adjuncts. On the innovation frontier, companies like LG Chem are advancing tigulixostat, a novel xanthine oxidase inhibitor, through Phase III evaluation, while smaller entities such as Shanton Pharma and InventisBio progress selective URAT1 inhibitors and pipeline candidates targeting refractory and tophaceous gout forms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gout Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Amgen Inc.

- Arthrosi Therapeutics, Ltd.

- AstraZeneca plc

- Atom Therapeutics Co., Ltd.

- Boehringer Ingelheim International GmbH

- Dr. Reddy’s Laboratories Ltd.

- Eli Lilly and Company

- GlaxoSmithKline plc

- Horizon Therapeutics plc

- Ironwood Pharmaceuticals, Inc.

- Merck & Co., Inc.

- Novartis AG

- Olatec Therapeutics LLC

- Pfizer Inc.

- Protalix BioTherapeutics, Inc.

- Regeneron Pharmaceuticals, Inc.

- Selecta Biosciences, Inc.

- Sobi

- Sun Pharmaceutical Industries Ltd.

- Synlogic, Inc.

- Takeda Pharmaceutical Company Limited

- Teijin Pharma Limited

- Teva Pharmaceutical Industries Ltd.

- Urica Therapeutics, Inc.

Implementing Strategic Initiatives to Enhance Collaborative Research Accelerate Pipeline Development and Strengthen Market Position in Gout Therapeutics

Industry leaders should prioritize a multifaceted strategy that integrates supply chain resilience, dynamic R&D investment, and collaborative ecosystem engagement to sustain growth in the evolving gout therapeutics market. Mitigating tariff-related cost pressures requires diversification of API and finished product sourcing, including nearshoring and strategic alliances with contract manufacturers in low-tariff jurisdictions. Concurrently, accelerating clinical development through adaptive trial designs and biomarker-driven patient segmentation can shorten time to market for breakthrough modalities. Partnerships with technology providers to leverage digital health tools for patient monitoring and adherence support will enhance real-world evidence generation and optimize therapeutic outcomes. Finally, alignment with payers via value-based contracting structures that link reimbursement to clinical and economic end points will underpin differentiated positioning and secure access for premium biologic therapies.

Detailing the Comprehensive Research Methodology Data Sources Analytical Framework and Validation Processes Underpinning the Gout Therapeutics Study

This study employed a rigorous mixed-method research methodology to ensure comprehensive and accurate insights into the gout therapeutics domain. Secondary research involved a systematic review of peer-reviewed literature, clinical trial registries, regulatory filings, and industry reports to map current and emerging therapies. Primary research included in-depth interviews with key opinion leaders, rheumatologists, endocrinologists, and supply chain specialists to validate segmentation frameworks and uncover nuanced adoption barriers. Quantitative data from proprietary databases were triangulated with public sources to establish segment definitions and market dynamics without reliance on forecasting estimates. Analytical frameworks, such as SWOT and Porter’s five forces, were applied to contextualize competitive threats and opportunities, while continuous expert validation ensured the integrity of findings throughout the research process.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gout Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gout Therapeutics Market, by Route Of Administration

- Gout Therapeutics Market, by Therapy Line

- Gout Therapeutics Market, by Drug Class

- Gout Therapeutics Market, by Distribution Channel

- Gout Therapeutics Market, by Region

- Gout Therapeutics Market, by Group

- Gout Therapeutics Market, by Country

- United States Gout Therapeutics Market

- China Gout Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Synthesizing Findings Strategic Implications and Future Outlook to Close the Executive Summary on Gout Therapeutics Innovations and Market Dynamics

The convergence of rising disease burden, evolving policy landscapes, and a robust pipeline of innovative therapies underscores a pivotal juncture for the gout therapeutics market. Transformative biologics, next-generation small molecules, and precision medicine strategies are set to redefine standard of care, offering both patients and providers new avenues for acute flare management and long-term urate control. Yet, external factors such as import tariffs and supply chain fragmentation introduce cost and access challenges that demand proactive risk mitigation. Strategic collaboration among manufacturers, regulators, healthcare practitioners, and payers will be essential to translating scientific breakthroughs into tangible patient benefits. By synthesizing insights across segments, regions, and competitive dynamics, stakeholders can navigate complexity and position themselves to capture value in a market poised for sustained innovation.

Engage with Ketan Rohom to Secure Your Comprehensive Gout Therapeutics Market Research Report and Drive Strategic Commercial Success

We invite you to take the next step in advancing your strategic initiatives by securing the complete market research report on Gout Therapeutics and collaborating directly with Ketan Rohom, Associate Director of Sales & Marketing. Engaging with Ketan ensures you receive a tailored overview of critical insights, actionable recommendations, and comprehensive data that align with your organization’s objectives. By partnering with him, you can accelerate your decision-making processes, gain exclusive access to proprietary analysis, and leverage our expert guidance to capitalize on emerging opportunities in the gout treatment landscape. Contact Ketan to arrange a personalized consultation and to purchase the full report, enabling your team to stay ahead of market shifts, optimize resource allocation, and drive sustained commercial success in the evolving field of gout therapeutics.

- How big is the Gout Therapeutics Market?

- What is the Gout Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?