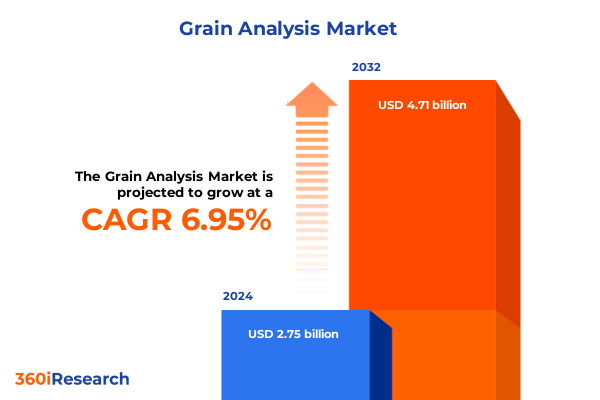

The Grain Analysis Market size was estimated at USD 2.93 billion in 2025 and expected to reach USD 3.13 billion in 2026, at a CAGR of 7.00% to reach USD 4.71 billion by 2032.

Unveiling the Evolving Dynamics of the Global Grain Market Amid Complex Economic Pressures Environmental Shocks and Trade Uncertainties

The global grain market stands at a pivotal moment, shaped by an intricate interplay of economic pressures, shifting trade policies, and environmental uncertainties. International agricultural commodity markets have long been a cornerstone of global food security, with approximately 20% of all calories traded across borders annually according to a leading intergovernmental outlook, underscoring the critical importance of well-functioning trade systems in supporting rural livelihoods and ensuring stable supplies.

In recent years, the grain sector has grappled with intensifying climate-driven disruptions and supply chain vulnerabilities. Extreme weather events have become more frequent and severe, contributing to significant yield fluctuations across key producing regions, from North America to the Black Sea basin, resulting in heightened concerns over both food accessibility and quality. These dynamics have prompted stakeholders to reevaluate traditional risk management approaches and to accelerate investments in more resilient production and logistics practices.

Navigating Transformative Shifts in Grain Production and Trade Fueled by Technological Advances and Policy Realignments

Technological innovation and evolving policy frameworks are driving a transformative shift in how grain is produced, processed, and traded. Precision agriculture tools, including satellite imagery and real-time crop health monitoring, are enabling producers to optimize inputs and bolster yields even under challenging climatic conditions. Meanwhile, digital trading platforms are streamlining transactions, reducing time to contract execution, and improving price transparency across global exchanges.

On the policy front, governments are increasingly embedding sustainability and traceability requirements within their regulatory frameworks. This includes enhanced reporting obligations for greenhouse gas emissions and mandates for deforestation-free sourcing, compelling grain companies to adopt regenerative practices and robust supply chain due diligence. Collectively, these technological and regulatory forces are reshaping traditional market dynamics, creating new competitive advantages for early adopters and imposing adaptation imperatives on established players.

Assessing the Far-Reaching Cumulative Impact of 2025 U.S. Tariff Measures on Grain Trade Patterns and Supply Chains

The introduction of sweeping U.S. tariff measures in early 2025 has exerted a multifaceted impact on global grain trade flows and domestic market structures. In the short term, retaliatory duties imposed by key trading partners, including China’s additional 15% levies on corn and wheat imports and Canada’s 25% duties on U.S. exports, precipitated immediate declines in futures prices for corn, wheat, and soybeans. For instance, the Chicago Board of Trade reported 3–4% drops in these commodity prices as markets digested heightened trade frictions.

Over the medium term, recalibration of trade relationships has accelerated. Mexico, historically the largest buyer of U.S. corn, is projected to reduce imports by 20–30% as it diversifies sourcing to South American suppliers, while China’s tariffs threaten to further erode soybean exports valued at over $12 billion in 2024, shifting demand toward Brazilian producers. These shifts are altering established supply chains and compelling U.S. exporters to explore new markets and reposition logistical assets.

Looking ahead, sustained tariff barriers risk reducing the United States’ share of global cereal exports from 12% to below 10% by 2030, according to agribusiness analyses, potentially triggering structural changes in domestic acreage allocation and prompting increased policy support in the form of subsidies or export incentives. The cumulative effect of these measures underscores the strategic importance of resilient market diversification and proactive engagement in multilateral trade dialogues.

Deriving Strategic Insights from Comprehensive Product Form and Application Segmentation Across Diverse Grain Categories

Insights derived from granular segmentation of the grain market reveal critical drivers of demand, channel dynamics, and emerging value pools. Examining product type distinctions, barley’s split into hulled and pearl variants highlights divergent quality and application requirements that influence the value chain, while distinctions between white and yellow corn inform feed versus ethanol production allocations. Parallel bifurcations in oats, rice, and wheat categories underscore the importance of targeted breeding, processing capabilities, and end-use specifications in shaping trade competitiveness and margin structures.

Form-based segmentation illuminates the balance between raw material flows and value-added processing. Dry grains processed into dehulled or whole kernel formats cater to feed and food ingredient markets demanding consistency and shelf stability, whereas flour and meal derived from milling operations command distinct pricing benchmarks and require specialized storage, distribution, and packaging frameworks to meet end-market specifications.

Application-led segmentation further clarifies growth corridors and strategic focus areas. Feed applications for livestock and pet nutrition sustain fundamental demand baselines, while food categories such as bakery, breakfast cereal, and snack manufacturing drive premium positioning through functional diversification. Industrial uses in biofuel production and brewing encapsulate a convergence of energy policy and agricultural output, with biodiesel and ethanol pathways presenting significant volumetric offtake. Seed segment dynamics, characterized by certified versus farm-saved varieties, reflect the interplay of regulatory regimes, intellectual property considerations, and on-farm decision making that will shape future genetic innovation adoption.

This comprehensive research report categorizes the Grain Analysis market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Application

Highlighting the Key Regional Dynamics across Americas Europe Middle East Africa and Asia Pacific Grain Markets

Regional market dynamics vary considerably across the Americas, Europe Middle East & Africa, and Asia-Pacific, each reflecting unique consumption patterns, policy environments, and infrastructural capacities. In the Americas, the integration of North and South American supply chains has intensified competition for export volumes, with Brazilian and Argentinian exporters leveraging cost advantages and logistical efficiencies to capture displaced U.S. market share. Domestic policy incentives for biofuel mandates in the United States and Canada further modulate demand profiles for corn and other coarse grains.

Across Europe, the Middle East, and Africa, grains serve dual roles as staples in human diets and inputs for livestock sectors. EU regulatory frameworks emphasizing traceability, sustainability, and food safety drive premium positioning for non-GMO and certified sustainable grain streams, while Middle Eastern and African importers continue to balance affordability and nutritional needs against supply risks exacerbated by regional geopolitical tensions.

In the Asia-Pacific region, rapid income growth and evolving dietary preferences are reshaping grain consumption landscapes. China’s gradual tariff adjustments and domestic stockpile strategies influence import volumes, while Southeast Asian markets exhibit expanding demand for rice alongside burgeoning feed requirements to support aquaculture and poultry industries. Infrastructure investments in ports and inland logistics are gradually alleviating bottlenecks, unlocking new corridors for intra-regional trade.

This comprehensive research report examines key regions that drive the evolution of the Grain Analysis market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Agribusiness Players Driving Innovation Sustainability and Market Resilience in the Grain Sector

Leading agribusiness players are deploying diverse strategies to navigate market volatility and align with sustainability imperatives. Archer Daniels Midland has responded to profit pressures and policy uncertainty by streamlining operations, announcing workforce reductions of up to 700 roles and targeted cost savings of $750 million to preserve margin resilience. At the same time, the company’s proactive stance on climate commitments, including a pledge to reduce Scope 3 emissions by 25% by 2035 and expand global regenerative agriculture acres to 5 million by 2025, underscores its dual focus on competitiveness and long-term sustainability.

Cargill, meanwhile, is reinforcing its position through strategic acquisitions and sustainability partnerships. The company’s move to acquire the remaining stake in Brazil’s SJC Bioenergia enhances its footprint in renewable energy production from sugarcane and corn, reflecting an integrated approach to biofuel and grain value chains. Concurrently, Cargill’s accelerated commitment to eliminate deforestation and land conversion for key row crops in South America by 2025 highlights the critical role of cross-sector collaboration in protecting ecosystems while ensuring supply security.

Collectively, these leading players exemplify how operational agility, responsible sourcing commitments, and strategic investments in value-added and renewable segments are shaping competitive differentiation in the global grain sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Grain Analysis market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies Inc.

- ALS Limited

- Ametek Inc.

- Bruker Corporation

- Bureau Veritas S.A.

- CEM Corporation

- Chopin Technologies SA

- Digi‑Star International Ltd.

- Eurofins Scientific SE

- FOSS A/S

- Intertek Group plc

- Kett Electric Laboratory Co., Ltd.

- Neogen Corporation

- PerkinElmer Inc.

- Perten Instruments AB

- Pfeuffer GmbH & Co. KG

- Romer Labs Division Holding GmbH

- Satake Corporation

- SGS S.A.

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- TÜV Nord Group GmbH & Co. KG

- TÜV SÜD AG

- Unity Scientific, Inc.

- Waters Corporation

Actionable Strategic Recommendations for Grain Industry Stakeholders to Enhance Resilience Improve Sustainability and Capture Growth

Industry leaders should prioritize diversification of market exposure by developing adaptable sourcing strategies that reduce dependence on any single geography or policy regime. Enhancing supply chain resilience through investments in digital traceability and real-time risk monitoring will enable proactive responses to trade disruptions and geo-political shifts.

Expanding regenerative agriculture initiatives and low-carbon processing capabilities not only meets rising consumer and regulatory demands but also builds long-term operational efficiencies. Collaborative partnerships across the value chain-connecting producers, technology providers, and end users-are essential to scaling sustainable practices with measurable environmental and economic returns. Likewise, engaging constructively in multilateral trade forums and policy advocacy efforts can help shape more predictable and equitable trade frameworks, mitigating the impacts of unilateral tariff actions.

Finally, strengthening scenario planning and financial hedging mechanisms against price volatility will safeguard margins and support investment in innovation. By aligning strategic priorities around these focus areas, grain companies can navigate uncertainty, capture emerging growth opportunities, and sustain competitive advantage.

Detailing a Robust Research Methodology Combining Primary Interviews Secondary Data and Quantitative Analytical Techniques for Grain Analysis

This analysis integrates rigorous primary research, including in-depth interviews with industry executives, agronomists, and trade experts, to capture firsthand perspectives on evolving market conditions. Complementing these qualitative insights, extensive secondary research was conducted using reputable databases, intergovernmental reports, and peer-reviewed publications to ensure the factual accuracy and contextual relevance of key trends.

Quantitative data was subjected to triangulation across multiple sources-such as international trade records, commodity exchange statistics, and policy announcements-to validate the impacts of tariff measures and supply chain shifts. Advanced analytical techniques, including scenario modeling and sensitivity analysis, were employed to assess potential market outcomes under varying regulatory and environmental conditions. Key findings were further peer-reviewed by subject matter specialists to uphold methodological rigor and impartiality.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Grain Analysis market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Grain Analysis Market, by Product Type

- Grain Analysis Market, by Form

- Grain Analysis Market, by Application

- Grain Analysis Market, by Region

- Grain Analysis Market, by Group

- Grain Analysis Market, by Country

- United States Grain Analysis Market

- China Grain Analysis Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2544 ]

Synthesizing Core Findings on Market Dynamics Policy Impacts and Strategic Imperatives Shaping the Future of the Grain Industry

In summary, the grain industry is undergoing a period of profound transformation driven by intersecting forces of technological innovation, shifting policy landscapes, and geopolitical tensions. Climate-induced production volatility and escalating trade disruptions underscore the need for agile risk management and diversified market strategies. Segmentation analysis reveals nuanced opportunities across product types, forms, and applications, while regional dynamics highlight differentiated demand drivers and regulatory contexts that industry participants must navigate.

Leading companies are demonstrating the critical importance of integrating sustainability commitments with operational efficiency, as evidenced by aggressive regenerative agriculture targets and strategic investments in renewable sectors. Moving forward, proactive engagement in policy discourse, coupled with advancements in supply chain traceability and collaborative value chain initiatives, will be key to unlocking new sources of competitive advantage and ensuring resilient, inclusive growth across global grain markets.

Take the Next Step Toward Informed Grain Market Decision Making by Engaging with Ketan Rohom to Secure Your Comprehensive Report

To deepen your understanding of the transformative shifts, tariff impacts, and strategic opportunities within the global grain market, connect directly with Ketan Rohom, Associate Director, Sales & Marketing. Engage in a tailored consultation to explore how this comprehensive report can support your decision-making processes, de-risk supply chains, and unlock new pathways for growth. Secure your copy today to gain exclusive access to in-depth analysis, expert insights, and actionable intelligence designed to empower industry leaders.

- How big is the Grain Analysis Market?

- What is the Grain Analysis Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?