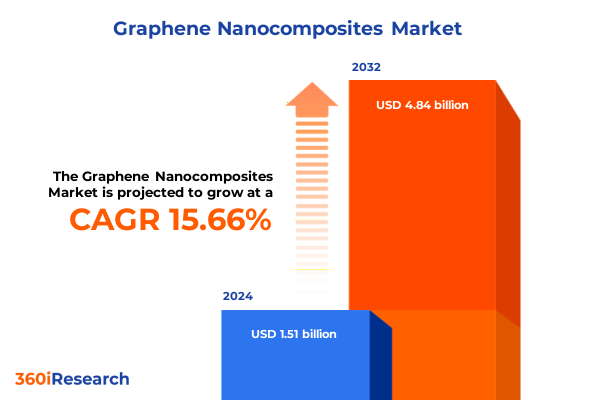

The Graphene Nanocomposites Market size was estimated at USD 1.73 billion in 2025 and expected to reach USD 1.98 billion in 2026, at a CAGR of 15.82% to reach USD 4.84 billion by 2032.

Unveiling the strategic significance and foundational principles of graphene nanocomposites as a cornerstone for next generation high-performance material solutions

Graphene nanocomposites have emerged as a groundbreaking class of advanced materials that marry the extraordinary properties of graphene with conventional matrices to unlock unprecedented performance advantages. Defined by the integration of graphene or its derivatives into host materials, these nanocomposites exhibit superior mechanical strength, thermal stability, and electrical conductivity compared to traditional composites. This introduction lays the groundwork for understanding how graphene’s atom-thin lattice structure, coupled with optimized composite architectures, propels new capabilities in applications ranging from flexible electronics to high-performance structural components.

By embedding graphene nanoplatelets, nanosheets, or functionalized derivatives within polymeric, metallic, or ceramic matrices, engineers and material scientists are harnessing synergistic effects that elevate composite properties to previously unattainable levels. In particular, the control of interfacial interactions between graphene fillers and host materials is critical for achieving uniform dispersion, load transfer efficiency, and defect mitigation. As a result, the field has witnessed a proliferation of novel synthesis approaches-such as chemical vapor deposition and exfoliation-that enable scalable production of graphene-based building blocks.

This executive summary aims to guide decision-makers through the most pivotal insights shaping the graphene nanocomposite domain. It sets the stage by outlining market-relevant shifts, tariff considerations, segmentation intelligence, regional nuances, company strategies, and recommended actions. By the end of this introduction, the reader will appreciate why this class of materials stands at the frontier of innovation and how a strategic understanding of its landscape can unlock transformative opportunities for tomorrow’s high-performance solutions.

Analyzing the disruptive technological advances and cross-industry adoption trends reshaping the graphene nanocomposite landscape for unprecedented innovation trajectories

Over the past few years, the graphene nanocomposite ecosystem has been redefined by a series of disruptive technological advances and adoption curves that span multiple verticals. Initially constrained by high production costs and limited scalability, recent breakthroughs in graphene exfoliation and chemical vapor deposition techniques have significantly lowered barriers to entry. Simultaneously, enhanced functionalization chemistries now enable seamless integration of graphene into polymers, metals, and ceramics, driving down processing complexities and elevating composite performance metrics.

Furthermore, the electrification of transport and the surge in demand for lightweight, high-strength materials have catalyzed adoption in automotive and aerospace sectors. In parallel, the convergence of 5G communications and the Internet of Things has spurred the development of graphene-infused conductive inks and electromagnetic interference shielding solutions. As a result, cross-industry collaboration between electronics manufacturers, materials suppliers, and end-use specialists has intensified, facilitating rapid prototyping and co-development initiatives.

Looking ahead, sustainability considerations are ushering in a third wave of innovation centered on green synthesis routes, recyclable matrix systems, and life-cycle optimization. These transformative shifts are redefining cost-value paradigms, creating new avenues for strategic investment, and positioning graphene nanocomposites as a pivotal enabler for the next generation of multifunctional materials.

Evaluating the cumulative consequences of 2025 United States tariff adjustments on graphene nanocomposite supply chains, cost structures, and competitive dynamics

In 2025, the United States implemented a series of cumulative tariff adjustments that bear directly on the graphene nanocomposite supply chain. Targeting key precursors and composite intermediates, these duties have incrementally increased the landed cost of graphite derivatives, polymer matrices, and specialty additives. As tariffs compounded over successive review periods, manufacturers found themselves navigating a more complex cost structure that eroded traditional import arbitrage opportunities.

Consequently, strategic sourcing decisions have shifted toward nearshoring and vertical integration. Companies are actively evaluating domestic graphite processing facilities and polymer compounding operations to mitigate exposure to escalating duties. At the same time, a growing number of material producers are forging long-term partnerships with upstream mining and exfoliation entities to secure preferential pricing and shield against further tariff volatility.

Moreover, this tariff landscape has prompted a reorientation of R&D priorities. With cost pressures mounting, research teams are concentrating on feedstock optimization, production yield enhancement, and process energy efficiency to preserve margin structures without compromising on material performance. In this context, a clear understanding of the cumulative impact of 2025 United States tariffs is indispensable for robust strategic planning and supply chain resilience in the graphene nanocomposite arena.

Deriving strategic intelligence from multidimensional segmentation analyses to uncover critical value pools and performance drivers within graphene nanocomposites ecosystem

A multidimensional segmentation framework reveals the nuanced drivers of value within the graphene nanocomposite market. By polymer matrix classification, elastomer grades deliver enhanced flexibility and resilience in wearable sensors, whereas thermoplastic variants-spanning polyethylene, polyethylene terephthalate, and polypropylene-dominate applications requiring a balance of structural integrity and manufacturability. Thermoset formulations, on the other hand, are prized for their thermal stability and are increasingly adopted in high-stress structural composites.

Delving deeper into end-use industry segmentation, aerospace and defense entities prioritize weight reduction and electromagnetic shielding, while automotive and transportation players focus on crashworthiness and battery performance. Coatings and paints manufacturers leverage graphene’s barrier properties for corrosion resistance, whereas composite fabricators exploit its reinforcement potential. In electronics and semiconductor applications, conductive films and inks enriched with graphene provide high-frequency signal integrity, and the energy sector integrates graphene nanocomposites for advanced battery electrodes and supercapacitor components. Medical device innovators are exploring biocompatible graphene oxide systems for drug delivery and diagnostic sensors.

From a material type perspective, functionalized graphene offers tailored interfacial chemistry, graphene nanoplatelets deliver cost-effective bulk reinforcement, and graphene nanosheets facilitate thin-film applications. Graphene oxide and reduced graphene oxide variants provide versatile options for tunable conductivity and chemical reactivity. Application segmentation highlights conductive films and inks as critical enablers for flexible electronics, electromagnetic interference shielding for defense and telecom infrastructure, sensor platforms for environmental monitoring, and structural components for next-generation composites. Product form analysis indicates that dispersions are preferred for liquid processing routes, films excel in membrane and barrier applications, and powders underpin additive manufacturing. Finally, among production technologies, chemical vapor deposition leads in quality control, epitaxial growth supports wafer-scale integration, and exfoliation offers a scalable, cost-effective path to graphene flakes. Sales channel dynamics reveal aftermarket channels as vital for maintenance and repair operations, OEM partnerships driving embedded system innovation, and research institutions acting as incubators for early-stage technology de-risking.

This comprehensive research report categorizes the Graphene Nanocomposites market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Polymer Matrix

- Material Type

- Product Form

- Production Technology

- End Use Industry

- Application

- Sales Channel

Distilling region-specific market dynamics and growth enablers across Americas, Europe Middle East Africa, and Asia Pacific to inform geographic expansion strategies

Region-specific dynamics play a pivotal role in shaping demand trajectories and competitive landscapes. In the Americas, robust R&D infrastructure and a strong manufacturing base underpin accelerated commercialization of graphene nanocomposites. North American transportation OEMs are forging partnerships with material innovators to reduce vehicle weight and enhance battery systems, while South American mining projects are ramping up domestic graphite processing capabilities to feed regional composites supply chains.

Within Europe, the Middle East, and Africa, regulatory emphasis on carbon neutrality and environmental compliance is driving investment into sustainable production technologies. European consortiums are piloting green exfoliation processes and circular economy models. The Middle East is capitalizing on low-cost energy resources to scale high-temperature CVD reactors, whereas Africa is emerging as a strategic graphite sourcing hub with expanding downstream fabrication facilities.

In the Asia-Pacific, a confluence of low-cost manufacturing, government incentives, and burgeoning electronics and energy storage sectors is propelling rapid uptake of graphene nanocomposites. China remains a global powerhouse for large-scale exfoliation and functionalization capacity, while Japan and South Korea focus on high-precision epitaxial growth and semiconductor-grade applications. Southeast Asian nations are carving out niche roles in polymer compounding and specialized dispersions, leveraging cost-competitive labor and logistics networks.

This comprehensive research report examines key regions that drive the evolution of the Graphene Nanocomposites market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading graphene nanocomposite industry innovators and their strategic positioning in product development, technology platforms, and partnership ecosystems

A handful of pioneering companies have emerged as bellwethers in the graphene nanocomposite sector, distinguished by their vertically integrated platforms and differentiated technology roadmaps. Leading the charge, one prominent developer has specialized in high-quality chemical vapor deposition graphene membranes, targeting advanced electronics and sensor markets. Another key innovator focuses on scalable exfoliation processes to produce cost-effective nanoplatelets and powders for bulk reinforcement and additive manufacturing applications.

Complementing these capabilities, a third technology provider has carved a niche in functionalized graphene derivatives, offering tailored surface chemistries to enhance compatibility with diverse polymer and ceramic matrices. Meanwhile, certain established specialty chemical firms have leveraged their global supply networks to integrate graphene oxide and reduced graphene oxide into barrier coatings and energy storage systems. Research institutes-turned-commercial ventures continue to play a critical role by advancing epitaxial growth methods for wafer-scale graphene sheets.

Partnership ecosystems further amplify competitive positioning, as original equipment manufacturers collaborate with material suppliers to co-develop composite formulations optimized for specific end uses. In tandem, aftermarket service specialists are embedding graphene-enabled repair and maintenance solutions into their service offerings. Collectively, these strategic moves underscore how focused R&D investment and agile go-to-market approaches are redefining leadership in the graphene nanocomposite arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Graphene Nanocomposites market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACS Material, LLC

- Angstron Materials Inc.

- Applied Graphene Materials Plc

- Arkema S.A.

- BASF SE

- Cabot Corporation

- CVD Equipment Corporation

- Directa Plus S.p.A.

- Evonik Industries AG

- First Graphene Limited

- G6 Materials Corp.

- Global Graphene Group, Inc.

- Graphenea S.A.

- Graphmatech AB

- Haydale Graphene Industries Plc

- LG Chem Ltd.

- Mitsubishi Chemical Corporation

- Nanocyl SA

- Nanotech Energy Inc.

- NanoXplore Inc.

- Ningbo Moxi Technology Co., Ltd

- Resonac Corporation

- Talga Group Ltd

- The Sixth Element (Changzhou) Materials Technology Co., Ltd.

- Thomas Swan & Co. Ltd.

- Vorbeck Materials Corp.

- XG Sciences, Inc.

Formulating pragmatic and high-impact recommendations for industry leaders to capitalize on emerging opportunities and mitigate risks in graphene nanocomposite markets

To thrive in the competitive graphene nanocomposite landscape, industry leaders should prioritize strategic collaborations that bridge upstream and downstream value chains. By co-innovating with graphite producers and polymer compounders, companies can secure preferential access to high-quality feedstocks and optimize composite formulations early in the development cycle. Concurrently, investing in modular, scalable production cell designs will enable rapid capacity expansion while preserving cost agility in the face of tariff volatility.

Moreover, organizations must strengthen supply chain resilience by diversifying raw material sourcing across multiple geographies and establishing strategic stockpiles of critical intermediates. Embracing advanced analytics and digital twins for production process monitoring can further enhance yield efficiencies and reduce operational downtime. In parallel, a rigorous focus on sustainability-through adoption of green exfoliation techniques and recyclable polymer matrices-will not only satisfy evolving regulatory requirements but also deliver a compelling value proposition to environmentally conscious end users.

Finally, to unlock new revenue streams, companies should explore adjacent application domains such as wearable electronics, smart textiles, and biomedical sensors. By coupling proprietary graphene expertise with targeted end-use partnerships, industry participants can accelerate market penetration and diversify their product portfolios. Collectively, these actionable recommendations will empower decision-makers to harness emerging opportunities and navigate the dynamic graphene nanocomposite marketplace.

Outlining rigorous and transparent research methodologies encompassing qualitative and quantitative approaches to ensure robust insights into graphene nanocomposites

A comprehensive research methodology underpins the insights presented in this report, combining qualitative and quantitative techniques to ensure robustness and validity. The study commenced with an extensive secondary research phase, reviewing scientific literature, patent filings, and materials science journals to map the current state of graphene nanocomposite technologies. Concurrently, trade publications and regulatory filings were analyzed to identify supply chain trends and tariff developments.

Primary research involved structured interviews with key stakeholders spanning material producers, automotive OEMs, aerospace integrators, electronics manufacturers, and governmental agencies. These discussions provided first-hand perspectives on adoption challenges, cost-performance trade-offs, and sustainability imperatives. Quantitative data were obtained through proprietary surveys of R&D laboratories and industrial end users, with responses triangulated against import–export records and customs databases to validate cost impact assessments.

Segmentation analysis was conducted by categorizing data across polymer matrix, end-use industry, material type, application, product form, production technology, and sales channel dimensions. Regional dynamics were examined through cross-referenced industry reports and on-site visits to manufacturing facilities in key geographies. Finally, all findings were reviewed by an internal panel of materials science experts to ensure methodological consistency and to refine strategic interpretations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Graphene Nanocomposites market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Graphene Nanocomposites Market, by Polymer Matrix

- Graphene Nanocomposites Market, by Material Type

- Graphene Nanocomposites Market, by Product Form

- Graphene Nanocomposites Market, by Production Technology

- Graphene Nanocomposites Market, by End Use Industry

- Graphene Nanocomposites Market, by Application

- Graphene Nanocomposites Market, by Sales Channel

- Graphene Nanocomposites Market, by Region

- Graphene Nanocomposites Market, by Group

- Graphene Nanocomposites Market, by Country

- United States Graphene Nanocomposites Market

- China Graphene Nanocomposites Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Synthesizing comprehensive insights to clarify strategic imperatives and underscore the transformative potential of graphene nanocomposites in advanced material industries

The synthesis of this executive summary underscores the transformative potential of graphene nanocomposites as a nexus of performance, functionality, and market opportunity. By integrating advanced segmentation analyses, tariff impact evaluations, and regional dynamics, decision-makers are equipped with a holistic understanding of where and how to invest for maximum strategic impact. Key company case studies illustrate the importance of vertically integrated platforms and collaborative innovation models in maintaining competitive differentiation.

Moreover, the intersection of sustainability agendas, regulatory shifts, and evolving end-use expectations highlights a pivotal moment for industry actors to recalibrate their R&D roadmaps and supply chain strategies. As production technologies continue to advance, the cost-performance equation will increasingly favor graphene-infused composites across a spectrum of high-value applications, from next-generation electronics and energy storage to lightweight structural components.

In conclusion, the insights distilled herein provide a clear roadmap for organizations seeking to harness the unique advantages of graphene nanocomposites. By aligning strategic initiatives with the identified market drivers and mitigation tactics, industry participants can accelerate commercialization timelines, deepen end-use penetration, and realize sustained growth in a rapidly evolving material landscape.

Engage with Ketan Rohom to access exclusive in-depth market research report on graphene nanocomposites and empower strategic decision-making with expert intelligence

To secure an unparalleled competitive edge in the rapidly evolving field of graphene nanocomposites, we invite you to engage directly with Ketan Rohom, Associate Director, Sales & Marketing. Leverage his deep expertise and industry insights to tailor a comprehensive solution that aligns with your strategic imperatives. By connecting with Ketan, you will gain immediate clarity on the report’s structure, scope, and bespoke analysis options designed to meet your organization’s unique needs. Don’t miss this opportunity to transform high-level intelligence into decisive action-reach out today to initiate your journey toward data-driven innovation and market leadership.

- How big is the Graphene Nanocomposites Market?

- What is the Graphene Nanocomposites Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?