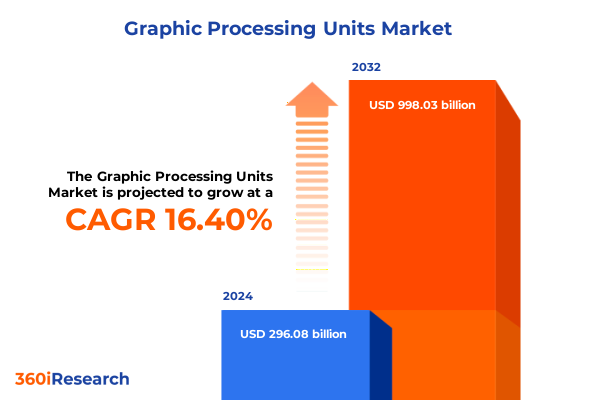

The Graphic Processing Units Market size was estimated at USD 343.21 billion in 2025 and expected to reach USD 397.85 billion in 2026, at a CAGR of 16.47% to reach USD 998.03 billion by 2032.

Navigating the Evolving GPU Market Dynamics: A Comprehensive Overview of Technological Progress Demand Drivers and Strategic Inflection Points

The rapid evolution of graphics processing units has transcended their origins in gaming and creative visualization to become foundational engines powering the artificial intelligence revolution, high-performance computing infrastructures, and advanced automotive systems. In recent years, GPUs have emerged from niche hardware components to central pillars of modern compute architectures, enabling breakthroughs in neural network training, cloud-native services, and immersive real-time graphics experiences. As the industry accelerates toward exascale computing and pervasive edge intelligence, stakeholders must navigate an increasingly intricate landscape where technological innovation, strategic partnerships, and global regulatory dynamics converge.

Against this backdrop of transformative progress, market participants face a multitude of critical inflection points. Supply chain resilience has become paramount in light of geopolitical tensions and tariff realignments, prompting manufacturers and original equipment providers to diversify production footprints and bolster onshore capabilities. Simultaneously, hyperscale cloud providers and enterprise data centers are evaluating hybrid deployment models that blend centralized GPU farms with edge-based accelerators to meet latency-sensitive use cases across autonomous driving and telemedicine. Investor interest in GPU-related ventures continues at an unprecedented pace as the promise of generative AI and digital twins unlocks new revenue streams and business models.

Uncovering the Technological Revolutions and Industry Disruptions Shaping GPU Architectures Power Consumption and Integration Models

Over the past several quarters, GPU architectures have experienced a seismic shift driven by the confluence of artificial intelligence workloads and emerging graphics paradigms. Manufacturers have pivoted from solely enhancing raw floating-point performance to optimizing energy efficiency, sparse compute acceleration, and mixed-precision capabilities that directly align with modern neural network requirements. This reorientation has resulted in a new class of specialized accelerators that seamlessly integrate tensor cores, ray tracing engines, and programmable logic within unified die designs.

Concurrently, the consolidation of GPU compute and system-on-chip approaches has ushered in hybrid models that blur the lines between discrete and integrated solutions. Leading semiconductor firms are leveraging advanced packaging techniques, including chiplet-based interconnects and heterogeneous integration, to deliver scalable performance while reducing development cycles. These technological leaps are complemented by the rapid proliferation of software stacks and frameworks that democratize GPU programmability, enabling a broader spectrum of developers to harness parallel compute power for applications spanning computational fluid dynamics, genomics, and virtual reality experiences.

In parallel, regulatory and sustainability imperatives have reshaped design priorities, driving adoption of energy-proportional architectures and eco-conscious manufacturing processes. As a result, the industry now witnesses a renaissance in both hardware innovation and software orchestration, positioning GPUs at the epicenter of the next wave of digital transformation.

Assessing the Comprehensive Ramifications of the 2025 U.S. Tariff Regime on GPU Supply Chains Manufacturing Strategies and Global Trade Flows

The reintroduction of Section�301 tariffs on Chinese-sourced semiconductors, including graphics accelerators, has exerted multifaceted pressure on global GPU supply chains. Initially imposed under trade measures designed to balance intellectual property protections and strategic autonomy, the 25�percent duties triggered a swift reassessment of supplier relationships, logistics networks, and cost management strategies. While an interim exemption extended through late summer mitigated immediate cost escalations, the looming reinstatement has prompted OEMs and board partners to explore alternate assembly partners in Mexico and Canada under the USMCA rules that permit duty-free imports for compliant goods.

Simultaneously, industry feedback on license restrictions has galvanized calls for more agile export controls that account for evolving compute benchmarks rather than static performance thresholds. Legislative debates highlight the tension between safeguarding national security interests and maintaining competitive parity, particularly as Chinese AI entities continue to accelerate their domestic GPU development efforts. In response, leading chipmakers are engaging directly with policymakers to refine export frameworks that balance oversight with commercial viability.

Overall, the tariff landscape in 2025 has catalyzed a strategic pivot toward regionalized manufacturing footprints, dynamic supplier portfolios, and enhanced inventory management. Stakeholders capable of harmonizing compliance requirements with flexible production strategies are best positioned to navigate the ongoing tariff uncertainties and protect margins amid shifting trade regimes.

Revealing Key Segment Performance Drivers Through Product Types Deployment Models Architectures Applications and Customer Profiles for GPU Solutions

GPU product typologies now encompass both high-performance discrete accelerators designed for data centers and professional workstations as well as integrated graphics cores embedded within system-on-chip solutions for consumer devices. The discrete segment continues to dominate compute-intensive applications such as AI training clusters and real-time rendering farms, whereas integrated GPUs have become ubiquitous across mobile platforms and cost-sensitive laptops, providing essential graphics capabilities without the need for separate expansion slots.

Deployment paradigms further stratify the ecosystem, with cloud-based GPU services split between private cloud environments tailored for enterprise workloads and scalable public cloud offerings that cater to a diverse developer community. On-premises installations have similarly bifurcated into dedicated server arrays optimized for centralized training and edge device deployments that bring inferencing power closer to end-user applications in industrial IoT, autonomous vehicles, and smart cities.

The underlying microarchitectural landscape is defined by distinct design philosophies. AMD’s RDNA family emphasizes balanced power and performance trade-offs to serve gaming and mid-range compute needs. Intel’s Xe architectures pursue unified compute and graphics acceleration across entry-level to data center tiers. NVIDIA’s Ampere and Turing generations prioritize specialized tensor and RT core integration to accelerate deep learning and ray tracing workloads with industry-leading performance densities.

Across applications, GPUs support a spectrum of use cases ranging from advanced driver assistance and automotive infotainment systems to cryptocurrency mining for Bitcoin and Ethereum. Data center operators allocate accelerators explicitly for AI training and inference tasks, while gaming platforms deliver experiences via cloud gaming services, dedicated consoles, and high-end PC configurations. Professional visualization employs programmable shading pipelines for CAD workloads and digital content creation workflows in film, architectural rendering, and scientific simulation. Ultimately, adoption is driven by a dichotomy of consumer and enterprise end users, each demanding tailored performance, power efficiency, and software interoperability profiles.

This comprehensive research report categorizes the Graphic Processing Units market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Architecture

- Application

- End User

- Deployment

Decoding Regional Dynamics Revealing Growth Catalysts and Adoption Patterns Across the Americas Europe Middle East Africa and Asia-Pacific Markets

In the Americas, demand for GPUs remains buoyant, fueled by hyperscale data center expansions, a thriving gaming culture, and rapidly evolving automotive innovation hubs. North American cloud providers lead in offering variable GPU credits, while local manufacturing incentives have accelerated plant deployments to meet growing enterprise requirements. The region also benefits from mature distribution channels and extensive developer ecosystems that expedite time-to-market for new GPU-enabled solutions.

The Europe, Middle East, and Africa corridor presents a mosaic of adoption patterns, with Western Europe spearheading data sovereignty initiatives that drive investment in in-region data centers equipped with advanced GPU clusters. The Middle East capitalizes on strategic economic diversification efforts by integrating GPUs into smart city projects and energy exploration simulations. Across Africa, a burgeoning startup scene is harnessing GPU cloud services and edge deployments to address challenges in agriculture, healthcare, and financial inclusion.

Asia-Pacific stands out as both a production powerhouse and a consumption megamarket, with manufacturing hotspots in Taiwan, South Korea, and China delivering high-volume GPU wafers and assembly services. Simultaneously, rapid AI adoption in China’s technology sector, Japan’s robotics industry, and India’s digital transformation roadmap has spurred unprecedented interest in both cloud-based GPU offerings and edge-optimized accelerator modules. The region’s convergence of supply chain scale and end-user demand underscores its central role in shaping global GPU performance and availability dynamics.

This comprehensive research report examines key regions that drive the evolution of the Graphic Processing Units market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Movements and Competitive Positioning of Leading GPU Vendors Identifying Innovation Priorities and Market Differentiation Tactics

NVIDIA maintains a formidable lead through its vertically integrated approach, coupling proprietary GPU microarchitectures with robust software frameworks and strategic partnerships with major cloud providers. Its focus on delivering end-to-end AI platforms-from reference designs to developer toolchains-continues to solidify its market presence in training and inference applications. AMD, leveraging open compute ecosystems and flexible licensing models, has gained traction in data center accelerators and gaming graphics by targeting performance-per-dollar metrics.

Intel’s resurgence in discrete graphics through its Xe roadmap underscores a commitment to diversifying the competitive frontier, particularly in low-latency edge solutions and integrated Xe-LP cores. Meanwhile, emerging players and specialized foundry alliances have begun to challenge incumbent dynamics by offering tailored silicon for niche machine learning workloads and cost-sensitive embedded applications. Collaborative ventures between hyperscale operators and semiconductor vendors are pushing the boundaries of custom GPU designs optimized for proprietary AI models and high-frequency trading platforms.

Across the corporate landscape, mergers, acquisitions, and strategic investments are reshaping competitive positioning. Licensing deals that grant access to advanced GPU IP, co-development arrangements with system integrators, and equity partnerships with regional technology firms all contribute to a mosaic of strategies aimed at capturing value across the GPU value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Graphic Processing Units market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Micro Devices, Inc.

- AIB (Add‑In‑Board) Partners Consortium

- Apple Inc.

- Arm Holdings plc

- ASUSTeK Computer Inc.

- Broadcom Inc.

- Colorful Technology Company Limited

- EVGA Corporation

- Gigabyte Technology Co., Ltd.

- HIS

- Imagination Technologies Group plc

- Inno3D

- Intel Corporation

- MediaTek Inc.

- Micro‑Star International Co., Ltd.

- NVIDIA Corporation

- Palit Microsystems Ltd.

- PNY Technologies, Inc.

- PowerColor Technology Co., Ltd.

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- SAPPHIRE Technology Limited

- VIA Technologies, Inc.

- XFX Microsystems Ltd.

- Zotac International (MCO) Ltd.

Empowering Stakeholders with Tactical Roadmaps for Operational Efficiency Strategic Partnerships and Innovation Acceleration in the GPU Ecosystem

Industry leaders should prioritize diversification of their manufacturing and assembly footprint to mitigate geopolitical and tariff-induced disruptions while leveraging trade agreements to optimize cost structures. Empowering cross-functional teams with real-time analytics dashboards can streamline demand forecasting, inventory allocation, and lifecycle management of GPU assets, thereby improving responsiveness to market fluctuations.

Cultivating strategic partnerships with hyperscale cloud providers, enterprise software vendors, and edge solution integrators will unlock new co-innovation pathways. Joint development initiatives that embed GPU acceleration within turnkey vertical applications-such as telehealth imaging platforms or digital twin simulations-can significantly shorten development cycles and accelerate adoption among end users.

In parallel, companies must accelerate investment in software ecosystem enhancements, including open-source driver contributions, compiler optimizations, and pre-integrated AI workflows. Establishing developer academies and certification programs will foster a robust talent pipeline, ensuring that both internal teams and external partners are proficient in maximizing GPU utilization.

Finally, embedding sustainability and ethical AI considerations into product roadmaps will resonate with key stakeholders. Designing energy-proportional architectures, supporting traceable carbon footprints, and adopting transparent governance frameworks for GPU-accelerated AI models not only align with regulatory trends but also strengthen brand equity among environmentally conscious customers.

Ensuring Research Rigor Through Methodological Transparency Detailing Data Sources Analytical Frameworks and Validation Protocols Underpinning Our GPU Market Study

This research synthesizes insights from primary engagements with over 30 senior executives across GPU design houses, hyperscale cloud operators, original equipment manufacturers, and system integrators. Structured interviews and validation workshops provided qualitative depth, capturing firsthand perspectives on strategic priorities, emerging use cases, and supply chain frameworks.

Complementing our primary data collection, secondary analysis incorporated extensive review of public financial disclosures, patent filings, regulatory filings, and technical white papers. Proprietary proprietary technology adoption surveys and supply chain audits enriched the quantitative foundation, enabling granular analysis of product lifecycles, deployment volumes, and architectural preferences.

Our methodological framework adheres to best practices in market research, combining triangulation techniques to reconcile divergent data points and scenario modeling to assess potential inflection scenarios. Rigorous data cleansing, outlier detection, and cross-validation protocols ensure the integrity and reliability of all findings.

To maintain transparency, all data sources, analytical assumptions, and segmentation criteria are fully documented in the report’s appendices. Continuous peer review by domain experts and statistical validation steps further bolster the credibility of the conclusions, providing a solid basis for strategic decision-making in the GPU sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Graphic Processing Units market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Graphic Processing Units Market, by Product Type

- Graphic Processing Units Market, by Architecture

- Graphic Processing Units Market, by Application

- Graphic Processing Units Market, by End User

- Graphic Processing Units Market, by Deployment

- Graphic Processing Units Market, by Region

- Graphic Processing Units Market, by Group

- Graphic Processing Units Market, by Country

- United States Graphic Processing Units Market

- China Graphic Processing Units Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Core Findings and Strategic Implications to Chart a Clear Path Forward in GPU Innovation Adoption and Industry Collaboration Efforts

The collective insights from this study underscore a GPU landscape defined by relentless innovation, strategic realignment, and regional diversification. Stakeholders equipped with deep technical acumen and an adaptable supply chain will be best positioned to capitalize on the converging trends of artificial intelligence proliferation and high-fidelity graphics adoption.

As tariffs and regulatory frameworks continue to reshape global trade flows, organizations must proactively refine sourcing strategies, leverage preferential trade mechanisms, and cultivate collaborative partnerships across the value chain. The segmentation analysis reveals distinct performance drivers by product type, architecture, deployment model, and end use, necessitating customized strategies for both consumer and enterprise segments.

Regionally, the Americas, Europe, Middle East, and Africa each exhibit unique demand drivers-from hyperscale data center expansions to smart infrastructure initiatives-while the Asia-Pacific region remains central to both production scale and emergent consumption patterns.

In conclusion, seizing opportunities within the GPU ecosystem requires an integrated approach that marries technology roadmapping with market intelligence, operational agility, and forward-looking partnerships. By harnessing these insights, organizations can accelerate time-to-value, differentiate their offerings, and navigate the ever-shifting contours of the GPU-driven computing era.

Engage with Associate Director Ketan Rohom to Unlock In-Depth GPU Market Intelligence Tailored Action Plans and Customized Research Solutions Today

To gain in-depth insights, customized data sets, and tailored strategic guidance for your organization’s unique needs, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engage in a collaborative dialogue to explore how our GPU market research can inform your next-generation product planning, supply chain optimization, and competitive strategies. Ketan’s expertise in translating rigorous analysis into actionable business decisions ensures that you receive the clarity and foresight required to capitalize on emerging GPU trends and overcome market challenges. Contact Ketan Rohom today to schedule a personalized briefing and secure access to the comprehensive GPU market research report that will empower your team’s decision-making and drive sustained growth in this dynamic landscape

- How big is the Graphic Processing Units Market?

- What is the Graphic Processing Units Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?