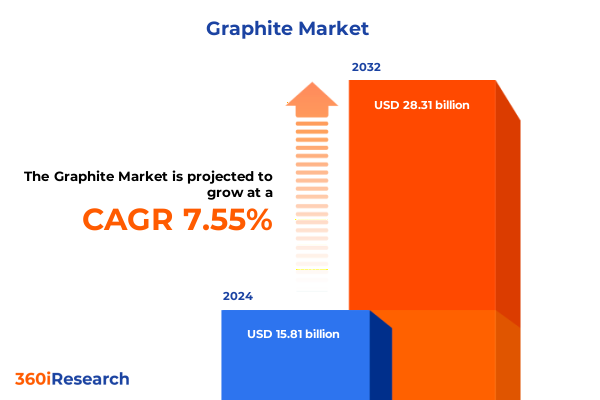

The Graphite Market size was estimated at USD 16.94 billion in 2025 and expected to reach USD 18.16 billion in 2026, at a CAGR of 7.60% to reach USD 28.31 billion by 2032.

Setting the Stage for Graphite Market Dynamics Amid Rapid Technological Advances and Emerging Geopolitical Tensions Driving Material Demand

Graphite has emerged as a foundational material in the global energy transition, powering applications from electric vehicle batteries to advanced thermal management solutions. Its unique combination of electrical conductivity, thermal resilience, and chemical stability positions it at the heart of industries striving for higher performance and sustainability. As demand intensifies, stakeholders across the supply chain are grappling with evolving procurement challenges, geopolitical risks, and the imperative to develop resilient, agile strategies.

This executive summary offers a concise yet comprehensive overview of the forces shaping the graphite landscape. It articulates the key transformative shifts driving growth, evaluates the cumulative impact of recent tariff policies in the United States, and distills insights across critical segmentation and regional dimensions. In addition, it highlights the strategic moves of leading companies, outlines actionable recommendations for industry leaders, and details the rigorous research methodology underpinning these findings. Ultimately, this document equips decision-makers with the clarity needed to navigate complexity and capitalize on emerging value pools.

Emergence of Electric Mobility Renewable Energy Adoption and Sustainability Mandates Reshaping Global Graphite Value Chains and Market Dynamics

Across the past few years, the acceleration of electrification and renewable energy adoption has fundamentally altered the demand profile for graphite. Electric vehicle manufacturers are ramping up production volumes, placing unprecedented emphasis on high-purity spherical graphite as the anode material of choice. Concurrently, grid-scale energy storage projects have expanded their footprints, creating robust demand for both natural and synthetic variants capable of meeting stringent performance and lifecycle requirements. As sustainability mandates tighten, low-carbon production techniques and closed-loop recycling initiatives are rapidly ascending to the forefront of sourcing strategies.

At the same time, supply chains are undergoing a paradigm shift driven by resilience and diversification priorities. The interplay of technological innovation, environmental regulations, and geopolitical considerations has prompted both established and new entrants to pursue strategic partnerships and invest in downstream processing capabilities. In this context, graphite is no longer a commodity traded purely on price; it has become a critical enabler of broader decarbonization objectives and competitive differentiation, compelling stakeholders to rethink traditional sourcing models and embrace collaborative ecosystems.

Escalating Trade Tariffs in the United States Catalyzing Cost Pressures Supply Diversification and Strategic Realignment across the Graphite Ecosystem

Since 2018, the imposition of heightened tariffs on graphite imports into the United States has had a cumulative impact on cost structures and trade flows. These measures initially aimed to protect domestic producers and encourage local capacity expansion; however, they inadvertently introduced volatility for end users reliant on consistent supply of high-purity and specialized graphite grades. Faced with rising landed costs, battery manufacturers and industrial consumers have accelerated efforts to diversify their supplier base, forging relationships with nontraditional sources in Africa, Latin America, and regional processing hubs across Asia-Pacific.

In response to tariff-driven pressures, market participants have adopted multifaceted strategies to mitigate risk and control expenditure. Nearshoring has gained traction as a means of securing unbroken feedstock pipelines, while long-term supply agreements and toll-processing arrangements are emerging as preferred contracting mechanisms. Furthermore, the tariff environment has underscored the importance of transparent cost pass-through practices and collaborative negotiations, ensuring that material procurements remain aligned with product roadmaps and sustainability goals. As the United States continues to calibrate its trade policies, flexibility and supply chain visibility will define competitive advantage.

Diverse Demand Drivers Highlighting Opportunities across Graphite Type Purity Form Application and End-User Industries Underscoring Strategic Imperatives

The graphite market’s complexity is underscored by its multifaceted segmentation, which spans material type, purity, form, application, and end-user industry. Natural graphite continues to dominate in cost-sensitive uses, particularly within conventional electrode and refractory markets, while synthetic graphite commands premium positions wherever ultra-high purity and precise morphological control are essential. High-purity grades exceeding 99.9 percent are now indispensable for next-generation battery anodes, whereas medium-purity ranges between 90 and 99 percent serve as versatile workhorses across lubricants and metallurgical applications. Grades below 90 percent still underpin legacy processes within steelmaking, yet their relative importance is tapering as cleaner alternatives gain traction.

Form factors further refine performance characteristics. Amorphous graphite remains the economical choice for thermal management in construction and automotive systems, while expanded graphite fulfills critical roles in flexible heat dissipation solutions. Flake graphite’s large crystallites continue to underpin electrode manufacturing in electric arc furnaces, contributing to steel and aluminium production, whereas finely milled graphite powder has become essential for specialized nuclear reactor feedstocks. This intricate web of demand drivers reflects a strategic inflection point: stakeholders must optimize across these dimensions to align material attributes with evolving performance requirements and value propositions.

This comprehensive research report categorizes the Graphite market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Purity Level

- Form

- Application

- End-User Industry

Divergent Growth Patterns in the Americas Europe Middle East Africa and Asia-Pacific Revealing Regional Strengths Challenges and Investment Opportunities

Regional nuances profoundly shape the global graphite market, with each geography charting a distinct trajectory. In the Americas, incentives for electric vehicle battery gigafactories and renewable energy storage projects have catalyzed investments in local processing capacity, placing a premium on high-purity synthetic graphite. At the same time, exploratory developments in natural graphite mining across Latin America signal a promising pipeline of resource diversification that could alleviate long-standing supply dependencies.

Conversely, the Europe, Middle East, and Africa region is leveraging strategic partnerships and regulatory frameworks to bolster resilience. The European Union’s Critical Raw Materials legislation has amplified the focus on recycling and secondary graphite sources, while investments in domestic purification facilities and circular economy programs are gaining momentum. The Middle East is exploring synergies between graphite production and hydrogen initiatives, and African portfolios are attracting global capital as Mozambique and Madagascar emerge as core natural graphite suppliers.

In Asia-Pacific, China maintains preeminence in both mining and downstream processing yet faces mounting environmental scrutiny and overcapacity challenges. Japan and South Korea are doubling down on proprietary synthetic graphite technologies tailored to next-generation battery chemistries, whereas Australia is rapidly evolving from upstream mining to integrated processing hubs that serve both domestic and export markets. India’s strategic drive to develop an indigenous graphite ecosystem reflects its broader ambitions to secure critical raw materials for burgeoning manufacturing sectors.

This comprehensive research report examines key regions that drive the evolution of the Graphite market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Graphite Producers and Innovators Forging Strategic Alliances Capacity Expansions and Technological Breakthroughs to Secure Competitive Advantage

Major players across the graphite value chain are recalibrating their strategic priorities to secure long-term competitiveness and capture emergent opportunities. Leading producers of natural graphite are forging alliances with battery manufacturers and refining specialists to deliver tailored anode-grade feedstocks, while synthetic graphite manufacturers have announced capacity expansions aligned with multi-gigawatt battery initiatives. These companies are also spearheading research into coated spherical graphite, leveraging proprietary surface treatments to enhance electrochemical performance.

Strategic partnerships and joint ventures have become the norm, bridging upstream mining operations with downstream cell manufacturing and recycling platforms. Selected firms are adopting vertical integration models to manage cost volatility and ensure consistent quality, while others are outsourcing specialized processes to tolling partners to optimize capital allocation. Across the board, there is a pronounced emphasis on sustainability credentials-ranging from reduced carbon footprints in production to traceability systems that certify responsible sourcing. These concerted efforts reflect a competitive environment where innovation, reliability, and environmental stewardship are equally critical.

This comprehensive research report delivers an in-depth overview of the principal market players in the Graphite market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ameri-Source Speciality Products, Inc.

- BTR New Material Group Co.,Ltd.

- Fangda Carbon New Material Co.,Ltd.

- Focus Graphite Inc.

- Grafitbergbau Kaisersberg GmbH

- GrafTech International Ltd.

- Graphit Kropfmühl GmbH

- Graphite Central

- Graphite India Limited

- Guangdong Kaijin New Energy Technology Co., Ltd.

- HEG Limited

- Imerys S.A.

- Merck KGaA

- Mersen Corporate Services SAS

- Nacional de Grafite

- NextSource Materials Inc.

- Nippon Kokuen Group

- Nippon Steel Chemical & Material Co., Ltd.

- Resonac Graphite Germany GmbH

- Sec Carbon, Limited

- SGL Carbon SE

- Tokai Carbon Co., Ltd

- Toyo Tanso Co., Ltd.

- Triton Minerals Limited

- Westwater Resources, Inc.

Strategic Roadmap for Industry Leaders Prioritizing Supply Chain Resilience Innovation Sustainability and Partnerships to Capitalize on Graphite Market Shifts

To navigate the rapidly evolving graphite ecosystem, industry leaders must prioritize a multifaceted strategy that balances risk mitigation with growth acceleration. First, cultivating diversified supply chains that span natural and synthetic sources will reduce exposure to geopolitical and tariff-related disruptions. Concurrently, targeted investments in high-purity synthesis and advanced coating technologies can unlock premium segments within battery and specialty industrial markets. Embracing circular economy principles-through formalized recycling programs and partnerships with end-of-life asset managers-will further reinforce sustainability objectives and secure secondary feedstocks.

Moreover, integrating digital traceability and supplier transparency tools will facilitate real-time monitoring of material provenance and cost structures. These capabilities not only streamline compliance with evolving regulatory requirements but also enhance negotiating power with upstream partners. Finally, forging collaborative R&D alliances with equipment manufacturers, research institutions, and end customers will accelerate innovation cycles and ensure that emerging material performance criteria are addressed proactively. By executing these initiatives in parallel, organizations can build resilient, future-ready supply chains and position themselves as preferred partners in the graphite value chain.

Robust Multi-Source Research Framework Combining Primary Stakeholder Engagement and Secondary Data Triangulation to Ensure Unbiased Graphite Market Intelligence

This analysis is grounded in a rigorous research methodology combining extensive secondary data collection with targeted primary stakeholder engagement. Initially, comprehensive desk research was conducted, encompassing technical white papers, patent filings, trade databases, and public regulatory disclosures. These insights were triangulated against proprietary transactional records and industry publications to ensure factual accuracy and contextual depth.

To enrich quantitative findings with real-world perspectives, in-depth interviews were carried out with more than fifty senior executives, engineers, and procurement specialists across mining, processing, manufacturing, and end-use industries. Feedback from these consultations was synthesized in expert workshops, facilitating peer review and consensus-building around critical market dynamics. Finally, a structured validation process led by senior analysts ensured consistency and objectivity, reinforcing the credibility of the qualitative interpretations and sector-specific insights contained herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Graphite market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Graphite Market, by Type

- Graphite Market, by Purity Level

- Graphite Market, by Form

- Graphite Market, by Application

- Graphite Market, by End-User Industry

- Graphite Market, by Region

- Graphite Market, by Group

- Graphite Market, by Country

- United States Graphite Market

- China Graphite Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Convergence of Technological Demand Geopolitical Dynamics and Industry Strategies Defining the Trajectory of the Global Graphite Landscape in 2025

The global graphite landscape is at an inflection point where technological imperatives, policy trajectories, and strategic investments converge. Escalating demand from electrification, energy storage, and high-performance industrial applications is testing the limits of traditional sourcing models, while geopolitical and trade considerations necessitate unprecedented levels of supply chain agility. Concurrently, segmentation across type, purity, form, application, and end-user industry underscores the market’s growing complexity and the need for differentiated strategies.

As regional dynamics evolve, with the Americas focusing on capacity localization, EMEA championing circularity, and Asia-Pacific driving innovation, companies must craft nuanced approaches that leverage their unique strengths. Leading organizations are already demonstrating the power of strategic partnerships, vertical integration, and sustainability commitments to secure competitive advantage. Ultimately, the ability to anticipate shifts, optimize resource allocation, and align with emerging regulatory frameworks will determine winners in this high-value ecosystem. This summary thus serves as a strategic compass, guiding stakeholders toward informed decisions and sustained growth amidst dynamic market conditions.

Empower Your Strategic Decisions with Exclusive Graphite Market Intelligence by Connecting Directly with Ketan Rohom to Acquire the Comprehensive Report

Engage with Ketan Rohom, Associate Director of Sales & Marketing, to secure comprehensive access to the full graphite market research report. By partnering with him, you will unlock an in-depth analysis that empowers your organization to anticipate market shifts, optimize procurement strategies, and harness emerging opportunities across type, form, purity, application, and geographic segments. Reach out to initiate a tailored briefing that outlines how these insights can drive your competitive edge in the rapidly evolving graphite ecosystem.

- How big is the Graphite Market?

- What is the Graphite Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?