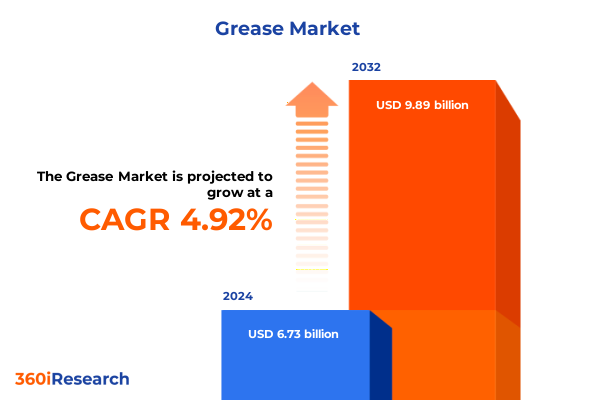

The Grease Market size was estimated at USD 6.66 billion in 2025 and expected to reach USD 6.98 billion in 2026, at a CAGR of 4.85% to reach USD 9.29 billion by 2032.

Exploring the Multifaceted Landscape of Grease Technologies Delivering Enhanced Performance Across Diverse Industrial and Automotive Sectors

In today’s industrial and automotive landscapes, grease serves as a critical enabler of operational efficiency and equipment longevity. As machinery complexity rises and operating conditions become ever more demanding, the selection and application of grease formulations have grown from a routine maintenance task into a strategic imperative. This executive summary begins with a panoramic overview of grease technologies, underscoring their foundational role across sectors ranging from manufacturing plants to marine shipyards. By setting the stage for an informed exploration of market dynamics, this introduction highlights the interplay between product innovation, supply chain intricacies, and end-user requirements that collectively shape the competitive environment.

Moreover, ongoing shifts in regulatory standards, coupled with heightened expectations for sustainability, are driving manufacturers to refine their formulations beyond traditional performance metrics. The market’s trajectory is therefore being redefined by factors such as bio-based base oils, advanced thickening systems, and smart lubrication solutions enabled by digital monitoring. This synthesis primes the reader to appreciate the strategic significance of emerging trends, providing a coherent foundation for the deeper analyses that follow.

Unraveling the Transformational Shifts Reshaping the Grease Market with Technological Innovations Regulatory Changes and Sustainability Demands

As the grease sector evolves, it is undergoing transformative shifts that extend well beyond incremental product improvements. Foremost among these is the integration of digital lubrication management platforms, which provide real-time condition monitoring and predictive maintenance capabilities. These systems harness sensor data to optimize lubrication intervals, reduce unplanned downtime, and extend equipment life. At the same time, advances in additive chemistry are yielding greases with tailored rheological properties, enabling formulators to meet the specific thermal stability, load-carrying capacity, and water-washout resistance demanded by modern applications.

Concurrently, the regulatory and sustainability landscape is exerting profound influence on raw material selection and manufacturing processes. Stricter emissions targets and environmental directives have catalyzed adoption of bio-based oils and non-soap thickeners that reduce ecological impact without compromising performance. Moreover, geopolitical events and trade policies are reshaping supply chains, compelling stakeholders to pursue diversified sourcing strategies and near-shoring initiatives. As a result, the grease market is being redefined by a convergence of technological innovation, environmental stewardship, and adaptive supply chain management.

Assessing the Cumulative Impact of Recent United States Tariff Implementations on Grease Raw Materials and Supply Chain Dynamics in 2025

The United States’ tariff measures introduced in early 2025 have imposed additional duties on several key grease raw materials, including aluminum and barium soap intermediates, lithium hydroxides, and select synthetic oil precursors. These levies have triggered notable ripple effects throughout the supply chain, elevating input costs and introducing volatility into procurement schedules. As importers contend with higher landed expenses, they have responded by renegotiating contracts, consolidating shipments to achieve economies of scale, and exploring alternative suppliers in tariff-free jurisdictions.

Meanwhile, domestic producers have leveraged the opportunity to expand their market share by ramping up local capacity and forging joint ventures with raw material innovators. However, these strategies face logistical hurdles, particularly for operations located far from primary production hubs. In response, some stakeholders are experimenting with toll-manufacturing arrangements and inventory buffering techniques to mitigate tariff-induced disruptions. Consequently, the net effect of the 2025 tariff environment underscores the critical importance of agile supply chain orchestration and forward-looking risk management in maintaining competitive advantage.

Deriving Actionable Product Base Oil Thickener Packaging and Channel Segmentation Insights to Optimize Market Positioning and Growth Trajectories

Insight generation from product, base oil, thickener, packaging, channel, and application segmentation reveals nuanced pathways for differentiation. Variations in product type-from aluminum complex grease known for its mechanical stability to polyurea grease prized in electric vehicle bearings-dictate specific performance attributes and market receptivity. Similarly, base oil choice plays a pivotal role in formulation value propositions. While mineral oils remain the cornerstone for cost-effective solutions, synthetic oils such as polyalphaolefins and esters elevate high-temperature performance and oxidative stability, whereas bio-based oils cater to environmentally conscious end users.

Distinct thickener classes further refine performance profiles, with metallic soap thickeners offering a proven balance of consistency and load capacity, and inorganic thickeners pushing temperature limits beyond traditional thresholds. Packaging type influences procurement and usage patterns, as drums serve large-scale industrial clients, cartridges address maintenance convenience, and pails and cans enable flexible deployment in mid-sized operations. The interplay between offline and online distribution channels reflects broader purchasing trends, with digital procurement platforms gaining traction among sophisticated buyers. Finally, application segmentation highlights the centrality of automotive maintenance-encompassing both passenger and commercial vehicles-while construction, mining, electrical, food processing, marine, and oil & gas sectors each demand tailored lubrication strategies that align with operational imperatives.

This comprehensive research report categorizes the Grease market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Consistency Grade

- Food & Incidental-Contact Grade

- Base Oil

- Thickener Type

- Packaging Type

- Application

- Distribution Channel

Unveiling Distinct Regional Performance Patterns Across the Americas Europe Middle East Africa and Asia Pacific in the Grease Market Landscape

Regional performance diverges notably across the Americas, Europe Middle East Africa, and Asia Pacific, shaped by distinct economic drivers and regulatory frameworks. In the Americas, the convergence of mature automotive markets with robust industrial bases underpins steady demand for established grease formulations, while growing infrastructure projects in Latin America are stimulating consumption of heavy-duty variants. In contrast, Europe, the Middle East, and Africa present a tapestry of advanced manufacturing hubs, stringent environmental regulations, and oil & gas production centers, each demanding specialized grease solutions that balance performance with compliance and cost.

Meanwhile, the Asia Pacific region is experiencing rapid industrialization and a surging appetite for electric mobility, which is fostering demand for high-performance synthetic and polyurea greases. Governments across Asia are also incentivizing sustainable practices, accelerating the uptake of bio-based base oils and non-soap thickeners. These regional nuances underscore the imperative for grease manufacturers to tailor their portfolios, distribution strategies, and R&D investments in accordance with local market dynamics and policy landscapes.

This comprehensive research report examines key regions that drive the evolution of the Grease market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Grease Manufacturers and Innovators Shaping Competitive Strategies Technological Advancements and Market Collaborations

The competitive battleground in grease manufacturing features established global majors and agile specialty producers vying for differentiation through technological prowess and strategic partnerships. Leading players have intensified R&D efforts to formulate greases capable of withstanding higher temperatures, greater loads, and extended service intervals, while also minimizing environmental footprints. Collaborations with additive innovators and base oil suppliers have yielded co-developed products that accelerate time-to-market and address emerging end-user pain points.

In parallel, consolidation through mergers and acquisitions has reshaped the competitive landscape, as companies seek to augment their product portfolios and expand geographic reach. Partnerships with original equipment manufacturers have emerged as a vital channel for co-innovating customized greases tailored to specific machinery platforms. These strategic maneuvers, combined with investments in digital lubrication services and predictive maintenance platforms, are enabling market leaders to differentiate on the basis of total cost of ownership rather than price alone.

This comprehensive research report delivers an in-depth overview of the principal market players in the Grease market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Shell PLC

- Exxon Mobil Corporation

- BP PLC

- Chevron Corporation

- TotalEnergies SE

- FUCHS SE

- Kluber Lubrication by Freudenberg SE

- ENEOS Corporation

- Idemitsu Kosan Co., Ltd.

- Valvoline Inc. by Saudi Arabian Oil Co.

- Phillips 66 Company

- Indian Oil Corporation Limited

- Axel Christiernsson International AB

- Calumet, Inc.

- CARL BECHEM GMBH

- AB SKF

- Eni SpA

- Lanxess AG

- China Petrochemical & Chemical Corporation

- The Lubrizol Corporation

- 3M Company

- CHS Inc.

- CITGO Petroleum Corporation

- DuPont de Nemours, Inc.

- Gazpromneft - Lubricants Ltd.

- Gulf Oil International Ltd.

- Harrison Manufacturing Co. Pty Ltd.

- Hexol Lubricants

- Honeywell International Inc.

- Kodiak LLC

- Lubri-Lab Inc.

- Marathon Petroleum Corporation

- Metalube Group Ltd

- Neste Oyj

- Orlen S.A.

- Penrite Oil Co Pty Ltd

- Petromin Corporation

- PETRONAS Lubricants International

- Quaker Chemical Corporation

- Sasol Limited

- The PJSC Lukoil Oil Company

Implementing Strategic Initiatives for Enhanced Lubrication Performance Supply Chain Resilience and Sustainable Growth in the Grease Sector

Industry leaders should prioritize investment in sustainable formulations by deepening partnerships with bio-base producers and exploring next-generation non-soap thickening systems. Such initiatives will not only address tightening environmental regulations but also resonate with end users seeking to enhance corporate sustainability profiles. Simultaneously, bolstering supply chain resilience through multi-source agreements and inventory optimization models will minimize exposure to tariff volatility and logistics disruptions.

Moreover, organizations must embrace digitalization of lubrication management by integrating sensor-enabled greases and data analytics platforms into maintenance workflows. This will facilitate predictive scheduling and real-time performance feedback, effectively reducing unplanned downtime and maintenance costs. To maximize value capture, it is advisable to tailor go-to-market approaches by aligning packaging formats and distribution channels with customer preferences. Finally, fostering continuous technical training programs for technicians and end users will ensure optimal grease application, further solidifying brand reputation and customer loyalty.

Detailing Robust Research Methodology Approaches and Analytical Frameworks Employed to Ensure Rigor Reliability and Comprehensive Market Insights

The research underpinning this analysis integrates both secondary and primary methodologies to ensure comprehensive and balanced insights. Initial data collection encompassed a wide array of industry publications, regulatory filings, patent databases, and corporate disclosures to map the competitive landscape and regulatory environment. Segmentation frameworks were validated through cross-referencing with trade association reports and technical standards documents.

Primary research involved structured interviews with material scientists, R&D executives, procurement specialists, and end-user maintenance leaders across key regions. These qualitative inputs were triangulated with quantitative shipment and production data to detect emerging consumption patterns and performance benchmarks. Analytical techniques such as SWOT, PESTEL, and Porter’s Five Forces were employed to assess strategic imperatives, while scenario analysis provided contextual depth on tariff impacts and sustainability trajectories. Together, these approaches deliver a rigorous, multi-dimensional understanding of the grease market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Grease market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Grease Market, by Product Type

- Grease Market, by Consistency Grade

- Grease Market, by Food & Incidental-Contact Grade

- Grease Market, by Base Oil

- Grease Market, by Thickener Type

- Grease Market, by Packaging Type

- Grease Market, by Application

- Grease Market, by Distribution Channel

- Grease Market, by Region

- Grease Market, by Group

- Grease Market, by Country

- United States Grease Market

- China Grease Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1749 ]

Drawing Conclusive Perspectives on Market Dynamics Technological Trends and Strategic Imperatives to Guide Stakeholder Decision Making

In summary, the grease market is at a pivotal juncture characterized by rapid innovation, shifting regulatory mandates, and evolving customer expectations. Advanced formulations and digital lubrication solutions are redefining performance benchmarks, while sustainability drivers are prompting a reevaluation of raw material sourcing and product lifecycles. Concurrently, tariff dynamics and regional policy differences are reshaping competitive positioning and supply chain architectures.

Going forward, stakeholders that can seamlessly integrate technological advancements with strategic supply chain resilience, and align their offerings to localized demand profiles, will secure durable competitive advantage. Embracing a proactive stance toward sustainability and digital transformation will not only satisfy regulatory requirements but also unlock new value streams. Ultimately, informed decision-making grounded in rigorous research and collaborative innovation will chart the course for sustained leadership in the evolving grease landscape.

Connect with Ketan Rohom Associate Director Sales Marketing to Secure Your Exclusive Access to Comprehensive Grease Market Research Insights Today

Engaging with Ketan Rohom, Associate Director of Sales & Marketing, will unlock tailored guidance in navigating the complexities of grease market dynamics and aligning procurement strategies with organizational goals. Institutions seeking to bolster lubrication performance, reduce total cost of ownership, and adhere to evolving sustainability mandates can benefit from a direct consultation that addresses specific use cases, regulatory compliance challenges, and technical requirements. By partnering with Ketan Rohom, decision-makers gain prioritized access to in-depth technical briefings, customized data visualizations, and strategic roadmaps that translate market intelligence into actionable plans. This collaborative engagement fosters confidence in procurement cycles and accelerates time-to-value, ensuring that investments in grease solutions deliver optimal performance and resilience. To secure comprehensive insights and hands-on support, reach out to Ketan Rohom today and position your organization at the forefront of grease innovation and market leadership.

- How big is the Grease Market?

- What is the Grease Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?