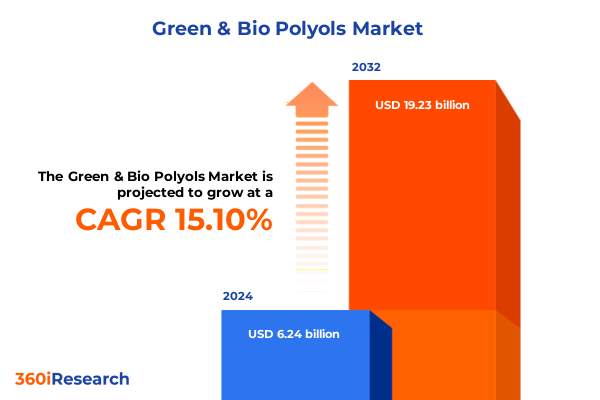

The Green & Bio Polyols Market size was estimated at USD 7.14 billion in 2025 and expected to reach USD 8.18 billion in 2026, at a CAGR of 15.18% to reach USD 19.23 billion by 2032.

Establishing the Foundational Context and Core Motives Driving Sustainable Innovation within the Rapidly Evolving Green and Bio Polyols Sector

The evolution of sustainable materials has ushered in unprecedented interest in green and bio-based polyols as foundational components of tomorrow’s value chains. As industries globally pursue ambitious carbon-neutral targets, the shift away from conventional petrochemical-derived polyols toward renewable feedstocks underscores a broader commitment to environmental stewardship. This movement is driven by increasingly stringent regulations aimed at reducing greenhouse gas emissions and by heightened consumer awareness around the lifecycle impacts of everyday products.

Transitioning to bio-based alternatives aligns with broader strategies addressing resource scarcity and circularity. Key decision-makers recognize that polyols sourced from natural materials-including vegetable oils, sugar derivatives, and cashew nut shells-offer the potential to maintain performance parity while dramatically lowering the embodied carbon footprint of final formulations. This introductory perspective establishes the foundational context and underlines the core motives shaping investment and innovation in the rapidly evolving green and bio polyols sector.

Unraveling the Transformative Technological, Regulatory, and Demand-Driven Shifts Reshaping the Global Landscape of Green and Bio Polyols

Recent years have witnessed transformative technological breakthroughs that have redefined how green and bio polyols are sourced, synthesized, and tailored to end-use requirements. Enzymatic processes have emerged as an eco-efficient route for converting complex natural polymers into high-purity polyols, while glycolysis and oligomerization technologies have unlocked new molecular architectures that enhance functionality. These advancements are reinforced by digitalization within chemical manufacturing, which streamlines process monitoring, reduces waste, and accelerates scale-up efforts.

Concurrently, regulatory frameworks-anchored by global initiatives such as the European Green Deal and evolving U.S. environmental mandates-have intensified the demand for low-VOC, non-toxic material alternatives. This convergence of policy drivers and consumer expectations has propelled industry veterans and disruptors alike to prioritize R&D investment, forging a new paradigm that balances performance, price, and planetary health.

Assessing the Cumulative Economic and Strategic Implications of United States 2025 Tariffs on the Green and Bio Polyols Supply Chain

The imposition of additional U.S. tariffs on a range of imported chemical intermediates and finished polyol products in early 2025 has had a cumulative effect on the green and bio polyols supply chain. Input costs for manufacturers reliant on overseas feedstocks have risen, triggering margin compression and compelling stakeholders to reassess sourcing strategies. These trade policy shifts have underscored vulnerabilities within lean, globalized production networks, driving renewed interest in localized capacity and near-shoring initiatives.

As a strategic response, several leading producers have accelerated capital expenditure on domestic biorefinery expansions to mitigate tariff exposure. Partnerships between polyol innovators and regional feedstock suppliers have proliferated, reflecting a broader push toward vertical integration. While short-term disruptions manifested in sporadic lead-time extensions and price adjustments, these measures have also catalyzed structural realignments, laying the groundwork for more resilient and diversified supply networks moving forward.

Deriving Actionable Insights from Multifaceted Segmentation Spanning Applications, Product Types, End Use Industries, Functionalities, Forms, and Technologies

Insightful segmentation analysis reveals nuanced growth trajectories across multiple dimensions of the green and bio polyols market. From an application standpoint, the automotive sector is leveraging bio-based polyols to meet stringent lightweighting and safety requirements, while coatings and adhesives demand specialized formulations for superior adhesion and environmental compliance. Footwear producers are increasingly incorporating renewable foam components to enhance comfort and sustainability profiles. Furniture and bedding manufacturers value flexible and rigid foam solutions for improved durability, and packaging innovators employ bio-based polyols to develop more compostable or recyclable cushioning materials.

Examining product type dynamics uncovers distinct adoption patterns: bio-based polyester polyols dominate applications requiring enhanced thermal stability, whereas bio-based polyether polyols deliver superior flexibility for cushioning applications. Cashew nut shell liquid and sucrose-based polyols cater to niche formulations where natural aromaticity or crystallinity is beneficial. Vegetable oil concentrations offer cost-effective reactivity profiles across a broad spectrum of use cases. End use industry segmentation highlights that construction-spanning commercial, industrial, and residential projects-continues to drive demand, with formulation specialists tailoring viscosity and cure rates to project-specific performance criteria. Additionally, functionality tiers differentiate performance, as di functional variants balance cost and performance, multi functional grades deliver enhanced crosslink density, and tri functional offerings optimize mechanical strength. Form preferences vary according to processing methods, with liquid polyols favored for blend uniformity and solid variants chosen for preformed block applications. Underpinning these segments, enzymatic, glycolysis, and oligomerization technologies each contribute unique value propositions, from energy-efficient synthesis to highly controlled molecular weights, guiding formulators in selecting optimal pathways aligned with sustainability goals and performance requirements.

This comprehensive research report categorizes the Green & Bio Polyols market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Functionality

- Form

- Technology

- Application

- End Use Industry

Exploring the Divergent Regional Dynamics Influencing Adoption, Investment, and Innovation across Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional analysis highlights distinct market drivers and adoption patterns across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. In the Americas, the robust regulatory environment in North America and the strategic reshoring of advanced manufacturing capacities have fueled the continued uptake of green and bio polyols. Brand owners in South America are also intensifying sustainability commitments, creating new partnership opportunities with local feedstock producers.

Meanwhile, in Europe Middle East & Africa, regulatory frameworks under REACH and the EU Green Deal have compelled formulators to accelerate the integration of renewable polyols into end products, with the Middle East’s expanding oleochemical infrastructure further diversifying feedstock sources. Africa remains a frontier for future growth, as emerging economies explore policy incentives to attract investment. In Asia-Pacific, leading economies continue to scale production volumes, supported by government subsidies and favorable land resources for biofeedstock cultivation. India’s construction and automotive sectors are especially dynamic, while Southeast Asia is innovating in packaging solutions to align with global circularity targets.

This comprehensive research report examines key regions that drive the evolution of the Green & Bio Polyols market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Competitive Postures of Leading Industry Players Accelerating Growth and Differentiation in the Green and Bio Polyols Domain

Key industry players are refining their competitive strategies to capture value in the green and bio polyols arena. Leading chemical producers have announced joint ventures and strategic collaborations to secure sustainable feedstock supplies and expand biorefinery footprints. They are simultaneously investing in next-generation technology platforms, including enzymatic catalysis and advanced reactor designs, to enhance unit economics and broaden their polyol portfolios.

Simultaneously, specialty chemical firms are differentiating through customer-centric innovation, leveraging proprietary technologies to deliver tailored formulations with performance advantages across specific applications. These companies are also engaging in proactive stakeholder dialogues, working alongside regulatory agencies, end users, and academia to establish industry-wide standards that facilitate faster adoption of renewable polyols. Collectively, these strategic postures are reinforcing the competitive landscape and accelerating the transition toward more sustainable material ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Green & Bio Polyols market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- BASF SE

- Bayer AG

- BioBased Technologies LLC

- Cargill, Incorporated

- Covestro AG

- Emery Oleochemicals Group

- Global Bio-chem Technology Group Company Limited

- Huntsman International LLC

- Jayant Agro-Organics Limited

- Mitsui Chemicals, Inc.

- NatureWorks LLC

- Novomer Inc.

- Perstorp Holding AB

- PolyLabs SIA

- Roquette Frères S.A.

- Stepan Company

- The Dow Chemical Company

Formulating Targeted Recommendations to Empower Industry Leaders in Navigating Evolving Market Dynamics and Capitalizing on Emerging Opportunities

To navigate the complex market dynamics and capitalize on growth pockets, industry leaders should prioritize integrated feedstock strategies that balance cost, quality, and sustainability credentials. Investing in flexible manufacturing platforms capable of handling diverse bio-based intermediates will provide agility in responding to shifting raw material availabilities and regulatory landscapes. Furthermore, deepening collaboration with end users through co-development initiatives can yield bespoke polyol solutions that address evolving performance and environmental demands.

Leaders are also advised to strengthen digital and data-driven decision-making capabilities, deploying analytics to optimize supply chain planning and reduce carbon footprints. Engaging proactively with policymakers and industry consortia will enable organizations to anticipate regulatory shifts and influence the development of practical sustainability standards. Through these concerted actions, companies can fortify market positions and drive meaningful progress toward circularity.

Detailing the Rigorous Mixed-Method Approach and Analytical Framework Underpinning the Comprehensive Evaluation of the Green and Bio Polyols Market

This research leverages a rigorous mixed-method approach to deliver a holistic perspective on the green and bio polyols market. Initial desk research encompassed analysis of public filings, patent landscapes, and technical literature to map technological trajectories and identify key innovations. This was complemented by primary interviews with stakeholders across the value chain, including raw material suppliers, formulation experts, OEM partners, and regulatory authorities, to validate hypotheses and uncover nuanced market realities.

Quantitative insights were triangulated with qualitative feedback through iterative expert panel reviews, ensuring consistency and depth. Advanced analytics techniques were applied to synthesize patterns in technology adoption, regional uptake, and supply chain resilience. Finally, all findings were subjected to a multi-tier quality assurance process, encompassing peer review and methodological audits, to ensure robustness and objectivity throughout the evaluation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Green & Bio Polyols market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Green & Bio Polyols Market, by Product Type

- Green & Bio Polyols Market, by Functionality

- Green & Bio Polyols Market, by Form

- Green & Bio Polyols Market, by Technology

- Green & Bio Polyols Market, by Application

- Green & Bio Polyols Market, by End Use Industry

- Green & Bio Polyols Market, by Region

- Green & Bio Polyols Market, by Group

- Green & Bio Polyols Market, by Country

- United States Green & Bio Polyols Market

- China Green & Bio Polyols Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Core Themes and Forward-Looking Perspectives That Underscore the Transformative Trajectory of the Green and Bio Polyols Ecosystem

The green and bio polyols ecosystem stands at a pivotal juncture, driven by regulatory acceleration, evolving consumer ethics, and continuous technological breakthroughs. Stakeholders are increasingly aligning on shared objectives of minimizing environmental impact while unlocking advanced material performance. This synthesis of core themes underscores the sector’s transformative momentum and the collaborative spirit guiding its evolution.

Looking ahead, the interplay between innovative production methodologies, strategic regional investments, and policy incentives will shape the trajectory of bio-based polyol adoption. Organizations that proactively integrate sustainability into their operational blueprints and foster cross-sector partnerships will be best positioned to harness the full potential of this burgeoning market.

Engage Directly with Ketan Rohom to Secure Advanced Strategic Intelligence and Tailored Insights from the Premier Green and Bio Polyols Market Research Report

We invite you to engage directly with Ketan Rohom, the Associate Director of Sales & Marketing, to unlock comprehensive strategic insights and actionable intelligence crafted specifically for your organizational needs. Through a personalized consultation, you will gain exclusive clarity on emerging supply chain dynamics, breakthroughs in bio-based feedstocks, and tailored pathways to secure competitive advantage in the green and bio polyols arena.

Contacting Ketan today will connect you to an unparalleled repository of market intelligence and bespoke support designed to accelerate your decision-making process. Reach out now to secure priority access and cultivate a deeper understanding of how sustainability-driven transformation can be leveraged to foster resilient growth and innovation within your enterprise.

- How big is the Green & Bio Polyols Market?

- What is the Green & Bio Polyols Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?