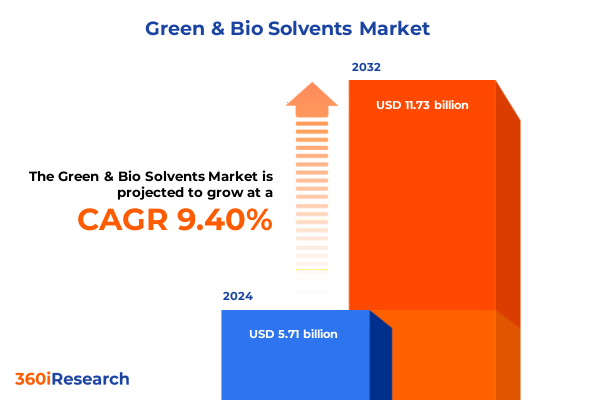

The Green & Bio Solvents Market size was estimated at USD 6.21 billion in 2025 and expected to reach USD 6.76 billion in 2026, at a CAGR of 9.49% to reach USD 11.73 billion by 2032.

Emerging Green and Bio Solvents Landscape Converging Sustainability Innovation and Regulatory Momentum Redefining Chemical Manufacturing

The pursuit of sustainable alternatives to conventional petrochemical solvents has accelerated investments and innovation across industries seeking to reduce environmental impact while maintaining performance. Green and bio solvents encompass a broad array of chemical compounds derived from renewable feedstocks, offering a pathway to decarbonize manufacturing, enhance lifecycle profiles, and meet tightening regulations. This shift has been propelled by the convergence of climate policy incentives and consumer demand for greener products, creating an intersection where chemistry and ecology harmonize to address global sustainability challenges.

In recent years, capital expenditures in biobased technologies and pilot-scale demonstration plants have risen sharply, underscoring the industry’s commitment to scaling renewable routes. Collaborative research efforts between academic institutions and private players have delivered breakthroughs in enzymatic and fermentation processes, enabling the cost-effective conversion of biomass into high-purity solvents. These scientific strides have, in turn, catalyzed strategic partnerships that bridge supply chain gaps and de-risk the pathway from development to commercialization.

Given the complexity of solvent applications-from fine chemical synthesis to large-scale cleaning and degreasing-this report provides an executive overview of the market’s transformative drivers, emerging technologies, and regulatory landscape. Through a lens that balances both technical rigor and market pragmatism, our analysis lays the groundwork for understanding how green and bio solvents are redefining the future of industrial chemistry.

Breakthrough Sustainable Technologies and Circular Approaches Driving a Fundamental Paradigm Shift in the Solvents Industry

The landscape of green and bio solvents is undergoing a fundamental transformation as novel production methods and circular economy principles gain traction across the value chain. Traditional petrochemical routes are increasingly supplemented by enzymatic synthesis platforms that leverage engineered enzymes for high-selectivity conversion of biomass feedstocks into functional solvent molecules. Similarly, supercritical carbon dioxide extraction has emerged as a clean alternative for recovering target compounds, eliminating the need for hazardous volatile organic solvents and minimizing post-process purification steps.

Alongside these technological evolutions, business models are shifting toward closed-loop systems that integrate solvent recovery and reuse, reducing process waste and improving overall resource efficiency. This approach aligns with the rising authority of environmental, social, and governance (ESG) criteria, prompting organizations to quantify and report the downstream impact of their solvent choices. Digital solutions, such as advanced process monitoring and blockchain-based traceability, further support transparent supply chains and accelerate compliance with emerging global standards.

Ultimately, these convergent shifts are redefining how companies approach solvent selection and procurement. Rather than treating sustainability as a standalone goal, forward-thinking enterprises are embedding green solvent strategies into core R&D and manufacturing roadmaps. This integration allows them to unlock new growth corridors, differentiate products on eco-performance, and build resilience against coming regulatory headwinds.

Complex Web of Carbon-Intensity Tariffs and Import Duties Reshaping the Cost Structure and Supply Chains of U.S. Green and Bio Solvents Market

A wave of U.S. trade measures introduced in 2025 is reshaping the economics of green and bio solvents, creating both headwinds and opportunities. The reintroduction of the Foreign Pollution Fee Act imposes a tiered ad valorem charge on imports whose carbon intensity exceeds U.S. benchmarks, applying escalating fees based on relative emissions levels. This policy aims to protect domestic low-carbon producers but also raises input costs for companies reliant on specialized European solvents and emerging bio-based reagents.

Meanwhile, biofuel and bio-feedstock imports from Canada face 25 percent duties, a measure that has already contributed to depressed canola prices and constrained processor margins in the renewable diesel and biodiesel sectors. Stakeholders report that volatility in feedstock costs is compelling some plant operators to temporarily idle production lines as they reassess supply chain strategies.

Chemical industry sources indicate that duties ranging from 10 to 25 percent on certain European solvent imports will drive up raw material costs substantially. Freight surcharges for key intermediates like monoethylene glycol and ethanol are expected to climb by 170–228 percent, while underlying reagent prices could surge by one-third, eroding narrow processing margins and prompting a search for alternative suppliers. As a result, companies are reevaluating global sourcing models and accelerating investments in domestic production capacity to mitigate tariff exposure.

Multidimensional Market Segmentation Revealing Distinct Patterns across Product Types Applications End-Use Industries Technologies and Distribution Channels

The market for green and bio solvents can be dissected through multiple lenses, revealing nuanced growth patterns across diverse segments. Alcohol solvents, known for their broad compatibility and favorable volatility profiles, remain pivotal for applications such as adhesives and sealants, cleaning and degreasing, and fine chemical synthesis, fueling innovation in automotive and consumer goods formulations. Ester solvents, prized for their solvency power and low toxicity, are gaining prominence in coatings and paints, as well as pharmaceutical and personal care products, where purity and performance are paramount.

Glycol solvents demonstrate versatility in textile processing and industrial cleaning, bridging functionality between traditional VOC-based solvents and newer biobased alternatives. Ketone solvents, although used in smaller volumes, command attention for specialty applications requiring high solvency and rapid evaporation rates. When viewed through the end-use industry prism, industrial manufacturing and oil and gas sectors drive substantial volume demand, while the pharmaceuticals industry prioritizes high-grade bio-solvents to meet stringent regulatory standards.

On the technology front, chemical synthesis remains the dominant route for cost-effective large-scale production, yet enzymatic synthesis and fermentation routes are carving out niche applications with improved sustainability metrics. Supercritical carbon dioxide extraction is also carving a space in natural product isolation. Distribution channels vary: direct sales cater to large-scale end users with custom specifications, industrial distribution networks support mid-tier processors, and online platforms are emerging as efficient conduits for smaller specialty solvent purchases.

This comprehensive research report categorizes the Green & Bio Solvents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source Technology

- Application

- End Use Industry

- Distribution Channel

Distinct Regional Policy Incentives and Market Dynamics Shaping the Adoption of Green and Bio Solvents across Americas EMEA and Asia-Pacific

Regional market dynamics highlight how localized drivers and policy frameworks shape the adoption of green and bio solvents. In the Americas, federal incentives such as the Inflation Reduction Act and state-level renewable fuel standards are fostering domestic production of bio-derived solvents and feedstocks. North American manufacturers leverage abundant agricultural residues and corn-based ethanol streams to develop sustainable alternatives, although recent tariffs on Canadian bio-feedstocks have introduced short-term supply disruptions.

Europe, the Middle East and Africa are navigating a complex regulatory matrix anchored by the European Green Deal and REACH updates, which set ambitious targets for VOC reduction and chemical safety. Local producers within the European market are accelerating investments in enzymatic and supercritical extraction technologies to comply with tightening emissions standards. Emerging markets in the Middle East are beginning to explore large-scale bio-refinery concepts, leveraging low-cost energy to pilot green solvent routes.

Asia-Pacific is characterized by rapid industrial growth and fierce cost competition, driving demand for scalable bio-based solvents that can meet price targets without sacrificing performance. Key players in China, India and Southeast Asia are expanding fermentation and chemical synthesis facilities, often through public-private partnerships that support feedstock diversification. However, inconsistent regulatory frameworks and infrastructure constraints continue to challenge the region’s full potential.

This comprehensive research report examines key regions that drive the evolution of the Green & Bio Solvents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Solvent Manufacturers Forge Alliances Acquisitions and Tech Partnerships to Solidify Leadership in Sustainable Chemical Solutions

Key industry participants are deploying a range of strategies to consolidate their positions and capture emerging opportunities in green and bio solvents. Leading multinational chemical companies are forming joint ventures with biotechnology startups to secure access to proprietary enzymes and fermentation platforms, thereby de-risking R&D and accelerating time-to-market. Concurrently, traditional solvent manufacturers are investing in retrofitting existing petrochemical plants with bio-based feedstock capabilities, enabling a smoother transition toward hybrid production models.

Strategic acquisitions have played a central role in bolstering portfolios, with recent deals focusing on small-scale innovators that specialize in supercritical CO₂ extraction and enzymatic catalysis. Companies are also forging alliances with end-use OEMs to co-develop customized formulations that address specific performance and regulatory requirements in sectors such as automotive coatings and pharmaceutical cleaning fluids. This collaborative approach enhances product differentiation and deepens customer integration.

Moreover, several players are scaling up carbon capture and utilization initiatives to integrate captured CO₂ streams as feedstocks in solvent production, exemplifying a closed-loop ethos. Investments in digital process optimization-including real-time solvent recovery analytics and predictive maintenance-are further improving cost efficiency and minimizing environmental footprints.

This comprehensive research report delivers an in-depth overview of the principal market players in the Green & Bio Solvents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- Arkema Group

- BASF SE

- BioAmber Inc.

- Braskem S.A.

- Cargill, Incorporated

- Corbion N.V.

- Cremer Oleo GmbH & Co. KG

- Dow Inc.

- E.I. du Pont de Nemours and Company

- Eastman Chemical Company

- Emery Oleochemicals

- Evonik Industries AG

- Florachem Corporation

- Florida Chemical Company, Inc.

- Galactic S.A.

- Genomatica, Inc.

- Gevo, Inc.

- Green Biologics, Inc.

- Huntsman Corporation

- Innospec Inc.

- LyondellBasell Industries Holdings B.V.

- Myriant Corporation

- Solvay S.A.

- Vertec BioSolvents, Inc.

Strategic Recommendations for Industry Leaders to Enhance Feedstock Agility Strengthen Collaborations and Build Resilient Green Solvents Supply Chains

Industry leaders aiming to thrive in the evolving green and bio solvents space should pursue targeted investments in feedstock flexibility and technology diversification. Prioritizing modular reactor designs that can seamlessly switch between conventional and biobased inputs will enhance resilience against tariff fluctuations and feedstock scarcity. In parallel, allocating R&D budgets to enzyme engineering and fermentation optimization can unlock proprietary advantages and reduce reliance on external licensors.

Deepening partnerships with agricultural suppliers and waste-stream aggregators can secure stable supply chains for lignocellulosic biomass and other renewable feedstocks. At the same time, collaborating with regulatory bodies to shape practical compliance frameworks will streamline product approvals and shorten time-to-market. Companies should also explore digital traceability platforms that integrate blockchain-enabled provenance tracking, fostering trust with environmentally conscious end users.

To mitigate geopolitical and trade uncertainties, establishing regional manufacturing hubs aligned with local incentives-such as the IRA in North America or REACH-compliant zones in Europe-will optimize cost structures and provide buffer against import duties. Embracing circular economy principles through solvent recovery and recycling programs will further reduce operational costs and enhance brand credibility with sustainability-focused stakeholders.

Comprehensive Research Methodology Integrating Primary Expert Interviews Secondary Literature Review and Data Triangulation for Unbiased Market Insights

This report synthesizes both primary and secondary data sources to deliver a rigorous analysis of the green and bio solvents market. Primary research involved in-depth interviews with R&D heads, procurement directors, and supply chain managers across leading chemical manufacturers and end-use industries. These conversations provided firsthand insights into technology adoption barriers, regulatory compliance strategies, and capital investment priorities.

Secondary research encompassed a comprehensive review of peer-reviewed journals, patent filings, government policy documents, and technical white papers to identify emerging production methods and lifecycle assessment metrics. Trade association publications and regulatory databases were consulted to map the evolving policy landscape and tariff frameworks. Sophisticated data triangulation techniques were employed to validate findings, ensuring consistency across quantitative shipment figures, qualitative stakeholder perspectives, and macroeconomic indicators.

Proprietary modeling tools were used to analyze cost structures, carbon footprints, and regional supply-demand balances, supporting scenario analyses for tariff impact and technology penetration. The resulting insights were cross-verified by an expert advisory panel composed of academic researchers, industry consultants, and former regulatory officials, ensuring both technical accuracy and market relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Green & Bio Solvents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Green & Bio Solvents Market, by Product Type

- Green & Bio Solvents Market, by Source Technology

- Green & Bio Solvents Market, by Application

- Green & Bio Solvents Market, by End Use Industry

- Green & Bio Solvents Market, by Distribution Channel

- Green & Bio Solvents Market, by Region

- Green & Bio Solvents Market, by Group

- Green & Bio Solvents Market, by Country

- United States Green & Bio Solvents Market

- China Green & Bio Solvents Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Accelerating the Industry’s Transition to Sustainable Solvents through Integrated Innovation Policy and Collaborative Market Strategies

As the green and bio solvents industry reaches a pivotal juncture, the interplay of technological innovation, regulatory imperatives, and shifting trade dynamics will determine the pace of adoption and market growth. Companies that proactively integrate sustainability into their core R&D and manufacturing strategies will not only comply with emerging environmental mandates but also unlock competitive differentiation through superior performance and eco-efficiency.

The combination of enzymatic synthesis, supercritical extraction, and circular processing models signals a new era where solvent selection is driven by lifecycle impact as much as by chemical performance. Regional policy incentives-from tax credits in North America to stringent VOC limits in Europe-are reinforcing the business case for renewable solvents, even as recent tariff measures introduce short-term cost headwinds that require strategic supply chain realignment.

Ultimately, success will hinge on collaborative ecosystems that link biotech innovators, feedstock suppliers, and end-use customers. By leveraging data-driven decision frameworks and forging multi-sector partnerships, stakeholders can navigate uncertainties, scale sustainable technologies, and accelerate the transition toward a low-carbon chemical economy.

Unlock In-Depth Green and Bio Solvents Market Intelligence through a Personalized Consultation with Ketan Rohom

If you are seeking comprehensive intelligence on market dynamics, technology trends, and competitive strategies in the green and bio solvents space, Ketan Rohom, Associate Director, Sales & Marketing, can guide you to the right research package tailored to your needs. By engaging directly with Ketan, you can discuss specific deliverables, custom data points, and tailored insights that align with your strategic priorities.

Equipped with your organization’s objectives and timelines, Rohom will design a solution that ensures you receive the most relevant and actionable market intelligence. Whether you require deep dives into regulatory impacts, supply chain resilience, or emerging technology roadmaps, this personalized consultation will clarify the scope, format, and depth of analysis necessary to support informed decision-making.

Reach out today to secure early access to executive summaries, proprietary datasets, and one-on-one briefings that can give you a competitive edge. By collaborating with Ketan Rohom, you will accelerate your understanding of key disruptors, identify high-impact growth opportunities, and engage with thought leaders driving the transition toward sustainable chemical manufacturing.

Act now to transform complex market data into strategic insights-connect with Ketan Rohom to purchase the comprehensive green and bio solvents market research report and empower your team with the knowledge to thrive in this rapidly evolving industry.

- How big is the Green & Bio Solvents Market?

- What is the Green & Bio Solvents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?